Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a Recovery Rebate Credit on your 2021 federal tax return if you didn’t get a third Economic Impact Payment or got less than the full amount.

In early 2022, we’ll send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021. You will need this information to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

The American Rescue Plan Act

Following the inauguration of Joseph R. Biden as president, the new Democratic majority began taking steps to pass a new $1.9 trillion coronavirus relief package to deliver further help, called the American Rescue Plan Act.

The plan, which was passed by both houses of Congress and signed into law by President Biden on March 11, 2021, calls for a nationwide COVID-19 vaccination program, $1,400-per-person relief checks, financial support for small businesses, funding to helps schools reopen, expanded and extended unemployment insurance payments, rent subsidies, and more. The American Rescue Plan also includes a provision that student loan forgiveness issued between Jan. 1, 2021, and Dec. 31, 2025, will not be taxable to the recipient.

Which Tax Return Is Used For My Third Stimulus Check

The IRS uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check. The new stimulus plan targets lower income ranges to exclude higher-earning taxpayers from getting a payment.

As we pointed out before, individuals making under $75,000 get the maximum stimulus payment of $1,400 . But payments are capped at $80,000 for single filers and $160,000 for couples. So filing at the beginning of the tax season with a lower income may help you qualify for a bigger check. But, if your income went up in tax year 2020, then you may want to delay filing so that eligibility is determined by your lower 2019 income.

You might also want to file early if the size of your family increased in 2020. The new stimulus plan includes a child tax credit that pays up to $3,600 for each qualifying child under 6 years old, and $3,000 for every child between ages 6 and 17. This means that if you became a parent during the tax year, you could get an additional payment by claiming your child as a dependent earlier.

SmartAssets child tax credit calculator will help you figure out how much you could get for each child.

You can use SmartAssets tax return calculator to figure out your 2021 tax refund or tax bill.

You May Like: Www.myillinoistax

Earned Income Tax Credit

The Earned Income Tax Credit is geared toward low-to-moderate income workers. EITC reduces the amount of tax someone owes, but heres the cool part: even if you dont owe any taxes or arent required to file a return, you can get the money. The amount of the credit is based on whether or not you have kids. To find out if you qualify, use the EITC assistant on IRS.gov.

The Irs Is Sending Out Letters About Stimulus Checks To Millions Of Taxpayers This Month

Dont panic if a letter from the IRS unexpectedly shows up in your mailbox this month. Tons of Americans are getting them and the message inside has nothing to do with an audit.

Starting in late January, the IRS is sending out letters to recipients of the third Economic Impact Payment, aka the COVID-19 stimulus check that went out last year. The notes are intended to help recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022, according to a recent news release.

It can be confusing, so lets recap. Congress has approved three stimulus checks since the coronavirus pandemic began. The first payment was a maximum of $1,200 most people got it in April 2020. The second was $600 most people got it in December 2020. The third was $1,400 most people got it in March 2021.

Recommended Reading: How To Get A License To Do Taxes

Are Stimulus Checks Taxable 5 Things To Keep In Mind When Filling Out Your 2020 Income Taxes

Tax filing season for calendar year 2020 opened February 12, a few weeks later than usual. Unlike last year, when the deadline to file and pay any tax owed was extended to July, this year, we revert to good ol April 15, so its time to get organized.

If you didnt learn the lesson of electronic filing last year, this is the year to dump the paper. Those who had electronic files with the IRS got stimulus checks faster than paper filers. To make the process seamless, choose direct deposit, the safest, most accurate and fastest way to get a refund, according to the IRS.

The Brokenness Of The Irs

A lot of practitioners and regular people get upset about IRS inability to provide reasonable service. I share this concern. I am also concerned about their failure to get people into compliance. It has actually become a viable strategy to just not pay the tax that you owe with the hope of waiting out the ten year statute of limitations as I discussed in IRS Collections Appears To Be Broken. Besides attracting a good number of eyeballs this post also made a good impression on my son who did a review of the year’s output which I published on Your Tax Matters Partner. He wrote:

The IRS assigns tax debt to private collectors? Those companies whose number my phone will tell me is a scam caller? Should be no surprise then that of the 30 billion dollars of tax debt The IRS has assigned to collectors, they have only received 500 million in return.

I also did a story on how hard it can be for regular people to be compliant – IRS Automatic Notices Alienate Taxpayers – A New Scandal Looming?

