How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

What If Freelancing Is A Side Hustle

If you have a traditional job and freelancing is a side hustle, you might be able to exempt yourself from paying quarterlies by asking your employer to withhold a little extra from your earnings. This is also true if your spouse has a W-2 job and you file jointly.

Revising your withholding ensures that the amount you end up owing is less than $1,000. That way, you won’t be penalized for underpayment.

To ask for extra withholding, you’ll need to fill out a new W-4 form. In the row labeled âOther Income,â enter your expected net earnings from freelance or contractor work. You can also use the IRSâs Tax Withholding Estimator tool to help you fill out the form.

How Do I Pay These Quarterly Taxes Online

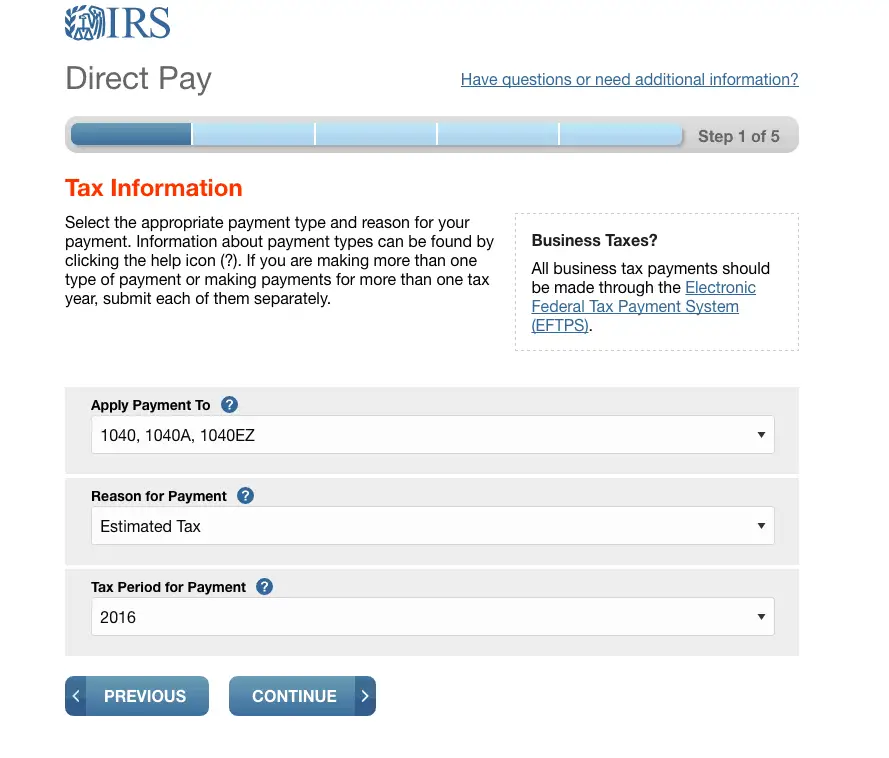

You can pay your estimated taxes each quarter through the IRS website by going to IRS.gov/payments. You can pay through IRS Direct Pay by entering your bank account information, or you can pay via credit card for a fee.

Alternatively, you can pay the IRS through the Electronic Federal Tax Payment System , provided free by the U.S. Department of the Treasury through which you can pay any tax due to the Internal Revenue Service using this system, according to its website. For estimated taxes to your state, check your states revenue department website.

Don’t Miss: Does Doordash Deduct Taxes

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

How To Pay Your Quarterly Taxes Online

The IRS makes it easy to pay taxes online. You can handle most of your tax transactions on the IRS website. It has everything you need to pay your taxes, including installment options, digital payments, estimated tax payment forms, and more. To pay online, you have to use an ACH transfer from your checking account or a debit/credit card. Paying your taxes online is completely secure, and its the quickest way to pay your taxes.

Most states allow online tax payments too. Remember, if your business operates in multiple states or cities, you could also be subject to taxes from other jurisdictions. Taxes can vary from state to state and city to city, so be sure to check the tax laws in all the areas you operate.

Also Check: Protesting Harris County Property Tax

How Do You Pay Quarterly Estimated Taxes

For a fee, you can always make your quarterly estimated tax payments with a debit or credit card, but IRS Direct Pay offers a direct transfer of funds from your bank account to the IRS for free. Payment can also be made by check that is mailed to the IRS with a completed estimated tax payment voucher, Form 1040-ES. Regardless of how you make payment, youll want to maintain records of your payments that show the amount and date paid to help you prepare your tax return.

