Change To Standard Deduction Increase For Charitable Contributions Computation

For tax year 2021, taxpayers who did not itemize deductions on their 2021 federal return and elected to take the standard deduction on the Arizona tax return are not required to reduce the total amount of their 2021 qualifying charitable contributions by the amount for which the taxpayer took the allowable charitable contribution deduction on their federal tax return.

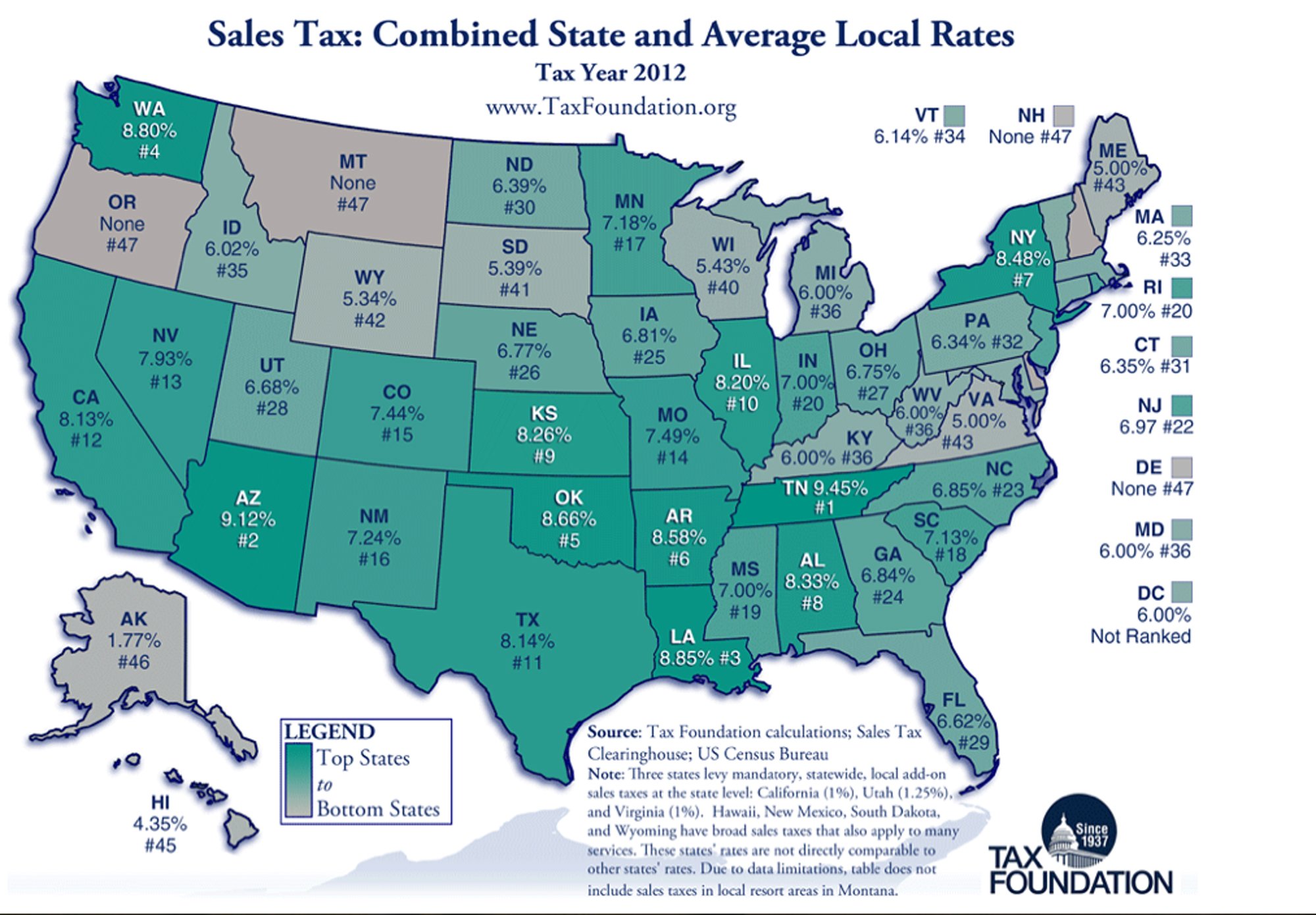

Transaction Privilege And Use Taxes

In order to engage or continue in business, a Transaction Privilege Tax license is required. It is thebusiness owner’sresponsibility to make an application and obtain a license with the Arizona Department of Revenue. Even if you havenoincome to report, you must write zero in the appropriate areas, then sign and submit your tax return.

