How Do I Obtain A Tax Id Number For An Estate Via Mail Or Fax

You also have the ability to obtain a Tax ID number via mail or fax. The EIN application process through mail or fax will take more time than the online process, but it is not all that complicated.

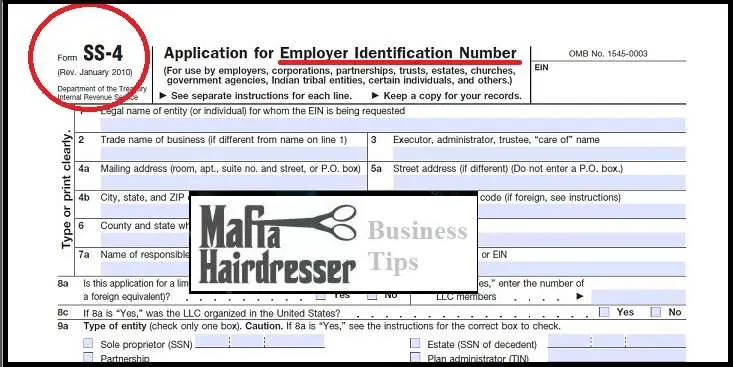

The mail application process will have you going through the form the Internal Revenue Service requires, called an SS-4. You will be filling out the form in full, via paper, and completing it before popping it into an envelope. Once you get the information on the application and into an envelope, you can mail it to the Internal Revenue Service. The IRS usually takes a few weeks between when they receive the form, do the validation, and send it back. Once they do, they will send you the Tax ID number.

The fax process is similar to the mail application process as you will be completing the form via paper. You will then use the IRS fax number to submit it to them for validation. Once they do the validation, over the course of several days, they will send you back your complete Tax ID number.

What You Need For File An Estate Tax Return

The estate tax is a transfer tax on the value of the decedent’s estate before distribution to any beneficiary.

For estates of decedents dying in 2006 or after, the applicable exclusion amount is $1,000,000. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax.

Estate tax returns and payments are due 9 months after the date of the decedent’s death.

Estate tax returns must be filed by the:

- Personal representative of the estate or

- Any person in actual possession of the decedent’s property.

What If An In

The personal representative must then serve with a surety bond and have a resident agent appointed, or he/she may petition the court to have an in-state resident co-qualify. Please call the Probate Division to discuss this situation with a Clerk.

*The information on this page is not intended to be legal advice. If you have any questions please consult an attorney.

Recommended Reading: How Much Is Payroll Tax In Louisiana

How Do I Report Income Earned Under The Ein

Income earned under the EIN assigned to a trust or estate is reported on a Fiduciary Income Tax Return Form 1041. In many cases though the trust or estates acts as a pass-through entity under which the income is passed out to the beneficiaries. I plan to write in more detail on trust and estate income taxes in future posts.

Apply For An Estate Tax Id Number Online

The fastest and easiest option is to apply for an estate tax ID number online. To qualify to use the online application, you must be based in the United States, and the estate must be in the United States. This rule also applies to corporations, partnerships and other entities that are applying for an EIN.

To ensure the process goes smoothly, gather all your details before starting the online application. Also, consider getting professional help that eliminates hassles and speeds up approval times.

To apply for an Estate tax ID number online, you want to have the following information on hand:

- Identifying information for both the deceased individual and executor including:

- Legal Name

Also Check: Is Plasma Money Taxable

Tax Responsibilities Of An Estate Administrator

A decedent and their estate are separate taxable entities. So if filing requirements are satisfied, an estate administrator may have to file different types of tax returns.

First, an estate administrator may need to file income tax returns for the decedent . The decedents Form 1040 or 1040-SR for the year of death, and for any preceding years for which a return was not filed, are required if the decedents income for those years was above the filing requirement. For help, see the Filing the Final Tax Return of a Deceased Taxpayer page.

Second, an estate administrator may need to file income tax returns for the estate . To file this return you will need to get a tax identification number for the estate . An estate is required to file an income tax return if assets of the estate generate more than $600 in annual income. For example, if the decedent had interest, dividend or rental income when alive, then after death that income becomes income of the estate and may trigger the requirement to file an estate income tax return. For help filing an income tax return for the estate see Filing the Estate Income Tax Return page.

If the estate operates a business after the owners death, the estate administrator is required to secure a new employer identification number for the business, report wages or income under the new EIN and pay any taxes that are due. Publication 1635, Understanding Your EIN PDF provides information about this requirement.

