How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

Washington Payroll & Other State Resources

Hopefully, this guide has provided a solid foundation to aid your business in handling Washington payroll taxes. While withholding, paying, and reporting payroll taxes can be a bit tedious, theyre necessary for any business that prioritizes tax compliance.

However, payroll taxes are the least of burgeoning business owners worries. Just getting started or need funding for your business?

Weve also got an in-depth guide to Washingtons best small business loans and financing options. This guide takes a deep dive into financing options for small businesses in the Evergreen state, including loans, borrower requirements, and what to look for in a good business financing option.

How Your Ohio Paycheck Works

Calculating your paychecks is tough to do because your employer withholds multiple taxes from your pay. The calculations are even tougher in a state like Ohio, where there are state and often local income taxes on top of the federal tax withholding.

First of all, no matter what state you live in, your employer withholds 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will also match your contributions. Together, Medicare and Social Security taxes are referred to as FICA taxes. Any earnings you make in excess of $200,000 are subject to an additional 0.9% Medicare tax that your employer does not match.

In addition to FICA taxes, your employer will also withhold federal income taxes from your earnings. This withholding will depend on things like your income, filing status and number of dependents and exemptions. Employees must fill out Form W-4 to indicate any changes to these factors. The recently updated version of Form W-4 no longer uses allowances. Instead, it features a five-step process that lets you enter personal information, claim dependents and indicate any additional income or jobs.

Your marital status will indirectly affect your paycheck size because it will affect your tax filing status. It can also affect your paycheck if you pay more in health insurance premiums to cover a spouse or children. These premiums will be deducted from each of your paychecks.

Don’t Miss: What Is Ca Use Tax

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

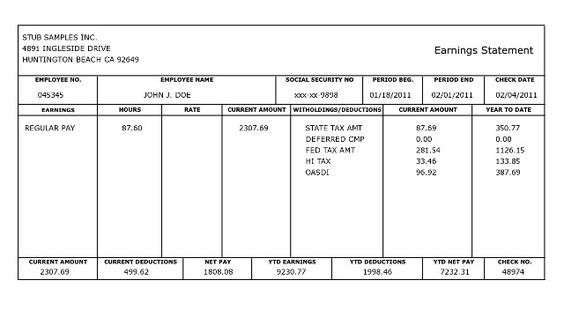

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

You May Like: How Are Hedge Fund Investors Taxed

Medical Dental Or Vision Premiums

Some companies have a program where they will reimburse you for your medical, dental, or vision premiums. Every employee contributes to a pool used to reimburse employees for these types of expenses.

Although you might get reimbursed, the premiums are still considered taxable income. This is because the company doesn’t actually give you any money–it just takes the money out of your paycheck before taxes are taken out.

Payroll Hourly Paycheck Calculator

This calculator uses the withholding schedules, rules and rates from IRS Publication 15.

APL Federal Credit Union

© 2018 APL Federal Credit Union. .All rights reserved. 800.367.5796 · 11050 Johns Hopkins Rd. · Laurel, MD 20723

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Recommended Reading: What School District Am I In For Taxes

How You Can Affect Your New York Paycheck

If you find yourself always paying a big tax bill in April, take a look at your W-4. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. For example, you can have an extra $25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. This paycheck calculator will help you determine how much your additional withholding should be.

Another way to manipulate the size of your paycheck – and save on taxes in the process – is to increase your contributions to employer-sponsored retirement accounts like a 401 or 403. The money you put into these accounts is taken out of your paycheck prior to its taxation. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. Another option is to put money in a spending account like a health savings account or a flexible spending account if your employer offers them. The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Just keep in mind that only $500 in an FSA will roll over from year to year. If you contribute more than that and then dont use it, you’re out of luck.

House Ways And Means Member Says Trump’s Taxes Underscore The Fact That Our Tax Laws Are Often Inequitable And That Enforcement Of Them Is Often Unjust

Democratic Rep. Don Beyer, a member of the House Ways and Means Committee, released a statement on Friday after the release of the returns saying the materials were “lawfully obtained” by the committee through the “IRS tax enforcement, including the presidential audit program.” He also noted that the report released last week showed “this program was broken” and justified “our legislative purpose,” which he said led to the passage by the House of a bill to bolster the IRS mandatory presidential audit program last week.

“Despite promising to release his tax returns, Donald Trump refused to do so, and abused the power of his office to block basic transparency on his finances and conflicts of interest which no president since Nixon has foregone,” Beyer said. “Trump acted as though he had something to hide, a pattern consistent with the recent conviction of his family business for criminal tax fraud. As the public will now be able to see, Trump used questionable or poorly substantiated deductions and a number of other tax avoidance schemes as justification to pay little or no federal income tax in several of the years examined.”

Beyer went on to say that these findings “underscore the fact that our tax laws are often inequitable, and that enforcement of them is often unjust.”

Recommended Reading: Can You Be Married And File Taxes Separately

Income And Unemployment: The Other Employment Taxes

Now that you know FICA and self-employment taxes are payroll taxes, lets take a brief look at income and unemployment taxes. Withhold income taxes from employee wages unless your employee is exempt from income taxes. The types of income taxes include:

Most states have state income taxes. If youre in a state with state income tax withholding, collect state W-4 forms from your employees to determine the amount per paycheck. Remember to check with your local government to determine if you need to withhold local taxes from your employees.

Unemployment taxes are the other type of employment taxes you must pay. Unlike income taxes, employers typically pay unemployment taxes. The two types of unemployment taxes are:

- Federal unemployment tax

Like payroll taxes, calculate your unemployment tax contributions based on your employees gross wages.

Keep in mind that income and unemployment taxes are not technically payroll taxes.