Also Check: Federal Tax Id Reverse Lookup

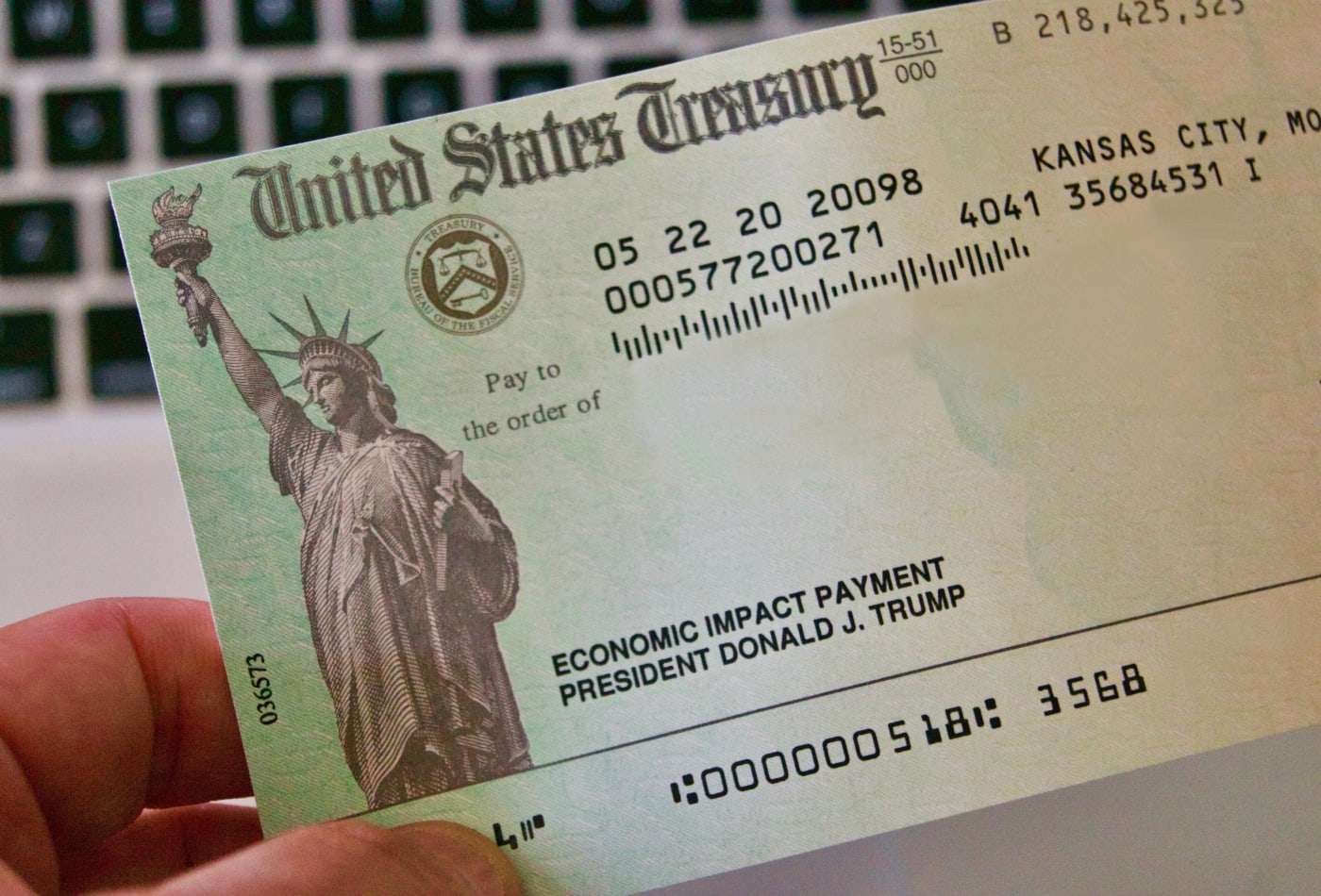

What Is The Stimulus Check

As part of the $2.2 trillion CARES Act, the federal government will issue payments – by check or direct deposit – to millions of income-qualified Americans. This is what we mean by “stimulus check.” The purpose of the payments is to help people cover basic necessities at a time when many have been told to stay home and have lost income.

If You’re Crunched For Time Find An Online Advisor That Can Help You While Staying Within Your Budget Click On Your State And Find Yours Today

In order to make the stimulus checks work from a tax perspective, the government technically had to structure them as advance payments on fully refundable tax credits. As such, the third stimulus check is linked to the 2021 Recovery Rebate Credit.

