Turbotax Vs H& r Block: Customer Service

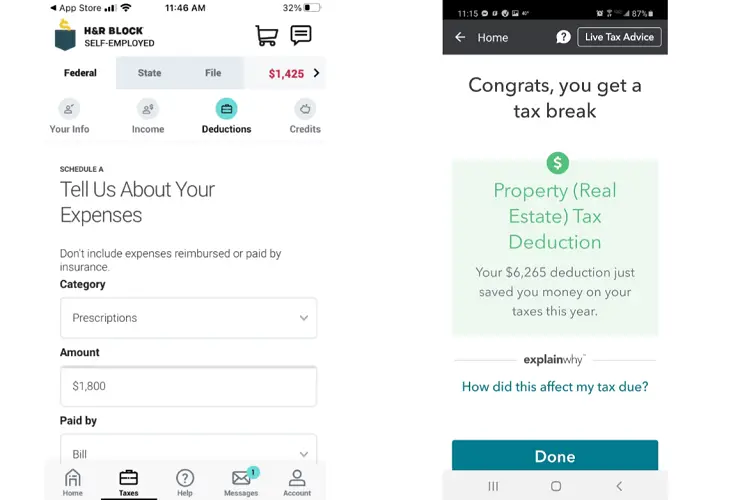

With TurboTax, all users have access to a chatbot or contact form for tech questions that crop up while using the platform. But if you shell out for TurboTax Live, this is where the service sings. Dial a TurboTax expert at all hours of the night or make an appointment in advance to review your return. Help is offered via a screenshare where you also get to see the face of your CPA .

This year, you can also tap into TurboTax Full Service, which means you upload your tax documents to a secure portal and a real live humanwhos assigned based on your specific tax needsputs your return together for a fee. Youll have a video call at the start, then again when your return is ready to be filed.

H& R Block is pretty competitive here. Their brand-new Online Assist package acts much like TurboTax Live, granting you on-demand access and screen-sharing sessions with a CPA for an added fee.

H& R Block also offers their Tax Pro Review service , which provides a one-on-one review of your return to check for errors before you file as well as missed deductions or credits. You can even request the same tax pro youve used in previous yearsa perk for anyone interested in relationship building here. But with H& R Block, you also have the option to meet in person with a tax professional at one of their many brick & mortar locations.

Exemptions On Capital Gains Tax For Donations

If you donate certain assets to a registered charity or other qualified donees, you may be exempt from paying capital gains tax on any capital gains realized from these gifts. The types of assets that are eligible for the exemption when donated are:

- A share of a stock of a mutual fund corporation or a unit of mutual fund trust

- A share, debt obligation, or right listed on the stock exchange

- An interest in a segregated fund trust

- Ecologically sensitive land

Qualified donees in Canada include:

- Registered charities

- Registered municipalities

- Registered national arts service organizations

You will still have to report any capital gains and losses of these gifts on the capital gains tax form and will be required to fill out a separate form T1170 Capital Gains on Gifts of Certain Capital Property to receive the exemption.

Read Also: Can You Change Your Taxes After Filing

Bottom Line Who Its For

H& R Block is worth checking out if you have simple deductions that arent included in other providers free tax filing versions. And their Deluxe and Premium tiers could be worth paying for, too, if youd benefit from some of their unique software tools.

Are you specifically looking for a tax software package that includes on-demand help from a human? In that case, going with H& R Block Online Assist instead of TurboTax Live will save you money.

However, if youre a small business owner who uses QuickBooks, TurboTax is probably going to be the best tax software for you. And if youre willing to deal with more basic software design , a discount filing service like FreeTaxUSA, TaxAct, or TaxSlayer could be a better option.

Read Also: How To File Taxes As A Doordash Driver

Upload Tax Documents To Speed Up The Process

H& R Block is one of the easiest online filing software packages. It allows users to upload tons of forms including 1099-NEC, 1099-MISC, 1099-INT, W-2 forms, and much more. If the form is standard, you can upload it in H& R Block. Users can even snap pictures of their forms and upload them using H& R Blocks app. When they are ready to file, the software will glean what it can from the photos and automatically fill in the details.

