Bitcoin Taxes: Understanding The Rules And How To Report Cryptocurrency On Your Return

- The IRS considers Bitcoin to be property rather than money, so transactions are subject to the same tax treatment as other investments.

- Bitcoin taxes can be triggered by trading, exchanging, or simply spending the cryptocurrency, so documenting everything is essential.

- Bitcoin is taxed at the special capital gains tax rate, which is often less than the ordinary income tax rate.

Bitcoin seems to be everywhere these days. From its mysterious origins in 2008, it has grown into a widely accepted currency, used for everything from investing to shopping to employees’ wages.

But many Bitcoin users don’t realize that buying/selling, exchanging, and even using Bitcoin to pay for things has tax implications. Yes, you read that last phrase right. In some cases, just spending your Bitcoin could be considered a profitable investment – and taxable.

From how exactly it’s taxed to how to prepare for filing, here’s what you need to know about Bitcoin taxes.

Reporting Crypto On Your Tax Form

Any time you make or lose money on your investments, you need to report it on your taxes using Schedule D.

In the past, many people who held blockchain technology and cryptocurrency may not have reported it. But ever since 2020, the IRS has added a question about crypto to page one of Form 1040 tax reporting purposes. Under the section where you put your name, address, and other personal information, it says, At any time during the tax year, did you receive, sell, send, exchange, or otherwise dispose of any financial interest in any virtual currency?

You only need to check Yes if you made any crypto transactions during the tax year if you just purchased crypto with real currency or held cryptocurrency but didnt buy or sell it, you can mark No.

New for tax year 2021: The IRS is requiring all taxpayers to answer Yes or No to the virtual currency question in order to e-file their return this year, so dont skip this question!

If You Stake Cryptocurrencies

Staking cryptocurrencies is a means for earning rewards for holding cryptocurrencies and providing a built-in investor and user base to give the coin value. Earning cryptocurrency through staking is similar to earning interest on a savings account. In exchange for staking your virtual currencies, you can be paid money that counts as taxable income.

You treat staking income the same as you do mining income: counted as fair market value at the time you earn the income and subject to income and possibly self employment taxes.

Read Also: How To Get Tax Id Number For Llc

What If You Dont Receive A 1099 From Your Crypto Exchange

All brokers and some crypto exchanges provide detailed information on your trades each year on a Form 1099. The tax form typically provides all the information you need to fill out Form 8949. However, many crypto exchanges dont provide a 1099, leaving you with work to do.

Most crypto exchanges dont do 1099 reporting, and theyre not yet required to, Harris says. He notes, however, that laws are already in place that require crypto exchanges to report trades in tax year 2023 for filing in 2024. Until then, its up to traders to figure their tax liability.

Without that reporting, its quite a bit more difficult for traders to figure their potential gains and losses.

Its going to be up to you to establish your holding period, your cost basis and your proceeds, Harris says.

That means digging through the records of your transactions, noting the purchase and sale dates, proceeds and anything else required on Form 8949. Thats no ones idea of a fun Saturday afternoon, but it can become even more complex due to whats called ordering rules.

Ordering rules govern which tax lots are sold when, meaning they determine whether a given sale is a short- or long-term investment.

For example, imagine you purchased 100 bitcoins in January, 100 in February and then another 100 in December. Then in March of the following year you sold just 250 of them for a profit. Youll have both a short-term gain and a long-term gain . But how do you split the tax between short- and long-term?

How To Report Cryptocurrency On Taxes

Filing your cryptocurrency gains and losses works the same way as filing gains and losses from investing in stocks or other forms of property.

There are 5 steps you should follow to file your cryptocurrency taxes:

Letâs walk through each one of these steps in detail.

