How Do I Access My Old Turbotax Account

Enter either your phone number or the email address in the space provided. You can now log in to your account using your new credentials. In the end, tap on the save option and save all the changes made. Now, you will have to type the existing password that you are using. You will then have to type all the changes that you will have to make.

By changing your password, you make sure that you are the only one who can access your account. For an additional security level, you can activate the confirmation in two steps. Here is how to change my TurboTax login turbotax password reset if I forgot my TurboTax username and password. In case, if the hackers have hacked users accounts, then the reason for resetting the password would be highly necessary, or else the information could be breached.

You are unable to complete the steps to reset the TurboTax password. You must contact one of our executives immediately. Our TurboTax staffs are available around the clock to offer you all kinds of help. If you are unable to complete the steps to reset the TurboTax password, you must contact one of our executives immediately. Ideally, accessing your TurboTax account or password shouldnt be difficult as long as you have your user ID and correct password. All you have to do is enter the correct user ID and password and you will be redirected to your profile.

Is Turbotax Live Worth The Cost

In our view, most tax situations will not require TurboTax’s expert help upgrades. The main strength of TurboTax is that it’s accessible and comprehensive, meaning that the process offers enough information that you don’t need to dig to find it. Many of your questions can be answered through its online resources. That makes the added Live assistance category, where you can ask an expert questions and have them review your return at the end, mostly unnecessary.

The category of Full Service is akin to a separate product. You’re simply sending your tax documents to a CPA or tax preparer, so you’re not using any of TurboTax’s interface — it’s just a way to find a qualified tax preparer through TurboTax. Our recommendation would be to compare the cost of a local tax expert with TurboTax’s Full Service option to determine which makes sense for you.

How To Estimate Your 2021 Tax Refund: Tips Calculators And More Cnet

How to estimate your 2021 tax refund: Tips, calculators and more.

For many, this is the amount withheld from their paychecks by an employer. As long as you own both wallets theres no tax to pay on transfers. However, you still have to keep track of the original cost of the transferred coins and have sufficient proof of it. Its actually very difficult to avoid crypto taxes. Every time you transfer funds to an exchange you are leaving a papertrail that tax agencies can catch on to.

Recommended Reading: Www.1040paytax.com Review

Turbo Tax Has Its Own Free Service For Certain Users

Intuit had been participating in the IRS program for more than 20 years before it announced its withdrawal. According to Fox Business, Intuit had prepared about three million returns processed through the IRS Free File in 2020.

Turbo Tax does have its own free service, but it’s only available to certain people filing simple tax returns, ABC-affiliate News 10 in Albany, New York, reported. Customers who have itemized deductions, unemployment income reported on a 1099-G, business of 1099-NEC income, stock sales, income from rental properties, charitable donations, education donations, and credits, deductions, and income reported on schedules 1-3 cannot use Turbo Tax’s separate free filing service, according to the news outlet.

RELATED: For more financial news delivered straight to your inbox, .

Turbotax Reset Password Not Working How To Fix

Finally, you know how to change your Turbotax password with email. Go to the Turbotax login page, and with your login details. Enter the phone number you registered the account with. Youve successfully recovered your lost Turbotax account. Now, you need to recover the TurboTax files. Go to the Start menu and locate the search button.

Whether you are using a tablet, mobile phone, computer with any operating system, TurboTax has the right solution for you. The first thing you must do is to open your TurboTax software. Users could get malware into their system online if their TurboTax account being hacked by the attackers. The data stored in the account could be compromised in order to gain any sort of advantage taking by hackers.

Recommended Reading: 1099 Nec Doordash

Who Should Use Turbotax

While there are multiple approaches to filing your taxes — hiring a CPA, using third-party software or using one of the IRS’s Free File Online partners — TurboTax will make the process easier for the widest range of people. Intuit offers four products, covering a spectrum of taxpayer situations. Individuals and families with a simple tax return, meaning a single W-2 and no investment or rental income, should be able to use the basic software for free.

