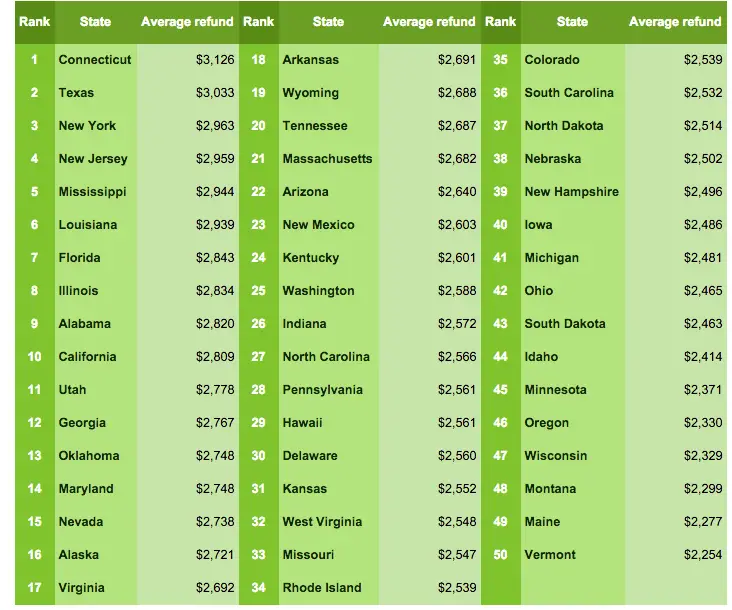

Should You Move To A State With No Income Tax

If youre trying to determine whether moving to a state with no income tax is financially worth it, start by taking a look at your most recent tax return. Calculate how much you paid in state income taxes and determine your individual income tax rate. Then, compare that total with what you would be paying in the state where you wish to move.

But those calculations should be the tip of the iceberg, according to Steber. Compare the property tax and sales tax rates of both locations, along with cost-of-living considerations, such as housing and food.

Familial and educational considerations might matter as well, which might not be immediately on your radar. Steber, for instance, ended up having to pay out-of-state tuition to his childrens colleges back in Alabama after the family moved across state lines to Florida.

I would tell you, if I had stayed in Alabama, I wouldnt pay out-of-state tuition, which wouldve offset the income tax that I wouldve had, he says.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Double Check Your Tax Return Before You File

Double checking your tax return prior to submission can ensure your tax refund is processed quickly. Failure to do so may cause the IRS to delay the processing of your tax refund.

Here is a list of questions to review prior to filing your tax return to ensure the IRS processes your tax refund as quickly as possible.

- Did I review my identifying numbers for myself, spouse and dependents?

- Did I ensure the names on my tax return are spelled correctly?

- Did I review my dependents information?

- Have I reviewed my banks routing and account numbers for accuracy?

- Did I include the correct date of birth for myself and dependents

- Did I electronically sign my tax return ?

Don’t Miss: How Do Tax Liens Work

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Does Accepted Mean My Refund Is Approved

Not yet. Accepted means your tax return is now in the government’s hands and has passed the initial inspection .

After acceptance, the next step is for the government to approve your refund.

First they look for things like back taxes and unpaid child support. If they find any debts, they’ll offset your refund to cover the outstanding amount. Once they are satisfied that you have no outstanding debts, they will approve and then issue your refund.

Think of the e-filing/refund process like applying for a job: although the employer has received your job application, they still have to review your application before they grant you an interview .

Related Information:

Read Also: How To Claim Babysitting Expenses On Taxes

What Does It Mean If The Irs Accepts The Tax Return

In the wake of submitting an accepted tax return online, the client will be alarmed and approved by the Internal Revenue Service. This does not imply that the division is through with investigating your return, just that the IRS has not discovered any undeniable issues making it to be denied. The organization actually needs to complete the survey of your reports and go over your insights.