Don’t Miss: How To Get Tax Return From Turbotax

What Does Crypto Tax Software Do

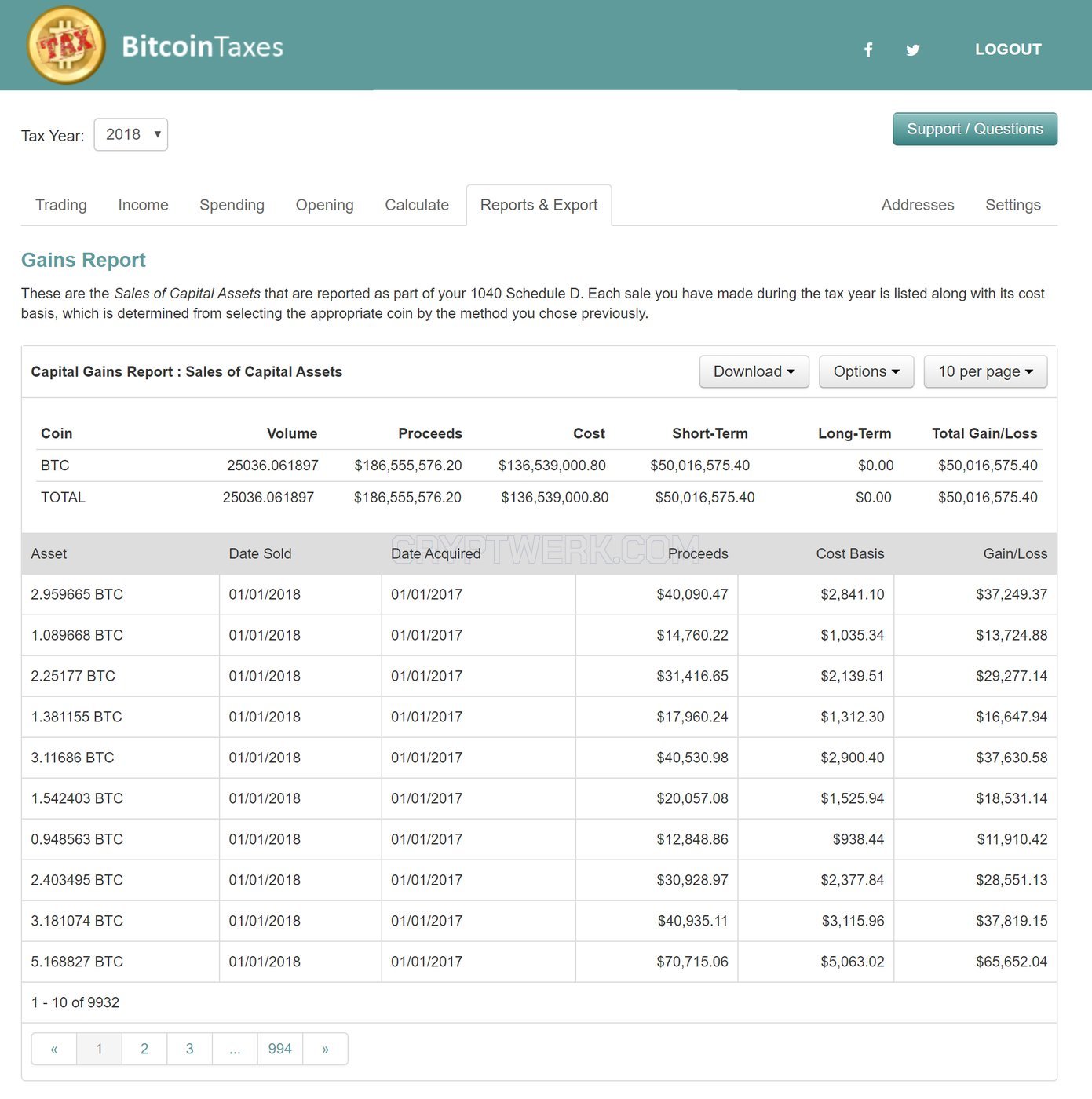

Crypto tax software helps you file your tax return with the IRS. Programs generally sync with crypto exchanges and wallets to track your purchases, sales and other transactions.

At tax time, most crypto tax software will export the various forms you need, saving you the time and trouble of tracking all your crypto transactions and completing IRS forms manually. Most crypto tax software charges money for their help with tax preparation. The amount is usually dependent on how many crypto transactions you make per tax year.

Can The Irs Track Bitcoin

Yes. The IRS can track Bitcoin and other cryptocurrencies.

If youre trading Bitcoin on centralized crypto exchanges, the majority of these exchanges issue 1099-MISC forms to the IRS for any users earning more than $600 in income in a single financial year. Larger exchanges may also be compelled to share further KYC data with the IRS to ensure tax compliance.

