Utah Statewide Business Licenses

The most common statewide license in Utah is the state sales tax license, sometimes called a sellers permit. Businesses in Utah need to obtain this license so that they can collect sales and use tax from customers. Additionally, many regulated professionsfrom cheese-making to physical therapyneed a specialized license from the Division of Professional Licensing.

Do I Need To Have A Bachelors Degree To Become A Tax Preparer

No, you cannot work as a tax preparer without having a high school diploma or a General Equivalency Diploma . To start working in this field, you must complete a tax preparation program offered by a technical or vocational school and obtain a PTIN number from the IRS. However, obtaining a bachelors degree in accounting can help you to make more money.

Starting A Tax Preparer’s Business In Maryland

Tax Preparers provide a vital service to their clients, however you are also businesses yourselves. In addition to providing you with all of the resources you need to fulfill your clients’ tax obligations, the Comptroller’s Office also understands that you have your own businesses to build and maintain. This section provides the resources that you need as a potential tax preparer to set up your business in Maryland.

You May Like: What Is The Minimum Income Required To File Taxes

Who Is Required To Register With Ctec

Any non-exempt tax preparer in California who, for a fee or for other consideration:

- Assists with or prepares state or federal income tax returns

- Assumes final responsibility for such returns

- Offers these services

Exempt prepares not required to register with CTEC are:

- California Certified Public Accountants

- Enrolled agents

- Attorneys who are members of the California State Bar

- Specified banking or trust officials

Preparing a tax return includes inputting of tax data into a computer.

