Who Has To Fill In The Steuererklrung Tax Return Germany

You will have to file tax return in Germany if in the year for which you are filing your tax return you have received:

- unemployment benefit

- financial aid from the employment office

You must also complete the tax return and submit it to the Finanzamt if:

- in that year you received salaries from several employers

- as spouses you have chosen income tax combination III/V or the factor has been entered for tax class IV

- if your spouse does not work in Germany, you will need to present the EU/EWR European Income Tax Form to the tax office

- whether tax exemptions are specified on the annual payroll tax slip

- you remarried in the year of your partners death

- you remarried after getting divorced in the same year

- you have earned additional income or income subject to progressive taxation exceeding EUR 410

- if you have a certain degree of disability, if you receive a disability pension or sickness pension

- if you are a legal person, i.e. if you have your own company , regardless of whether you work as an employee or not

- if your local tax office requires you to file a German tax return Steuererklärung even if you do not fall into any of the above categories

In addition to the above examples some other possibilities exist.

Optimise Tax Burden By Choosing The Right Tax Class

Youre not required to pay the Lohnsteuer as a self-employed person, however if your spouse is employed youll have to choose a tax class.Note: your tax class is primarily based on your personal circumstances as an employee. Classification in classes I, II, and VI may be predefined, but spouses should think carefully about selecting the tax class right for them. Dont shy away from changing your tax class if things shift in your life, either. It will greatly benefit you and your family to always remain in the ideal tax class.

Tax Classes For Married Couples

Marriage as an arrangement comes with many important decisions. Youll have to decide the right tax class for you both. Having children influences the decision because Germany grants tax advantages to married couplesespecially those with children. The state will attempt to accommodate parents as much as possible. Married couples must carefully choose between the various class combinations to decide which is right for them.Couples will automatically be assigned to tax class IV once married, however they then have the choice of combining classes III and V.Theres no right answer when it comes to which tax class you should choose to belong to if youre married. That depends on your respective salaries. Use a salary or tax class calculator to calculate your net salary and help you make the decision for you and your partner. Should you need to change your tax class, youll have to apply for this in writing and mail your request to the tax office. Youre permitted to do this once a year. Should you and your partner separate, neither of you may any longer use the combined tax class and you will each resume your places in your corresponding tax classes.

Also Check: How To File State Taxes Only

Crypto Losses In Germany

If you’ve sold, swapped or spent crypto within one year and made a loss instead of a profit, you won’t pay tax on it. However, you should track these losses as you can offset these losses against your profits to reduce your overall tax bill. If you have no profits to offset losses against, the German Tax Act allows taxpayers to carry forward losses to future financial years to offset against future gains.

The Tax Classes And The Self

While not subject to the Lohnsteuer, if youre self-employed you will be subject to the Einkommensteuer liability. In this case, you do not belong to any tax class and the amount youre taxed depends on how your activity is definedthat is to say, if youre exempt from trade tax as a freelancer or whether you yourself are a trader, run a sole proprietorship or partnership. When self-employed, you pay your quarterly Einkommensteuer in advance. Your Einkommensteuer return then depends on whether you will be reimbursed for overpayments or have to pay back taxes. As a self-employed person, prepare your tax return extremely carefully and make sure to submit it on time. Mistakes made are often much more devastating when youre self-employed, and you want to make the best possible use of the tax allowances and benefits provided. Its a good idea to contact a tax advisor on these matters. Organise your bookkeeping and you will make the process easier for both you and your advisor.