How To Get A Tax Id For A Trust

You can obtain a tax identification number instantly by completing the IRS EIN Tax ID Number Online Application online. Alternatively, you can print and complete the Application for Employer Identification Number and mail or fax it to the IRS.

- You can get the tax ID number for trust by lodging an application on the IRS website. Apply for a Federal Tax ID number / TIN. You can obtain an EIN number for a Trust Online. It typically takes around 10 minutes to complete if you have all the information handy.

Don’t Miss: Is Donating Plasma Taxable

General Responsibilities Of An Estate Administrator

When a person dies a probate proceeding may be opened. Depending on state law, probate will generally open within 30 to 90-days from the date of death.

One of the probate courts first actions will be to appoint a legal representative for the decedent and his or her estate. The legal representative may be a surviving spouse, other family member, executor named in the decedents will or an attorney. We will use the term estate administrator to refer to the appointed legal representative. The probate court will issue Letters Testamentary authorizing the estate administrator of the decedent to act on the decedents behalf. You will need the Letters Testamentary to handle the decedents tax and other matters.

In general, the responsibilities of an estate administrator are to collect all the decedents assets, pay creditors and distribute the remaining assets to heirs or other beneficiaries. As an estate administrator your first responsibility is to provide the probate court with an accounting of the decedents assets and debts. Some assets may need to be appraised to determine their value. All debts will need to be verified and creditor claims against the estate must be filed. How to verify a federal tax debt is covered in the Getting Information from the IRS page. How to get IRS to file a creditor claim in the probate proceeding is covered on the Getting the IRS to File a Proof of Claim in a Probate Proceeding page.

When Applying For Ein Via Telephone The Applicant Must:

Don’t Miss: Buying Tax Liens California

How Do I Obtain A Tax Id Number For An Estate Online

The easiest way to get a Tax ID for the estate is to go through the online application process. You can apply for an employer identification number for an estate right online through the Internal Revenue Services site.

The online EIN application process takes the form required from the Internal Revenue Service and makes it virtual. With a laptop, desktop, even a tablet, you can apply by filling in the information on the responsible party and everything else that requires answering.

The great thing about the online application process is the quick answer you get. The Internal Revenue Service will validate the information you provide in a matter of minutes. Within a 10-minute span of going through the application process, submitting it all for validation, and getting a response, you could have your Tax ID number.

Can Anyone Get A Tax Id Number

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number . It is a 9-digit number, beginning with the number 9, formatted like an SSN .

Don’t Miss: Have My Taxes Been Accepted

Determining The Value Of Assets

Estate representatives must be able to demonstrate the values of the assets through supporting documents, such as statements, an opinion of value from an appraiser, etc.

Values should be based on the fair market value of the assets as at the time of death.

Depending on the type of asset, valuation may be complicated. A professional appraiser with expertise in a particular area may assist in recommending a value.

How Do I Establish An Estate Tax Id Number

To establish an estate tax ID number, you should start by gathering information related to the estate. If you are not the executor of the estate, make sure that you have their details and their permission to request the EIN. To learn more, this article provides a great review on How to Apply for an EIN Number.

The executor can also authorize a third-party designee to receive information about the EIN. If you plan to do that, you should also have their information ready when you start the application process. Then, complete the process online, and you should have your EIN in less than an hour. Once you have your EIN, you can use it to file tax returns, open bank accounts for the estate, and handle a range of probate-related tasks.

You May Like: How To Get Tax Preparer License

How To File The Return

You can file the return online, by mail, courier or in person, or by fax.

You will only receive a confirmation of receipt if you submit online or in person.

Online

File the Estate Information Return online.

You will receive an immediate email confirmation of submission. You can also save a copy of the return.

Print and submit your return by mail or courier to:Ministry of Finance, Compliance Branch33 King Street West, PO Box 625Oshawa, ON8:30 a.m. to 5 p.m., Monday to Friday

You may also submit in person to select ServiceOntario locations.

Does Every Business Need A Tax Id Number

If your small business does not need any of the tax accounts listed above , then your small business doesn’t require a Business Number.

For businesses, the CRA’s small supplier definition states that to qualify as a small supplier, your total taxable revenues from all your businesses are $30,000 or less in the last four consecutive calendar quarters and in any single calendar quarter.