What Are Payroll Taxes

When you think of payroll taxes, you might think of all taxes you withhold from your employees paychecks. However, payroll taxes are just one type of employment tax. Payroll taxes include FICA and self-employment taxes. Both self-employment and FICA taxes cover Social Security and Medicare taxes.

Most employers must calculate and withhold payroll taxes from their employees gross taxable wages.

Do you need to calculate self-employment taxes for yourself? Well, that depends on your type of business entity. Typically, if you do not receive a salary like your employees, you must pay self-employment taxes.

You May Like: What Is The Sales Tax In Nebraska

What Is The Minimum Pay Frequency In Washington

Unless national law requires a more regular timeline, you must pay workers at least once a month. If you pay monthly, you should pay hourly wages from the first to the 24th of the month at the end of the month. After that, the remaining wages become a part of the following paycheck.

Overtime: If you are unable to compute overtime in time to meet the usual payday, you should set up a second pay period for overtime compensation.

Read Also: Where Can I Do My Taxes For Free

Lets Review Our Example Using The 2020 W

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

Read Also: How Is K1 Income Taxed

Operating A Business In Washington: Heres What You Need To Know About Payroll Tax

Business owners in Washington should understand that Washington is a no personal income tax state. It joins the ranks of these other states that do not have a state income tax: Nevada, Wyoming, South Dakota, Texas, Florida, Alaska, and Tennessee.

Though there is no personal income tax in Washington, youll need to pay and withhold federal payroll taxes and pay state unemployment tax.

Washington unemployment tax

To help workers who have lost their jobs through no fault of their own, Washington employers must pay unemployment tax. For 2022, the first $62,500 of each employees wage is taxed for unemployment. Rates vary based on industry and the history of claims paid to former workers.

Determining Federal Income Tax Withholding

The Internal Revenue Service expects taxpayers to pay taxes on wages at the time theyre earned. This is done through federal income tax withholding. The amount of federal income tax withheld varies by individual, based on the data in Form W-4, which all employees are required to submit to their employer.

The form includes information about whether a worker will file a tax return as married or single, the number of withholding allowances claimed by the worker and whether an additional amount should be withheld from each paycheck. Form W-4 includes a worksheet to help employees determine the correct amount of allowances for their financial situation. The IRS also provides a free online paycheck calculator to help determine the correct number of withholding allowances.

Read Also: How Is Retirement Income Taxed

Calculating Employer Payroll Taxes

In addition to the taxes you withhold from an employees pay, you as the employer are responsible for paying certain payroll taxes as well:

- FICA Matching: You are required to match the employees FICA tax withholding, which means your company will pay 6.2% tax for Social Security and 1.45% tax for Medicare. Using our example employee, you as the employer would pay a matching $129.17 for Social Security and $30.21 in Medicare, resulting in a $159.38 FICA obligation.

- Unemployment Taxes: You will also have to pay federal and state unemployment tax. Unemployment taxes are paid only by the employer, not the employee.

- Federal Unemployment Tax is 6.0% of the first $7,000 in wages you pay each employee each year. If your company is subject to state unemployment, you can receive a federal tax rate credit of up to 5.4%, which makes the effective tax rate 0.6%. Once an employee earns more than $7,000 in a calendar year, you stop paying FUTA for that employee in that tax year. Federal Unemployment: $2,083.33 x 0.6% = $12.50

- State Unemployment Tax varies by state. Consult with your states Department of Labor or Unemployment Revenue for tax rates, wage bases, and filing requirements. For this example, we will assume the employee has not yet been paid $7,000 year-to-date. We will use Floridas unemployment tax rate of 2.7%. State Unemployment: $2,083.33 x 2.7% = $56.25

Rinda Myers, Kurb to Kitchen LLC

Additional Deductions On Florida Paychecks

In addition to federal taxes, Florida employers can make other deductions. This income goes toward services like health insurance and retirement planning. These deductions apply before taxes, so they lower an employees total taxable income.

The most common pre-tax deductions include:

- Court-ordered garnishments such as alimony, child support, outstanding loans, and back taxes

- Commuter benefits

Note: Our calculator can only account for federal and state deductions. As a result, pre-tax deductions do not factor into our estimated paychecks.

Dont Miss: Where Can You File Taxes Online For Free

Don’t Miss: Do You Have To Pay To Get Your Taxes Done

Overview Of North Carolina Taxes

North Carolina has a flat income tax rate of 4.99%, meaning all taxpayers pay this rate regardless of their taxable income or filing status. This can make filing state taxes in the state relatively simple, as even if your salary changes, you’ll be paying the same rate. No cities in North Carolina have local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Top 5 States With The Highest Tax Burden

1. Hawaii: 26.7% on median income of $78,0842. Maryland: 25.2% on median income of $81,8683. Massachusetts: 24.9% on median income of $77,3784. Oregon: 24.7% on median income of $59,3935. Connecticut: 24.6% on median income of $76,106

One insight from our visualization is how low-income states generally see lower tax burdens. Mississippi, West Virginia and Arkansas are among the poorest states in the country, and consequently residents in each state pay less than 20% in total taxes. On the other hand, high-income states typically pay a greater percentage of their income in taxes. Maryland and Hawaii are among the top 3 highest income states, and they both pay over 25% in taxes. Thats because progressive tax systems require high-income earners to pay more, expressed as a percentage of income, than low-income earners. Of course, how much individual states are getting back from the federal government is also unequal.

Whats your impression of the relative size of the tax burden where you live? Do you think you are getting a fair bargain for your money, or not? Let us know in the comments.

Do you need insurance for your business? Dont worry, weve got you covered.

You May Like: Do You Have To Pay Taxes On Home Sale

Also Check: How Much Taxes On 1099 Form