When To Pay Your Taxes

Generally, federal tax returns and payments are due April 15, but that date can fluctuate. If the 15th is on a Saturday, Sunday, or legal holiday, the deadline will be shifted later. The IRS begins accepting tax returns in January, and if you are owed a refund, it’s to your benefit to file early so you can get the money sooner.

Federal Income Tax: W

W-2 employees are workers that get W-2 tax forms from their employers. These forms report the annual salary paid during a specific tax year and the payroll taxes that were withheld.

This means that employers withhold money from employee earnings to pay for taxes. These taxes include Social Security tax, income tax, Medicare tax and other state income taxes that benefit W-2 employees.

Both employers and employees split the Federal Insurance Contribution Act taxes that pay for Social Security and Medicare programs. The FICA rate due every pay period is 15.3% of an employees wages. However, this tax payment is divided in half between the employer and the employee.

Online Credit Card Payments

Credit card payments may be paid through JetPay, the authorized agent of the Bexar County Tax Assessor-Collector. There is a convenience charge of 2.10% added by JetPay to cover the processing cost. To pay with a major credit card, you must have your 12 digit tax account number and your credit card number. Payments may be made by calling 1-888-852-3572 or online.

You May Like: What Are My Taxes On My Property

How To Minimize Estate Taxes

Keep the planning simple and the total amount of the estate below the threshold to minimize estate taxes. For most families, that’s easy. For those with estates and inheritances above the threshold, setting up trusts that facilitate the transfer of wealth can help ease the tax burden.

One way to reduce estate tax exposure is to use an intentionally defective grantor trust , which is a type of irrevocable trust that allows a trustor to isolate certain trust assets so as to separate income tax from estate tax treatment on those assets. The grantor pays income taxes on any revenue generated by the assets but the assets can grow tax-free. As such, the grantor’s beneficiaries can avoid gift taxation.

You can reduce your estate taxes if you own a life insurance policy as well. On their own, life insurance proceeds are income-tax-free at the federal level when they are paid to your beneficiary. But when the proceeds are included as part of your taxable estate for estate tax purposes, they might push your estate over the cutoff.

One way to make sure that doesn’t happen is to transfer ownership of your policy to another person or entity, including the beneficiary. Another possibility is to set up an irrevocable life insurance trust .

The Costs Of Paying 2021 Taxes Late

Although a tax extension gives you up to six extra months to file, it doesnt give you any extra time to pay. Taxpayers are still required to pay the estimated amount owed by Tax Day, which was April 18.

While that can seem odd because you wont know exactly what you owe until you file, youre supposed to take your best guess. If you end up owing more than you paid, the IRS charges interest and failure-to-pay fees on the unpaid amount.

Failure-to-pay fee. The failure-to-pay fee is equal to 0.5% of the tax owed after the due date for each month, or part of a month, that the tax remains unpaid. This amount can total up to 25% of what was owed.

For example, if you file your tax return on Oct. 17 without making a payment on Tax Day and end up owing $1,000, youd also be required to pay 0.5% for each of the six months the total amount owed went unpaid. The final fee would likely be about $30.

Interest charges. Additionally, youll be charged interest on any unpaid amounts. The interest rate for individual taxpayers is the federal short-term rate plus 3%. As of Oct. 1, taxpayers will owe 6% per year on underpayments.

If, as in the example above, you file on Oct. 17 and owe $1,000 in taxes, youd also owe six months of interest. The interest charges would be based on half of the annual rate of 6% approximately 3% of $1,000, so would total $30.

The main benefit of setting up a payment plan is to avoid other collection attempts by the IRS.

Also Check: How To Calculate Annual Income After Taxes

If I Sell My House Do I Pay Capital Gains Tax

Some homeowners will owe capital gains tax on selling a home if they dont qualify for an exclusion or special circumstance. Generally speaking, its easier to minimize or eliminate capital gains taxes on a primary home than a vacation or rental property.

