Moving Call Centers To Low

I know many of you might think I am crazy, and the government should tax the rich more. But, the truth is penalizing the rich will only harm you . Have you forgotten how whole industries have been moved from one country to another? It has not happened once but multiple times throughout our history. Remember when all the companies moved their call centers to low-cost locations like India. They didn’t only move their site, but also the jobs with them.

Do you know why they moved to another area? Because operating in the current country was not profitable enough. Why do you think it was not profitable? One of the many reasons was costly labor and stringent labor union rules and their demands. The labor union wanted to help the employees they represented by penalizing the rich. Well, they ended up doing the opposite of it. All the employees lost their jobs, and the rich just got richer.

What do you think the Others did in this situation? They complained. What do you think the rich did when labor unions penalized them? They took control and found an innovative solution that made them even more money. Please note the goal here is not to let anyone down. The goal is to learn from it. What makes the rich different from the Others. How can you move from the Others to the rich?

Other Ways To Close Tax Loopholes For The Wealthy

- Pass the Buffett Rule. The Buffett rule, inspired by billionaire Warren Buffett, would require millionaires to pay a minimum tax rate of 30%. This will guarantee that the wealthy will not pay a smaller share of their income in taxes than a middle-class family pays. It would raise $72 billionover 10 years.

- Close the Wall Street carried interest loophole. Wealthy private equity managers use a loophole to pay the lower 23.8% capital gains tax rate on the compensation they receive for managing other peoples money. We should close this loophole so that they pay the same rate as others at their income level who receive their compensation as salary. This would raise $17 billion over 10 years.

- Eliminate the payroll tax loophole for S corporations. This loophole allows many self-employed people to use S corporations to avoid payroll taxes. Used by Newt Gingrich and John Edwards to avoid taxes, closing this loophole would require treating this income as salary rather than profit, making it subject to payroll taxes. This would raise $25 billion over 10 years.

Reasons Why The Rich Should Not Pay More Tax

Read Also: How To Get Copy Of Tax Return

Increase The Estate Tax

The estate tax is levied on the assets of the very best-off Americans when they die. The Tax Cuts and Jobs Act increased the level at which the federal estate tax kicks in so that the taxat a rate of 40%applies only to estates over $11.2 million. Only two of every 1,000 people are wealthy enough to trigger the tax when they die, or about 1,900 estates in 2018, according to the Tax Policy Center. Only 80 small farms and small businesses paid the estate tax in 2017, again according to the Tax Policy Center. Estate and gift taxes brought the government about $19 billion in 2019, only 0.5% of all federal revenues.

One proposal would lower the threshold to estates worth $3.5 million and impose graduated taxes depending on the size of the estatefrom 45% up to 65%. It would raise more than $300 billion over 10 years. Advocatesof an estate tax hold that it is a good way to avoid dynastic wealth in the U.S.and make the U.S. a fairer place where merit matters more and the net worth of onesparents matters less. As the wealthy get wealthier, they say, a stronger estatetax is increasingly important.

When someone dies with stocks, property or other assets that are worth more than he or she paid for them, the heirs do not have to pay capital gains taxes on those profits. No one does the profits go completely untaxed. Former Vice President Joe Biden, among others, has proposed taxing these profits. Heirs would have to pay tax when they sell the assets they inherit.

The More You Tax Wealth The Less Valuable It Becomes

By Scott Burns

7:00 AM on Dec 22, 2019 CST

I liked Elizabeth Warren when I interviewed her. That was many years ago, back when she was a professor at Harvard Law School. She was not involved in politics. Instead, she had researched the real causes of personal bankruptcy with Teresa Sullivan, then a dean at the University of Texas. Later, Warren wrote a book with her daughter exploring how two-earner families were as vulnerable as the single-earner family of yore.

Bankruptcy and family finance: Then and now, both are serious meat-and-potatoes issues.

