Apply For A Vehicle Tax Exemption

Apply at a Post Office that deals with vehicle tax.

You need to take:

- the log book in your name

- your vehicle tax reminder letter , if you have one

- an MOT certificate thats valid when the tax starts, or evidence if your vehicles exempt from an MOT

- an insurance certificate or cover note

If you do not have the log book, download and fill in an application for a log book . Take it to the Post Office with the £25 fee.

Frequently Asked Questions About The Nonresident Speculation Tax

Is the NonResident Speculation Tax related to the requirement to provide additional information?

The obligation to provide additional information is separate and distinct from the application of the proposed NonResident Speculation Tax . The NRST applies to certain transactions within the Greater Golden Horseshoe Region . The requirement to provide additional information applies to certain transactions in all of Ontario. More details on the requirement to provide additional information may be found on our webpage Prescribed Information for the Purposes of Section 5.0.1 Form.

I signed my agreement of purchase and sale on April 19, 2017. I am not a Canadian citizen or a permanent resident of Canada. Do I have to pay the NRST?

There is no NRST payable if the both the seller and the buyer signed a binding agreement of purchase and sale on or before April 20, 2017, and if an assignment of the agreement is not entered into after April 20, 2017.

I am a Canadian citizen living outside of Canada and I wish to purchase land in the Greater Golden Horseshoe Region. Will my purchase be subject to the NRST?

If a Canadian citizen buys residential land alone or along with other Canadian citizens or with permanent residents of Canada, he or she will not be subject to NRST. It is not relevant whether any of the Canadian citizens live in Canada or not.

“permanent resident means a person who has acquired permanent resident status and has not subsequently lost that status under section 46.”

*

Property Tax Exemptions Faqs

What are the different types of property tax exemptions?

For those who qualify, tax exemptions generally come in four different categories: Seniors: You may be eligible if you have a limited income and you are at or above a certain age People with disabilities: You may get an exemption if you have limited income and a disability keeps you from working Veterans: Armed forces vets with a total disability and veterans with serviceconnected disability ratings of 80% or may get an exemption Homestead: most states have a homestead property tax exemption that allows you to protect a certain amount of the value of your primary property from taxes

Are real estate taxes the same as property taxes?

Yes, real estate tax and property tax are considered the same. The Internal Revenue Service uses the term real estate tax. However, most homeowners call it property tax.

What’s a tax exemption vs. tax deduction?

These two are similar, but not synonymous. Much like a deduction, a tax exemption reduces your taxable income. However, exemptions excuse parts of your income from your taxable income and depend on your filing status and how many dependents you claim.

What is a property tax deferral?

A deferral means you can delay paying property taxes, as long as you meet the age and income guidelines. The property tax then becomes a lien on your house, which gathers interest as long as it goes unpaid.

Also Check: Federal Irs Tax Return

What If Purposes Or Programs Change After An Application Is Submitted

If the organization’s organizing documents, purposes, or programs change while the IRS is considering an application, you should report the change in writing to the office processing your application. If you do not know the office that is processing your exemption application, contact Exempt Organizations Customer Account Services.

Because material changes in a charity’s structure or activities may affect its tax-exempt or public charity status, organizations should report such changes to the IRS Exempt Organizations Division. See procedures for reporting changes for a complete discussion.

Entities Subject To The Nrst

The NRST applies to foreign entities or taxable trustees who purchase or acquire residential property in the GGH.

A foreign entity is either a foreign corporation or a foreign national.

A foreign corporation is a corporation that is one of the following:

A foreign national, as defined in the Immigration and Refugee Protection Act , is an individual who is not a Canadian citizen or permanent resident of Canada.

A permanent resident means a person who has acquired permanent resident status and has not subsequently lost that status under section 46 of the Immigration and Refugee Protection Act .

A taxable trustee means a trustee of:

Taxable trustee does not include a trustee acting for the following types of trusts:

Recommended Reading: Buying Tax Liens In California

When To File For 501 Status

To get the most out of your tax-exempt status, you’ll want to file your Form 1023 within 27 months of the date you file your nonprofit articles of incorporation. If you file within this time period, your nonprofit’s tax exemption takes effect on the date you filed your articles of incorporation . If you file later than this and can’t show “reasonable cause” for your delay , your group’s tax-exempt status will begin as of the postmark date on its IRS Form 1023 application.