Bear in mind that even if you qualify for a capital gains tax exclusion, you cant qualify for another exclusion for at least two years.

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast-growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 398,200 electronic payments in 2020. The Department also received more than 2.8 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Also Check: How To File Your Taxes For Free

Will I Get A Tax Form From Workmans Comp In Michigan

There is no tax form that will be sent showing how much was paid in benefits. Disabled employees should not expect to receive a W2 or 1099 unless they performed actual work for the employer during the calendar year. Watch out for employers who forget to provide necessary tax documents when light duty or other favored work has been performed. A simple telephone call to the employer can save a lot of trouble with the IRS in the future.

When To Pay Estimated Taxes

For estimated tax purposes, a year has four payment periods. Taxpayers must make a payment each quarter. For most people, the due date for the first quarterly payment is April 15. The next payments are due June 15 and Sept. 15, with the last quarters payment due on Jan. 15 of the following year. If these dates fall on a weekend or holiday, the deadline is the next business day.

Farmers, fishermen and people whose income is uneven during the year may have different rules. See Publication 505, Tax Withholding and Estimated Tax, for more information.

If a taxpayer doesnt pay enough or pays late, a penalty may apply.

Recommended Reading: Which States Do Not Have Property Taxes

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Register For Self Assessment

The first thing you need to do is register for Self Assessment for landlords.

If you arent already registered for Self Assessment, you usually need to register by 5 October in the tax year after you started receiving rental income. So, if you start receiving rental income in 2022-23, youll need to register by 5 October 2023.

HMRC might fine you if you dont register by the deadline, so be sure to do it as soon as possible.

When you register, you should get a Government Gateway user ID and password. With this you can set up your personal tax account, which lets you manage your taxes online.

Once youre registered, you can then file your tax return by filling out the Self Assessment tax return form either online or on paper.

That being said, Making Tax Digital means that paper tax returns will eventually be phased out. This is due to come in for landlords in April 2024 if you make over £10,000 a year but you’re able to sign up now if you like.

Read Also: When Will We Get Our Tax Return

Michigan Lawyer Discusses Whether Taxes Are Owed On Workmans Comp Payments

Many people live paycheck-to-paycheck and missing any time because of a workplace accident can result in a financial disaster. Michigan workmans comp law is a safety net in the form of payments for lost wages. We get lots of telephone calls and emails with the question: Do you pay taxes on workers comp checks? The answer is generally no but watch out for some potential issues.

When Are Estimated Taxes Due In 2022

Those who pay estimated taxes have a slightly different filing schedule than everyone else. People who pay quarterly estimated taxes include the self-employed, as well as those who work similar entrepreneurial or independent contractor jobs. If your paycheck doesnt have income taxes taken out before the money gets to you, then this requirement applies to you.

Estimated taxes are due quarterly and must be submitted with Form 1040-ES. Heres when those payments are due:

- First-quarter payments: April 18, 2022

- Second-quarter payments: June 15, 2022

- Third-quarter payments: Sept. 15, 2022

- Fourth-quarter payments: Jan. 17, 2023

Note: Like Tax Day, quarterly tax payments are due on April 18 this year. But because Jan. 15, 2023, is a Sunday, and Monday, Jan. 16 is Martin Luther King Jr. Day , the deadline to pay estimated taxes on the self-employment income you earn in the fourth quarter of 2022 has been pushed to Jan. 17, 2023.

This is the standard schedule to follow, provided nothing interferes.

If youre an employee who earns tips, youre required to report all your monthly tip earnings to your employer by the 10th of the following month. Your employer is responsible for sending those numbers to the IRS, as well as for adjusting how much money comes out of your paycheck to satisfy your tip withholding.

