Should A Return Be Filed Even If Not Required

Even if your child does not meet any of the filing requirements discussed, he or she should file a tax return if income tax was withheld from his or her income, or he or she qualifies for the earned income credit, additional child tax credit, health coverage tax credit, refundable credit for prior year minimum tax, first-time home buyer credit, adoption credit, or refundable American opportunity education credit. See the tax return instructions to find out who qualifies for these credits. By filing a return, your child can get a refund.

Learn The Rules About When A Child Must File A Tax Return Because Of Earned And Unearned Income

By Stephen Fishman, J.D.

Sometimes one or more of your children will need to file their own tax returns. This can be true even though they are still your dependents for tax purposes. Generally, a child is responsible for filing his or her own tax return and paying any tax, penalties, or interest on that return. However, if your child does not pay the tax due on this income, the parents may be liable for the tax. Moreover, if a child cannot file his or her return for any reason, such as age, the child’s parent or guardian is responsible for filing a return on the child’s behalf.

What If I Only Receive Social Security Benefits

In most cases, if you only receive Social Security benefits you wouldn’t have any taxable income and wouldn’t need to file a tax return.

One catch with Social Security benefits is if you are married but file a separate tax return from your spouse who you lived with during the year. Then you will always have to include at least some of your Social Security benefits in your taxable income to see if it is greater than your standard deduction.

Read Also: Turbo Tax 8962

What Is The Exemption Credit For California: 2021

For businesses in California, the exemption credit for 2021 is Dollars 10,600. This means that if your company has five or more employees, and you are not subject to Californias minimum wage law, you will be able to deduct Dollars 10,600 of your business income from your taxes.

In California, the exemption credit for property taxes is Dollars 2,474. The exemption credit is provided by Proposition 13, passed by the voters in 1978, and it applies to any taxing unit that imposes a tax on real or personal property. For your tax year 2019, California has an exemption credit of Dollars 500.

This means that no federal income tax is owed on your first Dollars 500 in salary or wages. If you move to California in 2020, you can claim the exemption credit starting with your first payroll deposit to a California employer of Dollars 1,000.

If you are a resident of California and your state income tax is computed in whole or in part on the federal taxable income, then you may be eligible for a credit. This credit is called Exemption Credit and it is up to Dollars 10,000 per person. You should refer to your tax return for specific details about this credit.

This is your tax deduction for the total of state income taxes you paid during the 2019 tax year.

Income Tax Filing Requirements

In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are:

- Single or married filing separately and gross income is greater than $12,550

- Head of household and GI is greater than $18,800 or

Note: For non-resident individuals the threshold numbers above are prorated based on the individual’s Arizona gross income to their federal adjusted gross income.

The filing requirements are explained at the beginning of the instructions on all Arizona income tax returns. All tax forms and instructions are available to download under Individual Forms, or by visiting ADOR offices.

To expedite the processing of an income tax return, ADOR strongly encourages taxpayers to use the fillable Arizona tax forms or electronic file . Fillable Forms and e-file information are available. Each year, ADOR provides opportunities for taxpayers to file their individual income tax returns electronically at no cost to those who qualify.

Read Also: Restaurant Tax In Philadelphia

What Is The Income Threshold For Filing Taxes 2020

In 2020, for example, the minimum for single filing status if under age 65 is $12,400. If your income is below that threshold, you generally do not need to file a federal tax return. Review the full list below for other filing statuses and ages. Wondering if you need to file to get your stimulus payment?

Dont Forget About State Returns

The filing requirements outlined above apply to federal income tax returns, but if you live in a state with a state-level income tax, you may also need to file there.

Filing requirements vary by state, so check with a tax professional or your states tax agency to figure out whether you need to file a state return.

You May Like: Car Sales Tax In North Carolina

Minimum Age To File Tax Return In Canada

The Canada Revenue Agency requires all individuals earning income in Canada, to file a tax return and pay the appropriate income tax in any year their gross income exceeds certain levels, regardless of age, to file a tax return and pay the appropriate income tax in any year their gross income exceeds certain levels. There is no specific age. It depends on whether you have earned enough income to do so. If you earn more than the amount of the personal exemption allowed by the Canada Revenue Agency within one tax year, you will need to report that income on an annual tax return.

Do I Need To File Taxes If I Only Made $3000

And if you made $3,000 you do not have to file taxes as this amount is clearly less than this minimum threshold. It is also worth noting that if your dependent’s income came from self-employment, then the IRS requires anyone earning more than $400 in a year to file taxes, regardless of filing or dependency status.

Don’t Miss: What Federal Tax Forms Do I Need

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Build Up Your Rrsp Contribution Room

Even if you only earned a small amount of employment income, filing your return builds your future RRSP contribution room. Your RRSP contribution room is increased by 18% of the earned income you report on your tax return. For example, if you report $10,000 of employment income on your 2020 return, youll be able to contribute $1,800 more to your RRSP the following year. Even if you dont want to contribute to an RRSP right now, the extra $1,800 you can contribute might be useful in the future.

