What Other Tennessee Taxes Should I Be Concerned About

As mentioned above, Tennessee also taxes interest and dividend income. For the 2020 tax year, the tax rate is a flat 1% for all taxpayers. However, the tax is officially repealed as of Jan. 1, 2021, which means your 2020 taxes will be the last time you pay it.

Tennessee has no inheritance tax, and its estate tax expired in 2016.

Tennessee Franchise And Excise Tax

Some states levy a tax on certain legal entities for the right to exist and do business in the state. Though some states call it a transaction privilege tax or simply a privilege tax, this state calls it the Tennessee franchise and excise tax. Despite its name, this is not a tax on franchises, but an essential part of filing taxes for your LLC.

You May Be Able To Reduce Or Eliminate Your Tax Burden

Despite the profit made, it doesn’t mean you need to welcome this income tax with open arms. There are legitimate ways that you can lessen or eliminate the tax burden you owe.

Many homeowners have work done to their home or property over the years of living in it. Perhaps you bought a house in the early 2000s and over the years you’ve: renovated the bathrooms, updated the kitchen with new cabinets and countertops, finished the basement, and built a beautiful deck in the backyard. Let’s say your all-in expense for these projects was $45,000.

That expense can be used to reduce the tax burden you owe. It won’t eliminate the burden entirely, but now instead of being taxed on gains of $300,000 , you’ll be taxed on $255,000.

Using the same example, but the home improvement expenses were $51,000 instead of $45,000, the homeowner would not owe capital gains as the capital improvement expense brought the total profit below $250,000!

You May Like: Where’s My Refund Ga

Does Tennessee Have Capital Gains Tax

Tennessee is one of nine states that does not tax capital gains on a state level. That doesn’t mean residents of Tennessee, or the below 8 states, can avoid paying this tax to the federal government, but they are exempt on a state level.

The other 8 states where residents get to avoid this tax are:

- Alaska

- Washington

- Wyoming

All of the states that border Tennessee have a state-level tax on capital gains. Arkansas and South Carolina are at the top, with a state tax rate of 7%.

Many people from across the country are moving to Tennessee as it is a tax-friendly state. In particular, retirees do not pay state tax on the income they earn on their pension, 401-k, or other retirement income sources!

PRO TIP: See the top 10 places to retire in Tennessee

Short Term Capital Gains Tax Rates As Of :

The exact rate will be equal to your ordinary income tax rate. To see a breakdown of tax brackets, .

It’s important to mention income tax rates change, and these tax rates may not reflect the most recent year’s ruling. You can use a capital gains calculator to help you understand what exactly you’ll owe in taxes if you have further questions or concerns.

In addition to the above profit nuance, there is also a residency and time nuance. For the sale to be exempt from the capital gains tax, the home must have been considered the primary residence for at least two years of the last five years. That doesn’t mean those two years need to be consecutive in the last five years. For example, over the course of a five year period, if you decided to live in the home for year one, rent it out for years 2, 3, and 4, but move back in year 5, you’ve technically lived in the residence for at least two years out of the trailing five years. Under this situation, since you lived in the home for at least two years, you would pay the long-term capital gains tax rate.

Don’t Miss: How Much Is H& r Block Charge

How High Are Sales Taxes In Tennessee

Tennessee has the second-highest state sales tax in the U.S. The state rate is 7% and that is supplemented by local rates that can be as high as 2.75%. On average, the total rate paid by Tennessee residents is 9.55%.

While prescription drugs are fully exempted in Tennessee, groceries are not. Tennessee charges a lower tax rate for groceries, but it is still one of just a handful of states that taxes grocery purchases. The sales tax rate for groceries is 4%.

What Is The Sales Tax Rate In Tennessee

Tennessee sales tax varies by location. There is a state sales tax of 7%, as well as local tax imposed by city, county or school districts, no higher than 2.75%. Groceries are taxed at 5% , and some services have a different tax rate.

Tennessee also has a state single article rate of 2.75% on any single item sold in excess of $1,600 but not more than $3,200.