That noted, TurboTax will not be the best choice for everyone. If you have a more complicated tax situation — say, you’re a self-employed worker with multiple clients or side hustles — TurboTax’s business packages may be overkill and more expensive than others. In fact, if you’re not inclined to hire a CPA, we recommend TaxSlayer for self-employed individuals.

It’s also worth noting that if you worked in multiple US states in 2021, and will need to file , there may be better alternatives. At around $50 a pop per state return, TurboTax doesn’t look as good as Jackson Hewitt, which charges $25 and includes free, unlimited state returns when you file a federal return.

How To Opentax File Without Turbotax

In case you have removed Turbotax deluxe from your system, you can still open the. Tax file. Below we have mentioned the process of how to open a .tax file without TurboTax.

- First, you will have to click on the start icon and then look for the tax2011 file. You will then have to change the year to the preferred one.

- Now, you will have to right-click on the name of the file and then start Turbotax software.

- You will then have to make sure that you have similar versions of the Turbotax application and the file.

- When done, tap on the file option and choose the Open option.

Winding Up

So, if you have chosen the wrong version of Turbotax and you wish to change it, this was all you need to do to start over on Turbotax. Hopefully, this guide was helpful.

Also Check: Do You Have To Report Income From Plasma Donations

Check Your Drive For Errors

Corrupted or missing system files may prevent you from installing new software on your computer. Run the DISM and SFC commands, and then check your disk for errors.

After that, right-click on the TurboTax installation file, and select Run as Administrator.

Tax Changes In 2019 2020 And 2021

Recent tax changes include the following:

- Alimony: Previously, the IRS allowed individuals paying alimony to deduct this from their taxable income while those receiving alimony counted it as part of their taxable income. Tax reform changed this rule effective for any alimony agreements entered into after December 31, 2018.

- : This payment, also known as the individual mandate under the Affordable Care Act, has been eliminated.

- The 7.5% deduction: Congress passed an extenders bill in 2019 that made the 7.5% deduction floor apply for 2019 tax year returns as well. In December of 2020, the Consolidated Appropriations Act made this 7.5% threshold permanent.

- The standard deduction: The standard deduction increased in 2021 to account for inflation. For most filers the amounts are:

- Single and married filing separately filers: $12,550

- Head of household filers: $18,800

Read Also: Taxes Taken Out Of Paycheck Mn

How To Start Over On Turbotax

After youve registered for TurboTax Online, you wont be able to Clear & Start Over. Consider creating a new account with a different username if its more convenient. A single email address can be used to link up to five accounts.

If you have accidentally deleted your tax return, you may be wondering how to start over on Turbotax. You can do so by following the steps below. First, tap on the File tab on your Turbotax screen. Then, select the option to file a new return.

Next, if you have problems with your original file, delete it and any PDF copies of the files concerned. Once you have deleted the original file, you can start over and file a new one.

How To Reset A Forgotten Turbotax Login Password

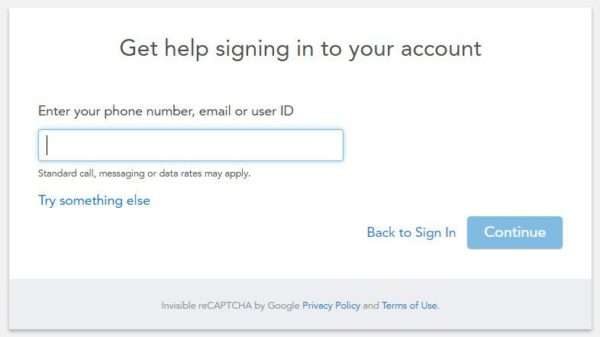

In case you also do not remember your password or account credentials, this post can be helpful. Here, we have explained to you how to use account recovery Turbotax on the system. Keep reading to retrieve credentials in some simple steps. The first time you login, enter your Username and Password in the login box which is located throughout the Turbotax Usa site. If you cannot remember your Username or Password use the Forgot Username or Forgot Password links to receive a reset email to your primary email address.