Don’t Miss: How To Amend My Taxes

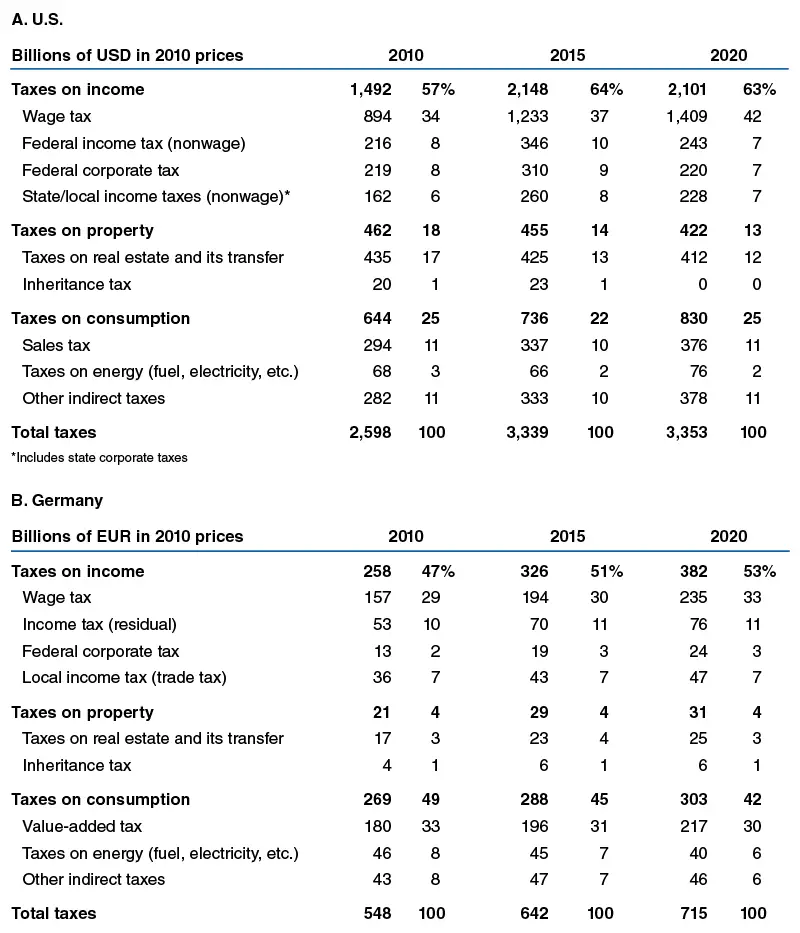

German Tax System & Taxes In Germany

Whether youre a German citizen or an expat, you are required by law to pay taxes if you earn money while living or working in Germany.

Taxes are levied by the federal government , federal states and municipalities . Tax administration is shared between two taxation authorities: the Federal Central Tax Office and the approximately 650 regional tax offices .

Tax revenue, derived from income tax, VAT, corporation tax and various other streams, is distributed between the federal government, states and municipalities.

How To Use The German Income Tax Calculator

Our income tax calculator for Germany can estimate your take-home salary and total taxes due in just a few clicks. All you have to do is select the federal state in which you reside and then enter your gross income. Once you press “Calculate”, the calculator will return your net salary along with a breakdown of tax expenses.

To make our calculator as quick and accessible as possible, we had to make a few assumptions with tax implications, such as that you aren’t married and have no dependents. We also assume you aren’t affiliated with a church. That means you may end up paying more or potentially less in taxes once your circumstances and deductions are applied.

You May Like: Can I Still File My Taxes After The Deadline

Trade Tax On Business Income

Business income is subject to local trade tax at a rate of up to 17.2%, depending on the applicable local tax rate. Real estate income is subject to trade tax if the property both

Real estate qualifies as a business asset if it is used in connection with business activities , held by a business partnership or held by a corporation .

The tax base for trade tax is determined by the taxable income for income tax or corporation tax purposes, modified by certain additions and deductions .

For dividends, liquidation proceeds and capital gains from a disposal of shares in a corporation, the above mentioned exemptions for corporation tax also respectively apply for trade tax. With respect to dividends and liquidation proceeds, however, a minimum shareholding of 15% is required.

A real estate holding company may apply for an extended trade tax exemption if its only activity is renting out its real estate. In this case, effectively payment of trade tax can be avoided entirely.

Another viable route for avoiding trade tax is acquiring German real estate via foreign entities provided that the place of effective management is located in the jurisdiction where the statutory seat of the foreign entity is.

To sum up, tax leakage with respect to income from real estate investments in Germany in many cases can be limited to income or corporation tax.

Collection Of Different Data Depending On The State

While a large number of German states levy the property tax uniformly according to the federal model, other states have, on the other hand, opted to follow their own property tax model. As a result, there may be regional differences in the data to be submitted in the context of the assessment return.