Read Also: How To Report Ppp Loan Forgiveness On Tax Return

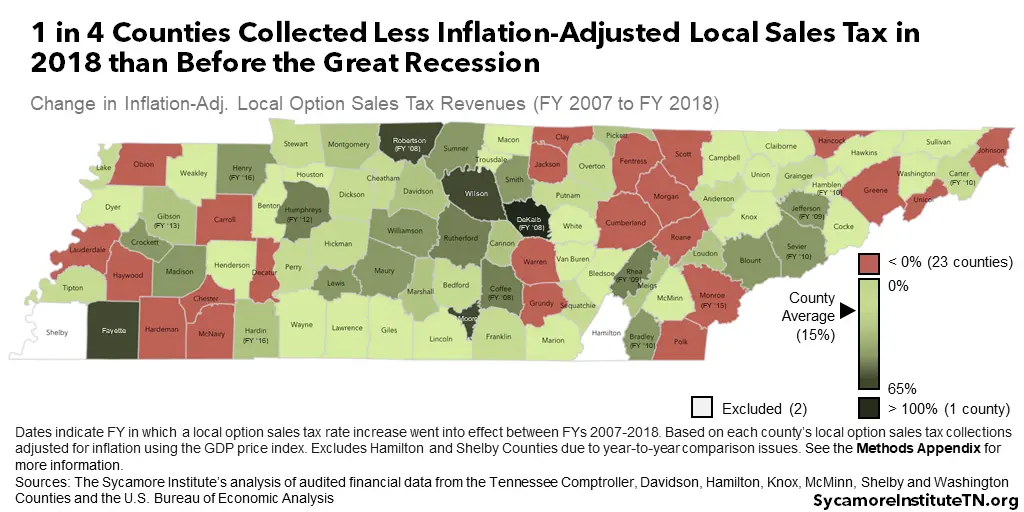

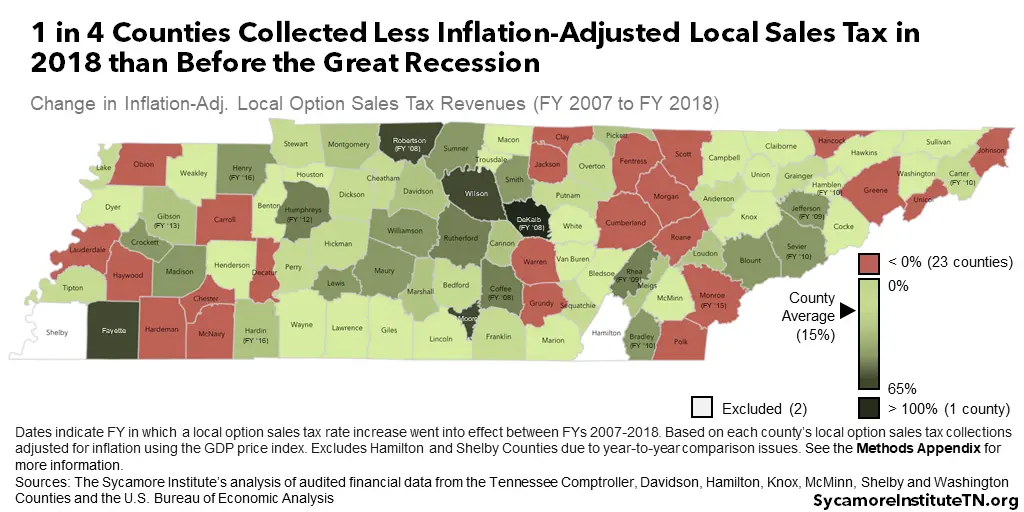

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

- Posted on

- In Counties and Cities, Economy, Taxes

The COVID-19 pandemic caused by the new coronavirus poses both health and economic challenges for Tennessee. Signs clearly point to the start of a recession that will create financial difficulties for our state and local governments, which are currently crafting their budgets for the coming year.

However, some counties will likely see greater revenue declines than others due to differences in their local economies, budget policies, and the spread of and response to the virus. Consumer spending, in particular, has taken a swift hit as businesses closed their doors and Tennesseans stayed home. This report uses local sales tax data from before, during, and after the Great Recession to shed light on how these changes might affect a key source of revenue for county governments across Tennessee.

This is our second in a series of reports exploring different aspects of the relationship between state and local government in Tennessee.