Or, click the blue Download/Share button to either download or share the PDF via DocuX. Step 6 To recover the password via email Id, you can change it via the code and a link that you will receive. You need to verify the code on the given link that you will receive. To recover your TurboTax password, follow these steps. On the login page, youll see I forgot my user ID or password option. With TurboTax 2019, you can track your refunds and access tools like TurboTax calculator etc.

Also Check: Do I Have To File Taxes For Doordash

Turbo Tax Is No Longer Allowing Users To Use The Irs Free Filing Program

Turbo Tax will no longer participate in the IRS Free File Program, starting Jan. 24 when the new tax season begins. The software’s parent company, Intuit, actually announced this change for the new year in July 2021, but many taxpayers were likely unaware because even early filers don’t start thinking about taxes until January or February, USA Today explained.

“Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax,” the company explains on its website. “With the Free File program surpassing its founding goals of e-file and free tax preparation, and due to the limitations of the Free File program and conflicting demands from those outside the program, we are not able to continue in the program and deliver all of the benefits that can help consumers make more money, save more, and invest for the future.”

Get Your Taxes Done Right With Turbotax 2020

TurboTax is tailored to your unique situationâit will search for the deductions and credits you deserve, so youâre confident youâll get your maximum refund.

- Get your taxes done right and your maximum refund

- Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately.

- Free product support via phone

- Extra help to maximize 350+ deductions and credits

- Accurately deduct mortgage interest and property taxes

- Coaches you and double checks every step of the way

Free Trial of Quicken Starter Edition 2021

- Get your complete financial picture at a glance–view balances, budgets, accounts and transactions, see spending trends and search transaction history, all in one place

- To redeem your Quicken offer and get more information about Quicken, install your TurboTax software and click âClaim this offerâ

TurboTax Deluxe is recommended if any of the following apply:

- Need to file both Federal & State Tax Returns

- Own a home

- Have charitable donations to deduct

- Have high medical expenses

Read Also: Door Dash Taxes

I’m Still A Turbotax Fan And Will Use It This Year

My biggest advice to anyone looking to do taxes themselves online: don’t click the Free File option unless you’re sure you qualify!

I was ultimately happy with the resolution Intuit customer service offered. It was a bit frustrating to get caught up how I did, but it was because of IRS rules. The highest levels of customer support were very friendly, helpful, and figured out a resolution that worked for me.

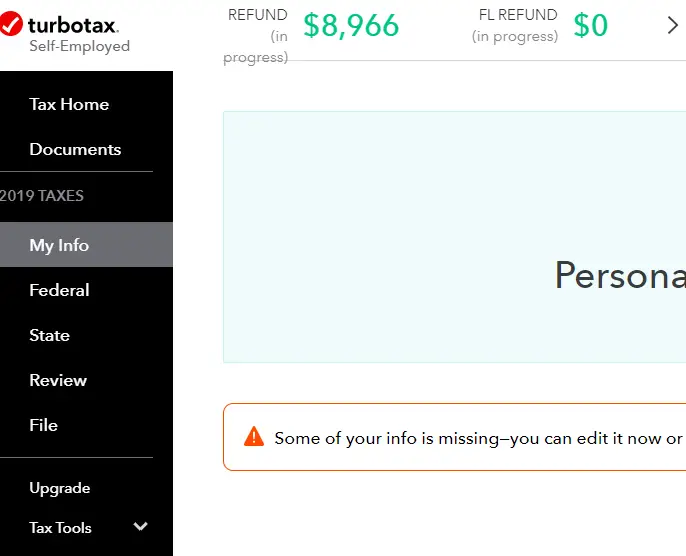

I’m planning to use TurboTax again this year for my personal taxes and already got started with my 2019 return in the self-employed, online version of TurboTax.

