What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Will The Irs Contact You If Your Taxes Are Wrong

Remember that the IRS will catch many errors itself For example, if the mistake you realize youâve made has to do with math, itâs no big deal: The IRS will catch and automatically fix simple addition or subtraction errors. And if you forgot to send in a document, the IRS will usually reach out in writing to request it.

Read Also: What Is Total Tax Liability Mean

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Is filed on paper

- Needs further review in general

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q& A below.

- Includes a Form 8379, Injured Spouse AllocationPDF, which could take up to 14 weeks to process

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return. If were still processing your return or correcting an error, neither Wheres My Refund? or our phone representatives will be able to provide you with your specific refund date. Please check Wheres My Refund? for updated information on your refund.

Also Check: How To File Taxes Without Last Year’s Agi

Wait I Still Need Help

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers rights. We can offer you help if your tax problem is causing a financial difficulty, youve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isnt working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List.

You May Like: How To Report Bitcoin Loss On Taxes

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

Also Check: How Much Are Annuities Taxed

Find Out Where Your Tax Refund Is

The Balance / Maritsa Patrinos

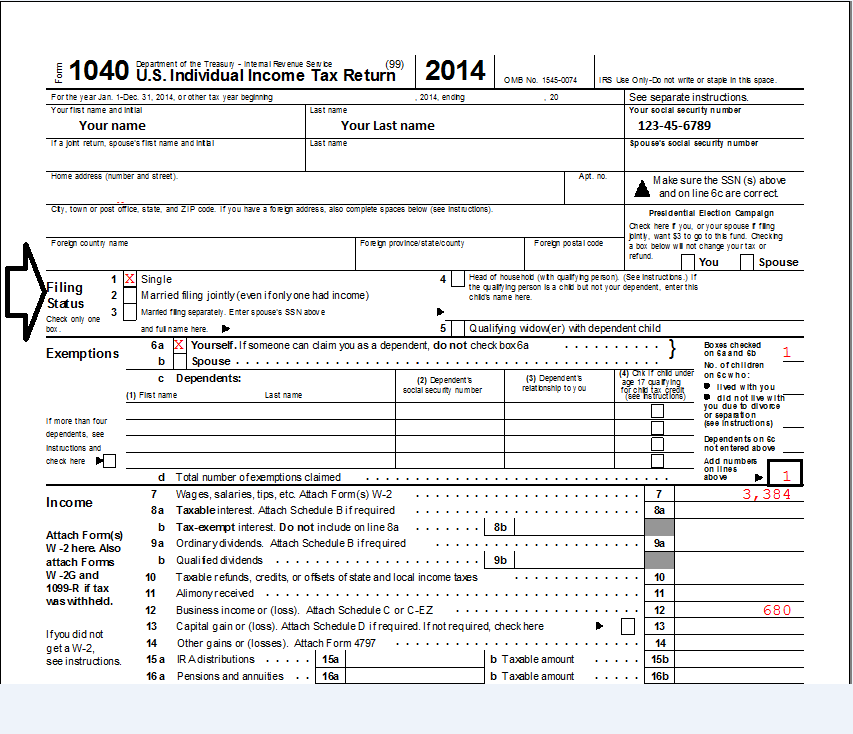

Filing your taxes can seem like a long process, but waiting for that tax refund can seem even longer. However, the Internal Service Revenue offers tools to allow you to trace your refund while you wait. You can check the progress of your tax return and see an estimated date for your refund.

When you receive your refund depends on how you submitted your tax return and the payment method you selected for receiving your refund. Learn how to use the different resources available to trace your refund and find out what to do if you dont receive your refund within the estimated time frame.

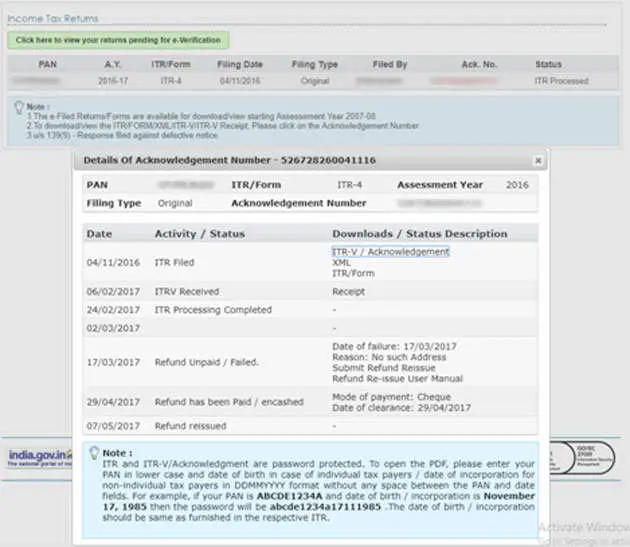

How To Check The Tds Refund Status

Visiting the online e-filing portal helps in knowing the refund status.

