Delawares Income Tax Advantage For New York Residents

Help minimize your state income tax liability with a personal trust administered in the First State.

- Personal trusts can be important vehicles for helping to minimize a familys state income tax liability

- As New York is a high-tax state, there may be opportunities to reduce or eliminate state taxes on some of your income by establishing a new trust in Delaware or moving an existing trust to the First State

- For example, the potential New York state tax savings on a $1 million long-term capital gain in 2022 could be as high as $68,479 the savings may be even greater for New York City residents

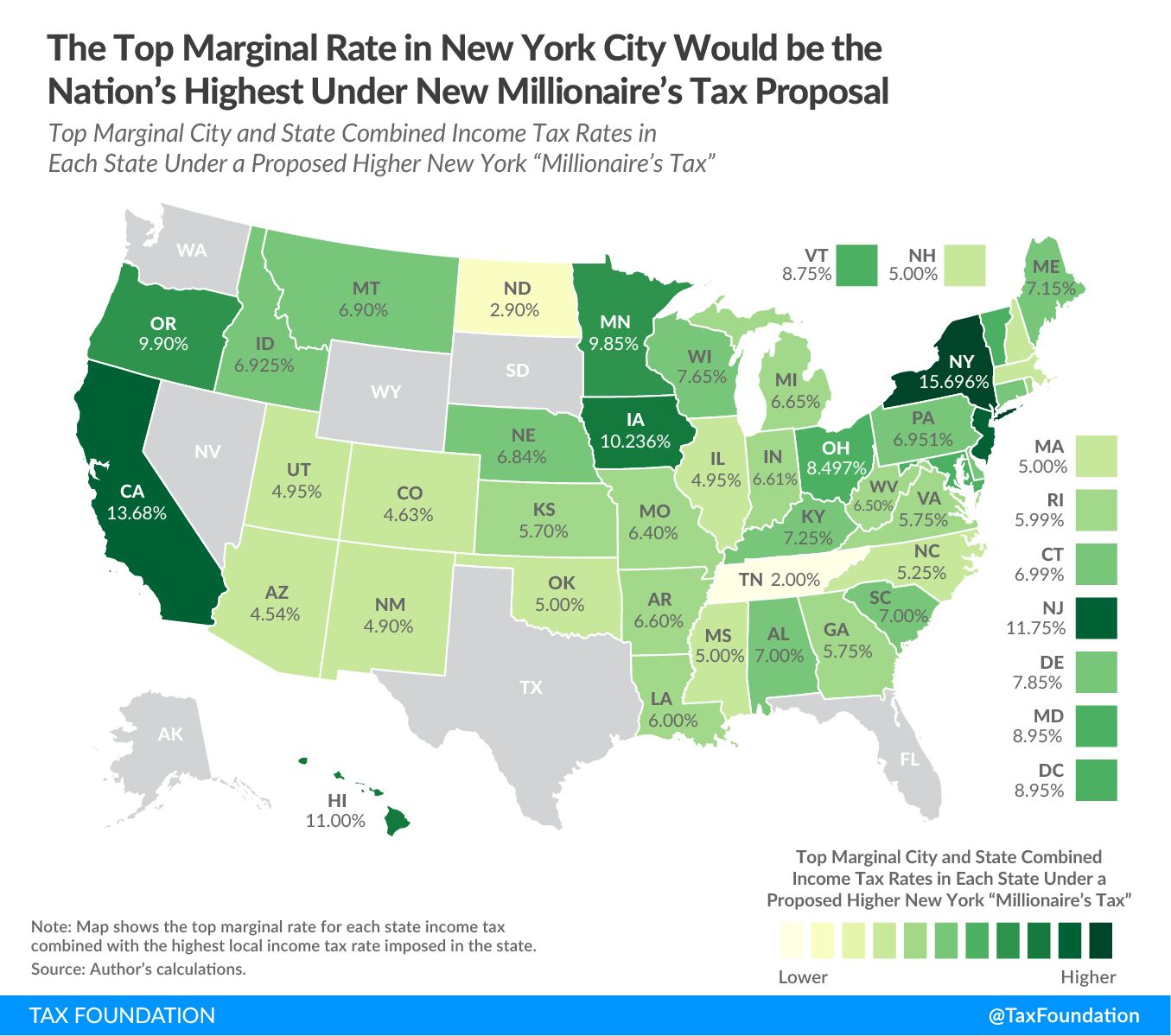

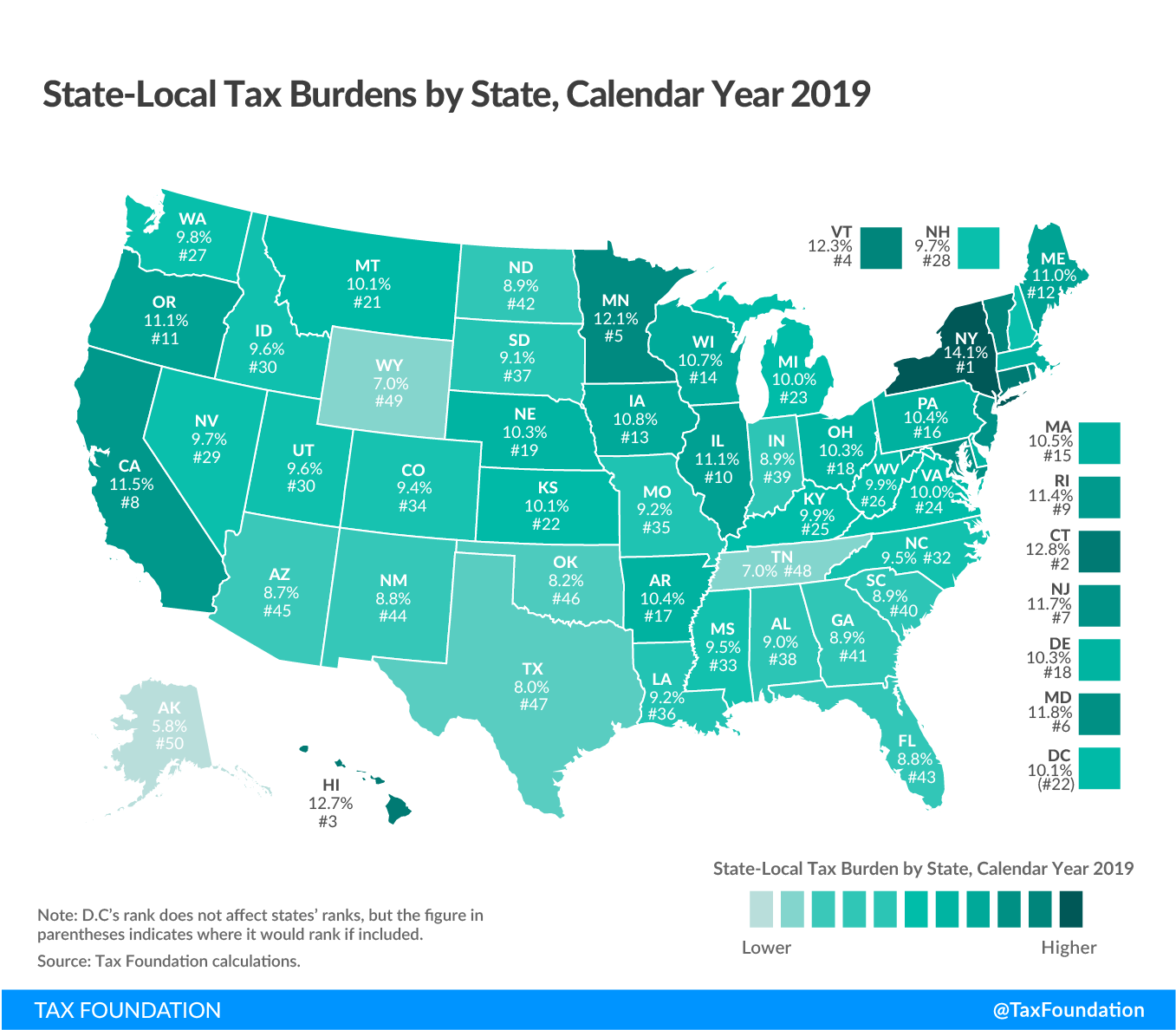

How can this help me as a New York resident? New York is a high tax state, regularly coming in as one of the highest in the country with a top marginal tax rate at 10.9%. New York City applies an additional income tax between 3.078% and 3.876%. Combined, these taxes may approach 15% for a resident of New York City.

Personal trusts can be important tools for helping to minimize a familys state income tax liability. Holding family wealth inside a trust may limit the ability of New York state and New York City to tax the trusts income. The location of your familys assets may be a significant driver of wealth by potentially reducing or eliminating the drag of state income taxes. This has been especially true since the effective repeal of the SALT deduction in 2017, which capped the amount of state taxes that may be deducted against federal gross income.