What Was The Big Criticism

Big names, like Intuit’s TurboTax and H& R Block, faced much criticism back in 2019 after a ProPublica investigation detailed how the companies limited the program’s reach by making free options more difficult to find online and instead figuring out a way to steer eligible taxpayers into products that weren’t free.

ProPublica’s reporting included pointing out that Intuit added code to the Free File landing page of TurboTax that hid it from search engines like Google, making it hard to find.

In January 2020, the IRS announced some changes designed to offer more consumer protections.

One such change: Tax preparation firms agreed that they would not exclude “Free File” landing pages from an organic internet search.

The IRS suggested that taxpayers search for standard labeling: “IRS Free File program delivered by .”

As part of IRS Free File, taxpayers cannot be offered bank products that often carry fees, such as high-cost refund anticipation loans.

If you used IRS Free File last year, the company you used is required to send you an email welcoming you back to their official IRS Free File services.

The email must include a link to the companys IRS Free File site and explain how to file with it. If you choose this email link and qualify, you will not be charged for preparation and e-filing of a federal tax return.

Read Also: How To Pay Taxes Doordash

S To Uninstall Turbotax Deluxe

To entirely remove TurboTax Deluxe from your Mac, you need to know how to manage its files in your system. Luckily, Mac uninstalls are much more accessible than those for Microsoft Windows.

If you are a beginner, this guide will guide you through the process. You will find the steps below easy to follow. Continue reading to learn how to remove TurboTax deluxe. If you encounter any difficulties along the way, you can always consult the support page.

To uninstall TurboTax deluxe from your Mac, you can use a Mac uninstaller utility. If you have a Mac, you should consider using PowerMyMacs Uninstaller. It has an expert uninstaller that will remove TurboTax and other unwanted Mac software without leaving any leftover files or registry entries. After completing the steps above, youre ready to uninstall TurboTax deluxe on your Mac.

To uninstall TurboTax from your Mac, start searching for the TurboTax application in the programs search box. A list of all its files and documents will appear on the right side of the window. Click Clean and choose Uninstall. After confirming the uninstallation, restart your computer to complete the process. TurboTax has been uninstalled successfully. You can also reinstall it if you need to.

Get The Tax Support You Deserve

TurboTax products are tailored to your tax situation and how much help you need while filing your taxes. To find the right version of TurboTax for you:

Step 1: decide what level of tax filing help you want

Whether youre filing on your own, with expert help or handing off your taxes, weve got you covered. We offer three different levels of help across all our products:

- TurboTax Online makes it easy to securely file your tax return, from start to finish, on any device. With the flexibility and convenience of the TurboTax Mobile App, you can fill out your return anywhere, anytime. Just answer simple questions, and well guide you through filing your taxes.

- With TurboTax Live Assist & Review, you get unlimited guidance from one of our TurboTax experts to answer all your questions. After youre done, your tax expert will review your return one line at a time, so that nothing is missed. You can file with full confidence knowing that your return is 100% accurate.

- With TurboTax Live Full Service, you hand over your taxes to a TurboTax expert to prep and file. Just set up your account, authorize us to get your tax slips and well match you with the right tax expert who will prepare your return from start to finish, claiming all your credits and deductions and getting you the best possible outcome.

Step 2: determine what complexity level you fall into based on what you need to report on your return

Don’t Miss: How To Appeal Cook County Property Taxes

How To File An Amended Return

To proceed with preparing and filing your amended return, all you need to do is file Form 1040-X, Amended Tax Return, along with the corrected or additional documents you didn’t originally file with your return. This will amend your return and give you an accurate picture of your tax situation. Federal returns can now be amended by electronically filing them, but only as far back as 2019 .

The IRS advises that you file an amended return with a claim for refund within three years of the day you filed your original return, or within two years of the day you paid outstanding tax, whichever is later. If you file a return before the due date , the IRS treats it as though you filed it on the due date. Withholding is deemed to be tax paid on the due date.

If you experienced changes related to any of the items above that have occurred since tax reform went into effect, you should file amended returns as soon as possible to correct any errors or oversights.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.