When You Should Call The Irs

The IRS online tools are all that most people need to track the status of a tax refund. But there are some exceptions. You might need to give the IRS a call in the following situations:

- Wheres My Refund?,Wheres My Amended Return?, or IRS2Go directs you to call.

- Its been more than 21 days since you filed electronically and youre eager to know the status of your refund or worried about theft or fraud.

- Its been more than 20 weeks since you mailed an amended tax return.

Keep in mind that calling the IRS wont speed up the processing of your refund. According to the IRS, if youre eager to know when your refund will arrive, youre better off using one of its online tracking tools. The IRS updates the status of refunds daily, generally overnight, so checking an online tool multiple times throughout the day probably wont be helpful.

Remember, phone representatives at the IRS can only research the status of your refund 21 days after you file electronically, six weeks after you mail a paper return, or 16 weeks after you mail an amended return.

How Taxpayers Can Check The Status Of Their Federal Tax Refund

IRS Tax Tip 2022-60, April 19, 2022

Once a taxpayer files their tax return, they want to know when they’ll receive their refund. The most convenient way to check on a tax refund is by using the Where’s My Refund? tool on IRS.gov. Taxpayers can start checking their refund status within 24 hours after the IRS acknowledges receipt of the taxpayer’s e-filed return. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Taxpayers can access the Where’s My Refund? tool two ways:

- Visiting IRS.gov

To use the tool, taxpayers will need:

- Their Social Security number or Individual Taxpayer Identification number

- Tax filing status

- The exact amount of the refund claimed on their tax return

The tool shows progress in three phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their bank of credit union to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Is filed on paper

- Needs further review in general

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q& A below.

- Includes a Form 8379, Injured Spouse AllocationPDF, which could take up to 14 weeks to process

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return. If were still processing your return or correcting an error, neither Wheres My Refund? or our phone representatives will be able to provide you with your specific refund date. Please check Wheres My Refund? for updated information on your refund.

You May Like: What Is The Tax Percentage Taken Out Of My Paycheck

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

Need Help Finding Info For The Where’s My Refund Tool

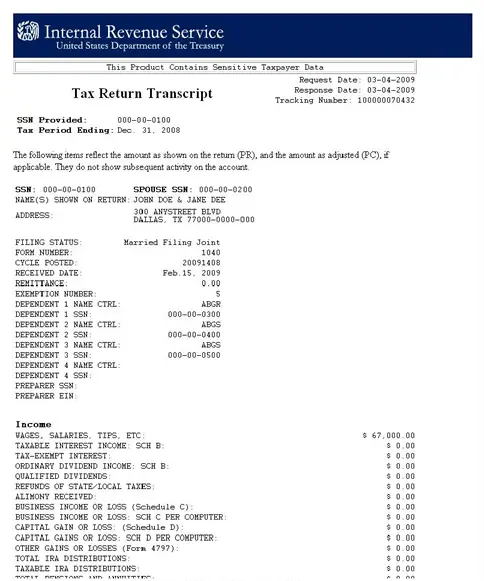

- Social Security Number

- If you filed Form ND-1, the Social Security Number is shown on Page 1, just to the right of your name and address information.

- If you filed Form ND-EZ, the Social Security Number is shown on Page 1, just to the right of your name and address information.

600 E. Boulevard Ave., Dept. 127 | Bismarck, ND 58505-0599 | Main Number: 701-328-7088

Recommended Reading: Are Refinance Points Tax Deductible

Wheres My State Tax Refund Nebraska

Its possible to check your tax refund status by visiting the revenue departments Refund Information page. On that page, you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Recommended Reading: Can I Pay My Federal And State Taxes Online

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct-deposited or mailed your refund.

The turnaround time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

Start Tracking Right Away

Another myth is that theres no way to tell where your refund is until you get it and you’ll be asking ‘Where’s my refund?’ for a while. Reality: You can track your IRS refund status in fact, if you file using tax software or through a tax pro, you can start tracking your IRS refund status 24 hours after the IRS receives your return. If you’re thinking ‘Where’s my state refund?’ there’s good news: You can also track the status of your state tax refund by going to your state’s revenue and taxation website.

Don’t Miss: How To Get Tax Info From Unemployment

Wheres My State Tax Refund New York

You can use this link to check the status of your New York tax refund. You will need to enter the exact amount of your refund in whole dollars in order to log in. This amount can be found on the state tax return that you filed.

Dont forget that if you paid any local income taxes for living in New York City or Yonkers, those taxes are included in your state return.

Why Is The Refund Lower

Sometimes, taxpayers receive the refunds in good time, only to discover the amount is lower than they thought. In this case, its possible your refund was adjusted. This is known as an offset. If it occurs, its because you have debt and the government is paying it out of your refund. Multiple federal and state agencies have the authorization to do so under the Treasury Offset Program, overseen by Financial Management Services. You may have outstanding debt due to:

- Non-tax debts, such as student loan payments

- Failure to pay child support

- State tax debts that get paid for out of your federal refund

- State unemployment compensation debts

When you received your refund, Financial Management Services will already have deducted the amount. The change in the amount shouldnt delay your refund, though. Whether you requested direct deposit or paper check, the tax return money should arrive in the same amount of time.

You should also receive a notice from Financial Management Services explaining the reason for the offset. It will contain the name of the agency to which the payment went. It will also have information about how to contact them. If you believe the offset was in error, call them right away.

If you have further questions or cannot resolve the issue, call the Treasury Offset Program Call Center. Their number is 1-800-304-3107.

You May Like: How To Pay Sales Tax For Small Business

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset or different refund amount when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2021 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

Recommended Reading: How To Figure Sales Tax

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your zip code.

If you e-filed, you can generally start to see a status four days after the Oklahoma Tax Commission receives your return. Paper filings will take longer and you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

California Inflation Relief Check: When Will I Receive The Payment & How To Track

The first payments for the Middle Class Tax Refund were sent out on October 7. People will of course be hoping to receive their money as soon as possible and fortunately the Californian Franchise Tax Board has for when people should receive their payment.

The CFTB says it expects to send 90 percent of the direct deposit payments for the Middle Class Tax Refund in October 2022. Those who received the first or second Golden State Stimulus via direct deposit can expect to see the money in their account between 7 October and 25 October. The remaining direct deposits will be issued between 28 October and 14 November 2022.

It’s time to hit refresh on your bank account!

Millions of qualifying Californians will receive up to $1,050 to help with rising costs from groceries to gas.

Office of the Governor of California

A number of people will receive a debit card with the money between October 25 and December 10, with the rest receiving the card by January 15, 2023. These are people who didnt file an electric tax form with information to be found on the CFTB website.

95 percent are due to be sent by the end of the year.

Democratic California Governor Gavin Newsom and legislative leaders agreed at the end of June to spend part of the states bumper budget surplus on the $17 million inflation relief package.

How can I track the payment?

Don’t Miss: How Much Income To File Taxes

When Will You Receive Your Payment

According to the California Franchise Tax Board website, eligible Californians will receive their payment via direct deposit issued to their bank accounts or via a debit card sent in the mail.

Direct deposit payments are expected to be issued to bank accounts during these windows: Oct. 7, 2022 – Oct. 25, 2022 and Oct. 28, 2022 – Nov. 14, 2022.

State officials said they expect about 90% of direct deposits to be issued in the month of October 2022.

Debit cards are expected to be mailed between Oct. 25, 2022 – Dec. 10, 2022, with the rest receiving the card by Jan. 15, 2023.

State officials said they expect about 95% of all payments – direct deposit and debit cards combined – to be issued by the end of this year.

So who will get paid by direct deposit, and who will receive a debit card?

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. The remaining eligible taxpayers will receive their payments in the form of a debit card, according to the California Franchise Tax Board website.

You will receive your payment by mail in the form of a debit card if you:

The CNN Wire contributed to this report.

¿Quieres leer este artÃculo en español? Haz clic aquÃ

Ways To Make The Tax Refund Process Easier

Find your tax refund fast by proactively checking your IRS federal tax return status. Before filing and using the IRS Wheres My Refund portal to track your 2021 government return, consider:

- Reviewing your return carefully. Mistakes can delay your returns progress on the tax refund tracker. Be sure to review your information carefully before filing with the IRS.

- Filing early. The earlier you file, the sooner you can check the status of your IRS federal tax return. Early filing also provides more time to deal with issues should something go wrong.

- E-Filing your return. Instead of spending 6-8 weeks wondering wheres my tax refund from the IRS?, do yourself a favor and file electronically. E-Filed government returns are typically processed in under half the time as paper returns.

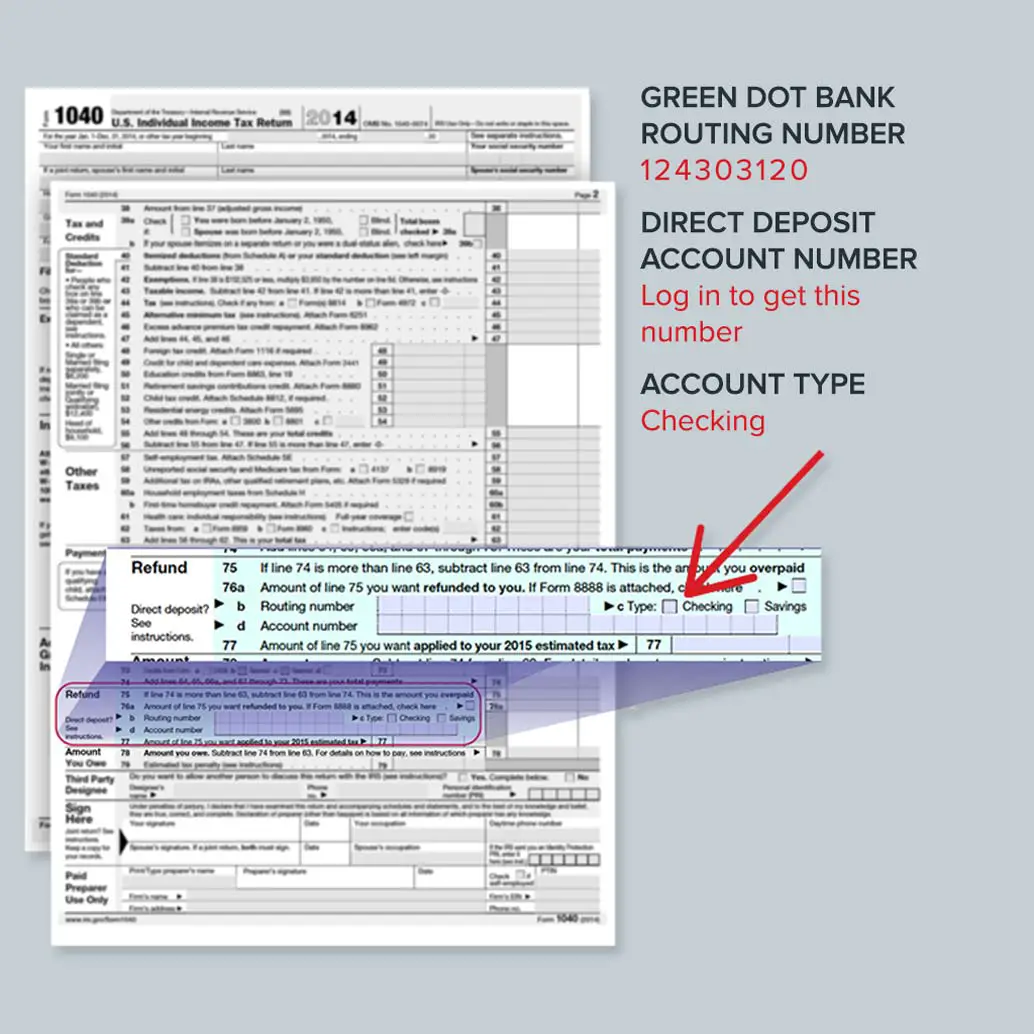

- Opting for direct deposit. Avoid waiting for your check by having your IRS refund deposited into your account. Once the WMR reads Refund Approved, your money will be ready to spend.

- Tracking your 2020 refund right away. Staying up-to-date on your return ensures youre in the loop every step of the way.

Read Also: How Can I Keep My Tax Return From Being Garnished

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News