How To Check Your Return And Refund Status

The only way to track your return and refund is to use the Wheres My Refund? tool on IRS.gov. You can call the IRS Tax Help Line at 800-829-1040, but if your return is active on Wheres My Refund? you are unlikely to get any additional details not provided online.

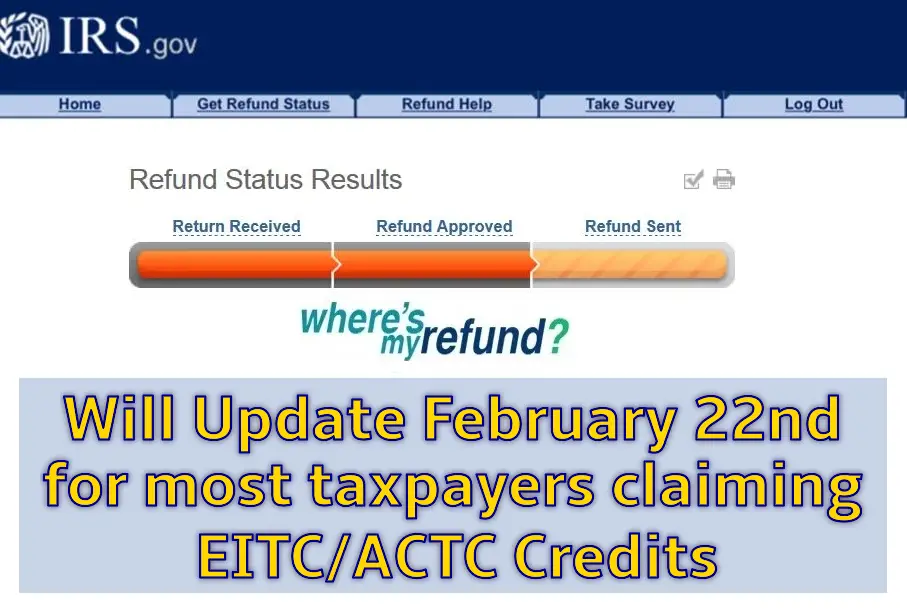

Your return status should appear within 24 hours of filing your electronic return or within four weeks of mailing your paper return. A status of received indicates that the IRS has your return for processing, and a status of approved means that the IRS has approved your refund. You will also see when the funds are expected to be distributed, and the status will change to sent when your refund is on its way.

How Do I Track My Tax Refund

If youre wondering where your refund is, there are a few ways you can check its status.

The IRS online tools. The fastest and easiest way to track your federal tax refund is to use the IRS Wheres My Refund tool or the IRS2Go mobile app, according to the IRS.7 These tools will tell you when your return is received, approved, and when your tax refund is sent. To use either of the IRS tracking tools, youll need your Social Security number, filing status, and exact refund amount. If you e-filed, you can start checking your status with these tools 24 hours after filing. But itll take about four weeks before you can check the status of a mailed return.

Through your e-filing service. If you e-filed your return, the tax preparation website you used will likely alert you via email or status update when your return is received, approved, and your tax refund is sent.

You can call the IRS, but the government notes that you might be on hold for a while before you get to speak to a representative. And IRS representatives can only research the status of your refund if its been 21 days or more since you filed electronically or more than six weeks since you mailed your paper return. If you choose to call the IRS, you should be ready to provide personal information like your Social Security number, birth date, and filing status.

If youre expecting an amended tax return, you can use the IRS Wheres My Amended Return? tool.8

So Far In The 2022 Tax Season The Average Tax Refund Is More Than $3300

For some Americans, this years tax season was easy. They filed electronically, elected to have their money sent by direct deposit to their bank account and, in three weeks or less, got their refund.

The IRS said that, as of March 18, almost 52 million refunds have been issued worth more than $171 billion, with the average payment totaling $3,305.

But for others, a massive return backlog has delayed refunds or held up the processing of returns that were refiled by taxpayers because a correction or change needed to be made.

With about three weeks left in the 2022 filing season, which began Jan. 24, heres what you need to know about why your return may have been delayed:

Don’t Miss: Doordash Deductions

What If You File Your Taxes Late

Filing taxes on time is generally a good practice. In addition to releasing yourself of the burden, you can expect an earlier tax refund. The longer you wait to file your taxes, the longer it will take to get your refund.

Plus, filing late might incur some expensive consequences. If the IRS owes you a refund, filing late generally wont hurt you. However, if you owe taxes, you will be penalized for both filing and paying late.