Earned Income Tax Credit

You can claim the earned income tax credit in New York if you have a qualifying child and can also claim the federal earned income tax credit. You are not entitled to this credit if you claimed the Noncustodial Parent New York State Earned Income Tax Credit . The credit equals to 30% of your allowable federal earned income tax credit minus your household credit.

What Are The Tax Benefits Of An Llc

One of the most popular ways to organize a business is as a limited liability company, otherwise known as an LLC. LLCs require less paperwork than C corporations and S corporations, while giving owners some of the same protections against being held personally liable for any actions of the business. But the true advantage of this title comes in the form of tax benefits. LLCs give business owners significantly greater federal income tax flexibility than a sole proprietorship, partnership and other popular forms of business organization.

Make sure you have a financial plan in place for your small business. Talk to a financial advisor today.

Don’t Miss: What Is Agi On Tax Form

New York Faces Revenue Shortfalls Due To Tax Paying Residents Moving Out

Approximately 115,000 New York State residents left between 2015-2019, taking their tax dollars with them.The rise of remote work due to the COVID-19 pandemic has further increased the volume of residents moving out of state. According to New York State Comptroller Thomas P. DiNapoli, the states largest revenue source is from personal income tax, which accounts for 2/3 of state revenues. The largest number of departures came from married filers who were earning between $100k-$500k, and these individuals typically paid a substantial amount of tax. As a result of these departures, state and local tax authorities are challenged with finding new revenue sources to replace the taxes lost due to residents leaving the state.This will likely take the form of increased audit activity of departing residents. Please note that former New York State residents often continue to have New York Source income particularly if they have deferred compensation and/or stock options.New York is aggressively auditing former residents who fail to report state source income and pay the associated tax. If you are considering changing your tax residence, or have received an audit notice, please contact a member of the Withum SALT team.

May 20, 2022

New York Income Tax Calculator

taxnew-yorktax

New York Income Taxes. New York States top marginal income tax rate of 8.82% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $1,077,550 pay the top rate, and earners in the next bracket pay nearly 2% less.

Don’t Miss: How Do I Change My Tax Withholding On Unemployment

How Do New York Tax Brackets Work

Technically, you dont have just one tax bracket you pay all of the New York marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your New York tax bracket is the tax bracket in which your last earned dollar in any given tax period falls.

You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. The chart below breaks down the New York tax brackets using this model:

| For earnings between $0.00 and $8,500.00, youll pay 4% |

| For earnings between $8,500.00 and $11,700.00, youll pay 4.5%plus $340.00 |

| For earnings between $11,700.00 and $13,900.00, youll pay 5.25%plus $484.00 |

| For earnings between $13,900.00 and $21,400.00, youll pay 5.9%plus $599.50 |

| For earnings between $21,400.00 and $80,650.00, youll pay 6.21%plus $1,042.00 |

| For earnings between $80,650.00 and $215,400.00, youll pay 6.49%plus $4,721.43 |

| For earnings between $215,400.00 and $1,077,550.00, youll pay 6.85%plus $13,466.70 |

| For earnings over $1,077,550.00, youll pay 8.82% plus $72,523.98 |

Do Non Resident Aliens Pay State Taxes

California state law does not mirror the federal law when it comes to taxing non-U.S. citizens the state of California does not recognize the federal level tax treaty. California income is taxable and subject to withholding for state purposes, irrespective of a federal exemption. California does not distinguish among …

Don’t Miss: When The Last Day To File Taxes 2021

Nys Reaping Big Rewards On The New York Exit Tax

New York conducted 30,000 nonresidency audits between 2010 and 2017, recouping around $1 billion from the practice.

State auditors have collected $144,270 per audit since 2015.

New York State has a high success rate on audits because they go through a residents credit card and bank statements.

They also use new high-tech tools that include tracking phone records and social media. Auditors also review veterinary and dental records.

New York is also working extensively to catch those individuals who fake their move to Florida.

Floridas residents arent subjected to any income or estate tax, unlike New York.

Even Blanca Ocasio-Cortez, the mother of Representative Alexandria Ocasio-Cortez,touted Floridas low-tax system.