Other Taxes And Duties For Your Llc

Depending on your industry, you may be liable for certain additional taxes and duties. For example, if you sell gasoline, you may need to pay a tax on any fuel you sell. Likewise, if you import or export goods, you may need to pay certain duties.

Speak to your accountant about any other taxes or duties you may need to pay.

Also Check: Reverse Ein Lookup Irs

Tennessee Sales Tax Rates By City

The state sales tax rate in Tennessee is 7.000%. With local taxes, the total sales tax rate is between 8.500% and 9.750%.Food in Tennesse is taxed at 5.000% .

Tennessee has recent rate changes .

Select the Tennessee city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Tennessee was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Faqs On Tennessee Business Tax

Yes. Tennessee does have a sales tax, which may vary among cities and counties. You can find more information above.

Tennessee doesnt tax wages. However, it does levy taxes on dividend and interest income. You can find more information above.

Yes. Tennessee does have a franchise and excise tax. You can find more information above.

Yes. In most cases, you must pay estimated taxes to the federal government. You’ll find more information above.

You May Like: Where’s My Tax Refund Ga

City And County Sales Tax

In addition to state sales tax, Tennessee law allows cities and counties the option of assessing a local sales tax of up to 2.75 percenton the first $1,600 of the purchase price. This rate varies depending on the city and county. For example, the Nashville-Davidson County Metro area has a local tax of 2.25 percent. Accordingly, if you buy that $25,000 vehicle in Music City, you owe an additional $36 in Metro local tax.

Are Other Forms Of Retirement Income Taxable In Tennessee

The only forms of taxable income in Tennessee are interest and dividend income, and this law is being phased out in 2021 and beyond. However, regardless of this tax, it does not cover interest or dividends earned by retirement accounts, such as a 401 or an IRA. The state does not tax retirement account income at all. Likewise, pension income, whether a government pension or private pension, is not taxable.

You May Like: Buying Tax Liens California

Can I Get My Penalty Waived

The TN Department of Revenue does allow the penalty to be waived if there is a “good and reasonable cause” for the delay. One example is that the payer has no previous payment problems over the last two years. If you think you qualify, sign into your TNTAP account and follow the link for “Petition for Penalty Waiver”.

How Much Is Total Sales Tax

Calculate and then add state and local taxes together to figure out how much you’ll pay in total sales tax. Manufacturer rebates and cash incentives from dealerships don’t factor in when calculating sales tax. You must pay taxes on the original purchase price of the car. Here is an example of how to find the total sales tax for a car purchase:

- Calculate vehicle purchase price

- Multiply purchase price by 7 percent state sales tax rate

- Multiply the first $1600 by local sales tax rate

- Multiply the next $1600 by 2.75 single article rate

- Add these three tax rates together to find the total sales tax

For a car purchase with no trade-in, your equation would look like this for a $20,000 car and a 2 percent local tax rate: + + = $1476.

Recommended Reading: How To File Taxes Without Income To Get Stimulus Check

What Are Tennessee’s State City And County Sales Tax Rates

As reported by CarsDirect, Tennessee state sales tax is 7 percent of a vehicle’s total purchase price. For example, if you buy a car for $20,000, then you’ll pay $1400 in state sales tax. According to It Still Runs, Tennessee cities and counties can charge a local sales tax of up to 2.75 percent on the first $1600 of a car’s total purchase price.

City and county sales tax rates vary depending on where you buy a car in Tennessee. If you buy a car for $20,000 in a location with a 2 percent local sales tax rate, then you’ll pay an additional $32 in local tax.

When Selling A House How Much Capital Gains Tax Do You Pay

First, you must determine if you are subject to short-term capital gains or long-term capital gains. We’ll get into how to determine this below, however, it is important to note that long-term capital gains are taxed at a significantly lower rate. Short-term capital gains on the other hand are taxed at your ordinary income tax rate corresponding to your tax bracket.

If a married couple makes more than $500,000 profit, and a single filer makes more than $250,000, you can expect to pay taxes to the IRS as follows.