But in politics, I find liberals who want to scold and punish the rich for being rich as wrong-headed as conservatives who like to scold and punish the poor for being poor.

Dont get me wrong. There are lots of reasons for the rich to pay more taxes. One reason is simple. As Willie Sutton once said of robbing banks, Thats where the money is. We can say the same for the wealthy. Theyve got the money.

Another reason is popularity. Everyone likes taxes that are paid by other people. So if you decide to tax the 1%, you can be pretty sure the remaining 99% will be enthusiastic. All will agree that such taxes are unusually wise.

But the whole idea of taxing wealth is kind of stupid. Or, to express it in a more polite way: Taxing wealth is counterproductive.

Here are three reasons:

The more you tax wealth, the less valuable it becomes. Its that simple.

Don’t Miss: How Can I Get My Tax Information From 2015

Us Tax System Is Most Business Dependent

Setting aside the debate over whether a low tax bill is fair, what is missed in such discussions is that American businesses are critical to the tax collection system at every level of governmentfederal, state, and local. In 2017, OECD economist Anna Milanez measured the amount of taxes that businesses in 24 countries contributed to the overall tax collection system. Her report determined that the U.S. was one of the most business dependent tax systems in the industrialized world.

The report found that U.S. businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. As Figure 6 shows, this includes taxes paid directly by businesses, such as corporate income taxes, property taxes, and excises taxes, as well as the taxes businesses remit on behalf of employees and customers, such as payroll taxes, withholding taxes, and sales taxes.

Without businesses as their taxpayers and tax collectors, or significantly altering the tax system, American governments would not have the resources to provide even the most basic services. Considering the role of businesses in collecting the taxes needed to support the functions of our government, one would be hard-pressed to say that the system is rigged in their favor.

The Rich Bear Americas Tax Burden

Most Americans would be surprised to learn that a 2008 study by economists at the Organisation for Economic Co-operation and Development found that the U.S. had the most progressive income tax system of any industrialized country at the time. Their study showed that the top 10 percent of U.S. taxpayers paid a larger share of the tax burden than their counterparts in other countries and our poorest taxpayers had the lowest income tax burden compared to poor taxpayers in other countries due to refundable tax credits such as the Earned Income Tax Credit and the Child Tax Credit.

Our income tax code has only gotten more progressive since then because of Washingtons continuing effort to help working class taxpayers through the tax code.

According to the latest IRS data for 2018the year following enactment of the Tax Cuts and Jobs Act the top 1 percent of taxpayers paid $616 billion in income taxes. As we can see in Figure 1, that amounts to 40 percent of all income taxes paid, the highest share since 1980, and a larger share of the tax burden than is borne by the bottom 90 percent of taxpayers combined .

In case you are thinking, Well, the rich make more, they should pay more, the top 1 percent of taxpayers account for 20 percent of all income . So, their 40 percent share of income taxes is twice their share of the nations income.

Recommended Reading: Who To Hire To Do Taxes

What Is A Wealth Tax

A wealth tax is an annual tax on a person or entitys assets rather than their income. That can include personal property, cash in bank accounts, real estate, retirement accounts, investments, interest in a business, and anything else of value.

Typically, the taxpayer can deduct any debts, such as mortgages or other loans, from the total of their overall wealth, making it a tax on their net worth. Additionally, most wealth taxes only apply to people with financial assets above a certain level.

For example, say you own $10 million in assets and have a $1 million mortgage debt on your home, making your net worth $9 million. If you had to pay a 2% wealth tax on anything over $5 million, you would owe $80,000.

Wealth tax advocates argue it would be an effective way to raise revenues, address the federal deficit, and fix Americas health care system. It would also address wealth and income inequality because it would encourage the wealthiest taxpayers to use their wealth rather than leaving it unspent in a bank account or invested in underutilized property.

Unlike raising income or other tax rates, it would also specifically target only the richest American households those who currently have tens of millions of dollars in cash and assets.