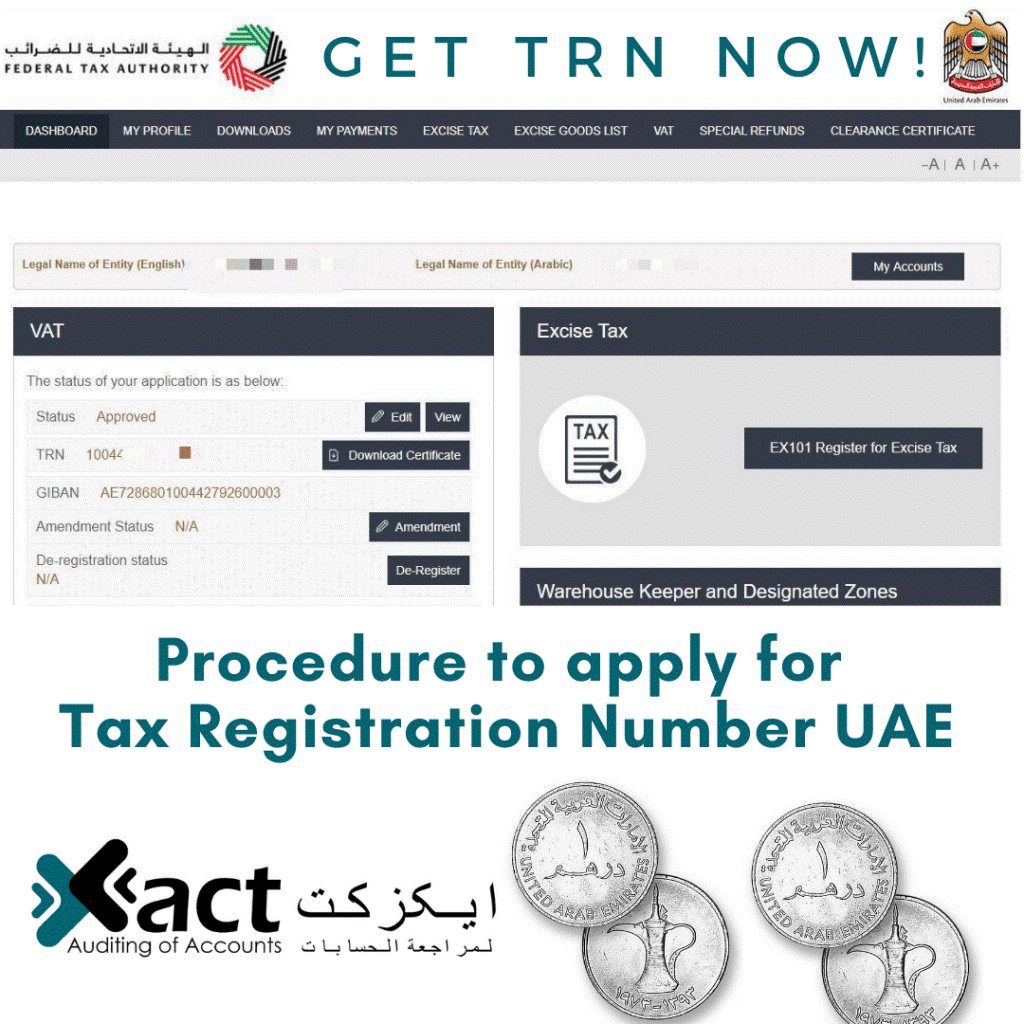

Tax Residency Certificate In Dubai Individuals

We have outlined above what a Tax Residency Certificate is and what it means for individual taxpayers. Individuals are only eligible for a Tax Domicile Certificate after residing in Dubai for more than six months. It also entitles the ex-pat to avoid paying double tax through the UAEs double taxation avoidance agreements with 88 other countries.

The required documents for an Individual Tax Residency Certificate are:

- A copy of your passport and Emirates ID

- A valid UAE resident visa

- Six months of bank statements from a UAE bank

- Your employment contract

- Proof of income in the UAE

- A certified copy of a residential lease agreement

- A report from the UAEs General Directorate of Residency and Foreigners Affairs that lists the individuals duration of stay in the UAE

Also Check: Is Life Insurance Tax Deductible

Get A Tax Registration Certificate

In order to get a tax registration certificate, you will need to apply through LACounty.gov. You can do this online or by mailing in a form. Once your application has been approved, your business will be able to receive state and local business licenses, as well as operate legally within California.

To obtain a Tax Registration Certificate for small businesses in Los Angeles County:

- Go to and choose the option for small businesses

- Select the type of business you are starting

- Choose the Tax Registration Certificate option from the dropdown menu on the left side of the page

- Submit it when complete

Should You Enter The Irs Filing Season Program

The IRS does not license tax return preparers or impose any educational or other requirements on them. Why? Because it’s not legally authorized to do so. But the IRS does have a voluntary registration program: the Annual Filing Season Program. To join this program, you must have a PTIN and complete 18 hours of tax continuing education. This program includes a six-hour federal tax law refresher course with the test. After completing these requirements, you’ll receive an Annual Filing Season Program Record of Completion certification from the IRS. You’ll also get listed in an IRS online database of tax preparers. This record is officially called the Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. Being listed in the directory can help you get business. In addition, Annual Filing Season Program participants have a limited right to represent their clients before the IRS. They may do so before revenue agents, customer service representatives, and similar IRS employees, including the Taxpayer Advocate Service. For more information, refer to the IRS Annual Filing Season Program web page.

You May Like: How To Be Tax Exempt

How To Start A Professional Tax Practice

Starting your own professional tax practice is a unique and intricate process, with Internal Revenue Service requirements and ever-changing laws adding to the complexity. Whether you are planning on becoming a solo practitioner or starting a larger practice, this page provides a detailed explanation of the steps you can take to start your own professional tax practice to help ease the process for you.

1. Get registered

Once you have decided on a type of entity for your business, you can register your business with your state. A common way that small businesses register is by filing a Doing Business As name with their state. This can be a simple way to become registered with your state without creating a formal business structure for your company. Another option is to form a limited liability company or corporation for your business, which automatically registers your business with the state. Contact your state government to find more information about registering with your state.

