Federal Occupational Safety And Health Act

The U.S. Department of Labor administers and enforces the federal Occupational Safety and Health Act rules designed to protect workers from workplace hazards.

For information regarding compliance with federal standards, contact the U.S. Department of Labor Raleigh-Area Office at 790-8096 or visit OSHA.gov.

Welcome To The Nhc Tax Department

Tax Office hours are weekdays from 8:00 am to 5:00 pm. While in-person service is available, customers are encouraged to call the office for assistance at 910-798-7300 or use the online resources below before coming into the office.

The Tax Department is responsible for obtaining, developing, analyzing, and maintaining records necessary for the appraisal, assessment, billing, collection, and listing of taxes associated with real and personal property within the jurisdiction of the county and municipalities, according to the state of North Carolina General Statutes. The Tax Department is required to provide information, research, and maintain records for the NC Department of Revenue, and provide statistical information for General Assembly analysts. The department also serves as the staff liaison to the Board of Equalization and Review.

The Different Types Of Taxes You Could Be Paying

Some states have a flat tax rate on incomes, also known as the fair tax. In Pennsylvania, the flat tax rate in 2020 was 3.07%, meaning that someone who earns $100,000 would only pay $3,070 in state income tax. There are only 8 states that have a flat tax rate in income, respectively Michigan, Utah, Indiana, Colorado, Illinois, Pennsylvania, North Carolina, and Massachusetts.

Other states have no income tax, but that doesnt mean there are no taxes paid to the state. For example, these states may still have to deal with other taxes, including gasoline tax, property taxes, cigarette tax, and sales tax. The seven states with no income tax are Florida, South Dakota, Texas, Wyoming, Washington, Nevada, and Alaska.

There are also some graduated tax rates that the remaining 36 states and the District of Columbia use. This framework is similar to the one used by the federal government. Under this type of tax, a person would have their income taxed in different brackets at different rates, which increase when the annual income also grows. However, there are fewer brackets compared to the federal tax code, and also lower tax rates.

State income tax can also be individual or corporate.

You May Like: How Are Lump Sum Pensions Taxed

What Is The Process For Arranging A Tax Payment Plan In North Carolina

Most taxpayers can request an Installment Payment Agreement by using the form available on the North Carolina Department of Revenues website. However, you may be asked to submit additional information. Individuals can use the Collection Information Statement for Individuals . Businesses should use the Collection Information Statement for Businesses . Its advisable to seek the help of a tax professional whenever you submit financial information to the North Carolina Department of Revenue.

Also Check: How Can I File My Past Years Taxes

Research & Development Tax Credit

R& D tax credits are often overlooked or under-utilized dollar-for-dollar tax savings that directly reduce a companys tax liability and/or offset payroll taxes. The R& D credit is available at both the federal and state level, with approximately 40 states offering an R& D credit to offset state tax liability.

Claiming R& D Tax Credits can be complex, as documentation is required to demonstrate how the underlying activities meet the four part test, federal and state tax laws and regulations are ever-changing, and a thorough review of the qualifying activities is required to determine eligibility. In some cases, companies can look back to all open tax years to claim missed R& D tax credit opportunities

At MGO, our dedicated R& D Tax Credit team brings over 30 years of experience. We will take a holistic view of your operations and research and development processes to identify areas where the R& D credit may apply.

Also Check: What Is The Sales Tax In Arkansas

North Carolina Tax Payment Plan

Are you wondering about eligibility for a North Carolina state income tax payment plan? It is possible to set up an Installment Payment Agreement through the North Carolina Department of Revenue . However, the way North Carolina handles the notification process for payment plans is unique. North Carolina is also one of the more generous states in terms of the length of time taxpayers have to pay off debts in installments. Lets explore your options for a North Carolina state tax payment plan.

Can You Pay North Carolina State Taxes In Installments

Yes, there is a tax payment plan North Carolina taxpayers can use to make payments in installments. Your specific installment period will be based on the amount that you owe in taxes. Heres the breakdown for North Carolina Installment Payment Agreements for individual taxpayers:

- Less than $1,000: 15 months.

- $1,000 to $6,999: 30 months.

- $7,000 to $49,999: 40 months.

- $50,000 or more: 50 months.

The repayment period for all installment agreements granted to businesses is 12 months. This is the case regardless of the amount that is owed. Keep in mind that you can only formally apply for one of these installment options once youve received an official notice from North Carolina Department of Revenue.

Don’t Miss: Do You Have To Pay Taxes On Life Insurance Payout

Overview Of North Carolina Taxes

North Carolina now has a flat state income tax rate of 5.25%. The average effective property tax rate for the state is below the national average. There is a statewide sales tax and each county levies an additional tax.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 2022 filing season.