H& r Block’s Investor Day

I’m trying to stay constructive on H& R Block’s new small business focus. It makes some sense for H& R Block to better utilize its large fixed-cost footprint. But ultimately, I’m wary of H& R Block’s track record in moving into adjacencies.

The investor day presentation did have some red flags in it:

Red Flag 1: “Financial Products”

Whatever my reservations on the small business focus are, they pale in comparison to the Financial Products. This entire idea seems laughably foolish. Because you give a refund loan on a preloaded debit card does not mean you have the right to win as a bank.

“Mobile-centric banking alternative?” It already exists – it’s called Venmo .

I hope whatever H& R Block’s plan here is done at a minimal expense and is abandoned quickly when it becomes obvious it will not work.

Red Flag 2: Slide 55, last bullet

The last bullet on Slide 55 of the earnings presentation was a red flag for me

As of October 31st, the current debt is 1.56 Billion. The high end of a 2.5x-3x range implies an EBITDA of just $520 million, meaning one of two things, both bad.

1. Expectations for spending are set to accelerate because of “investments” in these other initiatives.

2. Debt is set to accelerate, possibly from another acquisition

Recommended Reading: Do You Have To Do Taxes For Doordash

Video: When To Use Irs Form 8949 For Stock Sales

OVERVIEW

If you sold some stocks this year, you’re probably aware that you will need to include some information on your tax return. What you may not realize, is that you’ll need to report every transaction on an IRS Form 8949 in addition to a Schedule D. To find out more about form 8949, watch this video.

Monitor Your Holding Periods

When selling stocks or other assets in your taxable investment accounts, remember to consider potential tax liabilities.

With tax rates on long-term gains likely being more favorable than short-term gains, monitoring how long youve held a position in an asset could be beneficial to lowering your tax bill.

Holding securities for a minimum of a year ensures any profits are treated as long-term gains. On the contrary, the IRS will tax short-term gains as ordinary income. Depending on your tax bracket, any significant profits from short-term gains could bump you to a higher tax rate.

These timing strategies are important considerations, particularly when making large transactions. For the do-it-yourself investor, its never been easier to monitor holding periods. Most brokerage firms have online management tools that provide real-time updates.

Also Check: Where Is My Federal Tax Refund Ga

Donate Assets To Charity

When you make a donation to a registered charitable institution, you receive a tax receipt which allows you to deduct a portion of your donation from income tax owing. Instead of making a donation in cash, you can transfer ownership of stocks to the registered charity. . Its a way of rebalancing your portfolio without triggering a capital gain because you are not selling the stock, you are simply transferring ownership. You will receive a tax receipt for the current fair market value . Consult a tax professional before you do this so you follow the correct procedure.

Capital Gains Tax In Canada

You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base. Capital assets subject to this tax, according to the Canada Revenue Agency, include buildings, land, shares, bonds, and trust units.

The proceeds of disposition is what you sold your capital property for, less any outlays and expenses of selling. The adjusted cost base is what you paid to acquire the capital property, including any costs related to purchasing the capital property.

The capital gains inclusion rate is 50% in Canada, which means that you have to include 50% of your capital gains as income on your tax return. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains.

Read Also: Otter Tail County Tax Forfeited Land

Also Check: How Much To Save For Taxes Doordash

H& r Block Customer Service

Customer support is available around the clock during prime tax filing seasonJanuary 13 to April 19. And its available during extended business hours the rest of the year. You can access support through online chat, phone, and email.

As with most tax services, the free customer service option is for technical issues with the product. But if you need actual help with your taxes beyond very basic questions, youll need to pay for the additional services to access a live CPA to help with your taxes.