Tax Refund Schedule For Extensions And Amended Tax Returns

The refund schedule should be the same if you filed for a tax extension however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take eight-12 weeks to process. If you do not receive an amended tax return refund within eight weeks after you file it, then you should contact the IRS to check on the status.us.

Recommended Reading: Can You Claim College Tuition On Taxes

Important Filing Season Dates

- Friday, February 12. IRS begins 2021 tax season. Individual tax returns start being accepted and processing begins.

- Thursday, April 15. Due date for filing 2020 tax returns or requesting extension of time to file.

- Thursday, April 15. Due date for paying 2020 tax owed to avoid owing interest and penalties.

- Friday, October 15. Due date to file for those requesting an extension on their 2020 tax returns.

How Long Does It Take For Irs To Approve A Refund After It Is Accepted

Whenever you are accepted, you are on the IRS installment schedule. Just the IRS knows the status of preparing your tax return, regardless of whether you owe taxes or are expected a refund. In earlier years, the IRS gave more than 9 out of 10 refunds to citizens in under 21 days a year ago. Similar outcomes are expected for 2021.

Recommended Reading: How To Restart Taxes On Turbotax

My Tax Return Was Accepted Now What

While millions of people are still struggling with their Federal income tax paperwork and have not even set up an appointment with their accountant yet, millions more have already filed their tax returns and are waiting for what happens next. After filing their returns, many taxpayers check with their tax professionals or the IRS website on the status of their returns. When doing so, its common to receive a notice that a tax return has been accepted. However, despite receiving that notice, theres often little other follow-up. Users typically dont receive any refunds immediately after receiving this notification , or further indication of what the IRS is doing with the return. If dealing with your tax return already raises your anxiety levels, sitting idle after your tax return has been accepted can be downright stressful, especially if you dont know what that even means. My tax return was accepted now what? Read on to discover what to expect.

Irs To Accept 2021 Tax Returns Starting Jan 24

The IRS will begin accepting and processing 2021 tax returns starting Jan. 24, the Service announced Monday.

In News Release IR-2022-08, the IRS stated the date will allow it time to perform necessary programming and testing in advance of return filing, which it urged taxpayers and paid preparers to do electronically.

“Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year,” IRS Commissioner Chuck Rettig said in the release.

Rettig acknowledged that the Service is still processing some tax year 2020 returns. All paper and e-filed returns with refunds owed that were received before April 2021 have been processed if they did not contain any errors or require further review however, as of Dec. 23, 2021, there were still some 6 million unprocessed individual returns. And the Service has struggled to answer a record number of taxpayer and preparer phone calls, Rettig said.

“In many areas, we are unable to deliver the amount of service and enforcement that our taxpayers and tax system deserves and needs,” Rettig said. “This is frustrating for taxpayers, for IRS employees, and for me.”

Taxpayers who received the third economic impact payment during 2021 should receive Letter 6475, Your Third Economic Impact Payment, to help them and their preparers determine whether they are eligible to receive a rebate recovery credit for missing stimulus payments.

Don’t Miss: How Long Can You Wait To File Taxes

These States Are Taxing Forgiven Student Debt

While majority of states do not impose taxes on forgiven student loan balances, a handful will. Right now, we know Indiana, Minnesota, Mississippi and North Carolina all plan to tax forgiven student loans.

And two more states, Arkansas and Wisconsin, could follow suit, but haven’t yet confirmed their tax plans.

How Long Does It Take For A Tax Refund To Show In A Bank Account

The IRS sends more than 9 out of 10 discounts to citizens in under three weeks.

Shockingly, a 21-day conveyance of your tax return is not ensured. There are various variables including the decisions you make when you record that could affect what amount of time it requires for you to get your expense discount.

You will pick how you need to get any discount the IRS owes you. Here are your choices:

- Direct deposit into your bank account .

- Paper check sent through the mail.

- Check card holding the estimation of the discount.

- Buy up to $5,000 in the United States Investment funds Bonds.

