I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15, you can still claim the full credit of up to $3,600 per child by filing a tax return next year.

Residents Of American Samoa The Commonwealth Of The Northern Mariana Islands Guam And The Us Virgin Islands

Residents of American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, or the U.S. Virgin Islands may be eligible for advance Child Tax Credit payments and the Child Tax Credit. The credit is being administered by the tax agencies of each U.S. territory, not the IRS. Please contact your local U.S. territory tax agency regarding your eligibility, and for additional information about any other changes to the Child Tax Credit.

Additional Child Tax Credit Considerations For Us Citizens Living Abroad

Under the 2017 Tax Cuts and Jobs Act , taxpayers cant claim a child tax credit for a child who does not have a Social Security Number by the due date of the return.

The TCJA does, however, allow a new type of credita $500 nonrefundable credit for dependents who do not qualify for the child tax credit. Taxpayers can claim this credit for children who are too old for the child tax credit, as well as for non-child dependents. There is no SSN requirement to claim this credit, so taxpayers can claim the credit for children with an Individual Tax Identification Number or an Adoption Tax Identification Number if they otherwise qualify.

Recommended Reading: How Do I Figure Taxes On My Paycheck

Tax Credits And Income Changes

If your income goes up by £2,500 or more and you delay telling HMRC or wait until the next time your claim is due to be re-assessed, you might find youve been overpaid tax credits.

Youll be asked to pay this extra money back. This will be either by reducing your future tax credits, or by direct payments if your tax credits have stopped.

To avoid this bill, its even more important to tell HMRC within 30 days of when you get the extra money.

Itll be easier for your tax credits to be adjusted, and decrease the chance youll be chased for over-payments later.

It also works the other way. If your income falls by £2,500 or more, you might be entitled to more tax credits.

If youre asked to repay tax credits and will struggle to pay, speak to HMRC as soon as you can.

Find out more about what to do if youre overpaid tax credits in our guide to tax credit overpayments Repaying benefit debts and overpayments

The Regular Child Tax Credit Rules

Under the regular child tax credit rules in effect during 2018 through 2025 , everyone with a qualifying child starts out the tax year entitled to a $2,000 credit per child for the tax year. This credit is gradually phased out for taxpayers whose incomes rise up to and above the annual threshold amount specified for the year. Specifically, for each $1,000 that your modified adjusted gross income exceeds the income threshold level, the total child tax credit for a family is reduced by $50. If you make too much money, you won’t get any credit at all. However, the Tax Cuts and Jobs Act greatly increased the amount you can earn and still receive the credit. Indeed, only a small fraction of all taxpayers are unable to obtain the credit.

The child tax credit starts to be reduced only when your adjusted gross income reaches the following levels:

- $400,000 for married couples filing separately, and

- $200,000 for all other taxpayers.

For example, a married couple filing jointly with one qualifying child gets no child tax credit if their adjusted gross income exceeds $440,000. The $2,000 credit they started the tax year with would be whittled down to zero by 40 $50 reductions.

Also Check: How To Get Tax Credit For Solar

Why Have Monthly Child Tax Credit Payments Stopped

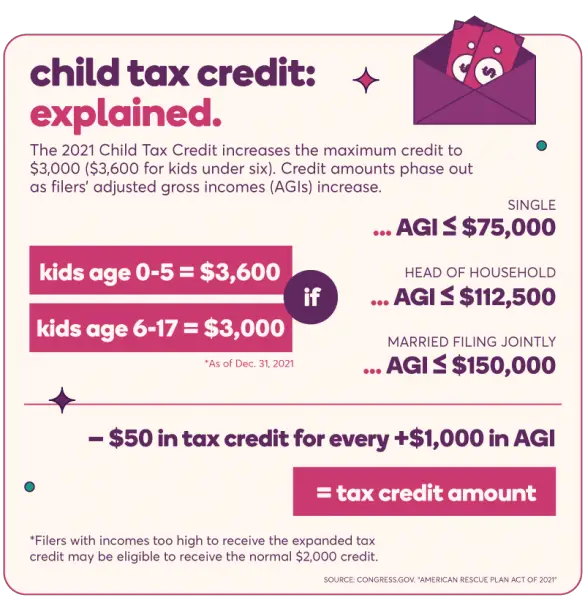

The American Rescue Plan increased the Child Tax Credit to $3,600 for qualifying children under 6 and $3,000 for qualifying children 6-17. It also provided monthly payments from July of 2021 to December of 2021. President Biden has proposed extending the enhanced Child Tax Credit. Families can still receive the entire 2021 Child Tax Credit that they are eligible for if they file in 2022. However, continuing enhanced benefits and monthly payments would require new legislation to be passed.