1. Log in to your account.

2. Check out the section labelled My Account and select Refund/Demand Status.

3. This reflects the assessment year, the status, and the mode of payment. In case of rejection, the corresponding reason is mentioned here as well.

Also Check: How To Do My Taxes Online For Free

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2022.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

When Youll Receive Your Payment

MCTR direct deposit payments for Californians who received GSS I or II are expected to be issued to bank accounts between October 7, 2022 and October 25, 2022. The remaining direct deposits will occur between October 28, 2022 and November 14, 2022.

MCTR direct deposit recipients who have changed their banking information since filing their 2020 tax return will receive a debit card. Debit cards for this group will be mailed between December 17, 2022 and January 14, 2023.

MCTR debit card payments for Californians who received GSS I and II are expected to be mailed between October 24, 2022 and December 10, 2022. The remaining debit cards will be mailed by January 14, 2023.

Refer to the tables below for the latest updates to the payment schedules.

| Direct deposit recipients who have changed their banking information since filing their 2020 tax return | 12/17/2022 through 01/14/2023 |

Direct deposits typically occur within 3-5 business days from the issue date, but may vary by financial institution.

Allow up to 2 weeks from the issued date to receive your debit card by mail.

We expect about 90% of direct deposits to be issued in October 2022.

We expect about 95% of all MCTR payments direct deposit and debit cards combined to be issued by the end of this year.