Fraud Negligence Frivolous Tax Return Penalties

- Negligence penalties and Large tax deficiency If a taxpayer understates their taxable income, in an amount equal to 25% or more of gross income, the 25% large individual income tax deficiency or other large tax deficiency penalty will be assessed. If the taxpayer understates their income by less than 25%, a 10% negligence penalty may be applied. If the taxpayer had an accuracy penalty assessed for federal income tax purposes, DOR will assess the 10% negligence penalty for State income tax purposes, unless a larger deficiency penalty applies.

- Fraud If a taxpayer received a fraud penalty from the federal government and their state return was based on that fraudulent return, they will also be assessed a 50% fraud penalty for state purposes. If taxation authorities assess a fraud penalty, the state cannot also assess a taxpayer for negligence, large tax deficiency, or failure to file for that same deficiency.

- Frivolous return If a taxpayer files a frivolous return, the state may assess up to a $500 penalty. A frivolous tax return is one that both fails to provide sufficient information to permit a determination that the tax return is correct and positively indicates the tax return is incorrect and evidences the intent to delay, impede or negate the State or purports to adopt a position that lacks seriousness.

You May Like: Do You Have To Declare Unemployment On Taxes

I Need To Pay My State Taxes But Cant Find The Notice Number For The Nc Department Of Revenue

There are two different areas on the NC Department of Revenue where you can pay a tax bill. One for paying when you have received a notice from them and one for simply paying your state balance due amount after filing your taxes.

Here is the link to the area where you would pay your state balance due amount :

Recommended Reading: Where Can You Get Tax Forms And Instructions

Individuals Required To File A North Carolina Individual Income Tax Return

The following individuals are required to file a 2021 North Carolina individual income tax return:

- Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021 for the individuals filing status.

- Every part-year resident who received income while a resident of North Carolina or who received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021.

- Every nonresident who received income for the taxable year from North Carolina sources that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income from all sources both inside and outside of North Carolina for the taxble year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021. For nonresident business and employees engaged in disaster relief work at the request of a critical infrastructure company, refer to the Personal Tax Division Bulletins.

Recommended Reading: How Much Tax Will I Get Back Calculator

North Carolina Income Tax

Benefits from the Retirement System receive special income tax treatment. However, since tax laws often change, the Retirement System cannot give you detailed tax advice concerning your retirement benefits. If you need more specific information with regard to how your retirement benefits are taxed, we would suggest that you consult the Internal Revenue Service, the North Carolina Department of Revenue, your attorney, or your accountant. You can reach the Internal Revenue Service and the North Carolina Department of Revenue at the following telephone numbers:

You may also contact your local branch of the North Carolina Department of Revenue.

If you are a North Carolina resident and have maintained five or more years of retirement service credit as of August 12, 1989, your retirement benefit paid by this System is not subject to North Carolina income tax. If you do not have five years of maintained retirement service credit as of August 12, 1989, you will be required to pay North Carolina income tax on the taxable portion of your retirement benefit. The amount of retirement benefits subject to North Carolina income tax is the same amount of retirement benefits on which federal income tax must be paid.

Please note: The Retirement Systems does not withhold state taxes for states other than North Carolina.

Side Nav

Phone: 814-4590Call Center open Monday through Friday, 8:30 a.m. – 4:30 p.m.Please Note: Currently, the Call Center takes a lunch break from 11:30 am to 12:30 pm

How Do I Pay My Nc State Tax

Taxpayers may pay their tax by using a or bank draft via our online payment system, or by contacting an agent at 1-877-252-3252. Taxpayers may also pay their tax with a personal check, money order or cashiers check.

What is the state withholding tax for North Carolina?

- The North Carolina state income tax is 5.75%. Therefore, the withholding tax should be the same as the state income tax. Employees do not need to take any action. The employers/businesses will need to deduct the withholding tax from employees paycheck and submit and file the withholding tax to North Carolina Dept of Revenue.

Read Also: How To File Your Taxes For The First Time

How You Can Affect Your North Carolina Paycheck

North Carolina taxpayers who find themselves facing a large IRS bill each tax season should review their W-4 forms, as there’s a simple way to use the form to address this issue. Specifically, you can elect to have an extra dollar amount withheld from each of your paychecks to go toward your taxes. While your paychecks will be slightly smaller, youll lower the chances of owing money to Uncle Sam during tax season.

You can also save on taxes by putting your money into pre-tax accounts like a 401, 403 or health savings account , provided your employer offers these options. Retirement accounts like a 401 and 403 not only help you save money for your future, but can also help lower how much you owe in taxes. The money that goes into these accounts comes out of your paycheck before taxes are deducted, so you are effectively lowering your taxable income while saving for the future. HSAs work in a similar manner and you can use the money you put in there toward medical-related expenses like copays or certain prescriptions.

Not yet a North Carolina taxpayer, but planning a move to the state soon? Take a look at our North Carolina mortgage guide for important information about rates and getting a mortgage in the state.