The status of the values must always refer to as the key date. Subsequent changes to buildings will not be considered under the new property tax for the time being. The established property tax values are then to be applied for the property tax as of the calendar year 2025.

Recommended Reading: How To Amend 2020 Tax Return

Claim All Your Allowable Expenses

Property investors are eligible for a variety of tax breaks, and knowing about them ahead of time might save you a lot of money.

You can take advantage of several attractive tax perks if you opt to rent your property in Germany.

The tax system allows landlords to deduct expenses incurred in generating rental income from any rental income received. These deductions are available through your annual income tax return.

Management fees, insurance, tenant advertising, council rates, gardening charges, and reasonable travel expenditures to examine the property can all be claimed, but its best to consult your property tax expert for a complete list which is valid for your personal situation.

Its also important to be aware of the expenses which you cant tax relief for such as expenses paid by the tenants, as well as expenses incurred from your own personal use of the property.

What About Stablecoin Steuern

Despite being pegged to another asset – stablecoins are treated exactly the same way as other cryptocurrencies or NFTs from a tax perspective – so the taxation all comes down to how long you’ve held the asset and the specific transaction, as well as how much you’ve earned in a year. You’ll pay Income Tax on profits when you sell, swap or spend stablecoins you’ve owned less than a year, as well as earn an income in stablecoins. Meanwhile, you’ll pay no tax at all when you sell, swap or spend stablecoins you’ve owned more than a year, or if you earn less than 600 in a year in capital gains .

The information on this website is for general information only. It should not be taken as constituting professional advice from Koinly. Koinly is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances. Koinly is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website.

You May Like: When Is Tax Filing Deadline 2021

Sole Proprietor Income Tax In Germany

A sole proprietor in Germany is treated as an individual for tax purposes, so the same calculations apply to you. Of course, there are various business expenses and deductions that you can use to reduce your tax liability.

As a sole proprietor, it is essential to separate your business transactions from personal transactions. Opening a Penta Business Account allows you to keep all your business transactions in a single account, and you can even link your Penta account to your accounts package. This simplifies your tax declaration, and if you are using a tax advisor, it makes their job much more straightforward.

Banking, taxes, and accounting in just one tool? No problem with Penta.

Selling Crypto For More Than 600 Within 1 Year

In Germany, if you sell bitcoins or any other cryptocurrency within twelve months of buying, you will need to pay Income Tax. When trading cryptos privately, it is regarded as any other private trade, for example like selling your car. In a private trade in Germany, you only have to pay taxes on any profits you generate with that trade and only if you sell that item within one year of buying it.

This means that whenever you sell something that you have owned for more than one year, you do not have to pay taxes on the profits you generated with that trade.

To avoid this, you would need to sell for under 600 or wait for a year to pass before you sell.

You May Like: How Does The 7500 Tax Credit Work

Income Tax Vs Tax Free

Although crypto tax can get complicated – from a simplistic perspective, there’s only two potential tax implications in Germany when it comes to your crypto.

Here’s a breakdown of the most common crypto scenarios and the type of tax liability they result in:

Germany To Extend Tax Rebate For People Working From Home

Starting in 2023, people working from home will be able to deduct 1,000 per year for working from home, up from the previous annual amount of 600. Here’s what you need to know.

This means that in future, 200 instead of 120 days devoted to home office will be eligible for the 5 per day deduction, which was originally introduced amid the Covid pandemic in 2020 and was set to expire at the end of this year.

READ ALSO: Germany plans tax rebate for people working from home

The sum can be deducted regardless if a separate workspace is used or available meaning it applies to employees working on their couches or kitchen tables.

This especially relieves families with smaller flats, who dont have the space available for an extra office, according to a statement on the German governments website.

Employees who do have a separate study, though, can furthermore claim 1,250 back on their taxes.

However, certain criteria must be met for example, the room must be used exclusively for professional purposes and must be separable from the rest of the apartment.

All workers in Germany also receive a lump sum of income-related expenses, which can be deducted each year: that amount is going up by 200 in 2022, bringing the total to 1,200.

The higher working-from-home allowance is part of the Annual Tax Act 2022, which was discussed by the Bundestag Finance Committee on Wednesday, and is set to be approved on Friday.

