Who Is Responsible For Paying Payroll Taxes

Both employees and employers are responsible for paying their share of payroll taxes to the government, known as employee payroll taxes and employer payroll taxes. But when it comes to actually submitting those payments, and making sure theyâre accurate and on time, the responsibility falls on the employerâs shoulders.

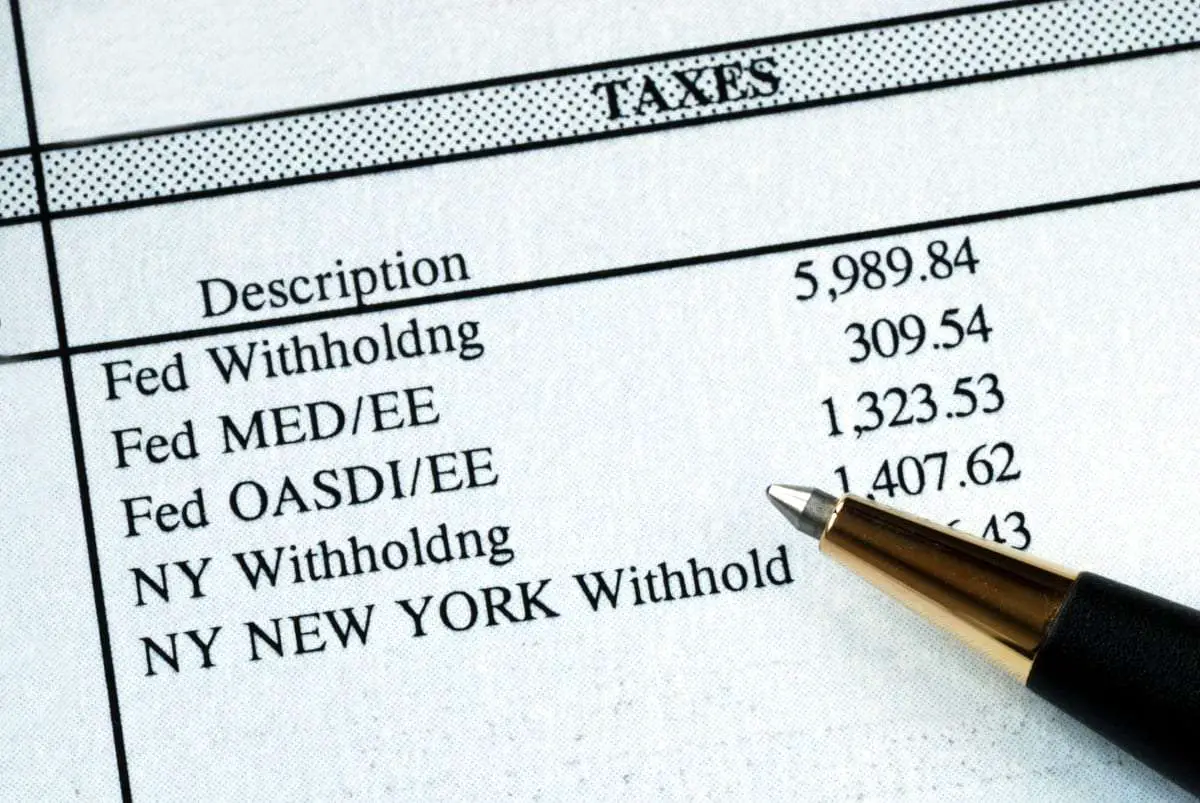

The employeeâs tax responsibility is covered by the employer, who withholds the employee portion of the payroll tax from their paycheck each pay period and remits it to the IRS on the employeeâs behalf. The employee can access their payroll deductions and see how much was withheld for payroll taxes by looking at their pay stub. The employer makes a tax payment directly to the IRS to cover the amount theyâre responsible for .

Paying Arizona Unemployment Insurance Taxes

In your wage reports, you report the total gross wages that you paid to all your employees in that quarter. However, you pay taxes on only the taxable wages, that is, the first $7,000 paid to each employee in the calendar year. The form will help you calculate the taxable wage amount.

You can pay the unemployment insurance taxes online at the same time as you do the filing and reporting of wages, or you can make the payment separately from your report filing. Bear in mind that your unemployment insurance taxes and your wage report are due at the same time.