She fled New York for Florida. She told the Daily Mailfrom her home in Eustis:

New York City Musical And Theatrical Production Tax Credit For Corporate And Personal Income Tax

On July 23, 2021, Governor Andrew Cuomo announced the New York City Musical and Theatrical production tax credit which is designed to revitalize the theater district after its close due to the Covid-19 pandemic by offering up to $100 million in tax credits. The two-year program for approved companies which will allow tax credits for up to 25% of qualified production expenditures such as sets, costumes, sound, lighting, salaries, fees, advertising costs, etc. First year program applicants can receive up to $3 million per production and second year applicants up to $1.5 million. Companies can receive credits for tax years beginning on or after January 1, 2021 but before January 1, 2024. Applications must be submitted by December 31, 2022 and final applications no later than 90 days after the production closes or 90 days following the program end date of March 31, 2023, whichever comes first.

Recommended Reading: The Wax Museum Nyc

Also Check: What’s The Latest I Can File My Taxes

Do I Have To Pay Ny Estimated Taxes

You do not need to pay estimated tax if: You expect to owe less than $300 of New York State, $300 of New York City, and $300 of Yonkers income tax after deducting tax withheld and credits that you are entitled to claim. You expect your tax withheld during 2021 to be at least: 90% of the tax shown on your 2021 return.

Definition Of Qualified New York Manufacturer Changes

For tax years beginning on or after January 1, 2018, the definition of a qualified New York manufacturer has been changed to use the New York State adjusted basis rather than the federal adjusted basis when determining whether a manufacturer meets the $1 million or $100 million property thresholds for determining eligibility for the manufacturers tax rate reductions and the real property tax credit. A qualified New York manufacturer is a manufacturer that is principally engaged in the production of goods by manufacturing, processing, assembling, refining, mining, extracting, farming, agriculture, horticulture, floriculture, viticulture, or commercial fishing during the tax year that either has property in New York State of the type described for the investment tax credit that has an adjusted basis for New York State tax purposes of at least $1 million at the end of the tax year, or has all of its real and personal property in New York State. C, I, 10/18/2019.)

You May Like: Where Can I Do My Taxes For Free Online

Are Stipends Taxed Differently

A stipend does not count as wages earned, so no Social Security or Medicare taxes get withheld. This means your employer will not withhold any taxes for you. However, a stipend does count as taxable income, so you will need to plan to set aside money for the taxes you will owe on your stipend at the end of the year.

Heres How Many Billions Bidens Student Loan Giveaway Will Cost Taxpayers

President Bidens plan to forgive up to $20,000 in federal student loan debt per borrower was hit with its first major lawsuit Tuesday just a day after the nonpartisan Congressional Budget Office estimated the bailout would cost taxpayers $400 billion.

The libertarian Pacific Legal Foundation filed the suit in an Indiana federal court on behalf of one of its attorneys, Frank Garrison, who argues that the loan forgiveness would force him to pay a hefty state tax bill.

The lawsuit asks for an injunction halting the executive action, which could affect up to 43 million people beginning next month.

Nothing about loan cancellation is lawful or appropriate,the lawsuit says. In an end-run around Congress, the administration threatens to enact a profound and transformational policy that will have untold economic impacts. The administrations lawless action should be stopped immediately.

Garrison will face immediate tax liability from the state of Indiana because of the automatic cancellation of a portion of his debt, the 17-page filing adds. These taxes would not be owed for debt forgiveness under the Congressionally authorized program rewarding public service.

Biden announced the massive loan forgiveness plan on Aug. 24, outraging critics who argued it was illegal and could worsen inflation, which already is at its highest rate since 1981 amid elevated federal spending.

Read Also: Do You Get Money Back From Taxes

Getting Your New York Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of New York, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your New York tax refund, you can visit the New York Income Tax Refund page.

What Is A Supplemental Tax Bill In California

A California Supplemental Tax Bill is a tax bill that is imposed after the sale or purchase of a property. You must pay the supplemental bill if your homes previous assessed value taxes are different from its newly valued appraised value. If youre looking for a quick fix, consider it a catch-up bill.

You May Like: Why Do I Owe Taxes This Year 2021

New York Income Tax Rate 2020

New York state income tax rate table for the 2020 2021 filing season has eight income tax brackets with NYtax rates of 4%, 4.5%, 5.25%, 5.9%, 6.09%, 6.41%, 6.85% and 8.82% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

The New York tax rate is mostly unchanged from last year. A couple of small changes were made to the middle bracket tax rates. The income tax bracket amounts are unchanged this year. New York income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2020 through December 31, 2020.

| 8.82% |

Please reference the New York tax forms and instructions booklet published by the New York State Department of Taxation and Finance to determine if you owe state income tax or are due a state income tax refund. New York income tax forms are generally published at the end of each calendar year, which will include any last minute 2020 2021 legislative changes to the NY tax rate or tax brackets. The New York income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

Empire State Child Credit

This is a tax credit for taxpayers who have one or more qualifying children. The amount of the credit is the greater of 33% of the portion of the federal child tax credit attributable to your qualifying children, or $100 multiplied by the number of qualifying children.