The deadline for filing your 2020 federal taxes is May 17, 2021.

Some people need more time to file taxes. If youre e-filing, you can file for an extension for free using the IRSs Free File. Paper filers will need to submit Form 4868 to get a six-month extension on their tax deadline. This strategy helps you avoid paying taxes late, but note that the form doesnt extend the time to pay taxes. If you wind up owing taxes after the extension, you will still be penalized.

When You Will Receive Your 2021 Tax Refund And How To File Electronically

The IRS states in its FAQ section that most refunds are issued within 21 calendar days. However, there’s a disclaimer stating that due to processing issues caused by the pandemic, it may take longer to deliver your refund.

Additionally, how you file your taxes can affect how long it takes to track the status of your refund. If you file electronically like the vast majority of Americans do you can start tracking your tax refund status within 24 hours of filing on the Where’s My Refund site. However, if you file by mail, your processing time extends to at least four weeks to see your payment status on the site.

So if you haven’t filed your taxes yet, you may want to consider filing electronically with a tax service like TurboTax or H& R Block to avoid issues like waiting for months to receive your refund or even losing your tax files altogether. Select ranked TurboTax as the best overall tax-filing software and as the best free tax software. These services can help you maximize deductions and increase your refund.

Also keep in mind that you can file your taxes online for free through the IRS if your adjusted gross income was less than $73,000 in 2021.

Recommended Reading: Does Doordash Pay Taxes

What If I’m Looking For Return Info From A Previous Tax Year

The Where’s My Refund tool lists the federal refund information the IRS has from the past two years. If you’re looking for return details from previous years, you’ll need to check your IRS online account.

From there, you’ll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you’ve received from the IRS and your address on file.

Some Tax Refunds May Be Delayed In 2021

In addition to the delays we outlined above, if you claimed the Earned Income Tax Credit and the Additional Child Tax Credit , your tax refund may also be delayed. If you claimed these credits, the IRS started to issue these tax refunds the first week of March if you claimed these credits.

Your financial institution may also play a role in when you receive your refund. Since some banks do not process financial transactions during the weekends or holidays, you may experience a delay in processing. If you opt to receive your tax refund by paper check, use our tax refund schedule to determine when you can expect to receive your refund.

Finally, you can expect your tax refund to be delayed if you filed an amended tax return. The IRS processes amended tax returns from three weeks up to 16 weeks after receipt. You can check the status of your amended tax return here.

Recommended Reading: Do They Take Taxes Out Of Doordash

First Check Your Refund Status Online

If you are wondering where your refund is, you can start by checking its status on the IRSs Wheres My Refund? page. To do that, the IRS says you will need:

- Your filing status

- Your exact refund amount

, supply the required information, and youll get results. Unfortunately, this tool does not provide much detail about why your money may be delayed. It may advise you to call the IRS, from which you should be able to learn more details. However, the IRS says you should not call unless one of the following two things is true:

- It has been 21 or more days since you e-filed.

- The Wheres My Refund? online tool tells you to contact the IRS.

Ways To Make The Tax Refund Process Easier

Find your tax refund fast by proactively checking your IRS federal tax return status. Before filing and using the IRS Wheres My Refund portal to track your 2020 government return, consider:

- Reviewing your return carefully. Mistakes can delay your returns progress on the tax refund tracker. Be sure to review your information carefully before filing with the IRS.

- Filing early. The earlier you file, the sooner you can check the status of your IRS federal tax return. Early filing also provides more time to deal with issues should something go wrong.

- E-Filing your return. Instead of spending 6-8 weeks wondering wheres my tax refund from the IRS?, do yourself a favor and file electronically. E-Filed government returns are typically processed in under half the time as paper returns.

- Opting for direct deposit. Avoid waiting for your check by having your IRS refund deposited into your account. Once the WMR reads Refund Approved, your money will be ready to spend.

- Tracking your 2020 refund right away. Staying up-to-date on your return ensures youre in the loop every step of the way.

Don’t Miss: Doordash State Id Number For Unemployment California

Whenever Your Tax Refund Comes Protect Your Identity

Identity theft during tax season is a real problem. According to the IRS, thousands of individual taxpayers have lost millions of combined dollars through tax scams.

The best way to protect your identity and your tax money is to know how the IRS communicates with taxpayers. You should never hear from the IRS through email, text or social media. You can automatically discard any phishing attempts that come through these channels.