Who Can Claim The Child Tax Credit

For the 2021 tax year, the American Rescue Plan Act temporarily increased the child tax credit , making it worth up to $3,000 per child . Thats an increase over the previous maximum of $2,000 per child for the 2020 tax year.

To qualify, the child must meet the following requirements:

- Is a son, daughter, stepchild, adopted child, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of these for example, your grandchild, niece, or nephew

- Is under the age of 18 at the end of the tax year

- Is a U.S. citizen with a Social Security number

- Did not provide more than half their own support during the tax year

- Lived with you for more than half the year

- Is claimed as a dependent on your federal tax return

- Does not file a joint return with a spouse or files it only to request a refund of withheld taxes

The CTC can only be claimed once per child per year. For example, in the case of divorced parents who both qualify to claim one child as a dependent, only one can claim the child and take advantage of the CTC. If both parents try to claim the child, the IRS will apply tiebreaker rules to determine who gets to claim the dependent. The IRS explains those tiebreaker rules in detail in Publication 501.

Also Check: How Long Does It Take For Tax Refund

If You Have Children You Support There Are Two Different Tax Credits You Should Know About

Children are expensive. To offset some of this expense, Congress provides two special tax credits to people who have children:

- a child tax credit, and

- a child and dependent care tax credit.

If you qualify, you can get both credits in the same year. In the past, the child tax credit was limited to middle and lower-income taxpayers. No longer: you can earn up to $400,000 and qualify for the full credit.

The Child Tax Credit Benefits Eligible Parents

IRS Tax Tip 2019-141, October 9, 2019

Taxpayers who claim at least one child as their dependent on their tax return may be eligible to benefit from the child tax credit. Its important for people who might qualify for this credit to review the eligibility rules to make sure they still qualify. Taxpayers who havent qualified in the past should also check because they may now be able to claim the credit.

Here are some details about this credit:

Taxpayers whose dependent does not qualify for this credit might be able to the claim the .

Also Check: What States Have The Lowest Sales Tax

What Is Family Tax Benefit Part A

Family Tax Benefit is a 2-part payment for eligible families to help with the cost of raising children. Here is what you need to know about Family Tax Benefit Part A.

If you and your family are affected by COVID-19, you may be eligible for additional payments. Visit the Services Australia website for more information.

The Family Tax Benefit is made up of 2 parts:

- Part A a payment made per child, depending on the familys circumstances

- Part B a payment made per family to give extra help to families that need it

Family Tax Benefit Part A pays a maximum of $191.24 per fortnight for children up to 12, and $248.78 per fortnight for children up to 19, if they are eligible. The amount you get depends on your income and the ages and number of children in your care. The payments can either be made fortnightly or as a lump sum at the end of the financial year to your bank, credit union or building society. Payments are made to a parent, guardian or an approved care organisation.

Family Tax Benefit Part A can also include a supplement at the end of the financial year after Centrelink balances your family assistance payments. If you are eligible, you may receive a supplement of up to $781.10 for each eligible child in the 2020-21 financial year, and $788.40 for the 2021-22 financial year. How much you get depends on how many children you have in your care, if you share care, your familys income and the number of days you were eligible for Family Tax Benefit Part A.

When Will I Start Receiving My Monthly Payments

People who receive payments by direct deposit got their first payment on July 15, 2021. After that, payments continue to go out on the 15th of every month. If you havent provided the IRS with your bank account information on a recent tax return, a check will be sent out to you around the same time to the address the IRS has for you.

Recommended Reading: How Do You Get The Eitc Tax Credit

Special Child Tax Credit Rules For 2021

To help families struggling in the wake of the COVD-19 pandemic, the child tax credit was expanded for 2021. For 2021 only, the child tax credit is increased to:

- $3,600 for every child under age 6, and

- $3,000 for children between the ages of 6 and 17 .

For example, a family with two children under age 6 will receive a $7,200 tax credit for 2021.

The increased credit amount is phased out for married couples with incomes over $150,000 and single parents who earn over $112,500. The credit is reduced $50 for each $1,000 your adjusted gross income exceeds these levels. For example, if you have one child over age 5, you’re entitled to a $1,000 increased credit for 2021. This amount gets reduced to 0 if you have 20 $50 reductions.

Once the increased amount is phased out, the amount of the credit remains $2,000 until the $400,000/$200,000 phaseout limits under the regular rules apply.

The entire credit is refundableyou get the full amount even if you owe no taxes.

Expanded Child Tax Credit: Issues Were Expected

Last years expanded child tax credit was a temporary enhancement payment, and it was part of the $1.9 trillion American Rescue Plan Act, which was approved in March 2021. The expanded child tax credit raised the credit amount up to $3,600 for a child up to age 6, and up to $3,000 for a child aged 6 through 17.