Don’t Miss: How To Protest Property Taxes In Harris County

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Long Term Capital Gains Tax Rates As Of :

Your capital gains tax rate as a single filer

- 0% if your income is between $0 and $40,000

- 15% if your income is between $40,0001 and $441,450

- 20% if your income exceeds $441,561

Your capital gains tax rate as a married couple, filing jointly

- 0% if the combined income is $0 – $80,000

- 15% if the combined income is $80,001 to $496,600

- 20% if the combined income is $496,601 or more

You May Like: Amended Tax Return Online Free

How Much Is Sales Tax For A Car In Tennessee

Sales tax for a car in Tennessee includes a state sales tax, a county or city sales tax, and a single article tax. Your sales tax total depends on if you have a car to trade in, where you buy the car, and if you qualify for any tax exceptions. Car sales tax in Tennessee applies to all road vehicles, whether bought new or used from a private party or a licensed dealer.

There are two ways to calculate the vehicle purchase price in order to apply the 7 percent state sales tax. If you don’t have a trade-in, then the purchase price is the amount you agree to pay prior to any rebates or incentives. If you have a trade-in, then the purchase price is the amount remaining after applying your old car’s trade-in value to your new car’s price. As confirmed by the SalesTaxHandbook, Tennessee doesn’t tax the value of your trade-in vehicle.

Local sales tax varies by location. The maximum charge for county or city sales tax in Tennessee is $36 on the first $1600 of a car’s purchase price. A single article tax is another state tax to consider when purchasing a car. It’s a 2.75 percent sales tax that’s applied to the car’s purchase price when it’s over $1600 but not more than $3200. Single article taxes for purchases over $3200 are capped off at $44 according to the Knox County Clerk’s office.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Read Also: How Much Is Payroll Tax In Louisiana