Section 1256 Contracts: Cash

Before you pat yourself on the back and relax, you may want to check and see if you traded any cash-settled index options or futures . In other words, if you see figures listed in the Regulated Futures Contracts & Section 1256 Options section in the Tax Reporting Statement or received a Substitute Form 1099 Statement from trading futures, then you have one more step.

If you did not trade any Section 1256 Contracts, then you may disregard the section below. To read more about Section 1256 Contracts, then please click here.

Now, its time to enter the profit/loss from Section 1256 products. Return to the Income section of the Federal tab. Locate and click Go To for Section 1256 Contracts and Straddles.

After clicking Go To for Section 1256 Contracts and Straddles, the software will ask, “Did you or your spouse hold any section 1256 contracts or straddles during 20xx that were not sold on or before December 31, 20xx?” Please click Yes to access Form 6781 so you can report your overall profit or loss.

Here, you can access Form 6781 to enter your profit or loss from Section 1256 contracts. Click Whole Form to enter your total profit or loss from trading these contracts.

Before you venture on to the whole form, you will want to dig up your Consolidated 1099. Namely, you’ll want to go to the Tax Reporting Statement page , where you can locate the Aggregate profit or on contracts from trading Section 1256 Options. Below, weve illustrated where you can find this.

Recommended Reading: How Does Taxes Work For Doordash

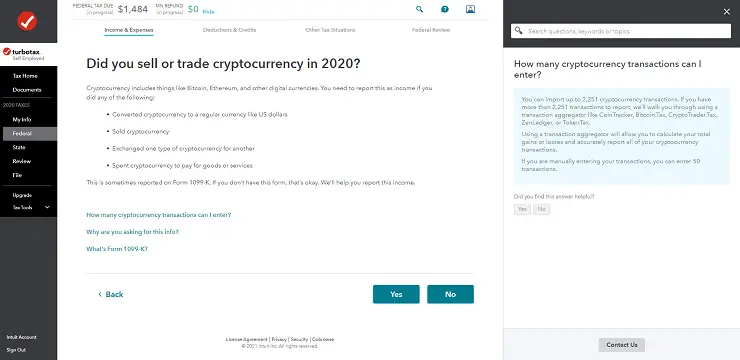

Got Bitcoin You Might Owe Taxes This Year

The IRS is wants to know about your crypto activity.

What’s bitcoin’s impact on your taxes this year?

If you bought, sold or traded cryptocurrency in 2021, you may have questions about how it’s taxed. The IRS treats virtual currencies, like bitcoin and ether — and even NFTs — differently from some other assets and investments, and there are specific rules you’ll need to follow if you sold or traded those assets last year.

“The average investor needs to understand that cryptocurrency is not like any other type of currency out there. Cryptocurrency is treated as property for tax purposes,” says Shaun Hunley, a tax consultant at Thomson Reuters. “So anytime you’re going to use cryptocurrency or transact in cryptocurrency, you’re going to have the potential for gain or loss on tax return.”

There’s an important caveat, however: If you used fiat currency — that is, US dollars — to buy crypto assets in 2021, you don’t have to report anything about it on your return.

If you sold crypto, however, you will need to report that on your return. And if you traded one crypto for another, that’s going to need to be reported, too. The good news is that reporting gains and losses is fairly straightforward once you know the ropes — and there are tools to help you, if you’re not inclined to take on the math and accounting yourself. Read on to learn everything you need to know about handling cryptocurrency on your state and federal tax returns this year.

Get Your Investment Taxes Done Right

From stocks & crypto to rental income, TurboTax Premier has you covered.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How To Find Employers Ein

How To Know Which Form Is Which

Common Tax Questions. FxPro Getting your data out of FxPro is fairly straightforward. From the series of tabs in Account Services select “Account Download”. Finding Your Account Documents. Click on the “My Accounts” tab. Click “tax activity”. Still have questions? General Questions. Now you’re ready to run the Excel2TXF software to create the. With your transaction history, you can calculate your cost basis and review the acquisition date of your stocks.