Employer Portion Of Social Security Tax

In addition to the amount withheld from its employees for Social Security taxes, the employer must contribute/remit an additional amount, which is an expense for the employer. In the year 2022, the employer’s portion of the Social Security tax is 6.2% of the first $147,000 of an employee’s annual wages and salary. Hence, the employer’s amount is referred to as the matching amount.

For example, if an employee earns $40,000 of wages, the entire $40,000 is subject to the Social Security tax. This means that in addition to the withholding of $2,480, the employer must also pay $2,480. The combined amount to be remitted to the federal government for this one employee is $4,960 .

For an employee with an annual salary of $200,000 in the year 2022, only the first $147,000 is subject to the Social Security tax. This means that in addition to the withholding of $9,114.00, the employer must also pay $9,114.00. The combined amount to be remitted to the federal government for this one employee is $18,228.00 .

The employer’s share of Social Security taxes is recorded as an expense and as an additional current liability until the amounts are remitted.

Recommended Reading: How To Figure Out Tax Deductions From Paycheck

Your Obligations To Employees

As an employer, you have three payroll obligations to employees:

1) Paying Wages

Employees must be paid on a recurring schedule typically, businesses opt for either monthly or bi-weekly payments.

Wondering how to pay employee salaries? Some SMBs still use physical checks, but this requires manual tracking and entry into payroll systems. Many now opt for direct deposit, which sends wages directly to staff bank accounts. Setting up direct deposit requires you to create a business account with the bank of your choice and then collect employee banking data to ensure funds are sent to the correct accounts. You can choose transfer these funds manually each pay period from your online banking portal, use a payroll system that integrates this function or pay a third-party provider to complete this task.

2) Remitting Deductions

The Canadian Revenue Agency requires you to collect specific deductions from employee pay:

- Employment Insurance

3) Ensuring Compliance

In addition to paying staff on a recurring schedule, the CRA typically requires small businesses to remit all source deductions money taken from employee wages by the 15th of the month after staff are paid. You must also send T4 and T4A tax slips to employees by the last day of February of the calendar year following the deduction period. For example, T4 slips for the 2019 calendar year must be sent out by February 29th, 2020.

Penalties For Missing Or Late On Employment Tax Payments

If employers fail to remit payroll tax payments or send them in late, it could have the following impact:

- Employers may face criminal and civil sanctions

- Employees may lose access to future Social Security or Medicare benefits

- Employees may lose access to future unemployment benefits

If youre late making deposits for FICA or federal taxes, youll be charged penalties as follows:

| Penalty | |

|---|---|

| 16 or more days but before 10 days from the date of the first IRS notice | |

| 10% | Amounts that should have been deposited, but instead were paid directly to the IRS or paid with your tax return |

| 15% | Amounts still unpaid more than 10 days after the date of the first IRS notice or the day you receive notice and demand for immediate payment |

Also Check: How To Mail State Tax Return

Arguments For And Against The Social Security Tax Cap

Proponents of increasing or eliminating the limit on earnings subject to the Social Security payroll tax argue that it would make the tax less regressive and be part of a solution to strengthen the Social Security trust funds. An analysis from the Congressional Budget Office estimated that phasing out the tax cap by subjecting earnings below the current taxable maximum and above $250,000, would have raised over $1 trillion in revenues from 2019 through 2028. Another argument is that removing the taxable maximum would adjust for the fact that higher-income individuals generally have longer life expectancies and thus receive Social Security benefits for a greater amount of time.

Opponents argue that increasing or removing the taxable maximum would weaken the link between the amount individuals pay in Social Security taxes and the amount they receive in retirement benefits. Opponents also contend that while low-income earners may pay a greater share of their income in Social Security taxes than those who are wealthier, they also receive a disproportionate share of government transfer payments that are not subject to the tax. Those opponents cite programs that have been created to at least partially offset the regressive nature of the Social Security payroll tax.

Arizona Payroll Taxes: Summing Up

As an Arizona employer, it is you who will have to handle the nitty-gritty of the state’s payroll taxes. That, in addition to IRS payroll taxes, may seem like a lot, but it actually isn’t once you nail the basics. Know your Arizona basics like the key forms and the quarterly or annual filings. Keep your two tax account numbers at hand – the EIN number and the UI number.

Know your departments: the Arizona Department of Revenue for Arizona income tax withholding and the Department of Economic Security for unemployment insurance tax. Payroll taxes are usually recovered from the employees’ wages but certain costs may ultimately be shared between you and your employees, depending on your employment policy.