Moreover, the credit was made fully refundable to ensure it covered more low-income parents. As well, half of the credit amount was sent in monthly installments from July through December, and parents were allowed to claim the other half at the time of filing their 2021 taxes this year.

Despite such significant changes to the CTC, the IRS had about four months to put the system in place to send out the payments. Thus, some mistakes were expected. Even the inspector generals office admitted that it was a significant undertaking to put the monthly payment system in place in such a short period of time.

If you are one of those who hasnt yet received the federal child tax credit despite being eligible, the good news is that you may still be able to claim it.

You can visit GetCTC.org, which is a website from Code for America. This website offers a simple form that people who dont typically file tax returns can use to claim their child tax credit and other stimulus payments. The online form is available through Nov. 15.

This article originally appeared on ValueWalk

Sponsored: Tips for Investing

Don’t Miss: How Do You Figure Out Your Tax Liability

Details And Deadline For The Child Tax Credit

The parents who missed last years deadline to claim child tax credit will be able to apply once again. The government announced that the parents must file by 15th November through the GetCTC.org tool. Parents must carefully fill in all the required details on this website in order to claim the money.

However, it must be noted that only parents who have no income or earn a very small amount of money that is not sufficient to support children will be considered eligible for this tax credit.

Checking Youre Below The Income Limit

You dont need to be working to claim child tax credits, but if you are you need to earn less than a certain amount.

The amount you can earn depends on your circumstances. HMRC looks at things like:

- the number of hours you work

- how many children you have

-

if youre a single parent

If you’re 18 or over, you can use the Turn2us benefits calculator to check if you can get child tax credits.

Don’t Miss: What Do You Claim On Your Taxes

Read More On Tax Credits

Anyone who got monthly checks should have received a letter from the IRS detailing the advance payments they received and how they can reconcile that with the total credit they qualify for.

The maximum credit is available to taxpayers with a modified adjusted gross income of:

- $75,000 or less for singles,

- $112,500 or less for heads of household and

- $150,000 or less for married couples filing a joint return and qualified widows and widowers.

If you earn more than this, the extra amount above the original $2,000 credit either $1,000 or $1,600 per child is reduced by $50 for every $1,000 in modified AGI.

Future Of The Child Tax Credit

The American Rescue Plan Acts changes to the CTC only apply to the 2021 tax year. Unless Congress extends these changes, the higher credit amount and advance payments will disappear after this year.

Additionally, the Tax Cuts and Jobs Act of 2017s changes to the CTC expire after 2025 unless Congress extends them or makes them permanent. After that, the CTC reverts to its previous form:

- The credit will start to phase out once your AGI exceeds $75,000 for single filers or $110,000 for married couples

- The maximum credit will be $1,000

- The credit for other dependents will disappear

- You will need to have at least $3,000 of earned income to qualify for the credit

You can read more about the child tax credit and the credit for other dependents as well as calculate your available credit in IRS Publication 972.

Also Check: How To Tax Return Online

To Get The Expanded Child Tax Credit

- File your taxes, even if you dont file them normally. This will tell the IRS where to send your payment and how many children you take care of. Also, if you dont file, you might miss out on other tax credits.

- To self-file or make an appointment for free tax preparation help, visit GetTheTaxFacts.org.

Renewing Your Claim For Tax Credits

State Pension calculator

You can manage and renew your tax credits at GOV.UK

Theres also online help available to support you. This includes webchat to help try and answer queries around renewing.

. But be aware that this line can get very busy in the days leading up to the deadline, so give yourself plenty of time.

Theres also a dedicated team to support the most vulnerable customers who cant go online. People who HMRC know need this support will be contacted by the support team.

Find out more about contacting this team on the HMRC websiteOpens in a new window

Always let HMRC know if your circumstances change at any time during the year. For example, if your income changes, your child leaves home or you move house.

This is because you might have to claim Universal Credit instead.

Also Check: How To File Old Taxes On H& r Block

Find Out If You Can Claim The Child Tax Credit

If you claim at least one child as your dependent on your tax return, you may be eligible to benefit from the Child Tax Credit. You should review the eligibility rules to make sure you qualify. Even if you haven’t qualified in the past, life circumstances often change and you may now be able to claim the credit.

Here are some important details about the Child Tax Credit:

- The maximum amount of the credit is $2,000 per qualifying child.

- You must list on your tax return the name and Social Security Number for each dependent you’re claiming for the Child Tax Credit.

- Your dependent for the Child Tax Credit must meet all the rules to be claimed as a qualifying child, and further, must be under age 17.

- The credit begins to phase out at $200,000 of modified adjusted gross income. This amount is $400,000 for married couples filing jointly.

- If your dependent does not qualify for this credit, you might be able to claim the .

How Much Can I Get With The Ctc

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 . Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you dont owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

Recommended Reading: Which State Has The Lowest Tax Rate