How To Calculate Federal Income Tax

There are two possible methods that employers and payroll companies can use to calculate FIT:

If you are concerned the federal income tax from a payroll run in Patriot is not accurate, or just curious how the calculations are determined follow along to learn how the software calculates federal income taxes.

Patriot uses the PERCENTAGE method for automated payroll systems. You can find the percentage method tax tables in IRS Publication 15-T.

- Page 5 has a worksheet to calculate the taxable wages.

- Page 6 contains the tax tables. Well explain how these work soon, but note six separate tables are used, depending on the following variables:

- The employees tax filing status indicated on their Form W-4 .

- Whether the employee checked the box for two jobs in Step 2 of their new W-4 form . If they used the 2019 or older W-4 form or if the new W-4 form box is unchecked, use the three tables on the left.

- Also, notice in the table that if the employees wages are low enough, no federal income tax will be withheld

Now, lets look at some examples of how to figure out federal income tax withholding. This will require some math, so grab a pencil and your thinking cap!

Lets say we have an employee with the following:

- No other adjustments

Here is what the employees paper W-4 looks like:

The employees first paycheck is $3,000, which is taxable.

What will the employees FIT withholding be? Heres what well need to do:

Us Resident Withholding Tax

The first and more commonly discussed withholding tax is the one on U.S. residents personal income, which every employer in the United States must collect. Under the current system, employers collect the withholding tax and remit it directly to the government, with employees paying the remainder when they file a tax return in April each year.

If too much tax is withheld, it results in a tax refund. However, if not enough tax has been held back, then the individual will owe money to the IRS.

Generally, you want about 90% of your estimated income taxes withheld and sent to the government. This ensures that you never fall behind on income taxes and that you are not overtaxed throughout the year.

Investors and independent contractors are exempt from withholding taxes but not from income taxthey are required to pay quarterly estimated tax. If these classes of taxpayers fall behind, they can become liable to backup withholding, which is a higher rate of tax withholding set at 24%.

You can easily perform a paycheck checkup using the IRSs tax withholding estimator. This tool helps identify the correct amount of tax withheld from each paycheck to make sure you dont owe more in April. To use the estimator, you’ll need your most recent pay stubs, your most recent income tax return, your estimated income during the current year, and other information.

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Don’t Miss: How To Pay My Federal Income Taxes Online

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

What Is The Income Tax Rate For 2020

The federal income tax has seven tax rates for 2020: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The amount of federal income tax an employee owes depends on their income level and filing status, for example, whether theyre single or married, or the head of a household. You can find your 2019 and 2020 federal income tax rate based on your filing status by using the IRS income tax rates and brackets.

RELATED ARTICLES

Also Check: How To File Income Tax Online

How Your Vermont Paycheck Works

It can be a challenge to predict the size of your paycheck because money is deducted for FICA, federal and state income taxes, as well as other withholdings. But when you start a new job, you’ll have to fill out a W-4 form. Your Vermont employer uses the information you provide on this form – with regard to your marital status and any additional dollar withholdings you take – to determine how much to deduct from your paychecks for federal and state taxes. You’ll need to submit a new form during the year if you want to make changes regarding your status or dependents.

The IRS made notable changes to the Form W-4 in recent years. The new version completely removes allowances, using a five-step process asking filers to fill out personal information, list dependents and indicate any additional income instead.

A portion of your income will also go toward paying Social Security and Medicare taxes. Collectively these are known as FICA taxes, and may be referred to as such on your pay stub. For each of these taxes, a percentage of your income is withheld for the sake of sustaining these programs. Your employer will match these percentages, meaning that in the end you will have only been responsible for half of your FICA taxes.

Mandated Withholdings By Law

The most commonly found deductions that are mandated by law include:

- Federal income tax withheld

- Local income tax withheld

Federal income tax withheld

Federal income tax is figured based upon information furnished by the employee on IRS Form W-4. From this form, the employer determines how to figure the employee’s tax withholding based upon the tax withholding tables provided by the Internal Revenue Service.

Employees should complete W-4’s with care. The more people claimed as exemptions on the W-4, the smaller the amount of tax withholdings. This may look great on the paycheck, but it may look rather bleak on the W-2 form when tax time rolls around.