You May Like: How The Wealthy Avoid Taxes

Individual Income Tax Vs Payroll Tax Usage

Collecting taxes is an ideal way for governments to generate public revenue. The Internal Revenue Service enforces tax collection for the government. But how do governments use the collected individual income and payroll tax? We’ll discuss the usage of payroll taxes and individual income tax to aid your understanding.

How are income taxes used?

The government imposes income tax on individuals and businesses and collects taxes for foreign affairs and national defense programs. The United States government uses income tax to fund public services, provide goods for citizens, pay law enforcement and other governmental obligations.

Are you wondering how governments service interest on the national debt? Look no further. It is one of individual income tax usage. These taxes are beneficial for funding social programs such as human and physical development, which in turn serve local communities.

How are payroll taxes used?

Payroll taxes are money deducted from employers’ wages and salaries and remitted to the federal government. While the government receives payroll services and taxes from the Internal Revenue Service, the funds serve different purposes. The government funds Medicare, which is health insurance, federal and state Social Security, and other social insurance programs for the welfare of society. Furthermore, these taxes fund unemployment insurance and federal employees.

Understanding Canadian Payroll Taxes

In the past year and a half, remote work has gone from work perk to a working norm. Companies that went remote in response to the pandemic have opted to stay remote or offer it as a hybrid option for some or all their workforce. Going remote offers many obvious advantages to employers, but one of the most important is accessing a wider talent pool. More and more U.S. employers are looking north to Canada to expand their teams or for their hardest to fill roles.

Remote Canadian talent is a great option for US employers but setting up a remote work arrangement in another country can be daunting, especially when it comes to payroll. Understanding Canadian taxes, particularly Canadian payroll taxes which vary from province to province, isnt easy. Errors in payroll taxes and failure to comply with Canadian employment standards can result in back taxes, fines, and even trigger an audit. Thats why so many U.S. companies work with a Canadian PEO that can take payroll and employment compliance off their hands.

You May Like: When Do I Have To Pay Capital Gains Tax

The Qubec Pension Plan

Both employers and employees are required to contribute to the Québec Pension Plan . The QPP is a public insurance plan that provides basic financial protection to people who are retired, disabled or have lost a loved one.

Employers are required to contribute to the QPP if their employees annual revenue exceeds $3,500. The maximum income eligible for the contribution rate is $61,600.

In 2021, the QPP contribution rate is 11.8%. This includes the contribution to the base plan and the additional plan. Each employee pays half of the rate and the employer pays the other half.

Reporting Wages And Filing Taxes

Once you get your UI number and you are declared liable to pay unemployment insurance tax, you will have to start filing quarterly unemployment tax and wage reports .

This means that you must report all gross wages of your employees in that quarter and file unemployment taxes for all taxable wages you pay. Note that you will also have to file for quarters where no wages were paid. You can submit your filing for unemployment tax and your wage reports online.

In your wage reports, the payments you include are salaries, commissions, bonuses, fees, fringe benefits, sick pay, tips reported to you by your employees, and the cash value of any non-cash benefits like gifts.

Certain payments are specifically not to be included in your wage reports. These include:

- Long term disability pay

- Payments made towards certain retirement plans for employees

You will need to have certain details ready when filling in your wage reports. These include:

- The calendar quarter and the year for which the wage report is being filed

- Your employees’ social security numbers and names

- The total amount of wages paid to each of your employees during that quarter

- The total amount of wages paid to all of your employees during that quarter

In any case, these are details that you will have to keep at hand for your payroll taxes. You will also need to keep your UI number at hand, as this will have to be mentioned.

Also Check: How To Avoid Capital Gains Tax On Property

Form Td1 Personal Tax Credits Return

There are two types of Form TD1, Personal Tax Credits Return federal and provincial or territorial. Both forms, once completed, are used to determine the amount of federal and provincial or territorial tax to deduct from the income an individual receives in a year.

Individuals who will receive salary, wages, commissions, employment insurance benefits, pensions, or other remuneration must fill out a federal Form TD1 and, if more than the basic personal amount is claimed, a provincial or territorial Form TD1. For Quebec, see Employment in Quebec.

An employee must fill out a Form TD1 and give it to the employer when the employee starts work. The employee should fill out a new Form TD1 within seven days of any change that may result in a change to their personal tax credits for the year.