If you owe taxes, know that IRS collection employees must show you two forms of credentials and will never request payment on the spot. When you do make an IRS payment, it should always be made to the U.S. Treasury. You can report phone scams to the Federal Trade Commission and phishing schemes directly to the IRS.

Also, be aware of how to inadvertently commit tax fraud on your own. If you dont feel confident that all of the deductions youre claiming are legitimate, you should hire a professional.

Your Return Hasnt Been Processed

The IRS has been behind on processing returns for the entire tax season, but there are a few situations causing additional delays for some taxpayers:

- You mailed your return instead of filing electronically.

- Your return has errors like an incorrect Recovery Rebate Credit.

- Your return is incomplete.

- You filed a claim for the Earned Income Tax Credit or Additional Child Tax Credit .

- You submitted Form 8379, Injured Spouse Allocation.

- You are a victim of identity theft or fraud.

- Your return needs additional IRS review.

If the IRS contacts you requesting clarification or more information, responding in a timely manner may help move your return along.

Don’t Miss: How To Appeal Property Taxes Cook County

You Didn’t Properly Enter Your Stimulus Payments

In 2021, most Americans received a third stimulus check payment related to the COVID-19 pandemic. While that money is non-taxable, it needs to be reconciled on your tax return if you are claiming the recovery rebate credit.

In recent testimony to the House Ways and Means Committee, IRS Commissioner Charles P. Retting said that in 2020, the IRS “received far more than 10 million returns” where taxpayers failed to properly reconcile their stimulus payments with the amounts entered for their recovery rebate credits. Those returns require a manual review and create lengthy delays.

If you plan to claim the recovery rebate credit on your tax return, learn how to avoid this error using IRS Letter 6475 or your online IRS account.

To get a prompt tax refund, be sure to enter your advance child tax payments correctly.

Calculating Your Tax Refund Canada

If you are expecting a tax refund, you can get a fairly accurate idea of how much you will be receiving before you actually file your tax return. Sure, you could use free online tax preparation software like TurboTax and fill in a couple of key facts and you should see fairly quickly and easily if you are getting money back or will owe money. Or you can ask for Real Tax Expert Advice on how to report your income or apply deductions. But what information is most important in providing that snapshot?

Recommended Reading: Do You Have To Pay Taxes On Plasma Donation Money

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Idaho: $75 Rebate Payments

In February, Idaho Gov. Brad Little signed a bill that allocates $350 million for tax rebates to Idahoans. There are two criteria for eligibility:

- Full-time Idaho residency and filed 2020 and 2021 tax year returns, OR

- Full-time Idaho residency and filed grocery-credit refund returns

The payments began in March. Each taxpayer will receive either $75 or 12% of your 2020 Idaho state taxes, whichever is greater . The rebate is applicable to each individual taxpayer and each dependent.

The tax commission will first issue rebates to taxpayers who received refunds via direct deposit, then send paper rebate checks. Over 800,000 rebates are expected to be sent by the end of this year.

State residents can also check the status of their rebate online.

Don’t Miss: Restaurant Tax In Philadelphia

Should You Call The Irs

Expect delays if you mailed a paper return or responded to an IRS inquiry about your 2020 return. Some returns require special handling such as those that require correction to the Recovery Rebate Credit amount or validation of 2019 income used to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return. If youre due a refund from your tax year 2020 return, you should wait to get it before filing Form 1040X to amend your original tax return.

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Recommended Reading: How Do Taxes Work For Doordash

Here’s How Long It Will Take To Get Your Tax Refund In 2022

Three in four Americans receive an annual tax refund from the IRS, which often is a family’s biggest check of the year. But with this tax season now in progress, taxpayers could see a repeat of last year’s snarls in processing, when more than 30 million taxpayers had their returns and refunds held up by the IRS.

Treasury Department officials warned in January that this year’s tax season will be a challenge with the IRS starting to process returns on January 24. That’s largely due to the IRS’ sizable backlog of returns from 2021. As of December 31, the agency had 6 million unprocessed individual returns a significant reduction from a backlog of 30 million in May, but far higher than the 1 million unprocessed returns that is more typical around the start of tax season.

That may make taxpayers nervous about delays in 2022, but most Americans should get their refunds within 21 days of filing, according to the IRS. And some taxpayers are already reporting receiving their refunds, according to posts on social media.

However, so far, the typical refund is about $2,300 less than the average refund check of about $2,800 received last year. That could change as the tax season progresses, given that tens of millions of Americans have yet to file. But it could signal that taxpayers could get smaller checks this year, an issue for households already struggling with high inflation.