When it comes to non-custodial wallets, its a little blurrier. Most of these wallets dont require KYC verification, so you might think theres no way the IRS can know about your investments. This is true – but if youre transferring your BTC between non-custodial wallets and exchanges, these exchanges will have details on your wallets that they could share with the IRS.

As well as this, many wallets ask you to link a bank account to your wallet. Banks may share information with the IRS about your transactions to ensure tax compliance.

The best way to remain tax compliant is to calculate and report your Bitcoin taxes correctly.

Recommended Reading: Why Have I Not Gotten My Federal Tax Return

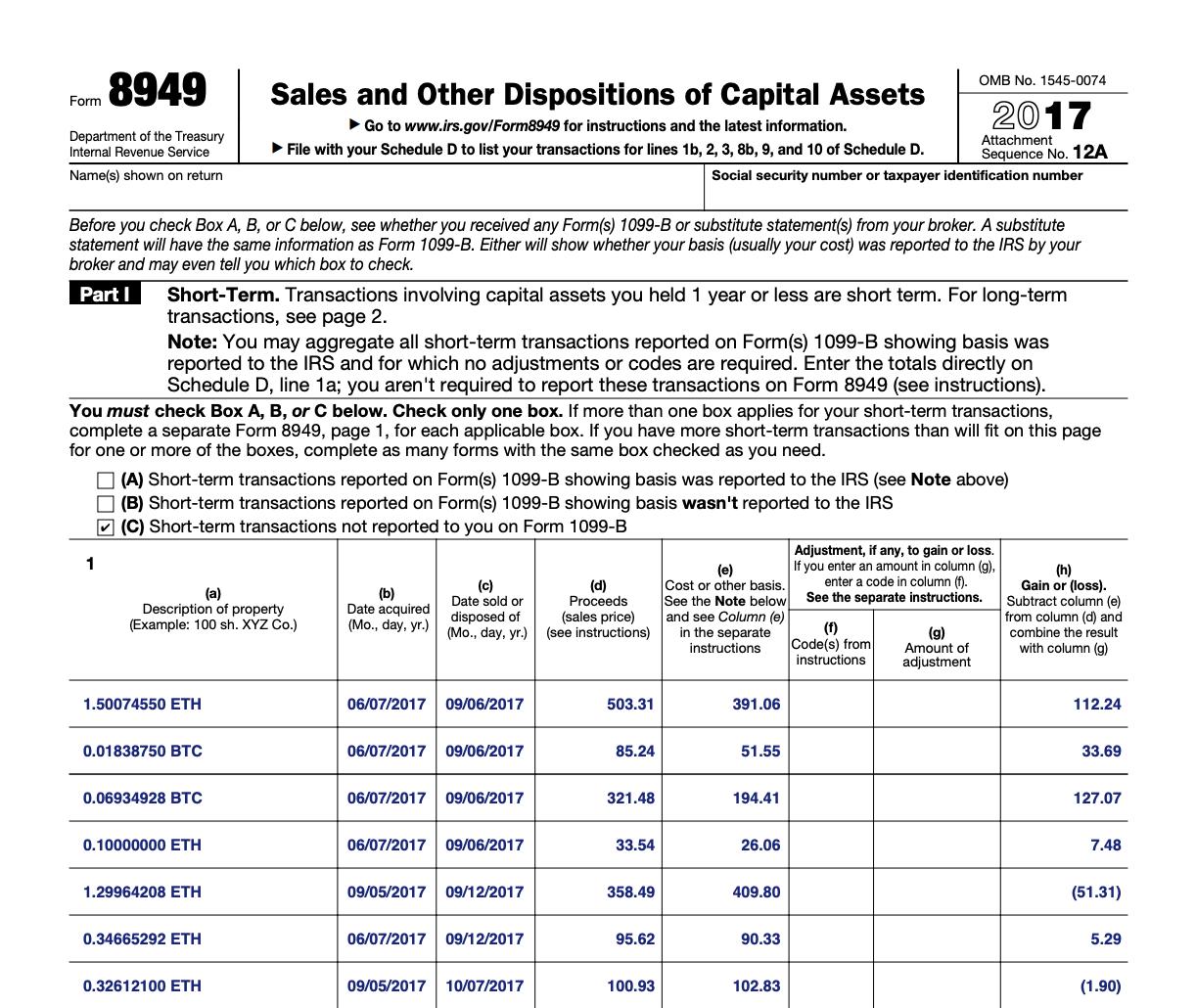

You Will Then Need To Organize Your Calculations Row By Row Including The Details Of Each Transaction:

-

Description of property: This describes the asset that was sold, exchanged, or spent. For example: 1.5 BTC

-

Date acquired : This is the day you purchased the crypto asset that you are using as your cost basis for the transaction.