Some business types may also require a Federal Employer Identification Number . While some states enable you to apply for an EIN during the business registration process, some states require a separate application.

to see if you need an EIN. Some cities may require additional registration, licenses or permits, so please contact your county clerk for additional information.

To obtain a PTIN number, you can register on the IRS website. Applying online takes about 15 minutes.

Comply With State Licensing Requirements For Non

The following states require non-credentialed tax preparers to obtain a state-issued license or registration. Many impose education and competency examination requirements as well. These license requirements do not apply to CPAs, enrolled agents, or attorneys. Some of these states have other exemptions. So study your state’s policy and requirements carefully.

You May Like: Do You Get Taxed On Cryptocurrency Gains

Form Your Business Entity

Youll need a business license in the name of your business. Its best to establish a business structure and business name before you apply for a business license. That way you dont have to reapply or amend your business license later.

Common legal structures for small businesses include:

If you establish an LLC, corporation or nonprofit corporation, youll establish a name for your company when you file formation paperwork with your state. Depending on your state, you may be able to get a DBA from the state, or you may need to file your DBA with your local government.

Federal Preparer Tax Identification Number

In order to legally prepare federal income taxes in Maryland you must apply for, be granted, and annually renew a Preparer Tax Identification Number from the Internal Revenue Service. Find out more at the IRS Web site for Tax Professionals. A state registration is not required to prepare federal individual tax returns.

Don’t Miss: What Are The 2020 Income Tax Brackets

Licensing Information For Some Specific Business Types

- Businesses based outside Seattle If your business is based outside Seattle and you do business within the city, then you must have a Seattle business license tax certificate. In other words, you need a license for where you conduct business not just for where you’re located.

- Subcontractors Subcontractors need a Seattle business license tax certificate even if the contractor who they are working with already has one. The license is valid only for the legal owner listed on it.

- Nonprofits If you raise funds in Seattle, whether as a for-profit or non-profit organization, you must have a Seattle business license tax certificate.

- Online-only business Contact us if you have questions about licensing for online-only businesses. You may need a Seattle business license tax certificate if your business originates from Seattle or has servers within city limits.

- Home-based business Businesses based in a Seattle home usually need a Seattle business license tax certificate. Contact us if you have questions about licensing for home-based businesses.

- Street/sidewalk vending In addition to a regular Seattle business license tax certificate, you may need a street-use permit to operate as a street vendor in the City of Seattle. A street-use permit is issued through the Seattle Department of Transportation . For more information, see SDOT’s Vending Permits page.

How Much Does A Tax Preparer Make And Whats The Average Salary For The Role

The amount of money a preparer can make is largely dependent on whether theyre a sole practitioner or work for a public accounting firm, the number of clients they can handle, and the geographical location of their practice.

So, while many first-year tax preparers may claim a starting salary around the $50,000, year one staff might be somewhere between $30,000-$40,000 at a different firm. And if youre serving as an intern, you might not make anything.

While the salaries of most regional firms will be set before you walk through the doors for your interview, the amount of money a sole practitioner can make is limitless . So, then the questions become: how many clients can you get? How much work can you get through? What kind of software can boost your efficiency and increase throughput?

Some people begin their careers at firms to get the first two years of experience. And then they break away and start a local firm. This allows you to get high-quality training to boost your skills out of the gate.

Several national and seasonal businesses also offer training to their preparers.

