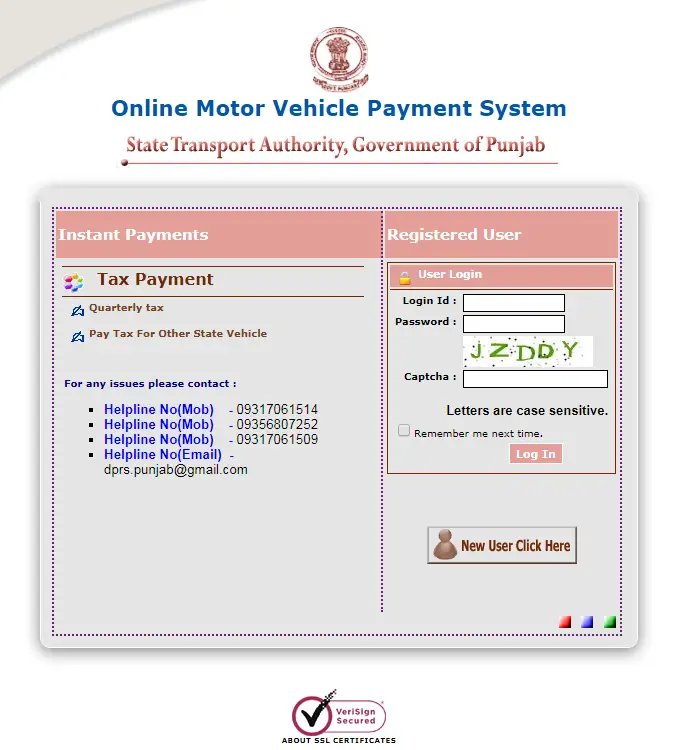

How To Pay Vehicles Token Online

Now you can pay token tax for the vehicles online without any hassle of standing in long queues and wasting your time. Here is how you can proceed with online payment of token tax:

- Install the application from play store or app store

- The next step is to create an account

- Then you have to select excise and taxation

- Search for vehicle

- Then the application will generate challan

- The last step is to note the PISD number and make the payment

This application shall accommodate the following government functions:

- Police Complaints

Motor Vehicle Tax

Motor Vehicles Tax is an important levy of Excise & Taxation Department. It brings considerable revenue and is another major source of income to the exchequer. It is administered under the provisions of the Motor Vehicle Ordinance, 1965 and Motor Vehicle Tax Act, 1958.

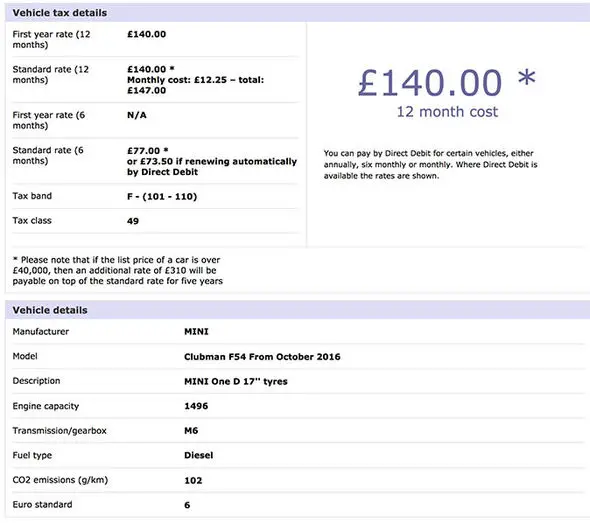

Rates of Token tax for Motor Car

Here is the rates list of token tax, Income Tax and Professional Tax for Motor Car:

Rates of Token Tax for Imported Cars

Here is the list of token tax for imported cars:

Terms & Conditions

- The Government may, by notification, exempt any class of vehicles from the levy of the tax under this section

- The tax under this section shall not be levied on a motor car owned by the Federal Government, the Government or any other Provincial Government

- The Government may by notification in official Gazette, make rules to carry out purposes of this section

Get Your Payment Together

At City Hall, we accept cash, credit cards, pinless debit cards, and checks or money orders made payable to the City of Boston.