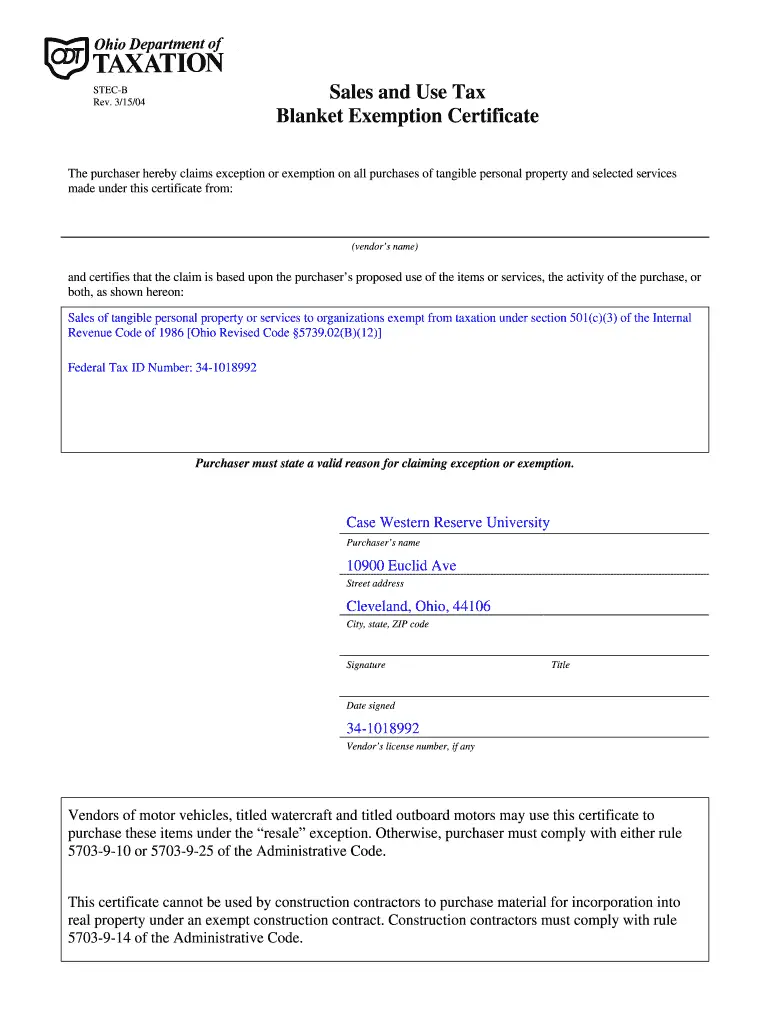

Where To Get A Certificate Of Tax Exemption

The Certificate of Tax Exemption is obtained from the Revenue District Office having jurisdiction over the residence of the taxpayer or where the taxpayer is registered.

- Certified True copy of government recognition/permit/accreditation to operate as an educational institution issued by the Commission on Higher Education , Department of Education , or Technical Education and Skills Development Authority

- If the government recognition/permit/accreditation was issued five years prior to the application, an original copy of a current Certificate of Operation/Good Standing or other equivalent document issued by the appropriate government agency shall be submitted as proof that it is operating as non-stock and nonprofit educational institution

- Original copy of the Certificate of Utilization of Annual Revenues and Assets by the Treasurer or his equivalent of the non-stock and nonprofit educational institution

You May Like: Protesting Harris County Property Tax

Canada Pension Plan Contributions

Income from employment or self-employment that is exempt from tax under section 87 of the Indian Act is also exempt from CPP contributions. However, an employer can elect to participate in the CPP. See Form CPT 124, Application for Coverage of Employment of an Indian in Canada under the Canada Pension Plan. If an employer has chosen not to cover the employment under the CPP, an employee can elect to participate in the CPP by filing Form CPT 20, Election to Pay Canada Pension Plan Contributions. For information about the Quebec Pension Plan, contact the Ministère de Revenue de Quebec.