There are certain instances where an employee may qualify to be exempt from federal taxes, however there are strict parameters for qualification of exemption and it is strongly recommended that advice is sought from a tax professional or the IRS before claiming tax-exempt status.

Social Security tax withheld

At the time of this writing Federal Law mandates that 6.2% of an employee’s taxable wage must be withheld and paid to the government. To this, the employer is required to “match” the amount withheld from the employee’s taxable wage and pay to the government as well. This means that a total of 12.4% is paid for each employee.

Medicare tax withheld

State and local tax withheld

Don’t Miss: How Soon Can You File Taxes 2021

Calculate The Gross Pay

A paycheck starts with the gross earnings of an employee. As stated earlier, this is the total amount before any withholding or deductions. To get the gross income in a paycheck for purposes of calculating income tax and other taxesSocial Security and Medicareyou need to include all wages, tips, and salaries earned in a pay period.

-

How to determine gross income: Gross pay is calculated for employees on hourly wage by multiplying the number of hours worked, including overtime, by the rate per hour. To get the gross pay for salaried employees, you divide the annual income amount with the number of pay periods. Heres an example of how to calculate gross income for salaried and hourly employees:If your annual salary is USD$42,000, youll divide that by the number of pay periods in the year to determine the gross income for one pay period. The total pay periods will be 24, if the employer pays you twice a month. That will be a gross income of USD$1,750, being USD$42,000 divided by 24. The gross pay of an hourly rate employee whos worked for 40 hours at a rate of USD$15 is USD$600. You also need to add overtime amounts to the regular pay to get the gross earnings in a pay period. Youll see how to calculate overtime in the next step.

Direct Deposit Authorization Form

As an employer, you can pay your employees several different ways: paper check, direct deposit, prepaid debit card, or cash. Direct deposit is often the easiest and most secure way to deliver paychecks, which is why it is by far the most popular. In fact, more than 82% of US workers are now being paid by direct deposit.

An employee who chooses to be paid by direct deposit must fill out a direct deposit authorization form, complete with bank routing numbers and account numbers. The form acts as a permission slip for you to deposit the employees net pay electronically into their bank account.

As part of the verification process, many employers will ask for a voided blank check to confirm the accuracy of the bank account information provided by the employee.

Read Also: How To Find Property Tax Amount

Overview Of Vermont Taxes

Vermont has a progressive state income tax system with four brackets. The states top income tax rate of 8.75% is one of the highest in the nation. No Vermont cities have local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

Read Also: What Is The Corporate Tax Rate In Florida

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

See How Your Refund Take

. Before-tax deductions will reduce the income tax withholding to federal state and. Get ready today to file 2019 federal income tax returns. This tax will apply to any form of earning that sums up your income.

Federal income tax and FICA tax. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. Use this tool to.

There are seven federal tax brackets for the 2021 tax year. In fact your employer would not withhold any tax at all. You pay the tax as you earn or receive income during the year.

FICA taxes consist of Social Security and Medicare taxes. For employees withholding is the amount of federal income tax withheld from your paycheck. Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes.

The amount of income tax your employer withholds from your regular pay. If this is the case. Adjustments to income – IRA.

Your bracket depends on your taxable income and filing status. The most probable reasons why your federal income tax was not deducted from your paycheck can be any of the following. These are the rates for.

The state tax year is also 12 months but it differs from state to state. Your income is too low for a deduction to be. You pay FUTA tax only from.

Taxpayers can help determine the right amount of tax to. The federal income tax is a pay-as-you-go tax. FICA taxes are commonly called the payroll tax.