Unsure which filing option is right for you?

Also Check: Www.1040paytax

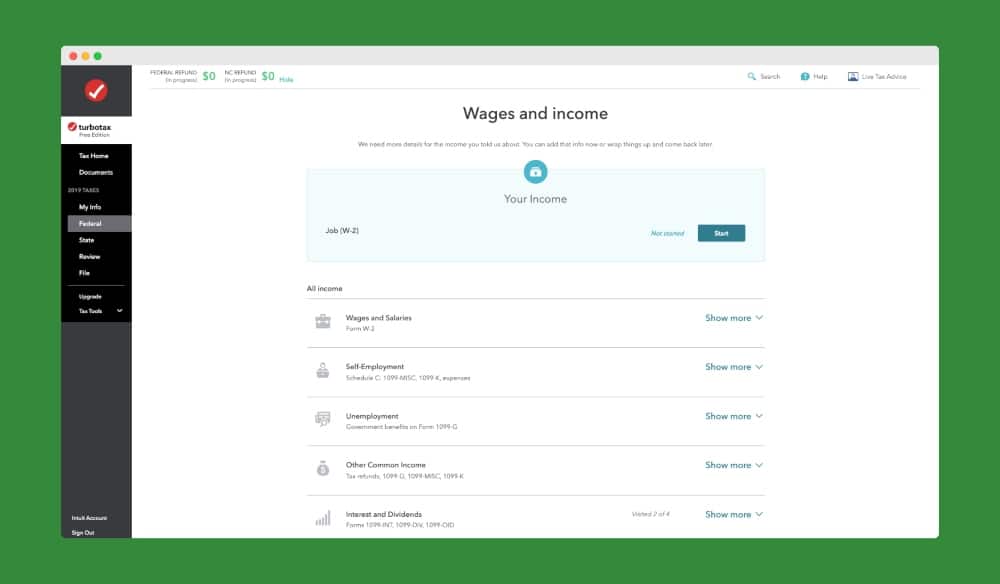

How To File A Free Return

If you arent sure if you need to file then you probably should. And being able to file for free with TurboTax makes it a no brainer. Youre able to file a return using the Free Edition if you have simple tax situations. According to TurboTax, simple tax situations can include:

- W-2 income

- Limited interest and dividend income

- A standard deduction

- Earned Income Tax Credit

- Child tax credits

Youre not eligible to use the free edition in situations like itemizing your deductions, business, or 1099-MISC income, rental property income or when taking a student loan interest deduction.

Before you start, get all of your paperwork gathered. If you have them, youll need things like your W-2, 1099-INT, 1099-DIV, or social security information. To determine if you need to file a return using TurboTax, begin by answer a few questions.

After that, youll be prompted to create a TurboTax account with Intuit. If you already have an Intuit account for Quickbooks or Mint, you can use the same login to have one account for all of their services.

Once your account is set up, next, youll add more details on your personal information to help personalize questions they ask you to complete your return.

Up next, theyll ask other questions like your marital status, mailing address, and if anyone else can claim you as a dependant. TurboTax asked questions based on your response to previous questions. So the steps you experience will be unique to your current situation.

- Wages and salaries

What Is The Minimum Income For A Dependent To File Taxes

Hi, I made some income over the past year and I’ve never done taxes before. I’m a dependent that my parents claim on their taxes. I am over 18, so I’m wondering what rules apply to me. I made approximately 900 dollars in 2021. Is that enough that I need to file taxes? I’m hoping someone can explain this very easily to me because I have no idea if I need to file taxes.

You May Like: How To File Taxes Doordash

Do You Have To File Taxes If You’re A Student

Your parents can claim you as a dependent up to age 19 unless you continue your education in which case they can claim you as a dependent through age 24. If you’re being claimed as a dependent, check the aforementioned requirements of dependents to see if you fit them. If so, you’ll have to file a tax return.

Even if you don’t have to file a tax return, you may still want to look into it. Depending on your situation, you may be able to deduct a limited amount of higher education expenses or claim education-specific tax credits like the American Opportunity Credit.

The Rules For Adults And Dependent Children

The rules change when someone can claim you on their tax return. In this scenario, you may have to file a federal tax return even if your income is lower than shown in the chart above. The thresholds look different because the IRS separates your gross income into two categories earned income and unearned income.

Earned income is the money you make by working for someone else or running your own business. Your unearned income includes investment income like interest, dividends or capital gains. It may also include canceled debt, taxable Social Security benefits, pensions and more.

The rules for when a dependent must file can be confusing, so be sure to read the threshold rules carefully. Theyre generally included in the instructions for each years Form 1040. You can also learn more in IRS Publication 501.