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Also Check: Efstatus Taxact Online

Add Quarterly Tax Payment Reminders To Your Calendar

Never miss a quarterly payment with lightweight calendar reminders.

Find write-offs.

Paying your quarterly estimated duty and tracking your business expenses is vital to staying on top of your taxes. Here’s a quick breakdown of what you need to know about paying your quarterly tax payments.

Who Pays Property Taxes In Florida

If you own a rental property or are the beneficiary of an estate gift, you will still have to pay Florida property taxes on your property. If you own property in Florida, your tax liability for it isnt capped. If you own a $10,000 or $1,000,000 house in Florida, you will have to pay real estate taxes.

Read Also: Do I Have To Claim Plasma Donations On My Taxes

Who Should Pay Estimated Taxes

The IRS uses a pay-as-you-go income tax system, meaning you must pay your taxes as you earn income. It enforces this by charging penalties for underpayment if you haven’t paid enough income taxes through withholding or making quarterly estimated payments. It also charges penalties on late payments even if you get a refund.

The IRS uses a couple of rules to determine if you should make quarterly estimated tax payments:

- You expect to owe more than $1,000 after subtracting withholding and tax credits when filing your return.

- You expect your withholding and tax credits to be less than:

- 90% of your estimated tax liability for the current tax year

- 100% of the previous year’s tax liability, assuming it covers all 12 months of the calendar year

The tax code calls this last item the safe harbor rule. This requirement increases to 110% of your adjusted gross income exceeds $150,000 .

One exception applies for farmers and fishers who earn at least 66.6% of their income from their trades and so only need to meet an equivalent amount of their tax liability.

Paying your taxes quarterly can also avoid the cash crunch you might face come tax time. Paying in quarterly installments makes paying your bill far easier than one lump sum payment, especially if you’ve underestimated your taxes due.

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18 PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax PDF, for additional information.

Don’t Miss: How Much Tax Do You Pay On Doordash

Rely On Income Tax Withholding

You may be able to rely on income tax withholding if one or more of these apply:

- You have a working spouse: If you have a spouse with a job, your spouse can increase his or her withholding to cover your anticipated estimated taxes.

- You have a W-2 earning job: Business owners, especially those with side businesses, may have part-time or full-time jobs. Again, figure withholding from your wages to cover the tax on your business income.

- You have an LLC thats elected S corporation status: If you have a limited liability company, you can opt to be taxed as an S corporation. This enables you to take a salary, and have withholding taken to cover the taxes on your salary as well as your share of business profits.

How To Calculate Estimated Taxes

The IRS recommends that self-employed people use Form 1040-ES to calculate their estimated quarterly tax payments. This process involves:

- Pro tip: not sure what you’re going to earn this year? Use your income, deductions, and credits from the prior tax year as a starting point.

Note: If you realize that youâve estimated your earnings too high or too low, just fill out a new Form 1040-ES worksheet to recalculate your estimated tax payment for the next quarter. You want to estimate your earnings as accurately as possible to avoid any penalties.

Also Check: Doordash Taxes For Drivers

Highlights Of The Data

- IRS’s actual expenditures were $13.7 billion for overall operations in Fiscal Year 2021, including supplemental funding to support the IRS’s COVID-19 pandemic-related activities .

- In FY 2021, the IRS used 78,661 full-time equivalent positions in conducting its work, a decrease of 12.9 percent since FY 2012 .

- Women represented 64.7 percent of IRS and Chief Counsel personnel, compared to 44.4 percent of the overall federal civilian labor force .

How Can You Pay Your Quarterly Taxes

There are many ways to pay quarterly taxes, from paying online to by phone or by mail. Many people choose to pay online because it is fast, easy, and secure. Visit the IRSâs guide to paying your taxes for instructions, or consult with your tax advisor about the best way for you to file and pay your quarterly estimated taxes.

Recommended Reading: Do You Pay Taxes On Plasma Donations

Limit On The Use Of Prior Years Tax

If youre required to make estimated tax payments and your prior year California adjusted gross income is more than:

- $150,000

- $75,000 if married/RDP filing separately

Then you must base your estimated tax based on the lesser of:

- 90% of your tax for the current tax year

- 110% of your tax for the prior tax year

This rule does not apply to farmers or fishermen.