Do All Nonprofits Have To Apply For Recognition Of Tax Exemption

No. Three groups are automatically exempt from filing an application: churches, organizations with gross receipts of less than $5,000, and affiliates of existing nonprofits covered by group exemption. All other nonprofits must file if they want to be formally recognized by the IRS as a 501 tax-exempt organization.

The IRS automatically recognizes several types of groups as public charities. These include certain educational institutions, hospitals and medical research organizations, public safety organizations, certain government organizations, and supporting organizations. Any other organization, if able to show that it is publicly supported, is granted a 501 status. Public support means that the organization is successful in raising funds from numerous sources, has a diverse board, or provides services that appeal and are accessible to the general public. As the definitions of some of these terms are not necessarily self-explanatory, it is always wise to officially obtain a determination letter from the IRS as soon as possible. It is the only way you can prove your status.

Read Also: How Does Doordash Do Taxes

Sale Of Tobacco Exempt Of Tobacco Tax

Black stock tobacco is cigarettes, tobacco sticks and fine-cut tobacco that has a federal stamp indicating that duty has been paid, but does not have an Alberta stamp. In Alberta, black stock is sold to eligible consumers by AITE retailers and in duty-free shops.

Registered AITE retailers must:

- purchase black stock tobacco tax included from wholesalers with an Alberta tobacco tax licence

- sell black stock to eligible consumers, that present their AITE card at the time of purchase, from a location located on reserve in Alberta

- sell Alberta stamped tobacco product to all other consumers

- apply weekly for a refund for all tax-exempt sales using an approved Point of Sale System

For more information regarding the sale of tobacco to eligible consumers, see Information Circular AITE 3 â Exemptions Under the AITE Program.

Federal law prohibits the sale of tobacco to anyone under 18 years of age, including individuals with an AITE card.

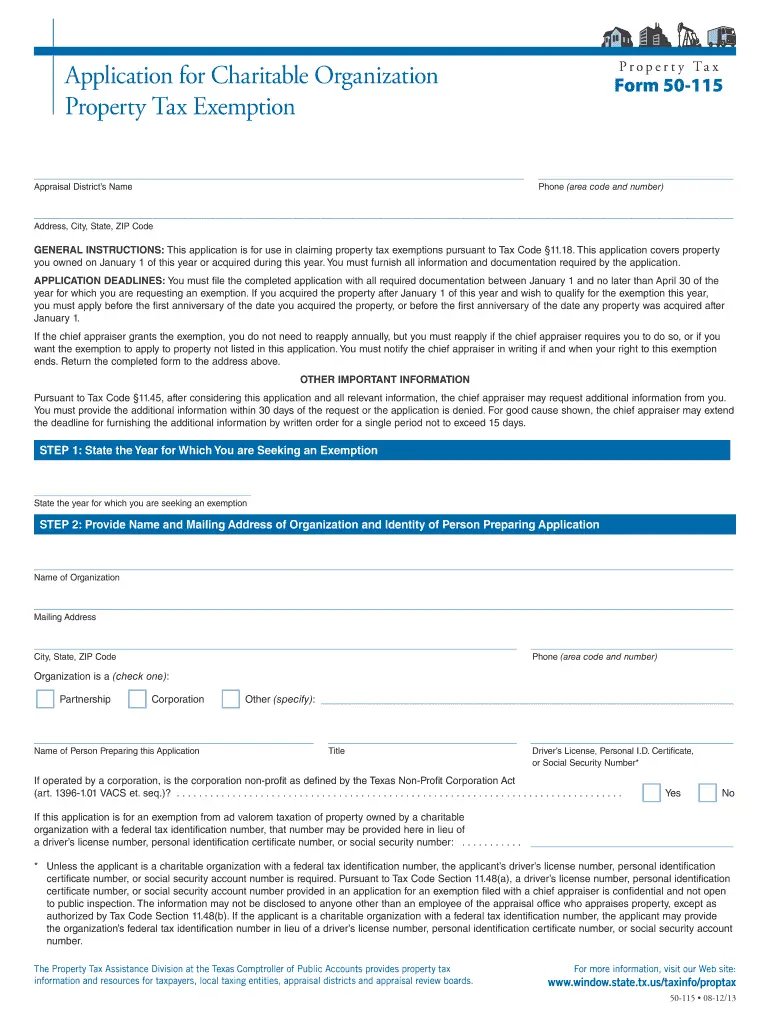

Applying For An Exemption

Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW, youll click Continue to proceed to creating your WA Cares Exemption account.