Read Also: How Much Do Business Owners Pay In Taxes

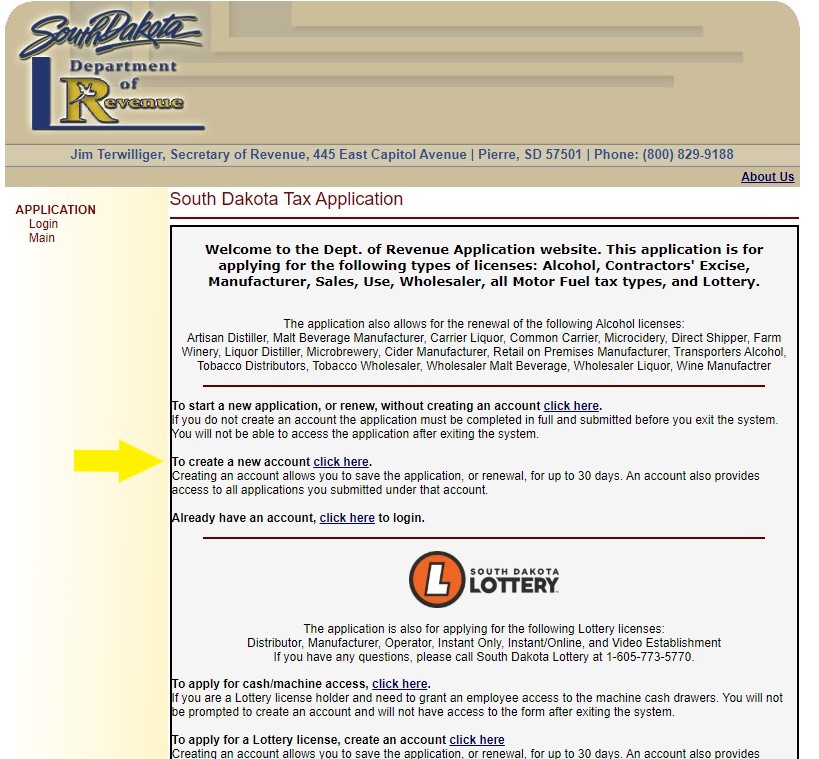

Applying For A Tpt License

The Arizona Joint Tax Application is used to apply for transaction privilege tax, use tax, and Employer Withholding and Unemployment Insurance. The application is called “joint” because it is used by both ADOR and Economic Security and allows the business owner to apply for any of the listed licenses and registrations on a single application.

License Registration Options:

One license number for all locations — location numbers identify each separate location.

Multiple license number for all locations — the license number will correspond with a unique location number.

Once licensed, if a business is closed or moved to a new location, the unique location number for that business will no longer be valid. ADOR will assign a new location number to a business if that business is moved to a new location. If a new expansion or location is opened for a business, the new location will be issued a new location number.

-

This option enables businesses to register, file and pay TPT online .Setup Your AZTaxes.gov AccountThis step-by-step guide will help you with new user registration and setting up your AZTaxes.gov account, .

What Is A Tax Residency Certificate

A Tax Residency Certificate means that a person is a tax resident. A Tax Residency Certificate is a legal document issued by the UAEs Ministry of Finance that proves that you pay taxes to the government and enables you to benefit from the UAEs double taxation avoidance agreements. These Tax Residency Certificates are valid for one year.

The Tax Residency Certificate is available to individuals who spend at least 183 days a year in Dubai .

Businesses can apply for a Tax Residency Certificate , whether they are based in a Free Zone or on the Mainland. Offshore companies are not eligible for Tax Residency Certificates. They must apply for a Tax Exemption Certificate instead.

For individuals and businesses alike, a Tax Residency Certificate can be used to reclaim any taxes paid in the same tax year period as the year in which you relocated your business to Dubai or settled in Dubai as an ex-pat.

Recommended Reading: What Percentage Is Payroll Tax

Who Must Complete Requirements

If you meet New York States definition of a commercial tax return preparer, you have New York State continuing education requirements. These requirements may not be satisfied with either CPE or CLE credits. You can see Who is a tax return preparer or facilitator to determine whether you meet the states definition.

Also Check: Where Do I Pay My Federal Taxes

When To Surrender Or Destroy Your Sales Or Use Tax License

Just like how your sales or use tax license needs to be amended in certain situations, there are cases where you need to destroy it all together. You generally must surrender or destroy your license if, among other reasons, you:

- Stop doing business

- Sell, transfer, or assign your business to another party

- Change the form of your business

These changes require that you deregister the business. When you deregister, some states will cancel a license when the business simply notes final on the last return, while other states provide a formal deregistration process.