To claim this credit if you are single, you must have an adjusted gross income of $75,000 or less. If you are married filing jointly, your AGI must be $110,000 or less. And if you are married filing separately, your AGI needs to be $55,000 or less to claim this credit.

Read Also: Do I Need To Charge Sales Tax Online

New York And California Release Revised Regulations On Pl 86

The New York Department of Taxation and the California Franchise Tax Board have issued a technical memorandum and a draft regulation respectively. The documents put out by the states revise their interpretation of P.L. 86-272.P.L. 86-272 prohibits states and localities from imposing income taxes on remote businesses if their only activity with the state is soliciting sales of tangible personal property. The Multistate Tax Commission recently reinterpreted P.L. 86-272, stating that businesses interacting with customers via a website or an app are engaging in unprotected business activities within the customers state in a variety of scenarios, and thus no longer qualify for P.L. 86-272 protection. Both California and New York are using this reinterpretation of P.L. 86-272 to modify their respective stances on when businesses can claim P.L. 86-272 protection. Furthermore, California has indicated that its revised interpretation of P.L. 86-272 can be applied retroactively. New York is also considering a retroactive application of its revised interpretation of P.L. 86-272. For more information, please see New Yorks Draft Regulation and Californias Technical Memorandum. If you have questions about whether your business may still be protected under P.L. 86-272, please contact a member of the Withum SALT Team.

New York Share Of Us Millionaires Is Decreasing

Between 2010 and 2017 the number of United States tax filers with adjusted gross incomes of $1 million or more increased 75 percent, which is more than 50 percent faster than growth in New York. In 2010 New Yorks share of millionaires was 13 percent compared to 7 percent in Florida. Between 2010 and 2017 New Yorks share of the nations millionaires decreased by 15 percent , while Floridas increased by 26 percent . The decreasing share of millionaires may be caused by a number of factors, including personal income tax rates. It is concerning because New York State and New York City are very dependent on tax revenues from millionaires, with almost 40 percent of personal income tax revenues coming from this group of taxpayers.6

There were even greater shifts in the share of capital gains earned by New Yorks millionaires, which have important revenue impacts for states coffers. Ordinary income is taxed where it is earned however, capital gains are taxed by the state of residency . For example, if a New Jersey resident works in New York, he or she pays New York taxes on wages earned in New York, but if the person earns capital gains, that income is taxed only by New Jersey.7 Individuals who derive most of their incomes from capital gains have a strong incentive to establish residency in a low tax state.

Don’t Miss: Do You Pay Income Tax On Life Insurance

Do Us Citizens Living Abroad Have To Pay State Tax

Unlike almost everywhere else in the world, American expats still need to file U.S. income taxes while living abroadâand that also may include state taxes. The fact is, if you remain a U.S. citizen or green card holder who works abroad, you are still required to file U.S. taxes and report your income every year.

Reality Check: Few Will Really Pay More Than 50%

New Yorks income tax rate for annual earnings above $1 millionwill rise to 9.65%, from its current 8.82%, under the latest deal. It will also create new tax brackets for income above $5 million and $25 million a year, with even higher rates of 10.3% and 10.9%, respectively.

The increases combined with New York Citys own 3.9% tax on personal income, as well as federal income tax rates that range from 10% to 37%, will raise the top marginal personal tax rate for city residents to nearly 52%. That would push New York past California, which currently has the highest marginal personal tax rate of just over 50% on income over $1 million.

Few of Gothams wealthiest, however, will end up paying rates that high. Nearly 3 million New York City residents file taxes, according to state data from 2018, but just 30,000 reported making more than $1 million a year. And only about 4,000 of those people made more than $5 million. Thats about the population of Armonk, the wealthy New York City suburb that is home to IBM headquarters.

And remember: That 52% surcharge is a marginal rate paid on the income above $25 million. High-wage earners will still pay a lesser, combined all-in rate of 44% on income below $1 million.

Dont Miss: Wax Museum Nyc Times Square

Also Check: How To Pay Oklahoma State Taxes