- Split your discount among up to three monetary records in your name, including a conventional IRA, Roth IRA, or SEP-IRA

The conveyance alternative you decide for your tax refund will influence how rapidly you get your assets. As indicated by the IRS, the quickest method to get your discount is to join the direct deposit strategy with an electronically recorded assessment form.

The following is an expected breakdown of how soon you may hope to get your tax refund, in light of filing and conveyance decisions.

Also Check: When Are Federal Taxes Due 2021

Irs Free File And Other Resources

IRS Free File is available to any person or family with an adjusted gross income of $73,000 or less in 2021. Leading tax software providers make their online products available for free. Taxpayers can use IRS Free File to claim the Child Tax Credit, the Earned Income Tax Credit and other important credits. IRS Free File Fillable Forms is available for taxpayers whose 2021 AGI is greater than $73,000 and are comfortable preparing their own tax returnso there is a free option for everyone.

Online Account provides information to help file an accurate return, including Advance Child Tax Credit and Economic Impact Payment amounts, AGI amounts from last year’s tax return, estimated tax payment amounts and refunds applied as a credit.

Taxpayers can also get answers to many tax law questions by using the IRS’s Interactive Tax Assistant tool.

Additionally, taxpayers can view tax information in several languages by clicking on the “English” tab located on the IRS.gov home page.

Will There Be Tax Delays Due To Covid

The IRS is warning that a resurgence of COVID-19 infections on top of less funding authorization from Congress than the Biden administration had requested could make this filing season particularly challenging.

The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund dont face processing delays, IRS Commissioner Chuck Rettig said.

Avoiding a paper tax return will be more important than ever this year to avert processing delays, he said.

Don’t Miss: Who Can I Call For Free Tax Questions

My Refund Check Is Now Six Months Old Will The Bank Still Cash The Check

A check from the NC Department of Revenue is valid up to six months after the date on the check. If a check date is older than six months, you should mail a letter along with the refund check to NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh, NC 27602-1168. Your check will be re-validated and re-mailed to you.

What About My State Tax Refund

What weve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refund.

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive or longer, if your state has been or still is under social distancing restrictions. To find out the status of your refund, youll need to contact your state tax agency or visit your states Department of Revenue website.

Recommended Reading: Can I File Taxes If I Have No Income

How Can I Check The Status Of My Refund

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

You May Like: Do You Have To Pay Taxes On Plasma Donations

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you’re receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

To Speed Refunds And Help With Their Tax Filing The Irs Urges People To Follow These Simple Steps:

- File electronically and use direct deposit for the quickest refunds.

- Check IRS.gov for the latest tax information, including the latest on Economic Impact Payments. There is no need to call.

- For those who may be eligible for stimulus payments, they should carefully review the guidelines for the Recovery Rebate Credit. Most people received Economic Impact Payments automatically, and anyone who received the maximum amount does not need to include any information about their payments when they file. However, those who didn’t receive a payment or only received a partial payment may be eligible to claim the Recovery Rebate Credit when they file their 2020 tax return. Tax preparation software, including IRS Free File, will help taxpayers figure the amount.

- Remember, advance stimulus payments received separately are not taxable, and they do not reduce the taxpayer’s refund when they file in 2021.

You May Like: What Is The Sales Tax In Washington

How To Track Your Refund Using The Irs Wheres My Refund Tool

To use the IRS tracker tools, youll need to provide your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure its been at least 24 hours before you start tracking your refund, or up to four weeks if you mailed your return.

Go to the Get Refund Status page on the IRS website and enter your personal data, then press Submit. You should be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, youll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

What To Do Once Your Refund Arrives

For many people, their IRS tax refund is the biggest check they receive all year, the IRS says. In anticipation of your windfall, its wise to have a plan for how youre going to use your windfall. Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you.

Your refund is yours to use how you see fit and can be used to help pay for day-to-day expenses or invested for long-term financial stability.

Also Check: Taxes For Door Dash

Recommended Reading: What Do You Claim On Your Taxes