What The Cola Means If You Haven’t Claimed Benefits Yet

If you decide to claim Social Security benefits, you will get access to the record-high COLA.

But you will also have access to it if you wait to start your benefit checks at a later date, according to Elsasser.

If you’re 62 now and don’t claim, your benefit is adjusted by every COLA until you do.

The amount of the COLA really should not influence claiming.Joe ElsasserCFP and president of Covisum

What’s more, delaying benefits can increase the size of your monthly checks. Experts generally recommend most people wait as long as possible, until age 70, due to the fact that benefits increase 8% per year from your full retirement age, typically 66 or 67, to age 70. Whether that strategy is ideal may vary based on other factors, such as your personal health situation and marital status.

“The amount of the COLA really should not influence claiming,” Elsasser said. “It doesn’t hurt you or help you as far as when you claim, because you’re going to get it either way.”

Withholding Taxes From Your Social Security Benefit

For taxpayers that know that will have to pay tax on their Social Security benefit, it is usually a good idea to have Social Security withholding taxes taken directly from your Social Security payments. Otherwise, you will have to issue checks for estimated tax payments throughout the year which can be a headache. They only provide you with four federal tax withholding options:

· 7%

· 12%

· 22%

These percentages are applied to the full amount of your Social Security benefit, not to just the 50% or 85% that is taxable. Just something to consider when selecting your withholding elections.

To make a withholding election, you have to complete Form W-4V . Once you have completed the form, which only has 7 lines, you can mail it or drop it off at the closest Social Security Administration office.

When Should Seniors File Returns

Taxes on social security benefits are based on the retirees income. If social security benefits are the only source of income for the senior, then there is no need of filing a tax return. As of 2017, retirees without spouses and have attained the required 65 years should file an income tax return if the gross earnings are more than $11,850. Seniors living on social security benefits, however, should not include the amount in this gross income. If the benefits make up your entire income, then your gross income for tax computation is equal to zero.

As of 2017, retirees without spouses and have attained the required 65 years should file an income tax return if the gross earnings are more than $11,850.

Unmarried retirees who have additional incomes liable to tax should determine if the amount exceeds $11,950 for tax computation. Married retirees filing their return jointly, on the other hand, may have their social security benefits taxed if they are earning more than $23,000. If one of the spouses is below 65 years of age, then the threshold amount reduces to $ 22,050.

Read Also: How To Extend Taxes To October

Social Security Benefit Taxation By State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. Of this number, nine statesAlaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyomingdo not collect state income tax, including on Social Security income.

Out of the nine states that do not levy an income tax, New Hampshire still taxes dividend and interest income.

Below is a list of the 12 states that do levy a tax on Social Security benefits on top of the federal tax, with details on each states tax policy.

Recommended Reading: Do You Have To Pay Taxes On Life Insurance

Taxes On Retirement Income

In retirement, different kinds of income are taxed differently:

- Most interest on bank deposit accounts is taxed at the same federal income tax rate as the money you receive from paid work.

- Distributions from traditional 401s and IRAs are typically subject to the tax rates associated with your current marginal tax bracket.

- Dividends paid or gains from the sale of stocks are taxed at 0%, 15%, or 20%, depending on how long you’ve held the stock, your taxable income, and your tax filing status.

- Other incomesuch as qualified withdrawals from a Roth IRA, a Roth 401, or a health savings account are not subject to federal income taxation and do not factor into how your Social Security benefit is taxed.1

When the total income calculated under the combined income formula for Social Security is more than the threshold , up to 85 cents of every Social Security income dollar can be taxed.

So as you work with financial and tax professionals, consider the following 2 strategies.

Recommended Reading: How To Save For Taxes

Is Social Security Income Taxable

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

If You Earn Enough Money For Your Benefits To Be Taxable You Could End Up Paying The Highest Income Taxes In The Country

Social Security benefits are tax free unless you earn too much income during the year. To know whether you might be subject to such taxes you have to figure your “combined income.” This is actually quite easy: Simply add one-half of the total Social Security you received during the year to all your other income, including any tax-exempt interest .

