How The Capital Gains Tax Works

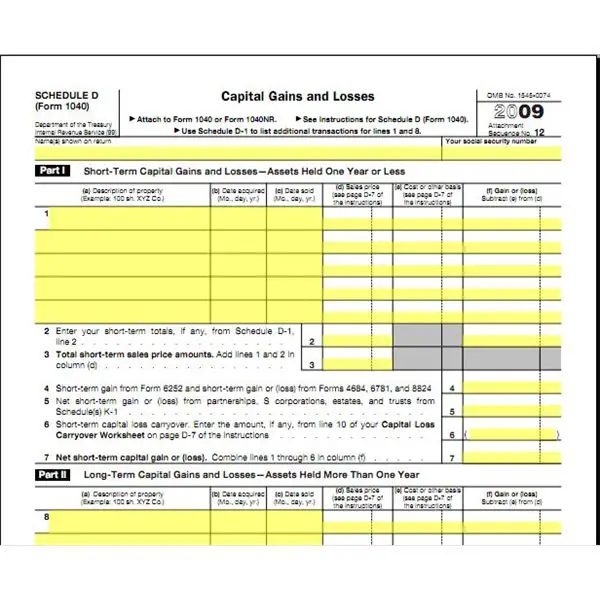

Say you bought 100 shares of XYZ Corp. stock at $20 per share and sold them more than a year later for $50 per share. Lets also assume that you fall into the income category where your long-term gains are taxed at 15%. The table below summarizes how your gains from XYZ stock are affected.

| How Capital Gains Affect Earnings | |

|---|---|

| Profit after tax | $2,550 |

In this example, $450 of your profit will go to the government. But it could be worse. Had you held the stock for one year or less , your profit would have been taxed at your ordinary income tax rate, which can be as high as 37% for tax years 2021 and 2022. And thats not counting any additional state taxes.

How Do Taxes Work On Robinhood

Paying Taxes on Robinhood StocksOnly investments you’ve sold are taxable, so you won’t pay taxes on investments you held throughout the year. If you had a bad year and your losses outstrip your gains, you can deduct up to $3,000 from your taxable income as long as you sell any duds by the end of the year.

Carry Over Losses To The Next Year

Remember capital losses offset capital gains. If you have both capital gains and capital losses in the same tax year, you must use them to offset the capital gain. However, if you only have a capital loss, or you dont have capital gains from the prior 3 years that you could amend and offset, you can carry those capital losses forward to offset future capital gains. You might need to consult a tax professional to follow the proper steps to do this.

Article Contents11 min read

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Also Check: What Is New York State Income Tax

Where Can I Locate My Composite Form 1099

If you did not sell stock or did not receive at least $10 worth of dividends, you will not receive a Composite Form 1099 for a given tax year.

If you’re looking for specific information about your tax filing, please reach out to a qualified tax professional.

Do I Have To Report Stocks If I Don’t Sell

If you sold stocks at a profit, you will owe taxes on gains from your stocks. … And if you earned dividends or interest, you will have to report those on your tax return as well. However, if you bought securities but did not actually sell anything in 2020, you will not have to pay any “stock taxes.”

Recommended Reading: Can You File Taxes Now

Capital Gains: The Basics

Lets say you buy some stock for a low price and after a certain period of time the value of that stock has risen substantially. You decide you want to sell your stock and capitalize on the increase in value.

The profit you make when you sell your stock is equal to your capital gain on the sale. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

There are short-term capital gains and long-term capital gains and each is taxed at different rates. Short-term capital gains are gains you make from selling assets that you hold for one year or less. Theyre taxed like regular income. That means you pay the same tax rates you pay on federal income tax. Long-term capital gains are gains on assets you hold for more than one year. Theyre taxed at lower rates than short-term capital gains.

Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. Thats why some very rich Americans dont pay as much in taxes as you might expect.

To recap: The amount you pay in federal capital gains taxes is based on the size of your gains, your federal income tax bracket and how long you have held on to the asset in question.

Do I Owe Crypto Taxes

In the U.S., crypto is considered a digital asset, and the IRS treats it generally like stocks, bonds, and other capital assets. Like these assets, the money you gain from crypto is taxed at different rates, either as capital gains or as income, depending on how you got your crypto and how long you held on to it.

To understand if you owe taxes, its important to look at how you used your crypto in 2021. Transactions that result in a tax are called taxable events. Those that dont are called non-taxable events. Lets break them down:

Not taxable

Taxable as capital gains

-

Selling crypto for cash: Did you sell your crypto for U.S. dollars? Youll owe taxes if you sell your assets for more than you paid for them. If you sell at a loss, you may be able to deduct that loss on your taxes.

-

Converting one crypto to another: When you use bitcoin to buy ether, for example, you technically have to sell your bitcoin before you buy a new asset. Because this is a sale, the IRS considers it taxable. Youll owe taxes if you sold your bitcoin for more than you paid for it.

-

Spending crypto on goods and services: If you use bitcoin to buy a pizza, for example, youll likely owe taxes on the transaction. To the IRS, spending crypto isnt that much different from selling it. You need to sell the asset before it can be exchanged for a good or service, and selling crypto makes it subject to capital gains taxes.

Taxable as income

Good news for hodlers

Don’t Miss: Do I Need Tax Loss Harvesting

Quick Ways To Legally Reduce Your Taxes

If you’ve made a significant amount of money in stock trading, there are simple ways to earn tax write-offs to reduce your taxable income. However, all of these strategies need to be completed during the same tax year, so it’s unfortunately too late to reduce your 2021 taxable income.

But from this year and on, you may consider using one or more of these strategies to avoid paying more taxes:

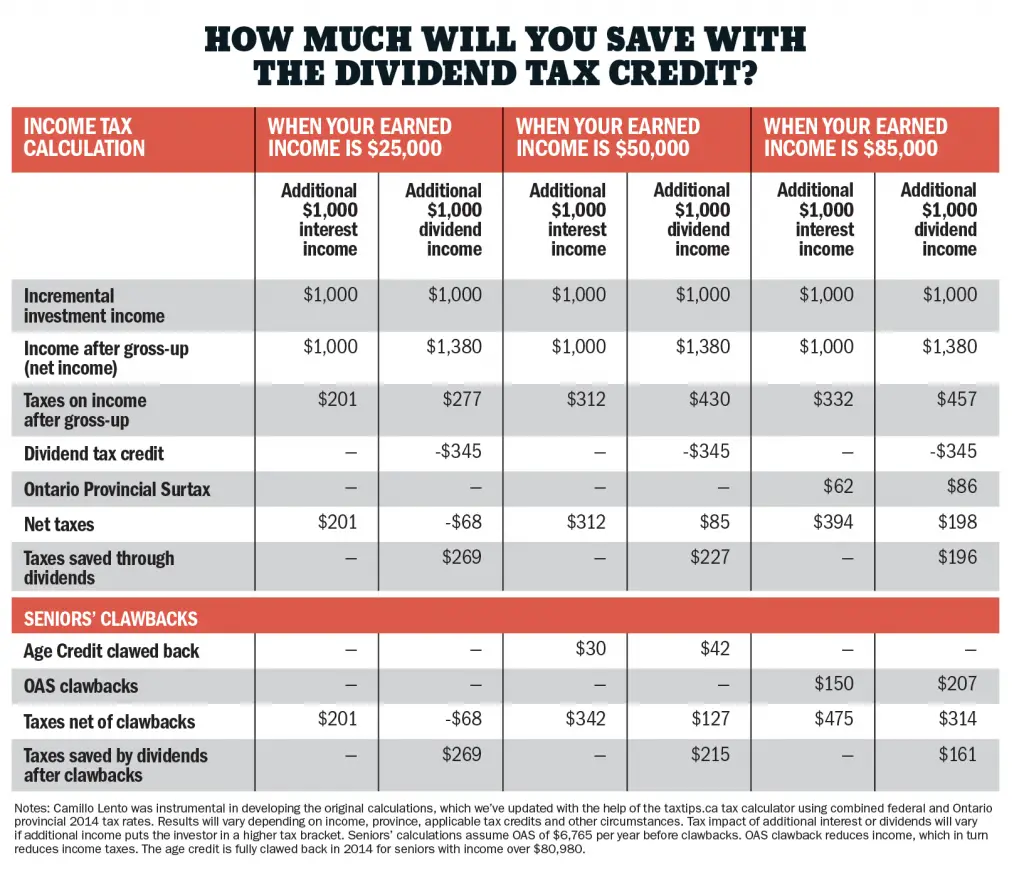

Dividend Stock Investors: How To Avoid Taxes

Dividends stocks a perfect for a wide variety of investors, but taxes can put a big dent into your cash income. Heres how to avoid taxes altogether.

Dividend stocks are ideal for a wide variety of investors. If youre young, you can use the regular payments to buy even more stock. If youre retired, you can put the cash towards everyday expenses. Best of all, you can flip between strategies at any time. The choice is yours.

Yet theres one aspect to dividend stocks that remains challenging: extra taxes. Many investors are forced to pay nearly one-third of their dividend income to the government. Thats a big hit if youre relying on those dividends to support your lifestyle or save for the future.

What if I told you that you could avoid taxes on your dividends entirely? That could allow you to retire years in advance, or extend your current retirement years into the future.

There are a few ways to generate tax-free dividends. Choosing the strategy that is the right fit is up to you.

Don’t Miss: How To Report 401k Withdrawal On Tax Return

How To Avoid Capital Gains Tax On Stocks

Capital gains taxes are a tax on the profits you make on investments, which you might owe if you are investing through a taxable brokerage account. The good news is that there are strategies investors can use to eliminate or minimize those taxes. The right ways for you will depend on your long-term financial goals. If youre not sure what path to take to avoid taxes you can work with a professional financial advisor who can help you create a financial plan and provide the right ways to avoid these taxes.

How The Super Rich Avoid Paying Taxes

If youre one of the 1% of Americans who control over 40% of the countrys wealth, life is full of choices. Among them how best to keep all that money away from the government? The U.S. economic system offers no shortage of loopholes allowing the ultra-rich to shortchange Uncle Sam.

Tax rates for those making > $1 million level out at 24%, then declines for those making > $1.5 million. Those making $10 million a year pay an average income tax rate of 19%. $70-$100 billion is the estimated tax revenue lost each year due to loopholes. So how exactly do the super rich hide that much money from the government every year?

Also Check: How To Calculate Pay After Taxes

Exemptions On Capital Gains Tax For Donations

If you donate certain assets to a registered charity or other qualified donees, you may be exempt from paying capital gains tax on any capital gains realized from these gifts. The types of assets that are eligible for the exemption when donated are:

- A share of a stock of a mutual fund corporation or a unit of mutual fund trust

- A share, debt obligation, or right listed on the stock exchange

- An interest in a segregated fund trust

- Ecologically sensitive land

Qualified donees in Canada include:

- Registered charities

- Registered municipalities

- Registered national arts service organizations

You will still have to report any capital gains and losses of these gifts on the capital gains tax form and will be required to fill out a separate form T1170 Capital Gains on Gifts of Certain Capital Property to receive the exemption.

Read Also: Can You Change Your Taxes After Filing

What Is The Capital Gains Tax Rate In Canada

Go rooting in the Income Tax Act and youll struggle to find something called capital gains tax. Thats because theres no special tax relating to gains you make from investments and real estate holdings. Instead, you pay the income tax on part of the gain that you make.

In Canada, 50% of the value of any capital gains are taxable. Should you sell the investments at a higher price than you paid youll need to add 50% of the capital gain to your income. This means the amount of additional tax you actually pay will vary depending on how much youre making and what other sources of income you have.

If you have both capital gains and capital losses, you can offset the capital gains with capital losses until you reach zero. If you only have capital losses, the CRA allows you to use the capital loss to offset a capital gain you originally declared in the previous 3 years, or you are allowed to carry forward the capital loss into the future. How far into the future, right now its indefinitely, so dont lose the paperwork! That said, rules can change and so its best to check with your tax professional before taking any action.

Recommended Reading: How To Figure Out Income Tax

Take Advantage Of Tax

When you invest your money through a retirement plan, such as a 401, 403, or individual retirement account , it will grow without being subject to immediate taxes. You can also buy and sell investments within your retirement account without triggering capital gains tax.

In the case of traditional retirement accounts, your gains will be taxed as ordinary income when you withdraw money, but by then, you may be in a lower tax bracket than when you were working. With Roth IRA accounts, however, the money you withdraw will be tax-freeas long as you follow the relevant rules.

For investments outside of these accounts, it might behoove investors near retirement to wait until they stop working to sell. If their retirement income is low enough, their capital gains tax bill might be reduced, or they may be able to avoid paying any capital gains tax. But if theyre already in one of the no-pay brackets, theres a key factor to keep in mind: If the capital gain is large enough, it could increase their total taxable income to a level where they would incur a tax bill on their gains.

Capital losses can offset your capital gains as well as a portion of your regular income. Any amount left over after that can be carried over to future years.

If You Earn Dividends And Interest

Even if you don’t sell any of your investments for profit, you may still owe some taxes on them for the money you earn passively. For example, if you own stocks, a mutual fund, or an index fund, you may receive periodic payments from that company. These payments are called dividends, and you have to pay taxes on them.

Additionally, if you own bonds and earn interest on them, you will also have to pay taxes on the interest earned. These vary based on the type of bond you own. If you own mutual funds, you will be responsible for paying taxes on any dividends earned. You will also have to pay taxes if you sold any mutual fund shares. However, you don’t have to pay taxes on any transactions performed by the mutual fund’s managers.

Don’t Miss: When Do You File Taxes This Year

Employee Stock Purchase Plan Tool Inputs

Employee Stock Purchase Plans have many complications. To use the ESPP tool, youll have to gather some data about your plan:

Company ESPP Inputs

- Grant Date Share FMV: The fair market value of the ESPP shares when your company extends the option to buy them.

- Exercise Date Share FMV: The fair market value of the ESPP shares when they exercise.

- Discount vs. Price

- ESPP Discount : If your plan is a percentage discount off the lower price at exercise or grant, enter the percentage here.

- Price Paid per Share : If your plan has a different discount mechanism, enter the price you pay per share. .

Tax Inputs

To calculate the difference in return between holding periods, you need to enter various tax rates.

- Enter your marginal tax rate that is, for each additional dollar you earn, what percentage goes to tax. Be sure to add Federal, State, and Local tax rates, if applicable.

- Short Term Capital Gains Tax Rate: Enter your short term capital gain rate. For many states , this is equal to the marginal income tax rate.

- Long Term Capital Gains Tax Rate: Enter your long term capital gain tax rate. Again, if applicable, add any state or local taxes.

Capital Gains Taxes: When You Sell A Stock For A Profit

Here’s the first thing you should know about investing and taxes as a new investor: If you own a stock and the price goes up, you don’t have to pay any taxes.

In the United States, you only pay taxes on investments that increase in valueif you sell them. In other words, it’s the profit from your investments that is taxed, not the investments themselves.

Consider this: Warren Buffett owns more than $100 billion in Berkshire Hathaway stock, and he’s never paid a dime in taxes on any of his shares. How? Because he’s never sold them.

The profit you make when you sell a purchased asset is called a capital gain. For investing and taxes, capital gains generally occur when you buy a stock or other investment at one price and later sell it at a higher price.

For example, if you buy stock for $2,000 and sell it for $2,500, you have a $500 capital gain. That gain is subject to taxes.

Capital gains taxes apply if you profit from the sale of most investment types. This includes bonds, mutual funds, ETFs, precious metals, cryptocurrencies, and collectibles. Even real estate sold at a profit can be considered a capital gain for investing and taxes, though the rules are a bit more complicated.

As you’ll see in the next couple sections, long- and short-term capital gains are treated differently when it comes to investing and taxes.

Recommended Reading: Can Medical Expenses Be Deducted From Taxes

Net Investment Income Tax

In addition to regular capital gains tax, some taxpayers are subject to the net investment income tax. It imposes an additional 3.8% tax on your investment income, including your capital gains, if your modified adjusted gross income is greater than:

- $250,000 if married filing jointly or a qualifying widow with a child

- $200,000 if single or a head of household

- $125,000 if married filing separately

Crypto Tax Guide For Australia 2022

Cryptocurrency taxes are no laughing matter. Youve been paying them for years thanks to the 2017 Australian government budget, it seems youll also be paying them for years to come. Dont worry read this Crypto Tax Guide for Australia 2022-23 to know it all!

Taxable income is any income your cryptocurrency holdings generate, including trading and mining. For example, if you have mined Bitcoin worth US $1000, this would be taxable income under Australian law.

You May Like: How Do Small Business Taxes Work

You May Like: Do You Pay Taxes On Social Security Disability