In all jurisdictions, you are responsible for filing until deregistration is complete, regardless of the fact that the returns will be for zero dollars. Failure to file even zero dollar returns could result in collection issues, as well as interfere with the release of bond monies paid for the original license. How the deregistration process works varies by jurisdiction.

At the state level, its generally best practice to check with the sales tax registration unit for each state. Below are links to the state sales tax web pages and sales tax registration web pages:

| SOUTH CAROLINA |

This listing excludes the NOMAD States, those States without a State Level Sales Tax: New Hampshire, Oregon, Montana, Alaska & Delaware

You May Like: How To Report Bitcoin On Taxes

Obtain A Tax Preparation License In Your State

You might need to take additional steps to become a tax preparer in some states. If you receive a PTIN but live in California, Connecticut, Maryland, Nevada, New York, or Oregon, you must obtain a state license to practice as a tax preparer in those states.

Connecticut residents must obtain a permit every two years from the states Department of Revenue Services, and California residents are required to complete 20 hours of continuing education each year. Always inquire about the most recent requirements from the state where you intend to work.

How Do I Keep Up With New Tax Law Changes

Keeping up with tax law changes is imperative for both new and experienced preparers. As a result, most preparers invest some time each day checking on any IRS changes, technical corrections, or any other state or local changes that might impact their business.

An excellent first stop is the IRS website, which is full of publications and instructions that will help new and experienced preparers navigate changes to the tax code, as well as commonly asked questions and other useful tips.Checkpoint Edge from Thomson Reuters is another resource for tax professionals who are looking to do their jobs with more accuracy, confidence, and daily news updates. Checkpoint Edge provides you with up-to-date research materials, editorial insight, productivity tools, online learning, and marketing resources that add value to your firm immediately.

Alternatively, if youre on a tight budget, a few well-chosen tax books may be sufficient to begin with.

“Understand that you cannot possibly know every tax law ever written, especially in times of sweeping tax law changes as we are experiencing today. Make yourself valuable by honing your tax research skills. If you don’t know the answer, you must know how to find the answer.”

Recommended Reading: How To Fill W 9 Tax Form

How To Get My Tax Preparers License

Contrary to common belief, only two states in the U.S. require tax preparers to be licensed. With the exception of Oregon and California, a person is not required to be individually licensed to receive a fee for income tax preparation services. However, many states have business license requirements.

Also Check: How Do You Add Sales Tax

How To Register For Business Licenses

Once youve decided to start a business in LA, the first thing you should do is contact your local government to find out what licenses you need. The types of licenses that apply to your business will depend on what type of company you are operating and how large it is.

You can ask for an initial consultation with a lawyer or tax expert specializing in small business registration. They can help guide you through registering for a business license, tax registration certificate, and becoming an LLC .

There are also two other important steps: filing to become an employer by getting a federal employer identification number , which allows them to pay taxes on behalf of their employees, and filing for unemployment insurance if they hire anyone full-time.

Also Check: How To Avoid Capital Gains Tax On Home Sale

Training To Be A Tax Preparer

Training options for tax preparers vary by the type of tax preparation work that you plan to do. Many tax preparation services offer training programs, as do some vocational schools. If you plan to work as a volunteer federal tax preparer, you can take training through the IRS Link and Learn program. Some preparers must complete continuing education courses as a condition of renewing their PTIN.

For-profit tax preparer organizations, including H and R Block, offer training courses that generally begin in the fall so you’ll be ready by tax season. COVID-19 has opened up opportunities for online learning as well. H and R Block’s program is a free IRS tax preparation course, although you will have to pay for your study materials. H and R Block does not guarantee employment however, successful completion of the course and final exam can lead to a job offer from the company.

References