You’ll have to pay tax on part of your benefits if your combined income exceeds these thresholds:

- $32,000 if you’re married and file a joint tax return , or

- $25,000 if you’re single.

If a married couple files their taxes separately, the threshold is reduced to zerothey always have to pay taxes on their benefits. The only exception is if they did not live together at any time during the year in this event the $25,000 threshold applies.

This applies to all types of Social Security benefits: disability, retirement, dependents, and survivors benefits.

How much of your Social Security benefits will be taxed depends on just how high your combined income is.

Individual filers. If you file a federal tax return as an individual and your combined income is between $25,000 and $34,000, you have to pay income tax on up to 50% of your Social Security benefits. If your income is above $34,000, up to 85% of your Social Security benefits is subject to income tax.

Once you start receiving Social Security benefits, to keep your income below the applicable threshold, or at least as low as possible, you should:

Also Check: How Much Are Annuities Taxed

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

Three Ways To Reduce The Taxes That You Pay On Benefits

Is Social Security taxable? For most Americans, it is. That is, a majority of those who receive Social Security benefits pay income tax on up to half or even 85% of that money because their combined income from Social Security and other sources pushes them above the very low thresholds for taxes to kick in.

But there are three strategies you can useplace some retirement income in Roth IRAs, withdraw taxable income before retiring, or purchase an annuity, to limit the amount of tax you pay on Social Security benefits.

Don’t Miss: How To Get Stimulus Check Without Filing Taxes

Ways To Avoid Taxes On Benefits

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income below the thresholds to pay tax. However, this may not be a realistic goal for everyone, so there are three ways to limit the taxes that you owe.

- Place retirement income in Roth IRAs

- Withdraw taxable income before retiring

- Purchase an annuity

Spousal Tax Relief Eligibility Explorer

Many married taxpayers file a joint tax return because of certain benefits this filing status allows. If you did so, you may be held responsible for monies due, even if your spouse earned all of the income – And this is true even if a divorce decree states that your spouse will be responsible for any amounts due on previously filed joint returns.

To qualify for Spousal Relief, you must meet certain conditions.

Recommended Reading: Can You Pay Estimated Taxes Online

How Social Security Benefits Are Taxed

Social Security beneficiaries must pay federal income tax on a portion of their benefits if their income exceeds certain thresholds the portion of benefits that is taxable rises with income. Income for this purpose equals a taxpayers adjusted gross income plus tax-exempt interest, certain other tax-exempt income, and half of Social Security benefits this is referred to as modified AGI. A three-part formula applies:

- For individuals with modified AGI below $25,000 and couples with modified AGI below $32,000, no Social Security benefits are taxable.

- For individuals with modified AGI between $25,000 and $34,000 and couples with modified AGI between $32,000 and $44,000, up to 50 percent of benefits are taxable.

- For individuals with modified AGI over $34,000 and couples with modified AGI over $44,000, up to 85 percent of benefits are taxable.

For a detailed explanation of the tax calculation, see Appendix Table 1.

How Do I Determine If My Social Security Is Taxable

Add up your gross income for the year, including Social Security. If you have little or no income besides your Social Security, you wont owe taxes on it. However, if youre an individual filer with at least $25,000 in gross income, including Social Security for the year, then up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more , then up to 85% may be taxable.

You May Like: Do Revocable Trusts File Tax Returns

What Could Happen To Future Benefit Increases

While 2023 marks a record high COLA, beneficiaries should be prepared for future years where increases are not as high.

If inflation subsides, the size of COLAs will also go down.

Whether the CPI-W is the best measure for the annual increases is up for debate. Some tout the Consumer Price Index for the Elderly, or CPI-E, as a better measure of the costs seniors pay. Multiple Democratic congressional bills have called for changing the measure used to calculate annual increases to the CPI-E. Others have suggested another measure, the Chained CPI, to help curb federal spending.

How Much Of Social Security Is Taxable

Although it’s possible that you won’t owe any taxes on your benefits, some Social Security recipients may owe taxes on up to 85% of their Social Security incomewhich means no taxpayer ever pays taxes on 100% of their Social Security benefits. Thedepends on your income from other sources and your filing status.