READ ALSO: Who benefits most under Germanys tax relief plans

Read Also: How Much Do Small Businesses Get Taxed

Determining Burden Of Property Taxes In Germany 2022

To clarify the real property tax burden for a commercial building in a municipality with an average real property tax B collection rate of 350 percent:

| Assessed Value |

| Schleswig-HolsteinThuringia |

In addition real property transfer tax also applies to a real property-owning partnership, if 95 percent of the shareholders change within five years. After that, if you need further details on property taxes in Germany you can follow this link to a good article from Wikipedia.

Or simple get in .

Capital Gains Tax & Selling Your Property In Germany

If you have owned your property for less than 10 years and choose to sell it, any financial gain made will be subject to capital gains tax of 25%. However, an exception is made if the property has been your main residence for at least two complete years. For this reason, when Germans buy property, it tends to be a case of choosing a long-term home, rather than attempting to get into the German housing market. This is worth bearing in mind if you will only be staying in Germany for a short period of time.

You May Like: How To Fill Out Tax Forms

How To Pay Less Crypto Tax In Germany

There are a few ways you can reduce your tax bill in Germany…

Payroll Income Tax In Germany: Payment Deadlines

Tax returns are paid after the end of the tax year. And the tax year coincides with the calendar year. The return is usually sent to the client by December 31 and is due by July 31. Thus, you should report for the year 2020 by July 31, 2021.

Two to six months after receipt of the tax return, the tax service will send you a notice containing the tax assessment. The tax assessment notice has information about the tax deductions that will be made to the applicant’s account. It will also inform you about the additional fees to be paid within four weeks.

You can fill in your tax return on paper or online at the website of the German Federal Central Tax Office. All taxpayers fill in a general tax form . Depending on the case, it may also be necessary to fill out additional forms.

You May Like: How Can I File An Amended Tax Return Online

Weve Answered All Of Your German Rental Income Tax Questions

Want to know about taxes on income from property in Germany? The German tax system can be tricky especially if you are not a resident of Germany or you dont speak the language.

But dont worry, Property Tax Internationals tax experts are here to help!

Every day our team encounters countless questions regarding taxes on income from property in Germany.

We have used some of those questions to create this handy guide on everything you need to know about paying tax on rental income in Germany.

- In this article:

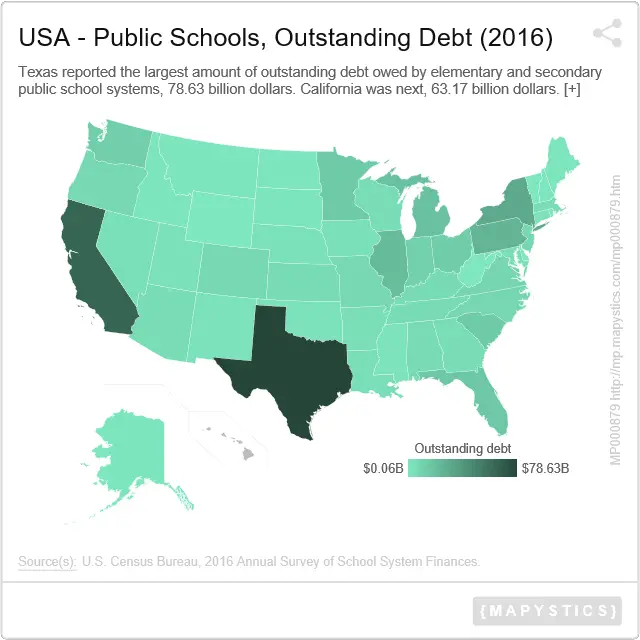

German Local Property Taxes

When researching the best locations to invest in Germany, pay attention to the rates of German local property taxes in the various regions.

In Germany, real estate is subject to this tax, and in German, its called Grundsteuer. It is a communal tax levied by each regions municipal government. Rates differ from one region to another and are also determined by the type of property and its assessed value.

This tax is calculated annually but its paid to your local tax office every three months, and it is imposed on all property owners in Germany.Current tax rates 2020 :

Recommended Reading: How To Find Out Tax Identification Number