-

Date sold or disposed of : This is the day you sold, exchanged, or spent the crypto asset.

-

Proceeds: Your proceeds are the gross USD value of crypto sold, exchanged, or spent.

-

Cost basis: Your cost basis is the gross USD value at which you acquired the crypto being sold, exchanged, or spent. This includes purchases in fiat currency or another crypto.

-

Adjustment, if any, to gain or loss: This code describes the adjustment amount you enter in column G. Typically, you will not have any adjustments, but the IRS lists capital gain adjustments in their instructions if you need them. For example, you may need to make adjustments if you received a Form 1099 without cost basis and need to report your purchase prices to the IRS.

-

Adjustment, if any, to gain or loss: This amount corresponds to the description code you entered in column F. Typically, you will not have any adjustments.

-

Gain or : Subtract column from column and combine the result with column – This is your net capital gain or loss in USD for this particular transaction.

The example below shows a completed Form 8949 of short term sales of ETH, ZEN and ELF.

What Is The 6173 Letter

The 6173 letter is an IRS letter involving cryptocurrency. It basically says that the IRS has information that the Taxpayer may not have met their US tax filing and reporting requirements.

It requires the Taxpayer to make a timely response to the IRS. But, while the letter may be scary, it is important to remember that it is not an actual audit per se.

Read Also: How Can I File Previous Years Taxes For Free

When You Make Money On Crypto Uncle Sam’s Going To Want A Piece

It’s not the most exciting part of crypto investing, but if you do invest, you need to know how taxes on crypto work. Although cryptocurrencies are still new, the IRS is working hard to enforce crypto tax compliance.

There are quite a few ways that you can end up owing taxes on crypto, and even trading one cryptocurrency for another is a taxable event. If you don’t keep accurate records, it can be hard to piece together your gains and losses at tax time. And, if you don’t pay your crypto taxes, even if it’s an honest mistake, you could end up suffering costly penalties.

This guide will explain everything you need to know about taxes on crypto trading and income. You’ll learn about how to file crypto taxes, crypto tax rates, and other important details about this complex subject.

Why Is Bitcoin Taxed

According to a survey conducted by The Harris Poll on behalf of Blockchain Capital, roughly 9% of American adults own Bitcoin. However, the IRS estimates that only a tiny percentage of them report crypto-related gains and losses on their tax returns.

In 2017, the IRS searched its database for the 2013 through 2015 tax years. It found:

- 807 individuals reported cryptocurrency transactions in 2013

- 893 individuals reported cryptocurrency transactions in 2014

- 802 individuals reported cryptocurrency transactions in 2015

That discrepancy is why the IRS is making cryptocurrency taxes an enforcement priority in 2021. In fact, Form 1040 for the 2020 tax year includes a question about cryptocurrency on the front page. It asks whether you’ve received, sold, sent, exchanged or otherwise acquired a financial interest in any virtual currency.

If you check “no” to this question when you did, in fact, engage in cryptocurrency transactions, the IRS can consider that a willful attempt to avoid taxes, and you could face harsher penalties if the IRS uncovers your omission.

You May Like: Who Claims Child On Taxes With 50 50 Custody

Determine Your Cryptocurrency Capital Gains And Losses For The Year

The IRS has made clear that each time the taxpayer disposes of cryptocurrency, they will incur capital gains or capital losses. Capital gains and losses on such dispositions must be recognized. The amount of taxes that must be paid depends on how long the cryptocurrency was heldthe holding periodas well the taxpayers annual income. If the holding period is for one year or less, the taxpayer will have a short-term capital gain or loss. Similarly, if the holding period is for more than one year, the taxpayer will have a long-term capital gain or loss.