On the Create an Account page, select the Create an Account button to the right of WA Cares Exemption.

Don’t Miss: How Do You Pay Taxes For Doordash

Business Income Example 6

Gayle is a 50% partner in a partnership that runs a gas station and convenience store on a reserve. The other 50% of the partnership is owned by an individual who is not registered as an Indian. The gas station and convenience store earns all of its income from sales to customers on the reserve. There is a small office in the convenience store where the books and records are kept and where all business decisions are made.

The following factors show a strong connection to the reserve:

- All of the partnerships income generating activities are on-reserve.

- All sales are made on-reserve.

- All of the business decisions are made on-reserve.

The partnerships income that is allocated to Gayle is tax-exempt.

How To Get A Carbon Levy Refund

Eligible consumers may apply for a refund when the carbon levy was paid in error. Carbon levy refund applications must be received within 2 years from the end of the year in which the fuel was purchased. Fuel purchased after May 30, 2019 does not include the Alberta carbon levy.

Step 1: Complete and submit the claimant registration

- Complete the Carbon Levy Claimant Registration â Indian or Indian Band form and submit your completed registration form to TRA.

- Do not submit a registration form if the fuel was purchased before January 1, 2019 or after May 30, 2019.

Step 2: Register for TRACS

- Complete the TRACS Enrolment Request to enrol in TRACS or contact TRA.

- Visit the TRACS page for more information.

Step 3: Complete the refund application

- Complete the carbon levy claimant refund application in your TRACS account.

Step 4: Receive your refund

- Receive your refund by direct deposit or cheque.

You May Like: How To Report Plasma Donation On Taxes

How To Claim Your Senior Property Tax Relief

Its important to file for your senior tax exemption by the deadline imposed by your state. Each state has different deadlines.

Most states have websites where you can find the deadlines for filing, along with the necessary forms and instructions.

Most states have websites where you can find the deadlines for filing, along with the necessary forms and instructions.

Applications for property tax exemptions are typically filed with your local county tax office.

While most states offer basic exemptions for those that qualify, your county may offer more beneficial exemptions.

Whether you are filing for exemptions offered by the state or county, you should contact the tax commissioner or the tax assessors office in your county for more information or clarification about qualifying for tax exemptions.

Amazon Tax Exemption Program

Individuals or businesses may qualify to make tax-exempt purchases. Our Amazon Tax Exemption Program supports tax-exempt purchases for sales sold by Amazon, its affiliates, and participating independent third-party sellers. The Amazon Tax Exemption Wizard takes you through a self-guided process of enrollment.

Go to the Tax Exemption Wizard.

Make sure that you have all the necessary information for enrollment:

- Territory/state in which you wish to enroll

- Entity type of your organization

- Organizations address

- Exemption numbers or exemption form*

We do not accept sales tax permits, articles of incorporation, tax licenses, IRS determination letter , W9’s, or certificate of registrations for enrollment into the program.

Once you’ve entered all of this information, you’ll be required to sign and accept the . By accepting the Terms and Conditions, you’re acknowledging that the information entered is correct and the tax-exempt organization is recognized as valid by the state or US territory in which you’ve enrolled. Your exemption should be active within 15 minutes of completing the enrollment.

Some state or U.S. territory exemptions are only issued by their respective taxing authorities. If you have such an exemption, you’ll be asked to upload your certificate for enrollment. Customer Service will then review your application and email within 24 hours to confirm your enrollment or to request additional information.