Don’t Miss: How Much Do You Get Back In Tax Returns

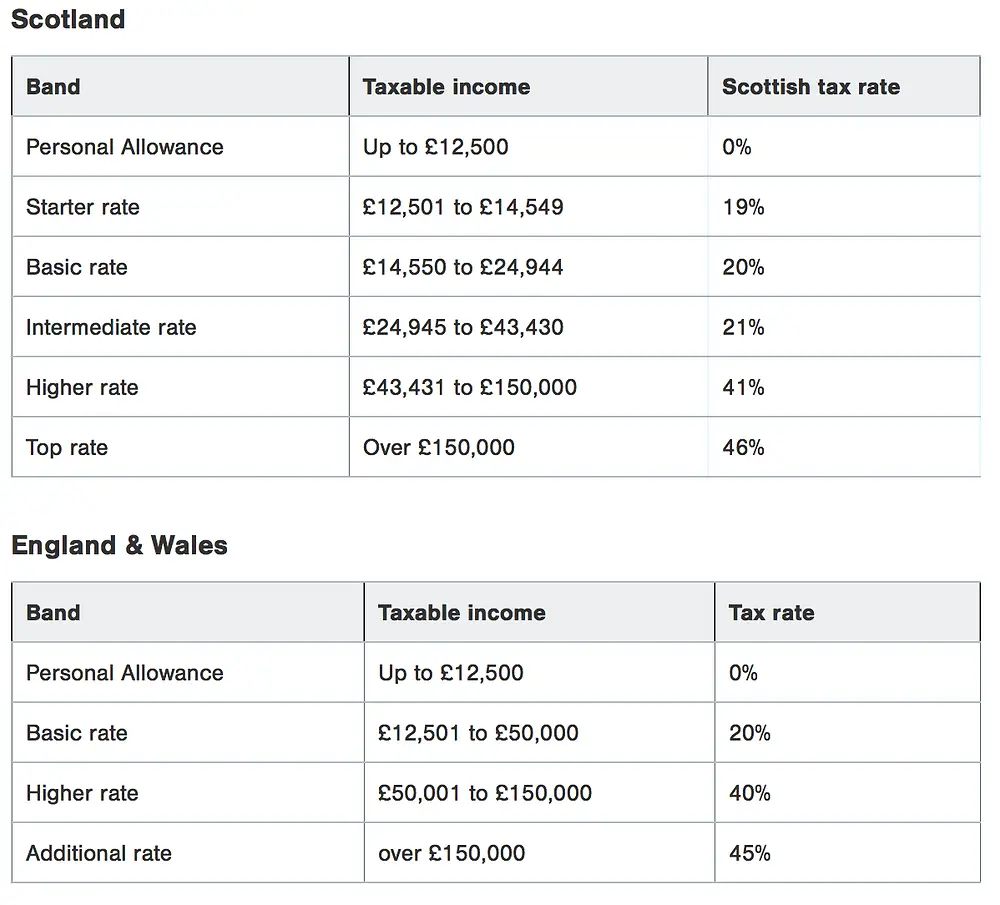

Were There Income Tax Changes At The Autumn Statement 2022

Significant changes for income tax were announced as part of the Autumn Statement 2022.

The personal allowance has been frozen at £12,570 until 2028 .

This could lead to a higher tax bill if your earnings increase .

In previous years, the personal allowance threshold rose in line with increasing earnings. But when its frozen, youll pay tax on more of your money.

The additional rate threshold will also reduce to £125,140 in April 2023, meaning that more people will be pushed into paying the 45 per cent rate.

Rental Tax Changes For Landlords

The government often announces tax changes for landlords. While weve tried to provide an exhaustive list of everything you need to keep in mind for your tax return, exactly what you need to pay will depend on your particular circumstances and how things change in future.

You can read about the buy-to-let tax rules landlords should know about, but its worth keeping your eye on our landlord news to follow the latest updates.

Recommended Reading: How To Complete K1 Tax Form

What Happens If There Is No Estate After Death

Suppose the decedent owes taxes and does not have an estate to be probated. In that case, collection agents will likely do an initial investigation into whether or not there are any assets in the estate.