What Is The Tennessee Property Tax Relief Program

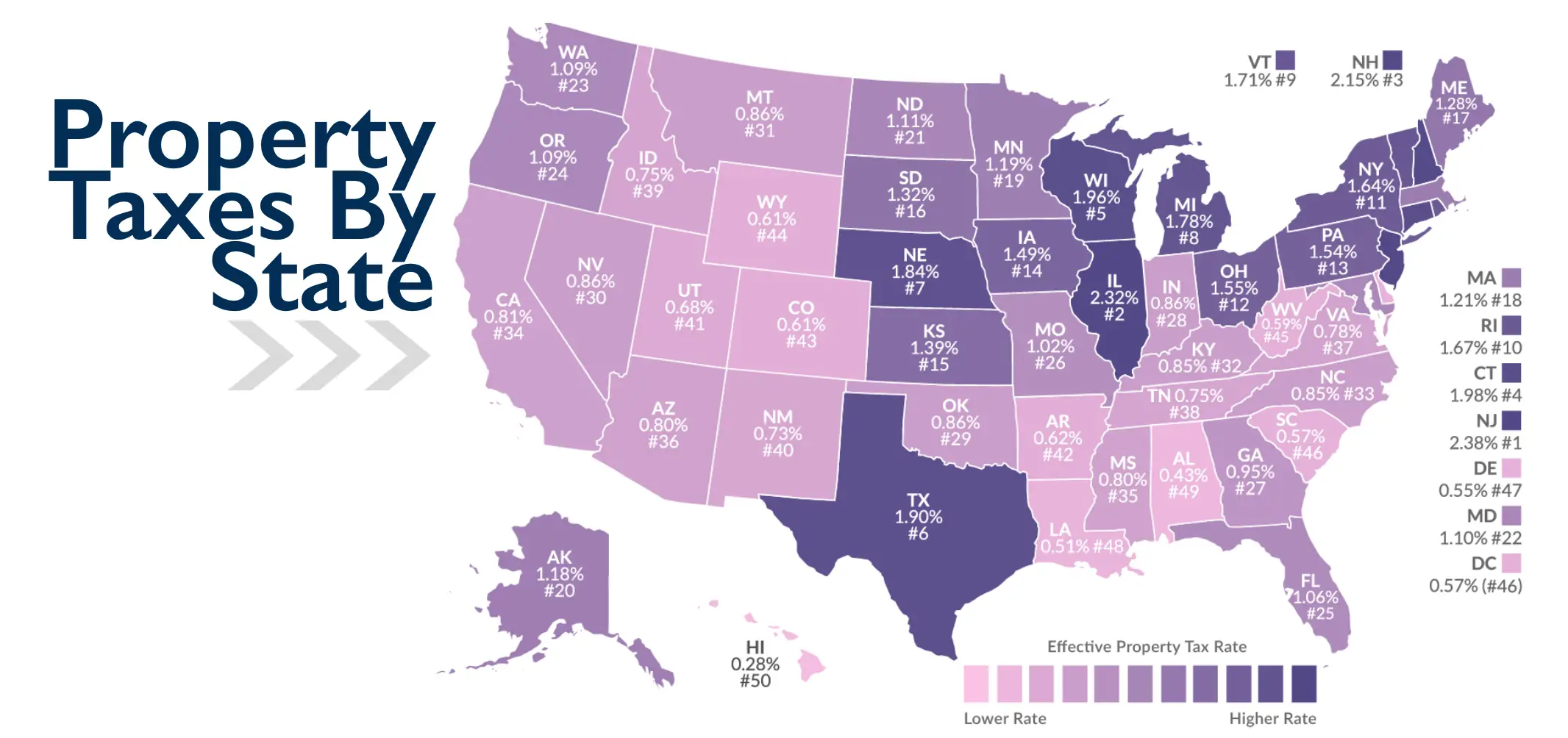

The state of Tennessee provides property tax relief to some elderly or disabled homeowners. To qualify, the applicants total household income can be no greater than $30,700. This includes Social Security benefits and other retirement income.

Senior applicants must be at least 65 years old, while disabled homeowners must be fully disabled according to the Social Security Administration . Eligible homeowners will receive an exemption of $29,000 on their home value. So, if your total home value is $100,000, your taxes will only apply to $71,000 of that amount.

Capital Gains On Selling A Home In Tennessee

Felix Homes

Whether you invest in real estate or the stock market, you’ll need to keep capital gains taxes front and center of your mind so you do not get hit with any tax surprises when you file your return. Taxes are confusing, and there’s no shortage of confusion when it comes to discussing capital gains taxes. If you live in Tennessee and you’re interested in learning about capital gains taxes, this article is perfect for you. We’re here to clear the air and keep you informed on everything you need to know regarding capital gains tax.

Recommended Reading: How Do I Protest My Property Taxes In Harris County

What Is Taxable In Tennessee

Tennessee sales tax applies to the sale of most goods, commonly known as tangible personal property . This includes property that can be seen, weighed, measured, felt, or touched. It also includes gas, steam, electric, water, and pre-written computer sofware. Custom-written software is taxable in certain situations as well.

Most other services are not taxable, including : furniture moving, medical services, beauty services, carpentry, lawn care service, and others.

For more details please see Tennessees Sales and Use Tax Guide.

Filing Your Tennessee Sales Tax Return

Tennessee requires all sales and use tax returns and payments to be filed and paid electronically. This is done through the Tennessee Taxpayer Access Point . First time filers must register for an account in order to file their return and make payments. After that, filers log in with their username and password to make file future taxes.

A helpful video about filing your sales and use tax return through TNTAP can be found here.

Read Also: Where’s My Tax Refund Ga

How Much Sales Tax For A Car In Tennessee

Whether you buy a new or used car in Tennessee, you must pay sales tax on the purchase unless it is exempt. Vehicle sales are subject to the Tennessee state sales tax and an additional single-article tax depending on the sales price of the vehicle. Since the sales tax also includes county or city taxes, the overall rate varies depending on where in the state you buy your vehicle. Most counties have an online calculator to help you understand the taxes you owe on your purchase.

Tennessee Sales Tax Exemptions

What is Exempt From Sales Tax In Tennessee?

The state of Tennessee levies a 7% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1% and 2.75%. The range of total sales tax rates within the state of Tennessee is between 8.5% and 9.75%.

Use tax is also collected on the consumption, use or storage of goods in Tennessee if sales tax was not paid on the purchase of the goods. The use tax rate is the same as the sales tax rate. Returns are to be filed on or before the 20th day of the month following the month in which the purchases were made. For example, purchases made in the month of January should be reported to the state of Tennessee on or before the 20th day of February.

Read Also: Have My Taxes Been Accepted