Unfortunately, you’ll need to fix up the date columns before proceeding: a. First, login to your account and follow the steps below: 1. Goto the Portfolio view. You can find it in the top, middle of your tax document. Click on it to get the transaction details like dates and wash sales. Select nicholas patrick shaughnessy day trading gold related stocks in singapore year and choose “CSV” as the download format. Clikc “Go”. Select the “Excel” output option. Just purchase the Full-Service option and we’ll take care of. XLS file. But it also lets you file schedules 1, 2 and 3, which is a big bonus because many taxpayers need to file forms. Zecco First, login to your account and follow the steps below: 1.

Why Did I Receive Multiple Tax Documents

Select “Download”. Click “Launch Maxit” Box. Questrade Hera are the steps to get your data out of Questrade: 1. Still have questions? Robinhood Securities IRS Form Customers who had taxable events last year will receive a from Robinhood Securities, our new clearing platform. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. TradeKing Getting your data out of TradeKing is very straightforward. Right click on any row in the account history and select “Custom Period”. Click on “Trade Activity”. Make sure the appropriate account number is selected. You should now see a “Download” link next to a green arrow at the upper right-hand side. Click “Download”. Save the.

Read Also: Doordash State Id Number For Unemployment California

Turbotax Vs H& r Block: Cost

At the end of the day, H& R Block costs less than TurboTax, but each package offers varying features, so the choice comes down to you and your tax needs.

The TurboTax pricing structure breaks down like this:

The Free OptionFederal: $0State: $0

Best for simple tax returns , this version allows you to file a 1040 and a state return for free.

Live Basic Federal: $50State: $0

The only thing that separates this from the free version is that it includes on-demand video access to a tax pro.

DeluxeFederal: $60 State: $50

Ideal for anyone who prefers to itemize their tax return, plus claim several other tax deductions and tax credits, too. Also, helpful if you have business income without any expenses.

PremierFederal: $90 State: $50

This version is the same as the Deluxe but adds the option to report investments as well as any rental income.

Self-EmployedFederal: $120 State: $50

The same as the Premier version, but it covers business income and expenses, as well as the home office deduction. You can also sync it with Square, Lyft and Uber to import expenses.

The H& R Block pricing structure breaks down like this:

The Free Option Federal: $0State: $0

This version allows you to file a simple tax return , in addition to schedules 1 and 3 for free.

Basic Online AssistFederal: $69.99State: $0

This is the same as the free version, except that you have access to H& R Blocks tax experts for on-demand tax help.

DeluxeFederal: $49.99 State: $36.99

PremiumFederal: $69.99 State: $36.99

What Are The Requirements To Not Report All Stock Transactions On The Tax Return 1099

I have been trading in 2017 on Robinhood. The 1099-B file they sent me has 500+ pages. When I requested a CSV file, I see just little less than 2000 lines. Export from Robinhood to TurboTax, TaxAct, etc only allows up to 500 transactions – therefore, in my case the import fails.

While trying out H& R Block, the import failed, but in the following steps in prompted with this option:

The IRS offers a shortcut if you have a lot of sales to report. You can enter them as a group instead of individual sales.

You can use the shortcut only for sales for which these apply:

- Your broker reported the basis to the IRS on Form 1099-B.

- You don’t have any adjustments, like wash-sale losses or a basis correction.

- They’re all one of these: Short-term , Long-term

But the 1099-B summary page I have shows only Short-Term , and broker-reported to the IRS . But I believe I do have adjustments as per the picture below:

Question is, can I file only the summaries? Is that only form 8949? What to do with the PDF file as TaxAct allows only 2MB file limit attachment and I was only able to reduce it to 9MB ?

Per the instructions for Form 8949, there are two exceptions to reporting all transaction on separate rows of Part I and Part II of Form 8949 which are available to individual tax payers.

The wash sales require you to make adjustments to the basis, so you do not qualify for Exception 1.

Per this quora answer,

Suppose my 1099 reads as follows:

Proceeds Cost Adjustment Gain/loss

You May Like: How To Do Taxes With Doordash