After the taxpayer has all their transactions grouped together by holding period, the transactions are netted. Cryptocurrency short-term capital gains are taxed at regular income tax rates and can be as high as 37% for tax year 2020. Cryptocurrency long-term capital gains are taxed at far lower rates of 0%, 15%, or 20%, depending on income. Capital losses incurred during the year are useful because they can offset capital gains on other assets as well as up to $3,000 of ordinary income.

Can You Claim Crypto Mining As A Business

If crypto mining is your primary income, you own a crypto mining rack and are running multiple specialized mining computers, for instance, you should report your earnings as a business on Form 1040 Schedule C.

When mining as a business, youll also have to pay the self-employment tax. Though the tax rates are higher when you mine crypto as a business, youre also eligible for tax deductions due to business expenses. Some deductions include:

You can also simplify reporting taxes on mined crypto with crypto tax software like TaxBit. TaxBit specializes in identifying mining receipts and allocating them in accordance with IRS regulations. If you mined cryptocurrency, you will be provided with an itemized ordinary income breakdown so you can accurately report your income. After itemizing the receipts, the final amount will be added to the other income you received throughout the year.

Also Check: How To Qualify For Farm Tax Exemption

Do I Need To Report Crypto On The Fbar

The FBAR is a controversial form used to report foreign bank and financial accounts and carries a hefty penalty for account holder noncompliance.

While the form is actually a FinCEN form and not an IRS tax form it is enforced by the IRS.

Whether or not cryptocurrency must be reported on the FBAR depends on a myriad of different factors. We have an entirely different FBAR crypto summary you can refer to in order to evaluate your overseas crypto and determine whether reporting would be applicable.

How Do You Report Bitcoin Income When Filing Taxes

Bitcoin is a form of decentralized, virtual currency that was introduced in 2009. It is decentralized because transactions can occur person-to-person without the use of an intermediary like a bank or other financial institution. This allows for more private transactions and allows users to save money on banking and transaction fees. In recent years, as Bitcoin transactions have become more common, people have begun to wonder how to properly report Bitcoin gains and losses, as well as income paid for your services in Bitcoin on their tax returns. At the Tax Law Offices of David W. Klasing, our dual tax attorneys and CPAs have years of experience helping folks who buy and sell Bitcoin properly report this on their taxes, and we can help you do the same.

Don’t Miss: When Do You Get Earned Income Tax Credit

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Determining Your Taxable Income:

Once you have all your transaction records, its time to figure out your taxable income. This is the amount of money you make from trading, mining, or spending crypto during the year. To determine your taxable income, simply add up all your gains and subtract your losses.

If you incurred a net loss for the year, you could use that to offset any taxable gains you may have had. For example, if you made $2000 in profits but had a net loss of $1000, your taxable gain would be $1000.

Don’t Miss: What Is Tax In Nevada

Calculate Your Crypto Gains And Losses

Every time you dispose of your cryptocurrency, youâll incur capital gains or capital losses. These disposal events include, but are not limited to:

- Selling your cryptocurrency for fiat

- Trading your cryptocurrency for another cryptocurrency

- Buying goods and services with cryptocurrency â

To calculate your gain or loss from each transaction, youâll need to track how the price of each one of your assets changed from the time you originally received them.

Hereâs a formula you can use:

Then, your capital gains and losses for your relevant cryptocurrency transactions should be reported on Form 8949.

How To Generate A Bitcoin Tax Report

The precise information youll need to generate for your Bitcoin tax report will vary a little depending on where you live and your regional tax office. This said, we can look at a general overview on how to generate a Bitcoin tax report yourself, as well as with a Bitcoin Tax calculator.

Doing your Bitcoin taxes yourself? Brave move. Youll need to start by compiling your complete Bitcoin transaction history and identifying your cost basis for each asset. Now you figure out which transactions are taxed and which are not – as well as which kind of tax applies. Next, calculate any subsequent capital gains or losses from selling, trading or spending your BTC, as well as the fair market value of any BTC on the day you received them in your countrys currency. Now take all this information and report it to your tax office in your annual tax return.

How much information youll need to include really varies depending on where you live. Some tax offices only want to know about your net capital gains and losses and any additional income from crypto. But others – like the IRS – want you to report each individual sale, trade or spend of BTC and other crypto.

This can create a lot of work – so save yourself hours of tax headaches with a BTC tax calculator like Koinly.

Read Also: Are Home Renovations Tax Deductible