You May Like: Protest Property Taxes Harris County

Must An Organization Whose Corporate Charter Is Reinstated After Being Administratively Revoked Or Suspended By The State Submit A New Exemption Application

No. If a corporation is reinstated by the state after an administrative suspension or dissolution of its corporate charter, its exempt status may be reinstated without the need for the corporation to reapply. The organization must submit evidence from the state that its charter has been reinstated, indicating the effective date of reinstatement. In addition, the organization should provide evidence that it has complied with any filing requirement for annual returns during the period during which its corporate status was administratively suspended or dissolved.

If, however, an organization’s exempt status has been automatically revoked for failing to file annual returns, exempt status cannot be reinstated unless it submits a new exemption application, even if the state reinstates its corporate status.

Business Income Example 5

Arnold works as a self-employed plumber. Arnold lives off a reserve, and operates out of an office that is located off a reserve. He earns 60% of his revenue from providing plumbing services to customers who live on a nearby reserve. As a result, 60% of Arnold’s plumbing income is tax-exempt. Arnold can deduct 40% of his business expenses from the 40% of his plumbing income that is subject to tax, unless the facts indicate that it would be more reasonable to allocate his revenue and expenses differently.

Also Check: Louisiana Paycheck Tax Calculator

Applying For Tax Exemptions

Tax exemptions related to the Indian Act

If you are eligible under the Indian Act, you may claim an exemption of the GST/HST and/or PST for goods and services supplied on a reserve.

Eligible residents in Ontario or on the Canadian side of the Akwesasne reserve may also claim an exemption for qualifying goods and services acquired off a reserve. The off-reserve exemption only applies to the Ontario Provincial component of the HST. For example, goods such as mobile phones, HD PVRs, as well as telecommunications services may qualify for the exemption.

Eligible residents in Québec located on the Kahnawake reserve may also claim an exemption for qualifying goods and services acquired off the reserve. The off-reserve exemption only applies to QST. For example, goods such as mobile phones, HD PVRs, as well as telecommunications services may qualify for the tax exemption.

Tax exemption for diplomats/consular corps

For diplomatic or consular corps, the GST/HST must be paid on taxable goods/services. However, a rebate can be claimed directly from the government authorities. For Provincial Sales Tax exemption, please follow the guidelines below.

To submit a claim for tax exemption:, follow these steps:

Who Can Provide The Exemption

AITE cards are no longer accepted as proof of eligibility.

As of October 4, 2021, the only accepted proof of eligibility for tax-exempt purchases made on reserve in Alberta will be the federal Certificate of Indian Status card or Temporary Confirmation of Registration document. Any version of the status card will be accepted, including expired cards.

Fuel or tobacco retailers wanting to provide the AITE to eligible consumers must be:

- located on a reserve in Alberta, or

- a fuel seller that delivers fuel to eligible consumers located on reserve in Alberta

Accommodation operators wanting to provide the AITE to eligible consumers must be:

- providing the accommodation on reserve in Alberta, and

- registered with TRA under the Tourism Levy Act. See Tourism Levy for more information on how to register and collect the tourism levy.

Read Also: Cook County Appeal Property Tax

State Tax Exemption Rules And Regulations

Through the Department of States Diplomatic Tax Exemption Program, the U.S. Government meets its obligations under Article 34 of the Vienna Convention on Diplomatic Relations and Article 49 of the Vienna Convention on Consular Relations, as well as other similar treaties and agreements, to provide exemption from state and local sales, restaurant, lodging/occupancy and other similar taxes charged to customers.

Generally, states, territories, the District of Columbia and localities develop their own statutes, and regulations concerning the manner in which vendors may grant such tax exemptions to foreign missions and their members.

The information below is provided to better assist vendors with understanding the applicable state and local rules and regulations concerning this issue. This listing is not exhaustive of all such statutes/regulations. Therefore, if a vendor does not find information specific to their location, they are encouraged to contact the Department of States Office of Foreign Missions or the appropriate tax authority. OFMs Headquarters, located in Washington, DC, can be reached 8:00am to 5:00pm by telephone at 895-3500, option 2 or by electronic mail at .