Don’t Miss: What States Allow Tax Deductions For 529 Contributions

How You’ll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return

- Received your Golden State Stimulus payment by check

- Received your tax refund by check regardless of filing method

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

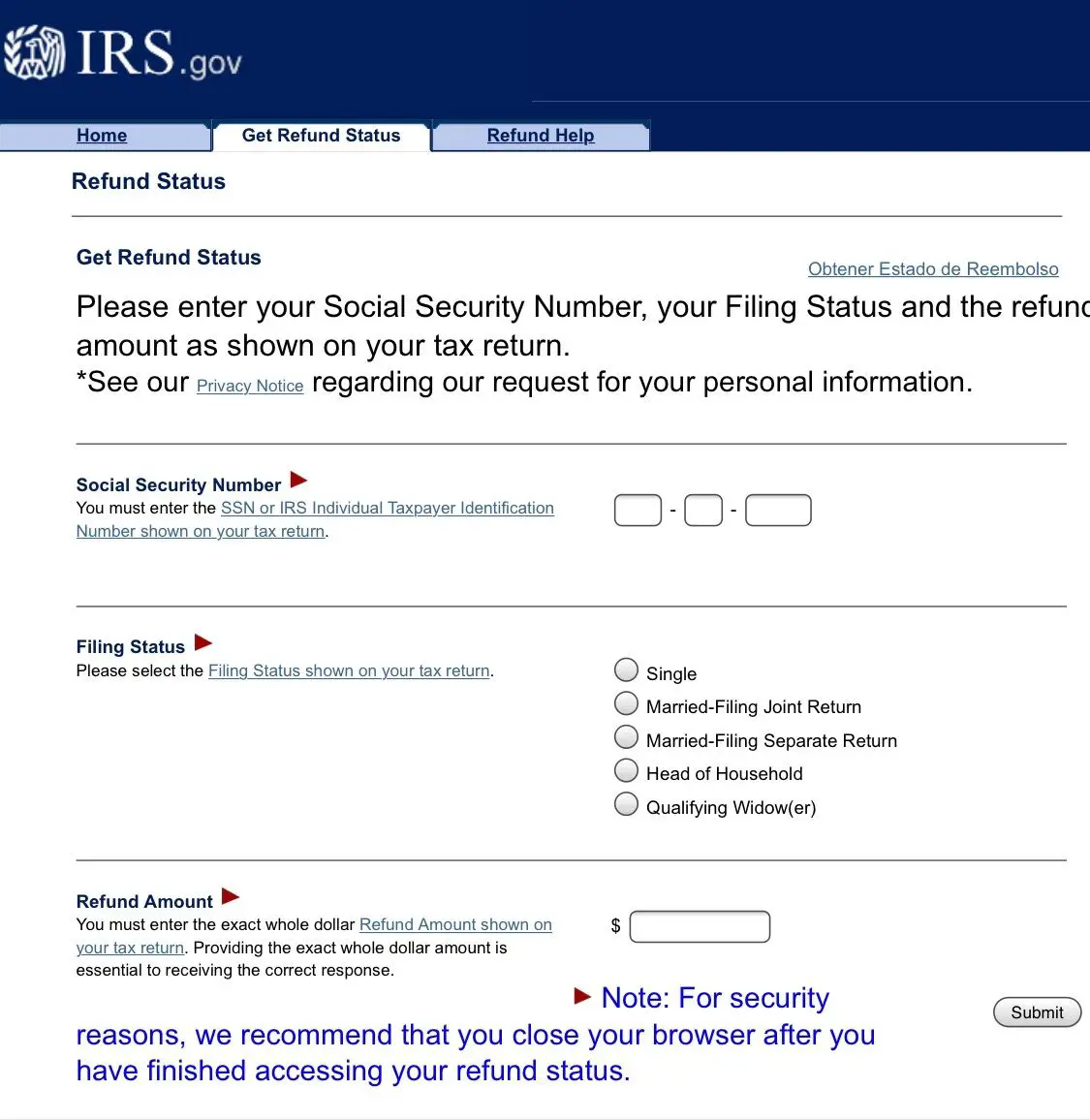

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Also Check: What Is Additional Child Tax Credit

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

Don’t Miss: How To Pay My Property Tax

How Long Do Tax Refunds Take

Your tax refund speed depends on how you filed and how you requested your refund.

If you filed electronically, your refund will usually come faster because your states department of revenue can automatically check your tax return and process your refund. Paper tax returns usually have to be processed by hand, and when everyone is filing at the same time, it takes a while to get through them all.

Similarly, a direct deposit refund goes faster because the computers can automatically send it to your bank account. Paper checks have to be printed, put in envelopes, and then sent through the mail system.

If you filed electronically, you can usually expect your tax refund to be approved in 1-3 weeks. Direct deposits usually come 2-3 business days later, while a paper refund check can take an additional 2-3 weeks.

If you filed by mail, it often takes 4-8 weeks for your state to process your individual income tax return and approve your refund. After that, add 2-3 days business days for direct deposit and 2-3 weeks for paper checks.

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one

Recommended Reading: How To Look Up Tax Return

What If I Didnt Get The Right Amount

Some people may get their checks quickly, yet discover that the payment amount is incorrect that could most likely be due to their dependents or changes in income.

The law provides $1,400 per adult and dependent, as long as the household income falls below the income threshold for eligibility. In the current bill, single people whose adjusted gross income was below $75,000 and married couples with income below $150,000 will receive their full payments, as well as their dependents. Payments decline for earnings above that, cutting off entirely for single people earning $80,000 and $160,000 for married couples.

But some people may not get the right amount, especially if they havent yet filed their 2020 tax returns. For instance, if a family had a baby last year but hasnt yet filed their 2020 returns, the IRS would base their payments on their 2019 returns which wouldnt include their new baby. In that case, the family would receive $2,800 for themselves, but not the extra $1,400 for their child.

The IRS said people who are paid less than they should receive due to changes in their tax situation in 2020 will eventually receive the extra money. When they file their 2020 tax return, the IRS will check if they are owed more, such as in the case of a baby born last year. If that happens, the IRS will automatically issue the additional $1,400 check to the family, officials said.

Article source: https://www.cbsnews.com/news/stimulus-check-irs-payments-tracking-2021-03-18/

Havent Received Your California Middle Class Tax Refund Heres Whats Happening

In October, millions of Californians were to start receiving relief payments of up to $1,050 as part of the stateâs âMiddle Class Tax Refund.â But now itâs November, and many Golden State residents are still waiting.

California, which posted a record $97 billion surplus, is sending rebates of between $200 and $1,050 to individuals earning less than $250,000 annually and households earning less than $500,000.

Californians will receive their Middle Class Tax Refund payment by direct deposit or debit card.

Wondering if youâll get your refund in time for the holidays? The stateâs Franchise Tax Board has published a schedule for issuing payments. The board said Friday that it has issued 4.5 million direct deposits and mailed out 905,000 debit cards so far.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 state tax return and received their tax refund by direct deposit. MCTR debit card payments are to be mailed to the remaining eligible taxpayers.

If you qualify for the MCTR, expect to receive your payment by mail in the form of a debit card if you:

-

Filed a paper return

-

Received your Golden State Stimulus payment by check

-

Received your tax refund by check regardless of filing method

-

Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

-

Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

Read Also: Can I Deduct Property Taxes In 2020

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Read Also: State Of California Estimated Taxes

Receiving & Using Your Debit Card

Some taxpayers will receive their payment on a debit card.

FTB has partnered with Money Network to provide payments distributed by debit card.

Refer to the How you’ll receive your payment section for information on how debit cards will be distributed.

Visit the Money Network FAQ page for details on making purchases, withdrawals, and transfers with your debit card payment.

Note the return address of the envelope is Omaha, NE.

Read Also: When To File Quarterly Taxes

Checking The Status Of A Federal Tax Return Over The Phone

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Don’t Miss: How To File Income Tax With No Income