The Law Of Unintended Consequences

An excellent case study for this can be found in the luxury tax from the 1990 budget deal. The motivation behind the tax was to bilk the rich to reduce the national deficit with targeted taxes. On the surface, this seemed pretty straightforwardtax the excess of the rich to raise money and spare the middle class. In theory, the well-meaning politicians thought that rich people would just simply pay more for their fancy toys.

Unfortunately, the law of unintended consequences is real, for the rich responded by buying less. The most pronounced effects of this luxury tax were felt throughout the American yacht industry. The additional 10 percent tax on yachts caused American boat builders to shutter operations and cut jobs as the rich either skipped out on yachts or bought them cheaper from overseas. The tax did not raise money for public programs instead, it actually created a revenue loss as a result of the associated job loss.

In the 1950s, when top marginal rates were 91 percent, research shows that a majority of the wealthy successfully avoided the tax and that decades of cutting high marginal rates induced growth.

This particular case isnt unique. The wealthy arent just money bags sitting around waiting to be tapped. In the 1950s, when top marginal rates were 91 percent, research shows that a majority of the wealthy successfully avoided the tax and that decades of cutting high marginal rates induced growth.

Recommended Reading: Can You Claim Home Improvements On Taxes

Instead You Get More Pass Throughs And Perceptions Of Rising Inequality

As the number of traditional C corporations has declined, the number of pass-through businesses has skyrocketed. As we can see in Figure 4, since 1986, the number of S corporations grew by more than fivefold, from about 826,000 to over 4.2 million. The number of partnerships did lag for a few years following 1986, but once the LLC form took off, the number climbed to roughly 3.4 million. Figure 4 does not include sole proprietorships, which grew from 12.4 million in 1986 to over 23 million today.

The shift in business forms since 1986 has meant that more business income is now reported on individual 1040 tax forms than on traditional 1120 corporate forms. The explosion of pass-through business income is most notably seen on the tax returns of high-income taxpayers, which is contributing to the appearance of rising inequality.

In Figure 5 below, we can see the changing composition of income for the top 1 percent of taxpayers from 1950 to 2017. The data is drawn from the website of University of Berkeley economist Emmanuel Saez. Focus on the line tracking the composition of what Saez calls entrepreneurial income, or pass-through income, because this line largely traces what he and Gabriel Zucman have identified as the trend in inequality since 1950.

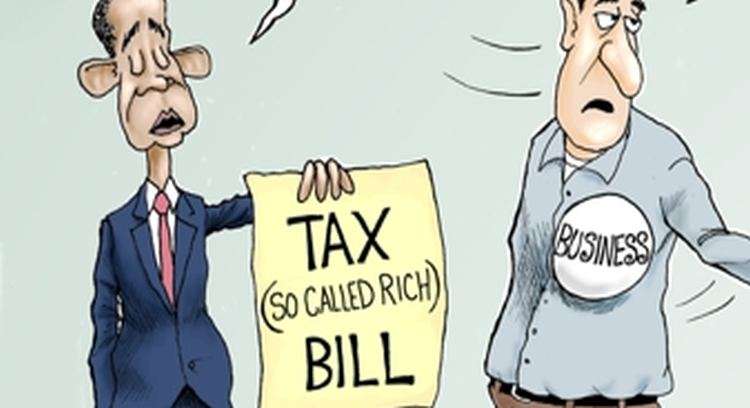

Raising Taxes Will Hurt The Economy

The idea that the agenda of Joe Biden would be positive for the economy is taken to mean that his plan to increase taxes would also be positive for the economy. However, it is a mistake to think the corporate or individual income taxes can be raised without negative effects.

His campaign recently told the New York Times, Tax increases now would accelerate growth by funding a stream of spending proposals that would help the economy. So the argument seems to go that because higher tax rates could fund new programs, higher tax rates would help the economy. But as noted by Douglas Holtz Eakin, The taxes are bad but all the better news for growth, if there is any, is in the spending proposals. That means tax increases on business and higher earners would inflict damage on the economy no matter how the revenue would be spent.