The IRS will need to determine, with reasonable certainty, that there are no assets with available equity in the estate. They will also need to determine that no estate assets were transferred to the beneficiaries or junior creditors instead of paying the decedents tax liability, Lyon explains. If so, they are likely to place the delinquent account into a “currently not collectible” status. That means the tax balances will be written off following a 10-year collection statute.

In a nutshell, if the estate does not have sufficient funds to cover the taxes owed, these tax obligations will go unpaid without penalty to the heirs or survivors, according to Arbulu.

And if the decedent didnt have any reportable income or assets to claim at the time of death, no tax returns need to be filed, either, he says.

Property Taxes And Your Mortgage: What You Need To Know

10 Min Read | Nov 14, 2022

I love taxes! Said no one ever.

Paying taxes is like taking a trip to the dentistits a part of life, but not a fun part. Property taxes are no exception.

Seasoned homeowners know property taxes are part of the deal. But its easy for new home buyers to overlook how property taxes can affect their budget during all the excitement of buying a house.

Even if you remember to factor in these pesky little boogers, youve probably got some questions about them: How are property taxes paid? How often do you pay property taxes? When do you pay them? And are property taxes included in your mortgage payment?

Lets cut through some of the confusion about property taxes so you dont make a mistake that could cost you hundredsor even thousandsof dollars!

You May Like: When Do I Get My Federal Tax Refund

The Payment Deadline Is April 30 2022

If you have a balance owing, your payment is due on April 30, 2022.

If you or your spouse or common law-partner are self-employed, your payment is still due on April 30, 2022.

Since April 30, 2022, falls on a Saturday, in both of the above situations, your payment will be considered paid on time if we receive it, or it is processed at a Canadian financial institution, on or before May 2, 2022.

If you filed your 2020 return and qualified for interest relief, you have until April 30, 2022, to pay any outstanding income tax debt for the 2020 tax year to avoid future interest charges. This applies to the tax owing for the 2020 tax year only, and not for any previous tax year.

You May Like: Is Mortgage Interest Tax Deductible

Can I Qualify For A Partial Capital Gains Tax Exclusion

Even if you cant exclude all of your home sale profit, there are other scenarios where you may be able to partially lower your taxable profit. If you experienced any of the below life events, you may be able to get a partial exclusion, calculated based on the percent of the two years that you lived in the home.

- Job change/relocation

- Having twins or triplets

Also Check: How To Check If I Owe Taxes

Avoid These Common Payroll Pitfalls By Reading Our Guide Today

In the event of a failure to pay payroll taxes at all, individuals within an organization may be held personally responsible. This is according to a rule known as the trust fund penalty or the 100-percent penalty. The gist is that if an organization fails to pay the proper payroll taxes, the IRS can hold a single person or a group of people responsible for the full amount that is owed. Such a person must be responsible for collecting or paying withheld income and employment taxes and willfully fail to collect or pay the taxes. In many cases, this person may be the head of a company, but the rule can also apply to:

- An officer or employee of a corporation

- A member or employee of a partnership

- A corporate director or shareholder

- A trustee of a not-for-profit organization

- Someone with authority and control over funds to direct their disbursement

- Another corporation or third-party payer

- Payroll service providers

- Professional employer organizations

Long story short, its best to avoid getting tangled up with the IRS in the first placebut you probably already knew that! Using payroll software and a certified payroll specialist is the best way to ensure your organization pays all payroll taxes on time and in the right amount so you can move forward headache-free.

What Is The Last Day To File Taxes

The last day to file taxes for individual federal income tax returns is usually April 15 unless this falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by another day. You can request a six-month extension by filing Form 4868, making your last day to file individual income taxes October 15, or the next business day if this is a weekend or holiday.

If you also file taxes for your small business as a partnership or S corporation, the last day to file taxes is March 15 or April 15 for C-corporations unless this day falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the company’s fiscal year.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Read Also: Where Can I Find Tax Id Number