Though stimulus checks are not taxable income, youll still have to report the money you received on your 2021 taxes the ones youll file this spring. If you didnt receive the entire third stimulus check and you think you qualify for more, you can also reconcile that on your taxes.

Read Also: Reverse Ein Search

Payments Were Technically Tax Credits

The stimulus payments in 2020 and 2021 were not taxable income because they were actually advance payments of tax credits. A tax credit is a dollar-for-dollar reduction in the amount of your tax liability. Typically, you claim a tax credit when you file your taxes. The credit is used to offset any balance due and, in the case of a refundable tax credit, any excess comes to you in the form of a refund.

Due to the severity of the pandemic, Congress determined that sending payments to Americans immediately was a better course of action than waiting for them to claim the credit on their tax returns. This provided rapid relief from the severe economic repercussions of the pandemic.

If taxpayers had been forced to wait until tax filing time to receive these credits, the financial consequences would have no doubt been much more severe. Nevertheless, the function and taxability of the stimulus payments was the same as if taxpayers had received a more traditional tax credit.

More Advice: How To Itemize Deductions Like a Tax Pro

I Already Received A Stimulus Check Do I Need To Report It On My 2020 Taxes

Well, what if youve already received a stimulus check from the first two rounds? Do you need to report your stimulus checks from 2020 on your tax return?

We can Verify this is false — you don’t need to report any of your stimulus checks from 2020 on your tax returns, because they aren’t considered taxable income.

Cari Weston, an accountant with the American Institute of Certified Public Accountants, told the Verify team that the checks are not considered taxable income…and will not be reported as such on 2020 tax returns.”

RELATED: Third stimulus check: Should you file your 2020 taxes right away or wait?

Technically, the CARES Act lowered the tax liability for last year, which means most people would have gotten a larger refund when they filed their 2020 taxes this year. But instead of waiting to send payments, the IRS issued those refunds as stimulus checks.

Also Check: Www Michigan Gov Collectionseservice

How About Homeless People

About $5 billion will be allocated to help the homeless, including the conversion of properties like motels into shelters.Another $5 billion will be used for emergency housing vouchers to help several groups of people from the homeless to people at risk of homelessness, including survivors of domestic violence find stable housing.

Health Insurance

What If I Wait Until The April 15 Tax Due Date Or File For An Extension

April 15 is the due date for all 2020 tax returns, but filing your taxes sooner will not only potentially speed up delivery of any tax refund you might collect but also position you to get any missing stimulus money weeks or even months faster. We made a handy comparison chart here that looks at the timing.

Filing for a tax extension won’t postpone your having to pay taxes you may owe. Those will still be due by April 15 otherwise, you accrue interest on the amount, which you’ll eventually have to pay on top of your income taxes. And you of course are delaying receiving your stimulus payment.

Read Also: Pin Number To File Taxes

You Might Need To Report Your Stimulus Payments On Your 2020 Federal Tax Return

If you received the full stimulus payment for the first and second round of payments, you wont need to claim the Recovery Rebate Credit on their tax return nor pay taxes on the amounts received.

For those who received a partial amount or no payment at allfor either round of aid, you may be able to claim the remainder on your 2020 tax return through the Recovery Rebate Credit worksheet. You will need to claim it even if you receive a partial payment in error. This allows the IRS to determine if you are eligible for an additional payment or not. Refer to your Notice 1444 to ensure you are claiming the correct amount.

The first full stimulus payment was $1,200 for single individuals and $2,400 for married couples. The second full stimulus payment was $600 for single individuals and $1,200 for married couples.

There was an income cutoff for receiving the full stimulus check and if you earned more than that amount, you may have still received a checkbut for a lower amount . For both rounds of payments, the full stimulus check amount was reduced by $5 for every $100 earned above $75,000 for single individuals and $150,000 for married couples.

If you qualify, the recovery rebate credit will either increase your tax refund or reduce the amount you owe .

What If I Receive Social Security Or Supplemental Security Income

Not everyone needs to file to get a stimulus payment. If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check, depending on how you normally receive your Social Security income.

If you receive Supplemental Security Income , you will automatically receive a stimulus payment with no further action needed. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive their SSI benefits.