Income Tax Filing Requirements

For tax years ending on or before December 31, 2019, Individuals with an adjusted gross income of at least $5,500 must file taxes, and an Arizona resident is subject to tax on all income, including from other states. Additionally, individuals here on a temporary basis have to file a tax return, if they meet the filing threshold, reporting any income earned in Arizona.

Here are the filing requirements:

For tax years beginning from and after December 31, 2020

The following amounts are used by full-year and part-year residents only. Nonresidents must prorate the amounts based on their Arizona income ratio which is computed by dividing the Arizona gross income by the federal adjusted gross income. For more information, see the instructions for completing Form 140NR.

| Individuals must file if they are: | AND gross income is more than: |

| Single | |

| $18,800 |

For Arizona filing purposes, full-year residents figure their gross income the same way they do for federal income tax filing purposes. Residents should then exclude income Arizona law does not tax, which includes:

- interest from U.S. government obligations

- Social Security retirement benefits received under Title II of the Social Security Act

- benefits received under the Railroad Retirement Act

- active duty military pay

- pay received for active service as a reservist for a National Guard member

- benefits, annuities and pensions as retired or retainer pay of the uniformed services of the United States .

You May Like: Pastyeartax

Are Other Forms Of Retirement Income Taxable In Arizona

Income from retirement savings accounts like a 403 or a 401 is taxed as regular income by the state of Arizona. It should be combined with income from other sources like wages or salaries as part of your total income. Tax rates range from 2.59% to 4.50%.

Income from pensions is also taxed as regular income. U.S. government civil service pension income and Arizona state or local pension income are all eligible for a deduction of $2,500 annually. Private pensions and pensions from states other than Arizona cannot receive this deduction.

What Are The Arizona State Income Tax Brackets

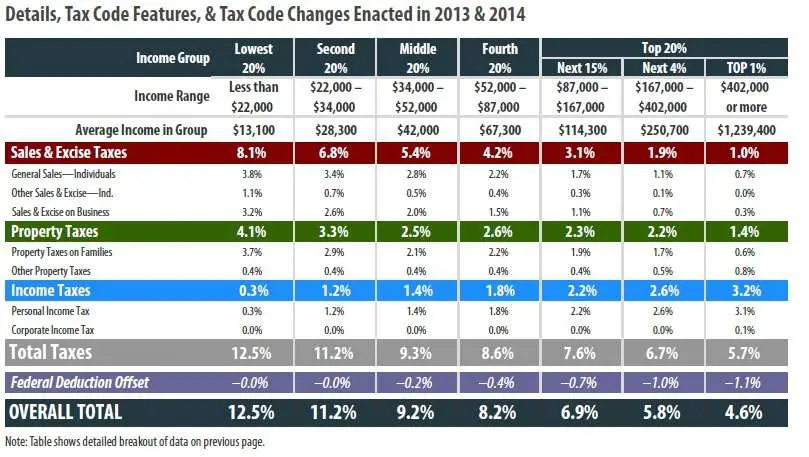

Income earned in Arizona is taxed in brackets at different rates. Those rates vary from low to high based on the amount of income you earn.

Arizona is considered to be a tax-advantaged state, meaning the Arizona tax rates are lower than many other states in the U.S.

The Arizona tax brackets, based in filing status , are as follows:

| Single |

Recommended Reading: Do I Have To Pay Taxes On Plasma Donation

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Arizona Budget Plan Would Massively Cut Tax Collections Create Flat Income Tax Rate

- Howard FischerCapitol Media Services

- May 19, 2021

The Arizona State Capitol in Phoenix.

PHOENIX Republican legislative leaders and the governor are circling in on a plan to permanently cut $1.5 billion in annual tax collections over the next several years, as the state is flush with cash.

The proposal would enact a flat 2.5% state income tax rate. That compares with the current graduated structure that has rates as low as 2.59% on taxable income up to $53,000 for married couples, and as high as 4.5% on earnings above $318,000.

The proposal favors those at the top end in more ways than one.

Lawmakers in the GOP majority intend to essentially have the state pay all or part of the 3.5% income tax surcharge approved by voters in November on earnings above $250,000 for individuals and $500,000 for married couples filing jointly. That levy imposed by Proposition 208, being challenged in court, is designed to generate up to $940 million a year for public education.

Its not just the income tax that GOP lawmakers are hoping to cut.

The proposal seeks to trim the assessment ratio of businesses, the figure used to compute their property taxes.