If you use a credit card or pinless debit card, there is a non-refundable service fee of 2.5% of the total payment, with a $1 minimum. This fee is paid to the card processor and not kept by the City.

If your debit card requires you to enter your pin to process a payment, you CANNOT use it to pay your fee.

What Are The Cost

Electronic Checks: Pay directly from your checking or savings account. This option is FREE of charge.

MasterCard®, Discover®, American Express® and VISA®. If you are using a debit card, it will be treated as a credit card payment and will have the same charges associated with credit card payments. The convenience fee for using a credit card is 2.95% of the payment amount. Prices are subject to change without prior notice.

Read Also: When Is Taxes Due This Year

Check Your Vehicle Identification Number Before You Renew

You will need to correct your vehicle identification number before you can renew your licence plate sticker online.

If the vehicle identification number on your dashboard and vehicle permit does not match, you will need to visit ServiceOntario to correct it. You will need to bring the following documents:

- the vehicle permit the vehicle portion of the permit is required

- your Canada Inter-Province Motor Vehicle Liability Insurance Card

- one of the following documents:

- original vehicle manufacturers warranty

- copy of manufacturers invoice

- original or copy of the bill/certificate of sale from the original selling dealer

- letter from an authorized dealer for your make of vehicle verifying the correct vehicle identification number of the vehicle

- copy of certificate of title/certificate of origin

- copy of new vehicle information statement .

- original safety standards certificate, form SR-E-214, only if the last 6 characters of the vehicle identification number are correct

- sworn affidavit by the vehicle owner explaining the vehicle identification number error

If you do not have insurance, you must get it from an insurance provider licensed to do business in Ontario. Proof of insurance is required to renew your licence plate sticker.

Board Of Supervisors Approves 15% Tax Relief On Personal Property Taxes

Vehicle values climbed by an average of 33% or more as of Jan 1, 2022 according to the J.D. Power pricing guide. To help vehicle owners, the Fairfax County Board of Supervisors approved 15% tax relief for personal property taxes as part of their FY 2023 budget markup. This will be accomplished by assessing vehicles at only 85% of their market value rather than the normal 100%. This option is provided for the County to ensure the assessments do not exceed actual fair market value due to unusual or extenuating circumstances and when an assessment ratio lower than 100% may reasonably be expected to determine actual fair market value.

Use our vehicle value tax calculator to estimate your taxes for the year.

Don’t Miss: How Much Federal Taxes Deducted From Paycheck

Reporting Of Payment & Receipt

A receipt will be provided through the mail for all completed payments made through the Orangeburg County Online Bill Payment system. The receipt will be mailed to the address on the tax bill. After making your payment, you will be given the option of printing a payment receipt this receipt is generated by Orangeburg Countys payment processing vendor and while it does confirm that your payment has been received it does not denote that Orangeburg Countys tax records have been updated to reflect your payment. Please allow up to 3 business days for our online records to show that your payment has been received and up to 7 days for your receipt from Orangeburg County to be generated/mailed.

Get Your Bill In The Mail Before Visiting City Hall

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. You pay an excise instead of a personal property tax. If your vehicle isn’t registered, youll have to pay personal property taxes on it.

We send you a bill in the mail. You need to pay the bill within 30 days of the date we issued the bill. Payments are considered made when received by the Collector.

The states Registry of Motor Vehicles determines the value of motor vehicles each year based on the list price and age of the vehicle. We use that information to figure out your excise tax.

You are taxed at a rate of $25 per thousand dollars of your cars value. If you registered your car after January 31, we tax you from the month that you registered your car until the end of the year. For example:

- if you register your car on April 20, you will be taxed for nine months of the year, from April 1 until December 31.

For more information, we created a page all about motor vehicle and boat taxes.

You May Like: What Is The Corporate Tax Rate In Switzerland

Now There Are Three Ways To Pay Your Tax:

1. Through an ATM

Visit your nearest 1Link ATM along with your ATM Card.

After PIN verification, select the option of Tax Payment under the option of bill payment and select Excise and Taxation from the main menu.

Enter the 6 digits of the PSID and Press OK.

Due amount against PSID number automatically/Fetch and display on the ATM Screen.