Note

cannot claim them againmore

Employees who do not fill out new forms may be penalized $25 for each day the form is late. The minimum penalty is $100, and increases by $25 per day to the maximum of $2,500.

Employees do not have to fill out new TD1 forms every year if their personal tax credit amounts have not changed.

You are committing a serious offence if you knowingly accept a Form TD1 that contains false or deceptive statements. If you think a Form TD1 contains incorrect information, call 1-800-959-5525.

Have a completed Form TD1 on file for each of your employees or recipients. We may ask to see it.

Note

Employment in Quebec

You can get Quebec forms from Revenu Québec.

Claim codes

What Other Responsibilities Do I Have As An Employer

- Employers have many responsibilities beyond whats required for payroll. These include development and implementation of an employee safety program, posting required posters, providing breaks and meal periods, getting a minor work permit and authorizations when hiring workers under 18, and a number of others. Attending the Department of Labor and Industries workshops is highly recommended.

- You are also obligated to report all new employees to the Department of Social and Health Services. Instructions are available at

- Learn more about employer responsibilities in the GROW and RUN chapters of the Washington Small Business Guide.

You May Like: What Address Do I Send My Tax Return To

How Do I Handle Independent Contractors Or Self

Independent contractors and self-employed individuals are not employees. However, employers should review the status of the worker to ensure that the individual is properly classified as an independent contractor. Businesses that engage them are not responsible for any employment taxes on payments made to them. These workers pay self-employment tax on their net earnings from self-employment , which is essentially the employee and employer share of FICA. If a self-employed person also has wages from a job, the wages are coordinated with the SE tax so that the wage-base ceiling can be properly applied.

If total payments to such worker in the year are $600 or more, the business must file an annual information returnForm 1099-NECto report the payments to the worker and to the IRS.

Why Are Payroll Taxes So Important

Some people might look at payroll taxes as just another payroll deduction . But the truth is, payroll taxes go directly towards creating a social safety net for workers in the United Statesâmaking them a hugely important part of the tax process.

Payroll taxes go to fund the programs that workers will rely on when they retire or find themselves unemployed. For example, if a worker gets laid off, they can rely on state and federal unemployment to replace a portion of their lost wages while they look for their new jobsâprograms that are directly funded by payroll taxes. When a worker retires and no longer has health insurance through their employer, they can rely on Medicare to get the healthcare they need.

The point is, payroll taxes arenât just another payroll deduction unlike income taxes , payroll taxes are used to fund social programs that directly benefit the people paying themâmaking them an extremely important and worthwhile tax for both employees and employers.

Don’t Miss: Can I Deduct Health Insurance Premiums From My Taxes

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky, and the penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

If youâd rather not deal with the stress, we highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time to handling pesky withholding calculations and payroll taxes. Whenever you need to check your records, youâll have automatically generated pay stubs to review with all the essential information.

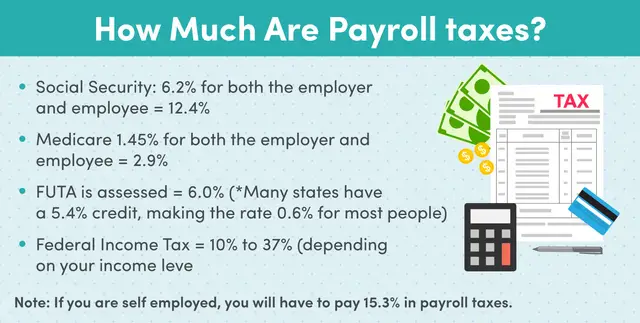

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Don’t Miss: How Much Of Your Paycheck Goes To Taxes

How Much Do Employers Pay In Payroll Taxes

So, how much is payroll tax? The cost of payroll taxes largely depends on the number of employees you have and how much you pay your employees. Why? Because payroll taxes are a percentage of each employees gross taxable wages and not a set dollar amount.

Payroll tax includes two specific taxes: Social Security and Medicare taxes. Both taxes fall under the Federal Insurance Contributions Act , and employers and employees pay these taxes.

Payroll tax percentage is 15.3% of an employees gross taxable wages. In total, Social Security is 12.4%, and Medicare is 2.9%, but the taxes are split evenly between both employee and employer.

So, how much is the employer cost of payroll taxes? Employer payroll tax rates are 6.2% for Social Security and 1.45% for Medicare.

If you are self-employed, you must pay the entirety of the 15.3% FICA tax, plus the additional Medicare tax, if applicable .