It currently stands at 18% of full-cash value, a figure that is supposed to approximate market value. The plan is to drop that in steps to 17%, which would lower the taxes owed.

Strictly speaking, that does not affect the state as it does not collect property taxes.

Also Check: How To Report Plasma Donation On Taxes

Top Income Tax Rates By State

Below, you’ll find the top 10 states with the highest income tax rates.

| State | |

|---|---|

| Wisconsin | 7.65% |

California tops the list with the highest income tax rates in the countryits highest tax rate is 12.3%, but it also implements an additional tax on those with income of $1 million or more, which makes its highest actual tax rate 13.3%. New Jersey and New York also implement this type of “millionaire’s tax.” Other states have a top tax rate, but not all states have the same number of income brackets leading up to the top rate. For example, Hawaii has a top tax rate of 11% and 12 income brackets, while Iowa has a top tax rate of 8,53% and nine income brackets. And of course, Washington, D.C. is not a state, but it has its own income tax rate.

Arizona Small Business Income Tax

On July 9, 2021 Governor Doug Ducey signed into law Senate Bill 1783 creating a small business income tax by enacting Arizona Revised Statute § 43-1701 effective for tax years beginning from and after December 31, 2020. The small business income tax rate for tax year 2021 is 3.5% on the amount of a taxpayers computed Arizona small business taxable income.Taxpayers filing Arizona Form 140, 140NR or 140PY with small business income reported on Federal Schedules B, C, D, E, F and Form 4797 and included in their federal adjusted gross income may voluntarily elect to report their small business income on the corresponding Arizona Small Business Income Tax return . This election is made annually and does not bind the taxpayer to report small business income separately in subsequent tax years.Taxpayers who elect to report small business income on one of the forms listed above are required to adjust their regular income tax return by reducing their federal adjusted gross income by the amount of small business income reported on the SBI return.Several new forms were created relating to the SBI tax form. They include, but are not limited to, the following.

- Form 301-SBI .

- Form 309-SBI .

- Form 204-SBI for making extension payments for the small business income tax return.

For more information including filing requirements, see the SBI form and instructions applicable for your residency status.

Recommended Reading: Can You Write Off Miles For Doordash

Rent Prices In Arizona Vs California

With a statewide average rent of $1,052, Arizona is considered to be one of the more affordable destinations for renters. Though, the actual rent you pay will vary based on the city you live in Arizona. For example, Scottsdale is the most expensive Arizona city to rent with an average rent of $1,914. The most affordable city to rent in Arizona is Tucson with an average rent of $1,115.

With that said, the following table displays the average rent for some of the various cities in Arizona:

| City |

| $1,575 |

Whats In Arizonas Tax Reform Package

After weeks of deliberations, Arizona Gov. Doug Ducey this week signed into law a budget for fiscal year 2022 that reduces the states individual income tax rates and consolidates brackets, a plan that will help restore Arizonas reputation as a low-tax alternative to California.

The enacted law kept the basic framework of the original bill intact, but the legislature did make several changes to the bill before it passed both chambers. The most notable changes include a slight adjustment to the interim individual income tax rates, the use of revenue triggers, an increase in the percentage of state individual income tax revenue distributed to localities under the states urban revenue sharing program, and further reductions in the commercial property tax assessment ratio.

A separate bill, SB 1827, also enacted this week, creates a 4.5 percent cap on the top marginal rate when the general rates and the Proposition 208 surcharge are combined. Taken together, these reforms will restore the competitive edge to Arizonas tax code by reducing individual income taxes for all individuals and non-corporate businesses while significantly improving the states tax structure.

The individual income tax rate changes that will take effect over the next few years are shown in the table, with a detailed explanation to follow. The entity-level tax is also explained in further detail.

Read Also: How Much Should I Save For Taxes Doordash

Tax Policy In Arizona

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Arizona |

Arizona generates the bulk of its tax revenue by levying a personal income tax and a sales tax. The state derives its constitutional authority to tax from Article 9 of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Determining Your Filing Status

The filing status that you use on your Arizona return may be different from that used on your federal return.

If you qualify as married for federal purposes, you qualify as married for Arizona purposes and must file using the status of either married filing joint or married filing separate.

If you are single, you must file as single or if qualified you may file as head of household.

You may file a joint return if you were married as of December 31, in the tax year. It does not matter whether or not you were living with your spouse. You may file a joint return, even if you and your spouse filed separate federal returns.

You may file a joint return if your spouse died during the tax year and you did not remarry in the tax year.