Pin Page

Read Also: When Are Federal Taxes Due 2021

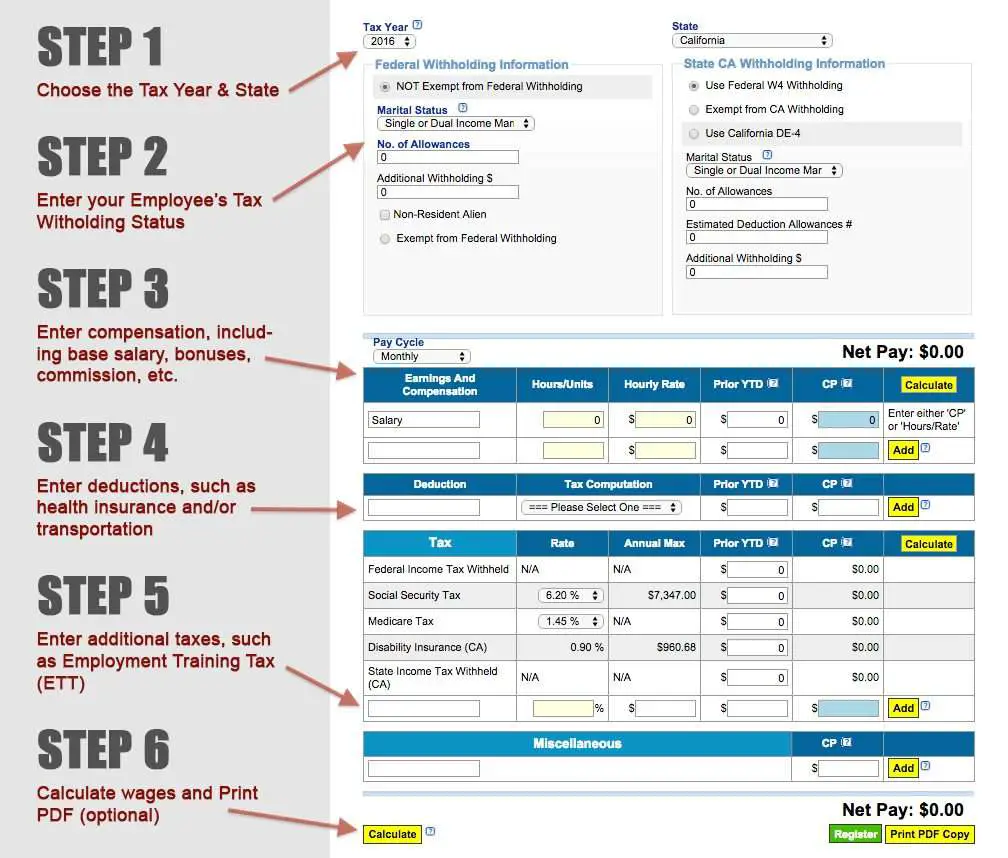

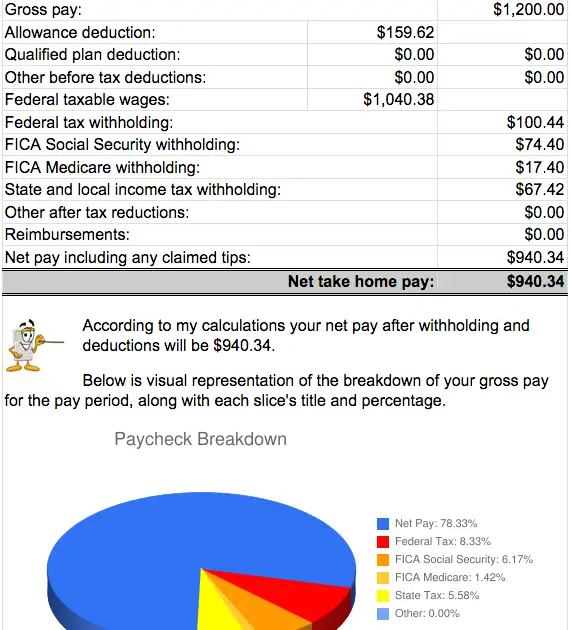

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

Also Check: Efstatus.taxact 2014

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Read Also: How Much Is Tax Preparation

Step : Figure The Tax Withholding Amount

To recap from the previous page, the adjusted annual wages are $69,400.

Lets look at the tax table found on page 6 of IRS Pub 15-T.

Note there are actually six different tables on this page. The one you use depends on the employees filing status, the version of the W-4 they are using, and whether they have checked the multiple jobs box in Step 2 of their new W-4 . Since our example is using the new W-4 and has the Step 2 box unchecked, were going to use the middle table in the left column.

- Looking in the Single or Married Filing Separately table, the employees taxable wages of $69,400 fall between the range of $44,475 to $90,325 . See the highlighted row above.

- We can see in Column C, at least $4,664 in FIT needs withheld for the year. The $4,664 is a total of the following:

- 10% on wages between $3,950 and $13,900

- 12% on wages between $13,900 and $44,475

Here is what the worksheet would look like: