How Businesses Calculate Sales Tax

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

The cost a customer pays when purchasing goods or services from a business includes both the company’s sales price and the cost of applicable sales taxes. Businesses and their employees need to know what sales tax is, why they must collect it and how to calculate the correct sales tax amount on each purchase.

Thoroughly understanding this information helps ensure they comply with their state and local sales tax rules and regulations. In this article, we discuss how sales tax is calculated, what it is and answer other frequently asked questions employees have about sales tax.

Use The Sales Tax Deduction Calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A .

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 .

Enter your information for the tax year:

- Sales tax paid on specified large purchases

W-2, 1099 or other income statements

Receipts for specified large purchases

ZIP code of your address and dates lived

When To Collect Sales Tax

Sales tax is collected at the time of the transaction. Sales tax is a consumer tax, so businesses need to charge the sales tax amount at the time of purchase. Businesses will then take this sales tax amount and send it directly to the right government agency .

Businesses need to charge a sales tax in the majority of cases. However, there are a few instances in which they will not charge a sales tax, such as:

-

States without sales tax

-

Resale products

Read Also: Can You Write Off Moving Expenses On Your Taxes

North Carolina Sales Tax Calculator

You can use our North Carolina Sales Tax Calculator to look up sales tax rates in North Carolina by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

North Carolina has a 4.75% statewide sales tax rate,but also has 458 local tax jurisdictions that collect an average local sales tax of 2.22% on top of the state tax. This means that, depending on your location within North Carolina, the total tax you pay can be significantly higher than the 4.75% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in North Carolina:

What Is Sales Tax

Sales tax is a tax on the sale of goods and services. In the US and the District of Columbia all states except Alaska, Delaware, Montana, New Hampshire and Oregon impose a state sales tax when you buy items or pay for services. Alaska however does allow localities to charge local sales taxes as do many other states.

Some states do not charge sales tax on specific categories of items. In Massachusetts for example sales tax is not charged on regular grocery items. Also many states have additional tax surcharges. In the hospitality industry it is common for restaurants and hotels to charge a tax rate higher than the state sales tax rate. Check with your state and locality for expected sales tax rates and potential tax surcharge rates.

Read Also: How Much To Set Aside For Taxes

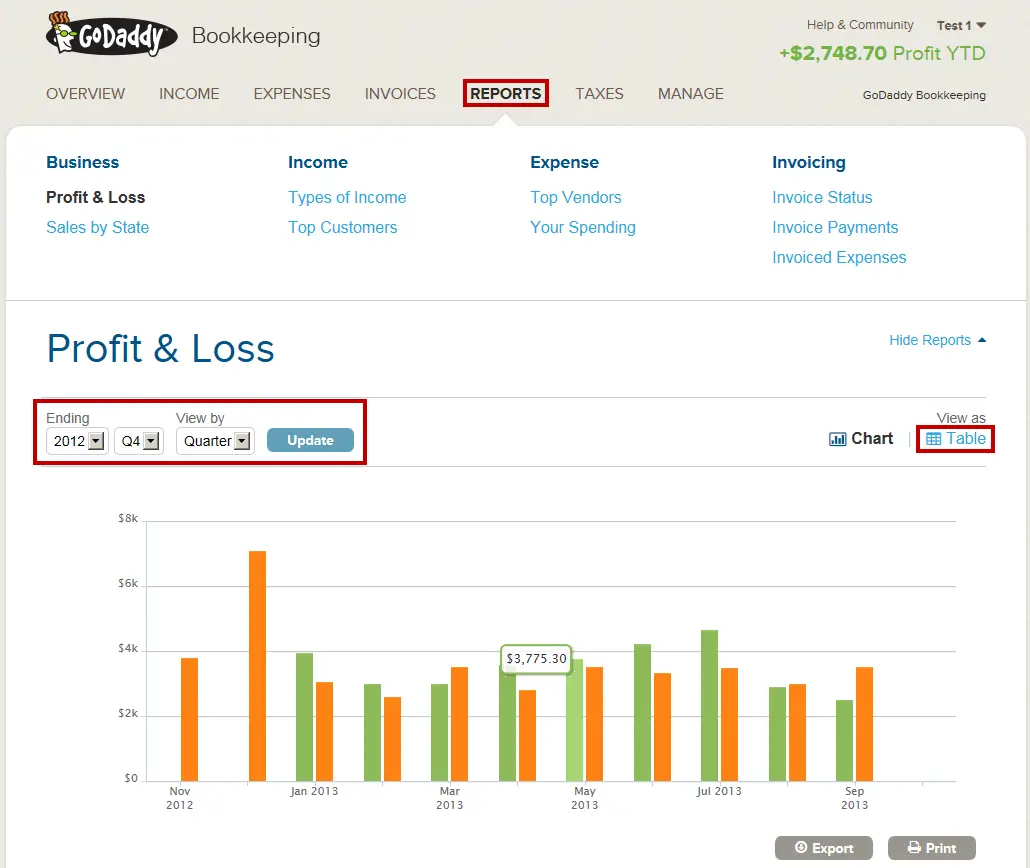

File Your State Sales Taxes

When you filed for your tax license, the applicable state will have assigned you both an ID number and a filing frequency.

Your assigned frequency could be monthly, annually, quarterly, or something else entirely.

You will likely also need to break down the amounts of tax youve collected according to city, county, region, and so forth, so know what the state protocol is and be prepared.

When youre ready, you can file state sales taxes online, by mail, or over the phone in most cases.

Be sure to file even if you didnt actually collect taxes during a given period, as this is necessary to maintain your tax license.

How To Calculate Sales Tax On Almost Anything You Buy

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our our partners, however, our opinions are our own. Terms apply to offers listed on this page.

- It’s not hard to calculate sales tax.

- However, it’s much more complicated to figure out the exact tax rate, since it varies by state and by purchase amount.

When you buy something in the US, you almost always pay more than the sticker price.

That’s because of sales tax, which can vary by state or city but is generally about 4% to 8% of the item’s retail price, imposed when you check out of brick and mortar stores, online retailers, and restaurants.

Sales tax in the US is determined at the state level. There are five states that do not impose a sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware. The remaining 45 states and Washington DC all have a sales tax, which varies depending on the product and service for sale.

If you’re shopping in most US states and you want to know how much you’ll be paying in total before you check out, here are steps you can take to calculate the sales tax.

You May Like: Can I Get My Tax Refund On Cash App

Texas Sales Tax Calculator

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Texas has a 6.25% statewide sales tax rate,but also has 999 local tax jurisdictions that collect an average local sales tax of 1.684% on top of the state tax. This means that, depending on your location within Texas, the total tax you pay can be significantly higher than the 6.25% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Texas:

How To Calculate Sales Taxes From Receipt Totals

Related

Anyone whos been shopping in the United States knows that the price on an item isnt always the total amount you have to pay. Most states have their own sales tax, which can vary from state to state, and sometimes between cities and counties as well. If youre traveling, it can be hard to predict how much things will cost from at each destination. For businesses, its necessary to keep track of sales tax charged, because you’re responsible for the collection and remittance of these taxes.

Read Also: What Is The Sales Tax Rate In Washington State

Calculate The Combined Sales Tax Rate

The combined sales tax rate is a single figure that represents an area’s total sales taxes, which includes city, county and state sales taxes. Businesses calculate the combined sales tax rate by adding these individual sales tax rates together. Businesses with two or more locations need to calculate the combined sales tax rate for each area they do business in to ensure they collect the correct amount of sales tax from consumers at each location.

For example:The city of Tampa is in Hillsborough County in the state of Florida. Florida’s base sales tax rate is 6%, and Hillsborough County has a sales tax rate of 2.5%. When you add these sales tax rates together, the combined sales tax rate in Tampa, Florida is 8.5%. But counties surrounding HillsboroughâPinellas County, Pasco County and Polk Countyâeach have a sales tax rate of 1%, making the combined sales tax rate in these areas 7%.

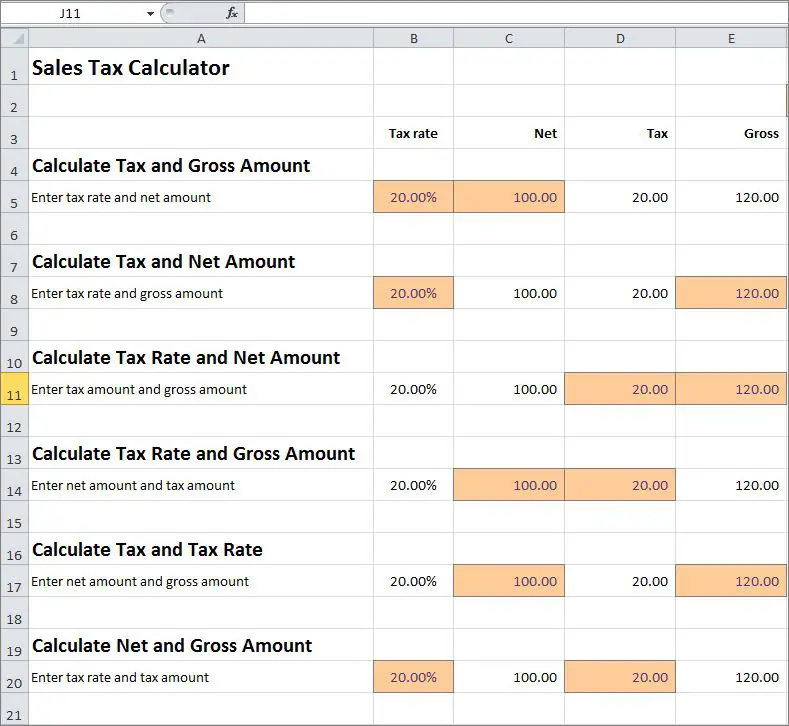

How The Sales Tax Decalculator Works

The Excel sales tax decalculator works by using a formula that takes the following steps:

Step 1: take the total price and divide it by one plus the tax rate

Step 2: multiply the result from step one by the tax rate to get the dollars of tax

Step 3: subtract the dollars of tax from step 2 from the total price

Also Check: Who Can I Call About My Tax Refund

Gather Local Sales Tax Rate Information

Since sales tax rates vary by location, some areas have a rate that is a combination of city, county and state sales taxes, while other areas have only a state sales tax. In areas that don’t have a state sales tax, cities and counties within the state may or may not have one.

Begin by determining whether or not there is a state sales tax in the state your business is in. If so, determine what the state sales tax rate is. This is known as the base tax rate. Then, determine whether or not the city or county has a sales tax rate and what the rate is.

What Rate Should I Be Charged

If you buy an item from a business located in an unincorporated county area, you will generally be charged the county sales tax rate on your taxable items. If the same item is purchased in a city with an additional district tax, you will be charged that city’s tax rate. If you purchase an item from outside of California for use in the city and/or county where you live, you owe use tax on that purchase. If you have not saved your receipts from such purchases, the Use Tax Lookup Table calculates how much you owe, and you can enter it as a line item when you file your income tax returns.

Also Check: How Can I File My 2015 Taxes For Free

Determine Whether You’ll Even Be Paying Sales Tax

First of all, if you’re shopping in New Hampshire, Oregon, Montana, Alaska, or Delaware, the sticker price will be the total price. No sales tax needed.

Another way to avoid sales tax completely is to shop on a tax holiday, which individual states periodically announce to try and boost consumer spending. “Some states also allow for an exemption from sales tax for certain items. Typically, this is medicine, food, or other life essentials, but can also be items like clothing in some cases,” says Dennis Shirshikov, financial analyst at FitSmallBusiness.com.

The Federation of Tax Administrators keeps an updated calendar of which states are issuing tax holidays and when, so you can plan ahead.

Find The Total Sales Price For Taxable Goods And Services

When you calculate the sales tax amount for a single taxable item, the total sales price is the price listed on the product. When you calculate the amount of sales tax a customer owes for the purchase of several goods or services, add the listed sales price of each taxable item together to find the total taxable sales price.

Remember to keep non-taxable items out of this calculation and calculate their total sales price separately. Completing this step before you calculate the sales tax amount simplifies the number of calculations you need to make.

Recommended Reading: Does Contributing To Roth Ira Reduce Taxes

Which States Do Not Have Sales Taxes

As you have already learned, its not the federal government that sets sales taxes. Instead, this is controlled and collected by each individual state.

Even though the states are the ones that regulate sales taxes, there are also those that simply do not have them.

These are the 5 US states without a statewide sales tax:

In the case of Delaware, its important to note that, while the state has no sales taxes, it does impose a gross receipts tax. Unlike regular sales taxes, its not paid by the consumer but is instead being directed to the businesses. As of 2020, this tax ranges from 0.09% to 0.7%.

How To Calculate Sales Tax From Total

Sales Tax Calculation To calculate the sales tax that is included in a companys receipts, divide the total amount received . In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06.

How to create formula to calculate the sales tax?

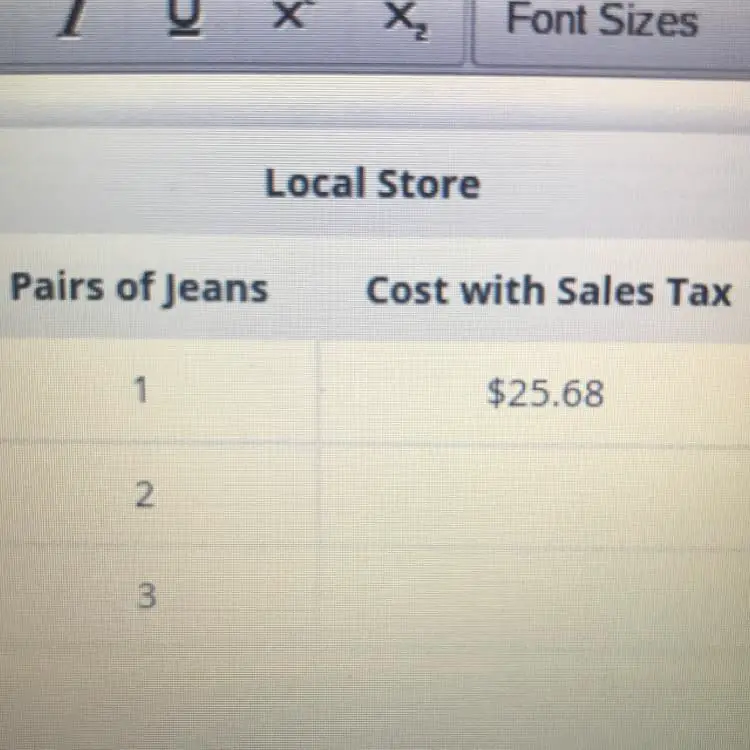

- In this condition, you can easily calculate the sales tax by multiplying the price and tax rate. Select the cell you will place the calculated result, enter the formula =B1*B2 , and press the Enter key. And now you can get the sales tax easily. See screenshot:

Recommended Reading: How To Organize Tax Documents For Accountant

What Products And Services Require Sales Tax

Each state features its own unique set of products and services that are considered taxable. Generally speaking, retail, sales of tangible items, and prepared foods are subject to sales tax. To determine whats taxable in your state, take a look at The Federation of Tax Administrators list of state revenue departments. Find your states hub page, and locate the sales tax rates, inclusions, and exemptions.