Also Check: Power To Levy Taxes

Stimulus Checks Unpassed Tax Provisions And Other Fun In 2021

Silhouette man jump between 2021 and 2022 years with sunset background, Success new year concept.

getty

My trademark as a tax blogger is “stuff I find interesting”. Not surprisingly a bit of that stuff is not that interesting to a very large number of people. Much as I appreciate the discerning elite of my readers, I sometimes like to reflect on what seems to be of the most interest. Here is what my readership found most interesting in 2021.

Will 2020 Stimulus Payments Affect Your Taxes

In April, the federal government began sending stimulus payments to millions of Americans in an effort to ease financial stress caused by the COVID-19 pandemic and to boost the U.S. economy. These payments offer a bit of relief for people who have struggled to pay rent, buy groceries or take care of other basic needs as a result of the pandemic-triggered downturn.

If you received one of these checks or are on track to get one, you might be curious how the stimulus payment affects your taxes. In short, while there is a relationship between your check and your taxes, receiving a check won’t increase your tax liability or reduce your refund.

Read on to learn about the impact of your stimulus check on your taxes.

Recommended Reading: Reverse Ein Lookup Irs

Child Tax Credit Payments

The advance Child Tax Credit payments began going out to tens of millions of eligible households in mid-July, and are being paid in up to six monthly installments through the end of 2021 . Families got up to $300 per each eligible child under 6, and $250 for every qualifying child between 6 and 17 years old.

However, because the amounts were primarily based on 2019 or 2020 tax returns whichever was the latest in the IRSs records some people may have obtained more or less than what they were actually eligible for this year, according to the IRS.

Anyone who collected too much might need to repay some or even all of the advance credit, the federal agency says. On the other end of the spectrum, people who received less can claim the remaining amount when they file their 2021 taxes.

Since only the first six months of the child tax credit was paid in advance, the last half of it will be claimed on the 2021 tax return. Some parents opted out entirely of the advance payments and will be able to claim what theyre owed as one lump-sum amount.

Ultimately, Families who received advance payments will need to compare the advance Child Tax Credit payments that they received in 2021 with the amount of the Child Tax Credit that they can properly claim on their 2021 tax return, according to the IRSs website.

The IRS has created a special page for taxpayers which outlines actions that can be taken to simplify the filing process next year.

The Al Capone Syndrome

My post on an odd reaction to whatever it was that happened on January 6, 2021 – Congressional Democrats Want It Made Clear That Insurrection Is Not A Tax Exempt Activity – proved popular. I had a bad feeling about January 6 and spent the morning and afternoon watching a variety of news feeds. The notion that the IRS needed to caution exempt organizations that they shouldn’t be overthrowing the government if they wanted to maintain their exempt status really seemed a bit silly. It struck me as an instance of what I call the “Al Capone” syndrome, which has people who did all sorts of other crimes being convicted of tax crimes.

You May Like: Doordash Payable Account

Stimulus Checks Are Being Sent Out In January Find Out If You Will Get A $1400 Payment

- 18:10 ET, Dec 30 2021

STIMULUS checks are being sent out in January with Americans urged to find out if they are eligible for a $1,400 payment.

The third stimulus checks, officially known as Economic Impact Payments, were sent to Americans who earned less than $75,000 as an individual, or $150,000 for a married couple.

Americans who could see a $1,400 payment in 2022 include parents who welcomed a new baby in 2021.

Who Qualifies For The Third Stimulus Check

Millions of Americans who were eligible for the $600 second stimulus checks could qualify for the third round of stimulus payments up to $1,400. However, many high-earning taxpayers who were eligible for previous stimulus checks are now excluded. The plan narrows income eligibility to exclude individuals earning over $80,000 and couples making over $160,000:

- Singles phase out at AGIs between $75,000 and $80,000.

- Heads of household phase out at AGIs between $112,500 and 120,000.

- Couples phase out at AGIs between $150,000 and $160,000.

Keep in mind that this is different from the sliding scale that was used to determine eligibility for previous stimulus payments. The IRS reduced second stimulus checks by 5% for the total amount made over the AGI limit. This means that payments went down by $5 for every $100 over the limit.

The table below breaks down third stimulus payments based on narrower income ranges for singles and joint tax filers:

| $1,400 Stimulus Checks With Narrower Income Ranges |

| Single AGI |

| $174,000 and up | $0 |

If you want to get a specific breakdown, SmartAssets third stimulus check calculator will give you an estimate based on your filing status, AGI and dependents.

Read Also: Wheres My 3rd Stimulus 2021

Read Also: Doordash Payable 1099