Also Check: Is Ein Same As Sales Tax Number

Is Social Security Considered Gross Income

Since the 1980s, some recipients of these benefits who meet certain income levels have been required to pay taxes on the money they receive. While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

How To Avoid Tax On Social Security Benefits

The fundamental strategy behind minimizing your tax on Social Security benefits is to keep your total taxable income as low as possible. Ideally, you can reduce your combined income below the thresholds the IRS uses to calculate the tax owed on Social Security income.

Your combined income is half your Social Security income plus income from other sources, such as wages, dividends, interest, pensions, retirement account distributions and business income. You may not be able to completely avoid paying taxes on Social Security, but there at least three ways to reduce the tax that you owe:

Read Also: Can I File Bankruptcy On State Taxes Owed

How Social Security Taxes Work

The fact that levies are applied to benefits is “extremely unpopular,” Altman said. “People hate it, but it actually makes policy sense,” she said.

One key reason that it makes for good policy is that Social Security benefits and private pensions are taxed in a similar way.

When the program was created in 1935, benefits were not taxed. That began to change in 1983, when Congress changed the rules so that up to 50% of Social Security benefits could be included in taxable income, if a taxpayer’s income was over certain thresholds.

More changes came in 1993, which raised the portion of certain Social Security benefits subject to taxation to 85%. That change applied to higher income beneficiaries.

The result is a complicated set of rules that still applies today.

First, the taxes are based on what is known as provisional or combined income. That includes half of your Social Security benefits plus your adjusted gross income and nontaxable interest. That means that any income from wages, interest, dividends or other taxable income is counted.

Then the 50% and 85% thresholds are applied.

Individuals with combined income between $25,000 and $34,000 will pay income tax on up to 50% of their benefits. That also goes for couples with incomes between $32,000 and $44,000.

Individuals with combined income of more than $34,000, as well as couples with more than $44,000, may pay tax on up to 85% of their benefits.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: How To Check Income Tax Return Status

For Years New Mexico Was One Of Just A Few States That Still Taxed Social Security Benefits New Mexico Seniors Deserve To Hold Onto Their Hard

Beginning with tax year 2022, most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. Tax relief from the new Social Security exemption is expected to total $84.1 million in the first year. The exemption is available to single taxpayers with less than $100,000 in income, to married couples filing jointly, surviving spouses and heads of household with under $150,000 in income, and to married couples filing separately with under $75,000 in income.

Instructions on how to claim the exemption will be available beginning with the 2022 Tax Year Personal Income Tax instructions.

Do you know someone who could benefit? Please share this page. Are you considering retiring in New Mexico? Retire New Mexico can help. Learn more here:

Latest News

Some American College Students

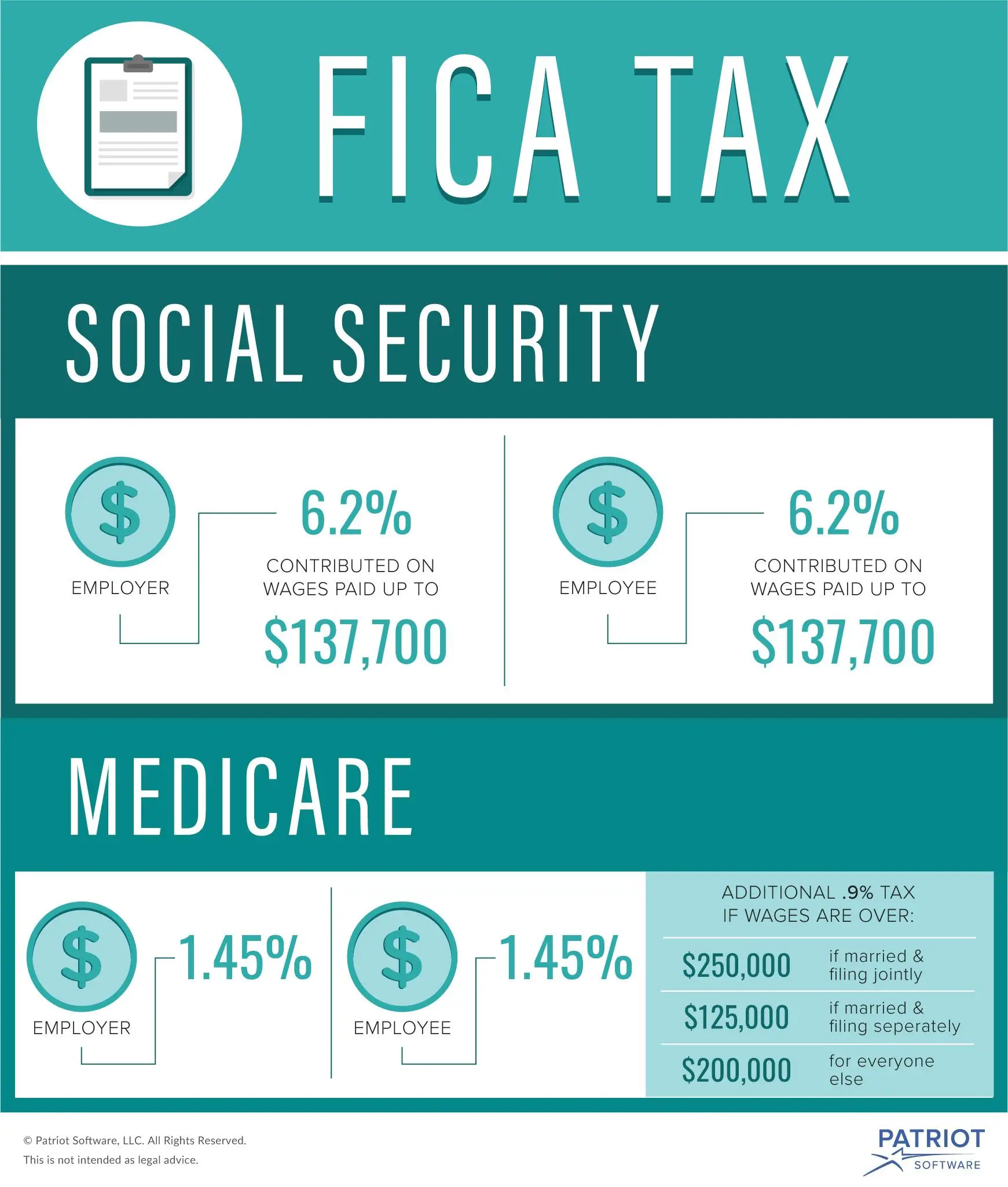

American college and university students who work part-time at their schools may also qualify for an exemption from Social Security tax. The job must be contingent on the students full-time enrollment at the college or university or half-time status if in the last semester or trimester.

“Students who are employed by a school, college, or university where the student is pursuing a course of study are exempt from paying FICA taxes as long as their relationship with the school, college, or university is student, meaning education is predominantly the relationship, not employment,” says Alina Parizianu, CFP®, MBA, who as of 2021 was a financial planning specialist for MMBPB Financial Services in New York.

Income beyond a certain level isn’t subject to Social Security tax, but Medicare tax applies to all income.

Don’t Miss: How Much To Charge For Tax Preparation

Other Things To Watch Out For

While everyone likes to minimize their taxes, especially ones that you can avoid without too much legwork, its important that you keep things in perspective.

Tax strategy should be part of your overall financial planning, says Crane. Dont let tax strategy bethe tail that wags the dog.

In other words, make the financial moves that maximize your after-tax income, but dont make minimizing taxes your only goal. After all, those who earn no income also pay no taxes but earning no income is not a sensible financial path. For example, it can be better to find ways to maximize your Social Security benefits rather than minimizing your taxes.

And it could be financially smart to first avoid some of the biggest Social Security blunders.

Dont forget that these rules apply to minimizing your tax at the federal level, but your state may tax your Social Security benefit. The laws differ by state, so itsimportant to investigate how your state treats Social Security.

There really arent any tricks, you just have to be careful with your interest and dividends, says Paul Miller, CPA, of Miller & Company in the New York City area.