Arizona Form 140 is for full year residents only. You may not file a joint income tax return on Form 140 if any of the following apply:

- Your spouse is a nonresident alien .

- Your spouse is a resident of another state.

- Your spouse is a part-year Arizona resident.

If filing a joint return with your nonresident spouse, you must file a joint return using Arizona Form 140NR.

If filing a joint return with your part-year resident spouse, you must file a joint return using Arizona Form 140PY.

Head of Household Return

You may file as head of household on your Arizona return, only if one of the following applies:

- You qualify to file as head of household on your federal return or

- You qualify to file as a qualifying widow or widower on your federal return.

You May Like: Doordash Tax Withholding

Qualifying Foster Care Organization Contributions

Donating to qualifying foster care organizations can also help lower your overall state tax bill in Arizona. Qualifying foster organizations are those that provide immediate basic needs for residents of Arizona who are low-income, disabled or receive temporary assistance for needy families and provide immediate basic needs to at least 200 qualifying individuals in the foster care system.

The maximum credit is $1,000 for married couples filing jointly and $500 for single, head of household and married filing separate filers.

Arizona Enacts Several New Tax Measures

The State of Arizona adopted several significant tax measures during the 2021 legislative session, including an individual income flat tax, a high-earner tax bypass, and a federal SALT cap workaround.

Background

Currently, Arizona has four individual income tax brackets for individuals ranging from 2.59% to 4.5%. In addition, under Proposition 208, which the electorate passed in November 2020, a 3.5% state income tax surcharge is levied on taxable income exceeding the thresholds of $250,000 for single filers or $500,000 for joint filers . Consequently, to the extent applicable, high-income earners would be taxed at a total combined state tax rate of 8% on any income exceeding the thresholds.

Because owners of pass-through businesses, such as partnerships and S-corporations, pay income tax under the individual income tax code, rather than the corporate income tax code, this combined 8% state tax rate was deemed by many to discourage in-state investment and diminish Arizonas economic growth. Citing an effort to restore Arizonas competitiveness, legislation was enacted to make changes to Arizonas income tax system.

S.B. 1827 and S.B. 1828 4.5% Individual Tax Rate Cap and Individual Income Flat Tax

On June 30, 2021, Arizona Governor Doug Ducey signed into law S.B. 1827 and S. B. 1828, enacting comprehensive Arizona individual income tax reform.

S.B. 1783 High-Earner Tax Bypass

H.B. 2838 Federal State and Local Tax Cap Workaround

Footnotes:

Recommended Reading: 1040paytax.com Safe

Are Pensions Taxed In Az

Income from retirement savings accounts like a 403 or a 401 is taxed as regular income by the state of Arizona.Income from pensions is also taxed as regular income. U.S. government civil service pension income and Arizona state or local pension income are all eligible for a deduction of $2,500 annually.

Getting Your Arizona Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of Arizona, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your Arizona tax refund, you can visit the Arizona Income Tax Refund page.

Read Also: How Do I File Taxes With Doordash

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Arizona State Income Tax Rates And Tax Brackets

Note that an additional 3.5% tax surcharge applies to those with a taxable income over $250,000 and over $500,000 .

|

Tax rate |

|

|---|---|

|

3.34% of taxable income over $27,808, plus $720. |

|

|

4.17% |

4.17% of taxable income over $55,615, plus $1,649. |

|

4.5% |

4.5% of taxable income over $166,843, plus $6,287. |

|

1% of taxable income over $250,000, plus $10,029. Plus, an additional 3.5% surcharge of taxable income over $250,000. |

|

Tax rate |

|

|---|---|

|

3.34% of taxable income over $55,615, plus $1,440. |

|

|

4.17% |

4.17% of taxable income over $111,229, plus $3,298. |

|

4.5% |

4.5% of taxable income over $333,684, plus $12,574. |

|

1% of taxable income over $500,000, plus $20,059. Plus an additional 3.5% surcharge of taxable income over $500,000. |

Read Also: 1099 Doordash

Taxes Are A Reality Of Life In Every State Even Those With Relatively Low Individual Income Tax Rates Like Arizona The Grand Canyon State Not Only Taxes Income But Gasoline Real Estate And Purchases Of Goods And Services Too

If you live or work in Arizona, youll almost certainly be paying more than one kind of tax to the state or local governments. And even if youre just passing through, you could find yourself subject to sales taxes on purchases of goods or services you make in the state.

Lets look at the different kinds of taxes and tax rates you may encounter in Arizona.