2. Net banking

Log in to your internet or mobile banking platform.

Select the option of Tax Payment under the option of Bill Payment and select Excise & Taxation from the main menu.

Enter the 6 digits of your PSID and Press OK.

Due amount against PSID number automatically fetch and display on the your Screen.

Message of successful transaction will appear on the screen.

3. Bank branches

Visit the nearest 1Link Member bank branches along with a print of the PSID and ask the cashier to make the payment of levy against the PSID.

Pay Your Stamford Taxes Four Ways

The City of Stamford is pleased to offer an online payment system for Personal Property, Real Estate and Motor Vehicle Taxes. This feature gives residents a more convenient way to pay their taxes. Here is a list of the features our online tax portal can provide:

- View your bill and make a one-time payment without registering.

- Register for an account to enjoy 24/7 access to your payment history and bills.

- Pay anytime, anywhere with a mobile optimized experience online, on your mobile device, or by text message .

- Schedule a payment for the same day, a future date, or enroll in AutoPay automatically pay the invoice amount from your default payment method on the due date.

- Go Green! Sign up for paperless billing.

- In addition to receiving email reminders when a payment is due and a confirmation email after making a payment, you can sign-up for courtesy email reminders which can be sent to multiple people in your household.

When using the online portal for payments, please make sure all information is entered correctly. Payments that are charged back/returned due to incorrect entry of information will result in a $20.00 returned item charge.

for Online Tax Payment FAQs

Please Call 844-543-1263

Please note if you have delinquent Real Estate or Personal Property taxes this IVR line will only list the oldest tax due. Please use the on-line payment system or contact the tax office to search for all taxes due.

What information will you need to pay using the IVR line:

Read Also: Is Ein Same As Sales Tax Number

Treasurer Record Search And Online Payments

Important NoticeSpartanburg County Treasurer will never call, text or email you asking for any personal information such as a bank account or credit card number, account PIN or password or Social Security number. If you have any questions about the status of a payment you submitted, please contact the Spartanburg County Treasurers office at 864-596-2603.

Search our database or make payments online.

Spartanburg County encourages those needing to pay Vehicle taxes to avoid coming inside the office. Citizens can pay Vehicle taxes through mail, drop box, phone or internet. As of 5:00 p.m. March 23,2020, Spartanburg County will waive all Credit/Debit card fees until further notice.

Spartanburg County Treasurer is no longer accepting 2020 real property tax payments. For inquiries regarding real property tax for 2020 and prior, please contact the Tax Collector at 864-596-2597. Read the following if making payments online or by phone.

Skip The Line Pay Online

Paying online with an E-check or credit card gives you the flexibility to pay when desired.

- Its easy, convenient, and secure!

- Accessible 24 hours a day.

- Schedule payment today to occur at a later time.

To pay online, please visit epay.cityhallsystems.com.

If you have any questions regarding setting up an account or finding your bills, call City Hall Systems at 508-381-5455.

If you have questions regarding your actual bill, you may call the tax collector at 978-620-3170.

Also Check: When Are Tax Extensions Due

Get Your Bill In The Mail

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. You pay an excise instead of a personal property tax. If your vehicle isn’t registered, youll have to pay personal property taxes on it.

We send you a bill in the mail. You need to pay the bill within 30 days of the date we issued the bill. Payments are considered made when received by the Collector.

The states Registry of Motor Vehicles determines the value of motor vehicles each year based on the list price and age of the vehicle. We use that information to figure out your excise tax.

You are taxed at a rate of $25 per thousand dollars of your cars value. If you registered your car after January 31, we tax you from the month that you registered your car until the end of the year. For example:

- if you register your car on April 20, you will be taxed for nine months of the year, from April 1 until December 31.

For more information, we created a page all about motor vehicle and boat taxes.

Important Dmv Release Notice

All outstanding vehicle taxes associated with your name and/or VIN#/plate #, including taxes not yet delinquent, must be paid in full for a release to be issued.

DMV System Upgrade: as of November 16,2015, the DMV no longer accepts paper tax releases.