The Annualized Income Installment Method For Freelancers With Fluctuating Income

It’s not unusual for freelancers and self-employed individuals to earn loads of money in one quarter and very little the next. That can make estimated tax payments stressful.

The annualized income installment method can help make this situation easier. Using this method, you’ll be able to figure out how much you are paying per quarter using Schedule AI. It can be found on page 3 of form 2210.

You May Like: Paying Taxes For Doordash

How To Avoid The Underpayment Estimated Tax Penalty

- The underpayment tax penalty can be avoided if the taxpayer owes less than $1,000 in tax after withholdings and credits

- The other way to avoid the underpayment penalty is by paying a minimum of 90% of the tax you owe, or 100% of the tax shown on the return for the previous tax year

- For example, if your tax bill for the previous year was $4,000, and this year you withheld $4,500, but your total income tax bill is $6,500, you won’t have to pay the underpayment penalty because you withheld more than the last year’s tax obligation

- Let’s assume you made estimated tax payments of only $2,000. This is approximately 31% of your tax obligation and is less than your prior year’s income tax

- Therefore, you’ll have to pay the underpayment penalty unless you meet other criteria specified by the Internal Revenue Service. You can use FlyFin’s tax penalty calculator to figure out your underpayment penalty

How Do I Get My Colorado Property Tax Statement

At the Property Tax Inquiry, you can set up a payment, view your parcel details, check and print any applicable payments made during the prior year and view and print a summary of your current year. An owner of record receives yearly property tax statements and annual card notifications in January of every year.

Read Also: How Does Doordash Taxes Work

How To Pay Quarterly Taxes: 2022 Tax Guide

From flexible work hours to not reporting to a boss, being self-employed comes with a lot of perks. However, with the freedom of working for yourself also comes responsibilities such as paying quarterly taxes. Heres a checklist and basic steps to pay quarterly taxes in 2022. If you need more help with taxes, consider working with a financial advisor.

When Are Estimated Tax Payments Due

For estimated tax payments, there are four payment periods, each with its own due date. The IRS says that for taxpayers who mail their estimated tax payment, the postmark date has to be on or before the due date. For IRS Direct Pay, the deadline is 8 p.m. ET on the due date. And for credit or debit card payment, the deadline is midnight on the due date.

The payment periods and due dates are:

- April 15.

- June 15.

- Sept. 15.

- Dec. 31.

According to Publication 505, theres only one due date for 2021 estimated tax if at least two-thirds of your gross income for 2020 or 2021 comes from fishing or farming: Jan. 18, 2022. For more information about estimated tax, consult Publication 505 on the IRS website.

Also Check: Tax Id Reverse Lookup

How To Estimate Your Quarterly Taxes

You pay federal income taxes on a pay-as-you-go basis. The burden is on you to payestimated taxes four times a year April 15, June 15, September 15, and January 15 of the following year to cover your anticipated tax bill.

Underpaying your taxes triggers a penalty, while overpayment is the equivalent of giving the government an interest-free loan that cant be recouped until you file your return. Fortunately, the IRS provides worksheets to help you calculate quarterly taxes accurately. You can also find resources on the TurboTax site. And QuickBooks Self-Employed can help manage your deductions and calculate quarterly tax payments for you.

How To Avoid Penalties

In order to avoid underpayment penalties, it is essential to be as accurate as possible when calculating your quarterly taxes. Since tax liability can sometimes be difficult to estimate, especially if your income is irregular, the IRS offers a safe harbor method. To avoid penalties of underpayment, use one of the three safe harbors:

- Calculate what you owe for this year and pay 90% of that amount in four installments.

- Pay 100% of the tax liability for the previous year

- Pay 110% if your adjusted gross income is higher than $150,000 for married couples and $75,000 for singles.

You May Like: Is Freetaxusa A Legitimate Company

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

Make An Estimated Income Tax Payment

If the Tax Department sent you a notice and you want to pay it, see Pay a bill or notice. Do not pay a bill from this page.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates. To determine if these changes will affect your 2021 estimated tax payments, see Estimated tax law changes. If you need to adjust already-scheduled payments due to the new brackets and rates, you may cancel and resubmit your scheduled estimated tax payments.

You May Like: Is Doordash A 1099 Job