If I Enter 0 On The Use Tax Line Or Do Not Enter An Amount Will I Receive A Bill Or Be Audited

A person will not automatically receive a bill for use tax if an amount for use tax is not reported due. If the Department discovers through other means that a person owes use tax on purchases, the person will be assessed tax plus penalties and interest. In addition, a person may be selected for audit by the Department.

Read Also: Does Roth Ira Get Taxed

Pay By Automated Telephone: 1

When you pay Electronically

Whether paying online, by phone or in our office, a convenience fee is assessed for your credit card, debit card, or electronic check payment. This fee is paid to Forte Payment Systems, not to Henderson County. The amount of the fee and the total amount to be charged will be disclosed to you prior to you providing your credit card information. You will have the option to cancel the transaction prior to any charge being processed. If you elect to continue, your credit card statement will show two charges, one charge for the tax, the other for the convenience fee. Payments made online and through our automated phone system may take up to 3 business days to reflect online. You will always be credited for payment on the date you make payment.

Convenience Fee Schedule

The following fee schedule applies to payments made online, through our automated telephone system, and also those made in our office.

| Service Type |

|---|

| 2.4% of payment total,$1.50 minimum fee |

* Remember: Cash, Check, and Money Orders are always accepted on timely payments in our office with no additional fees.

How does the system work?

Begin by searching for only one of the following:

- Name Best results using primary owner name

- Bill number Drop the leading zeros on the bill number located in the upper left-hand corner of your tax bill

- Parcel number All Real Property has an assigned six to eight digit parcel number located on your bill

Safe and Secure

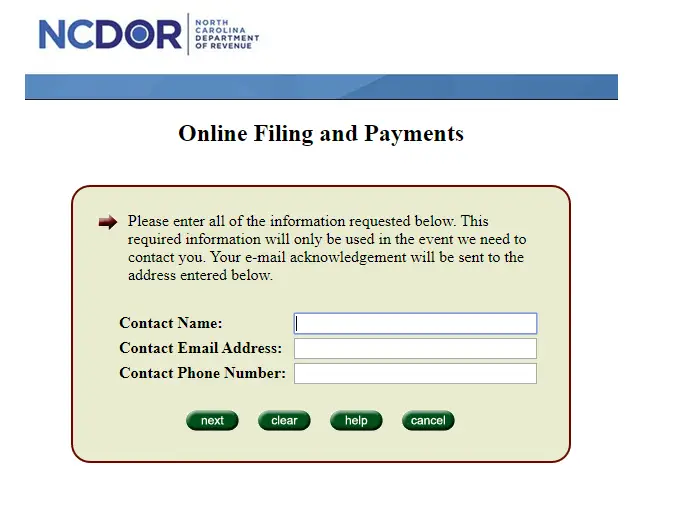

Making Federal And Nc Tax Payments Online

When making tax payments to the IRS or to the NC Department of Revenue , paying online is an available option. Payments for Tax Due with Returns, for Estimated Taxes and for Extensions can be made using this method.

To Make A Federal Tax Payment:

Go to the IRS website for making a tax payment.

- Select Make a Payment

- Under Pay Your Taxes Now select if you are paying by direct pay or debit/credit card. There is no charge to pay by bank draft. Fees for credit/debit cards are noted on the website.

- Select Make a Payment

Also Check: Where Can I Find My Property Tax Bill

Renew Registration And Pay Property Tax Online

1. Visit myNCDMV and or download the app for iOS or Android and click Continue to myNCDMV Services.

2. Create an account using your email address, Apple, Facebook or Google credentials, or Continue as a Guest .

8. Enter your contact information. Then, click Submit.

9. Review your Vehicle Renewal Summary and click Add item to cart if everything looks good.

10. Click Go to cart if you dont need to add another item. Click Ill add something else if you need to renew another vehicle or need to make another purchase online through myNCDMV.

11. Enter your email address into the Send Receipt To box if youre logged in a guest. If you have an account, your receipt is sent to the email address that you use to log in to myNCDMV.

12. After clicking Go to cart, click Choose a Payment Method and enter a or link to a bank account.

Note: If you already have a card or bank account linked, it will automatically appear here. Click on the payment method to change or add a new payment method.

13. Click Pay $.to finalize and submit your order.

Note: You will receive a payment receipt in your email and if signed in, you can also see it in the Receipts tab of your myNCDMVProfile .

Nc Installment Payment Agreement

North Carolina offers an Installment Payment Agreement. Many may also refer to it as a tax payment plan or installment agreement. With this option, if the taxpayer cannot pay the balance in full, they can pay it over time. The type of tax and the amount owed usually determine the duration of the Installment Payment Agreement. Taxpayers can find out more about NCs installment payment agreement here.

You May Like: Do We Pay Taxes On Social Security

What Can Cause A Delay In My North Carolina Refund

A number of things could cause a delay in receiving your North Carolina refund, including the following:

- Math errors in your return or other adjustment. If the adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. Your state tax returned for you to complete using the correct form type.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. Your state return may be returned to you. You must complete the correct form type before your return can be processed.