DMV Delinquent Tax Release:

- Payments made in full will be posted to the account within 24 hours. A mass release file is sent electronically to the DMV daily after the posting of all payments, DMV files are then updated nightly during the work week. Please allow 48 hours for a release.

- Payments posted & paid by cash, money orders or certified bank check will be cleared using the above process.

- Payments made by personal checks in office or by mail will have an automatic five business day hold, unless you provide proof of payment before that time.

- All payments made online before 8 pm Monday-Thursday are uploaded & posted on the next business day . All payments made after 8 pm Monday-Thursday allow 48 hours to be posted. Payments made after 8 pm on Friday-Sunday would not be posted until the following Tuesday.

Convenience Fees for Online Payments

- ACH-Checking/Savings Account

You May Like: Do You Pay Taxes On Dividends Reinvested

Deadline To File And Pay Taxes Was May 17

Find out what to do if you cant pay what you owe. An extension to file is not an extension to pay the taxes you owe.

The estimated tax payment deadline was April 15. Get details on the 2021 tax deadlines.

Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee.

Dont Miss: Texas Car Registration Cost

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 238,000 electronic payments in 2020. The Department also received more than 2.6 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Departments most popular filing methods.

Recommended Reading: When Are Self Employment Taxes Due

How To Pay Your Individual Taxes Online

- Participating financial institutions

1 These financial institutions also provide non-resident payment options.

Get Your Bill In The Mail Before Calling

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. You pay an excise instead of a personal property tax. If your vehicle isn’t registered, youll have to pay personal property taxes on it.

We send you a bill in the mail. You need to pay the bill within 30 days of the date we issued the bill. Payments are considered made when received by the Collector.

The states Registry of Motor Vehicles determines the value of motor vehicles each year based on the list price and age of the vehicle. We use that information to figure out your excise tax.

You are taxed at a rate of $25 per thousand dollars of your cars value. If you registered your car after January 31, we tax you from the month that you registered your car until the end of the year. For example:

- if you register your car on April 20, you will be taxed for nine months of the year, from April 1 until December 31.

For more information, we created a page all about motor vehicle and boat taxes.

Don’t Miss: Is Medicare Supplemental Insurance Tax Deductible

Fairfax County Provides The Option To Pay Most Of Your Tax Bills Online

Simply input information from your bill and you will be able to pay online! Pay online with e-check or credit/debit card. A third-party processing fee is assessed for credit/debit card payments. There is no charge for e-check payments.

- For vehicle tax bills, you will need the last 4 digits of your VIN and property number as shown on your tax bill. If you do not have a bill with you, you will need your DMV customer number and the last 4 digits of your vehicle’s VIN.

- For real estate taxes, you will need this year’s stub number from your real estate tax bill. If you wish to pay now and do not have a current bill, please call DTA at 703-222-8234 to obtain your stub number.

- Pay your real estate and vehicle taxes using your smartphone and QR code reader. Just scan the QR code at the top of your bill and you will be brought to our online payment portal. This option is not currently available for all tax types.

- Pay Your Fairfax County Taxes on-the-go with our free mobile app. Search Fairfax County Government on Google Play or the Apple App Store. Once you download the app and launch it, click on the Services icon, select the tax type you want to pay, and follow the simple instructions. Make sure you have the bill for the tax you are planning to pay.

Please note that the payment page will timeout after 20 min of inactivity. If this happens, you will need to refresh the page and start from the beginning.

Do I Need To Tax My Car During Lockdown

The bottom line is that everything is exactly the same as before the Corona Virus lockdown. However, there may be an opportunity for you to save money.

You need to tax your vehicle during lockdown, but if you dont have to pay tax because youre not driving you can save some cash.

So, if you have private land and wont be using your car you can actually SORN your vehicle and pocket the cash.

Remember though, if you caught driving your car without vehicle tax you can be fined up to £1,000 by the DVLA.

With the lockdown currently restricting our travel to essential only travel more and more people wont be using their vehicle. If applying for a SORN makes sense for you, thats great.

You will still need to insure the vehicle, however.

100% electric cars dont need to pay any car tax so there would be no point in getting a SORN.

Recommended Reading: What Is Form 8995 For Taxes