Don’t Miss: 1099 Form Doordash

Filing To Earn Social Security Work Credits

Children can begin earning work credits toward future Social Security and Medicare benefits when they earn a sufficient amount of money, file the appropriate tax returns, and pay Federal Insurance Contribution Act or self-employment tax. For the tax year 2021, your child must earn $1,470 to obtain a single credit . They can earn a maximum of four credits per year.

If the earnings come from a covered job, your childs employer will automatically take the FICA tax out of their paycheck. If the earnings come from self-employment, your child pays self-employment taxes quarterly or when filing.

Read Also: Do You Pay Taxes For Doordash

Cases When Youll Have To File

Even if you didnt have much income, you may still have to file taxes if any of the following circumstances apply:

- You had Federal taxes withheld from your pension and/or wages for 2019 and wish to get a refund back

- Are you entitled to the Earned Income Tax Credit for 2019

- You received unemployment income

- You were self-employed with earnings of more than $400

- You sold your home

- You owe any special tax on a qualified retirement plan You may owe tax if you:

- Received an early distribution from a qualified plan

- Made excess contributions to your IRA or HSA

- Were born before July 1, 1949, and you did not take the required minimum distribution from your qualified retirement plan

- Received a distribution in the excess of $160,000 from a qualified retirement plan

If any of the above circumstances apply to you then you should file a federal tax return regardless of your earnings.

Most of us with a small business or side hustle will need to file since self-employment income of more than $400 is one of the minimum requirements.

Also Check: Do You Pay Taxes On Doordash

Single Married Filing Separately

First and foremost, if youre married and filing a separate tax return, the minimum income to file taxes is $5. This isnt a typo or misinformation. The federal government encourages married couples to file their tax returns jointly. This is the reason why the minimum gross income to file a tax return is $5.

The minimum income to file a tax return for single filers is $12,600 for their 2020 taxes. This is for single filers who are under the age of 65 though. If youre filing as single and over the age of 65, you get an additional $1,650 in the standard deduction. The additional increase ultimately increases the minimum income limit that applies to you. Instead of $12,600, the income limit is $14,250 for those who are single and over 65.

There is also the case with blindness. If youre legally blind for tax purposes, the minimum income limit to file a tax return increases, the same as the 65 age.

| Filing Status |

| $5 |

What is legally blind for tax purposes?

If a taxpayer has a visual field of less than 20 degrees, he or she will be considered legally blind. In addition, if the vision of the person cant be corrected to 20/200 in the better-seeing eye with corrective lenses or glasses, it will be considered as legal blindness.

Other Situations In Which You’ll Need To File A Tax Return

According to the IRS, you must also file a tax return if, for example:

- You are self-employed and had net earnings of at least $400 in 2020

- You owe any special taxes

- You earned $108.28 or more from a “church or a qualified church-controlled organization that is exempt from employer social security and Medicare taxes”.

Also Check: When Does Doordash Send 1099

Income Thresholds For Taxpayers 65 And Older Are Higher

If you are at least 65 years old, you get an increase in your standard deduction. You also get an increased standard deduction if:

- You are blind

- Or your spouse is also at least 65

- Or if your spouse is blind

The largest standard deduction would be for a married couple that are both blind and both over 65 years old.

Having a larger standard deduction can allow you to have more income than someone under age 65 and still not have to file a return. TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

Why You Should File Anyway

Even if you arent required to file a tax return because your income doesnt meet the minimum thresholds, you may want to do so anyway. Thats because you may be eligible for a refundable credit.

One of the most missed-out refundable credits is the Earned Income Tax Credit , designed to provide relief for low- and moderate-income taxpayers. For 2018, the credit can be worth up to up to $6,431.

Another refundable credit is the Additional Child Tax Credit . This year, you can receive a refund that equals 15 percent of your earnings above $2,500, up to $1,400.

Don’t Miss: Do You Get Taxed On Plasma Donations

Is There A Minimum Income To File Taxes In California

For many California residents, filing taxes is a requirement, but there can be some exceptions based on income and other factors. Individuals or families who do not earn a significant gross income may not have to file a federal income tax return, but there can still be advantages to doing so. OC Free Tax Prep can help offset the costs of filing for low-income households and ensure families are maximizing their return potential.

California residents are gearing up for tax season. Though the deadline to file is May 17, 2021, it is not too early to start gathering necessary documents. A big question on some peoples minds, however, is whether they even need to file taxes if they did not have significant income.

The American Opportunity Tax Credit

This credit covers up to $2,500 for qualified college expenses and is partially refundable. If the credit brings the amount of tax you owe to zero, you can have 40% of any remaining amount of the credit, up to $1,000, refunded to you.To be eligible for the AOTC, students must be within their first four years of higher education and be enrolled at least half time at some point during the tax year.

To claim the AOTC, you must file a federal tax return with a completed Form 8863 attached to your Form 1040 or Form 1040A.

Also Check: Is 1040paytax Com Real