Sales Tax By States In 2021

To demonstrate the diversity of sales taxes in the United States, you can find more details about the applied sales taxes in U.S. states in the following table. Besides, you can check when the different states introduced the sales tax and if there is an exemption or reduced rate on sales of food.

|

State |

|---|

Recommended Reading: How Can I Pay Tax Online

How Retailers Can Calculate Sales Tax

The TaxJar API is a sales tax calculation engine for eCommerce merchants running their own storefront, shopping cart or marketplace. With the TaxJar API, TaxJar works within your online shopping cart to determine how much sales tax you should collect.

The TaxJar API takes your address, your buyers address, your sale and shipping amount, and the states specific sales tax rules into account to make sure you charge your customer the right amount of sales tax on every sale. Sell products like groceries or clothing that are taxed differently in different states? Need to collect sales tax on shipping? TaxJar has all those scenarios covered.

TaxJars sales tax API clocks in at sub-18ms with 99.99% uptime. Our calculations are over 99% accurate and we offer an accuracy guarantee for all TaxJar API users.

Ready to get started calculate sales tax in your eCommerce store without worrying about moving the decimal? To learn more about TaxJar and get started, visitTaxJar.com/how-it-works.

Related Resources

Do You Need To Collect Sales Tax

You must collect sales tax if your business has a presence in a state that imposes sales tax. The majority of states enforce sales tax.

If your business has nexus in several locations, you might need to collect and remit sales tax for other states, too. What is nexus? Nexus occurs when your business has a presence in a state.

You have nexus if you store inventory, have employees, use a third-party provider to ship orders to customers, or attend a trade show in a state with sales tax. Understand origin vs. destination sales tax laws to determine whether you collect sales tax using your primary or secondary states tax rate.

You might not need to collect sales tax on every transaction, or even at all. Here are some instances where you might not need to collect sales tax:

1. You do business in a state that does not impose sales tax. Alaska, Delaware, Montana, New Hampshire, and Oregon do not enforce sales tax. Although there is no state-mandated sales tax in these five states, keep in mind that there might be local sales tax laws that require you to collect.

2. There is a sales tax holiday. Many states provide a day or weekend where consumers can shop without paying sales tax. Generally, your state will designate certain items that are tax free. Do not collect tax on tax-free items during a sales tax holiday.

You May Like: Where To File Federal Tax Return In California

Do All States Have Sales Tax

While most states have a sales tax, some states do not. These states are Alaska, Delaware, Montana, New Hampshire and Oregon. Businesses operating in these states only add sales tax to their customers’ purchases if they need to collect it for the city or county. Hawaii and New Mexico also don’t have a state sales tax, but they have general excise and gross receipts taxes similar to sales tax.

Include Any Extra Customer Fees

Add all other customer fees to the results from step four to get your list price. For example, you charged $20 delivery and $10 installation fees for your product for $30 total extra fees. You then plug these fees into your net price formula and calculate to get your result.

For example:If your company’s product has a $120 list price, $32 discounts, 5% sales tax of $6, $30 in customer fees, your net price calculation would include:

Net price = $120 – $32 + $6 + $30

Net price = $124

Recommended Reading: How To Become Tax Exempt

How Does The Net Price Differ From The List Price

The list price or headline price is the cost you set to interest buyers in your products or services. When reading newspapers or checking online, customers find the list price, which may vary depending on the dealers.

For example, some dealers may provide discounts on the manufacturer’s suggested retail price, or MSRP, or increase the cost, depending on their needs. Regardless of what a store may charge, the list price is always the cost printed on the product.

Buyers don’t see the net price until after the seller calculates discounts, taxes and product fees. Stores print the net price on a receipt’s bottom and include what the customer pays the product seller.

The price then splits between the store providing the product, the manufacturer and tax-collecting groups. Stores that charge more than the manufacturer’s MSRP keep the extra money and pay the manufacturer the rest of the cash, beyond taxes and product fees.