Also Check: How To Appeal Property Taxes Cook County

How Can An Ein Be Obtained

In the good old days , an EIN was obtained through a paper form called an SS-4 filed by mail or fax. How quaint. Of course, you can still apply by mail or fax, but in most cases an EIN can be obtained in a matter of minutes through the EIN Assistant on the IRS website. The EIN Assistant will walk you through several pages of fields which you must complete with the appropriate information. If properly submitted and accepted, the number is generated immediately and the notice can be downloaded as a PDF. This immediacy is a great thing, but beware that the application is a legal document and the information that you submit can have tax consequences. Before you apply for a number, be sure that you actually need the number, that you understand the proper entity that is applying and that you have accurate information about the trust or estate. I recommend that an EIN be obtained in close consultation with the estate attorney and/or CPA. In many post-death administration cases, I will walk through the EIN Assistant to obtain the EIN while my client is in my office.

May Assets In The Estate Be Sold

If the decedents will directs that certain assets not be sold , those assets should not be sold unless necessary for the payment of funeral expenses, charges of administration or debts. Other assets under the personal representatives control should be sold as soon as convenient if they are likely to decline in value. The personal representative has no authority over the decedents real estate unless the authority was granted by will.

What if the named executor wishes to be removed as such after qualifying? Only the court may remove a qualified personal representative. It may be necessary to have another personal representative ready to be appointed at the time the original personal representative is removed. The executor, like any other qualified personal representative, must present a petition for removal, and set the matter on the courts docket call and present a proposed court order for the judges signature. A filing fee is required. You must file these documents, along with the filing fee. A new civil action case file will be opened. You should also reference the fiduciary case number on the documents, if applicable.

Also Check: How Can I Make Payments For My Taxes

How Do I Get A Tax Id Number For An Irrevocable Trust

How to Get a TIN for an Irrevocable Trust

How Long Does It Take After Qualification To Complete The Probate Process

Finalization of an estate varies in time depending upon various circumstances. A personal representative must file an inventory within four months from the qualification date. A first accounting or statement in lieu of accounting must be filed within sixteen months from the qualification date. Personal representatives file these documents with the Commissioner of Accounts office.

Don’t Miss: Reverse Ein Lookup Irs

Do I Request An Ein For A Revocable Living Trust

Q: As successor trustee of a revocable living trust to be administered in California, do I request an EIN for a revocable living trust or an irrevocable trust after the death of the grantor? Would I request the 645 election? How do I know if it is a qualified revocable trust?

If you become successor trustee prior to the death of the grantor , then you will not need to obtain an EIN for the revocable living trust. The grantor will continue to report all of the income and expenses of the trust on his or her individual tax return. Once the grantor dies and the trust becomes irrevocable, you will need to complete the application for an EIN as soon as possible so you can properly report all post-death transactions under the trust EIN.

You may obtain an EIN by completing Form SS-4 online at irs.gov. Although you are not required to do so, you should make an election under IRC Sec. 645 prior to obtaining the EIN in order to request the appropriate yearend of the trust.

As to whether or not the revocable trust is qualified, most living trusts are. To be qualified, the grantor/decedent must be treated as the owner of the trust because he or she had the power to revoke the trust prior to death.

Estate and trust rules can be very complicated, so make sure you are working with a professional who is experienced in this area.

Jennie Hoopes, CPA, a team member with Sweeney Kovar, LLP, in Danville, Calif.

How Do I Get A Resale Tax Id Number

Resale numbers are issued by state governments. Typically, you apply for a number from your states tax agency, which issues you a resale license, permit or certificate bearing the number. Then, when you make purchases that arent subject to sales tax, you provide the merchant your license or certificate number.

You May Like: How To File Taxes Without Income To Get Stimulus Check

Can You Use A Social Security Number For An Estate Account

When a person dies, the executor, also known as the personal representative, must open an estate in the decedent’s name. The estate requires a tax ID number, but it can‘t use the Social Security number of the late person for this purpose. Fortunately, obtaining an ID number from the IRS is relatively simple.

Likewise, do I need a tax ID number to open an estate account?

To open any bank or investment account, you’ll need a taxpayer ID number for the estate, which is itself a taxpayer. You can apply for an ID number online, at www.irs.gov. You need to complete a simple form with a confusing title: IRS Form SS-4, Application for Employer Identification Number.

Secondly, how long does it take to get a tax ID number for an estate? If you do not include a return fax number, it will take about two weeks. If you apply by mail, send your completed Form SS-4 at least four to five weeks before you need your EIN to file a return or make a deposit.

Also, how do I get a tax ID number for an estate?

Before filing Form 1041, you will need to obtain a tax ID number for the estate. An estate’s tax ID number is called an employer identification number, or EIN, and comes in the format 12-345678X. You can apply online for this number. You can also apply by FAX or mail see How to Apply for an EIN.

How do you close an estate account?

IV.Closing The Estate