In fact, all major analyses of the tax plan of Biden find negative effects on the economy. Estimates from the Tax Foundation model show that his tax plan would reduce productivity output by nearly 1.5 percent over the long term. The magnitude varies across estimates due to different factors, like how open the economy is, but the direction does not.

Erica York is an economist with the Tax Foundation based in Washington.

Don’t Miss: How Do I Pay My Payroll Taxes

Do The Wealthy Pay A Fair Share Of Taxes

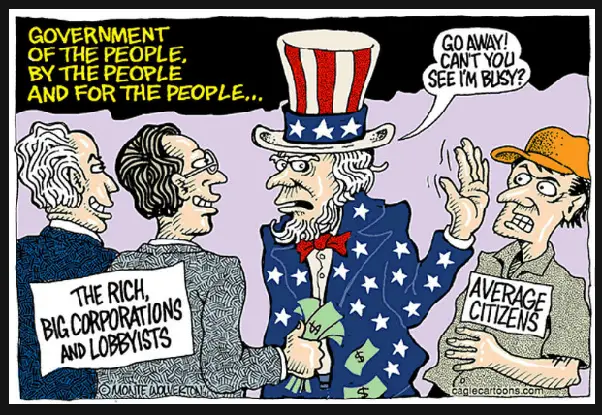

The wealthy dont pay a fair share of their taxes. The CPC said, We cannot afford to extend tax breaks for corporations or the wealthy that cripple our ability to invest in areas that expand economic growth, like infrastructure and education.

The CPC also said, Tax reform must be done in a way that raises significant revenue, protects working families and the vulnerable, and requires corporations and the wealthy to pay a fair share.

Stop Complaining And Start Taking Action

Why do you think the rich have companies registered in other countries and operating in another? To save tax or, in other words, to protect themselves from getting penalized. On the other hand, the Others get punished every time they get paid or buy something. The Others don’t want to take control. They are comfortable complaining about their life. They complain that the government is not doing its job. But, guess what, it’s them who elected the government. They complain that they are not getting paid enough. But, who is forcing them to work there? They are free to learn new skills and go for a better opportunity. The problem is not that they don’t know the solution. It’s the fact that they don’t want to get up their ass and perform the action.

Complaining is easy. Doing something is not.

If you still think penalizing the rich to reward the Others is good, then think twice. Don’t focus on punishing the rich however, focus on becoming one of them. And the first step to becoming part of the elites is to start taking ownership. Move from consuming to producing. Be an inventor, a problem solver, and sell those solutions to the Others.

I hope you enjoyed reading this article. If you did, then help Master Investment grow by sharing it with your friends. If you are looking for ways to support me. Well, buy me a cup of coffee from here. 🙂

Recommended Reading: Do You Have Until Midnight To File My Taxes

Envy Doesn’t Explain ‘soak The Rich’ Taxation

Pink piggy banks balancing on seesaw 3d illustration

getty

Back in April, the conservative economist Lawrence B. Lindsey published an article in The Wall Street Journal complaining about the Biden administrations plan to raise the capital gains rate.

An increase to 39.6% would actually cost the government money because it would exceed the revenue-maximizing rate. There could only be one motive, Lindsey insisted.

Tax rates above the revenue-maximizing rate are punitive, Lindsey charged. The government is giving up revenue simply to punish the rich.

Lindsey acknowledged that wealth redistribution can be good policy. Higher taxes on the rich to finance spending, or to transfer money to lower-income people, may be good for societys welfare, he wrote. Economists typically value money received by a poor person more highly than money going to a rich person, so overall social welfare is enhanced by such transfers.

Taxes that fund constructive redistribution are defensible, Lindsey continued. But when politicians design a tax with rates that exceed the revenue-maximizing rate, they actually shrink the states capacity for useful redistribution.