Calculate Income Tax On Salary With An Example

Your salary is inclusive of Transport Allowance, Special Allowance, House Rent Allowance , and Basic Salary. In the old regime, certain salary components such as leave travel allowance, telephone bill reimbursement, and a part of the HRA were exempt from tax. However, if you choose the new regime, these exemptions are not available.

Given below is an example of how tax calculation works under the New regime when compared to the old regime:

How To Subtract Dates In Excel

The easiest way to subtract dates in Excel is to enter them in individual cells, and subtract one cell from the other:

End_dateStart_date

You can also supply dates directly in your formula with the help of the DATE or DATEVALUE function. For example:

=DATE-DATE

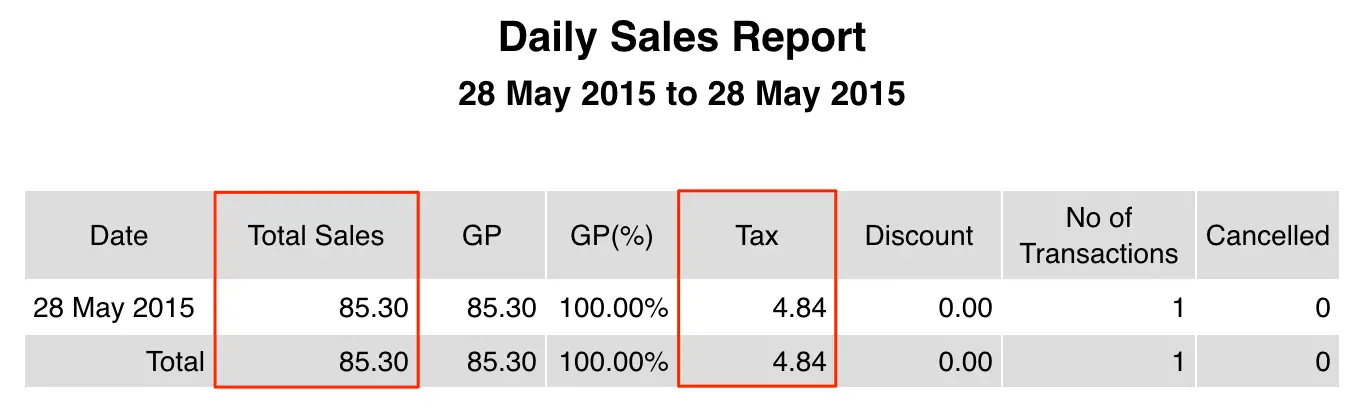

How To Separate Sales Tax From Total

Suppose you sell gizmos for $100 each. Further suppose you are in Houston, so you charge $108.25 per gizmo to account for the 8.25 percent sales tax. Thats simple enough. But your accounting gets complicated if you decide to sell gizmos at a discounted price, or if you round the total to the nearest dollar. Then someone hands you $110 and says, Keep the change. When its time to pay your sales and use tax at the end of the month, you need to have a clear formula for separating the sales tax from what you charge before taxes. Thankfully this task is not difficult.

1

Determine the final total for your net sales, including tax, for the current tax period, manually or with point of sale software.

2

Add 100 to your sales tax on a calculator, and store the answer in memory. Divide your sales tax by that stored number. Record the answer. For example, 8.25 divided by 108.25 equals 0.076212471132.

3

Multiply your net sales by the answer to the previous step. This new answer is the total sales tax for that period. For example, a net sales of $108.25 times 0.076212471132 equals $8.25 sales tax.

4

Subtract the total sales tax from your net sales. This new answer is your total income before taxes. For example, $108.25 minus $8.25 equals $100.00.

References

- Consult with a certified accountant to make sure your sales tax accounting methods are correct.

Writer Bio

Recommended Reading: Appeal Property Tax Cook County

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

How Do You Calculate Original Price After Discount

Finding the original price given the sale price and percent

Read Also: Property Tax Protest Harris County

Important Terms And Definitions In Tax Calculation

- Assessment Year: When your income for a certain financial year is assessed in the coming financial year, it is referred to as an assessment year.

- Financial Year: The period between the current years April 1st and the following years March 31st. This is the time period wherein you are required to collate all your documents and submit your investment proofs.

- Previous Year: The financial year that acts as a precursor to the following assessment year. Your income for the current year is assessed in the next year .

- Deduction: It is a reduction in the total taxable income based on Section 80 and Chapter VI-A. Specific kinds of spending such as investment in life insurance policies and payment of childrens tuition fee help you avail a tax deduction.

- Exemption: It is a specific amount that is excluded from the gross total income before calculating tax. Exemptions are available under Sections 10 and 54. Interest earned from tax-free bonds and salary components like LTA are examples of exemptions.

How To Do Matrix Subtraction In Excel

Suppose you have two sets of values and you want to subtract the corresponding elements of the sets like shown in the screenshot below:

Here’s how you can do this with a single formula:

The results of the subtraction will appear in the selected range. If you click on any cell in the resulting array and look at the formula bar, you will see that the formula is surrounded by , which is a visual indication of array formulas in Excel:

If you do not like using array formulas in your worksheets, then you can insert a normal subtraction formula in the top leftmost cell and copy in rightwards and downwards to as many cells as your matrices have rows and columns.

In this example, we could put the below formula in C7 and drag it to the next 2 columns and 2 rows:

=A2-C4

Due to the use of relative cell references , the formula will adjust based on a relative position of the column and row where it is copied:

Read Also: How Much Is H& r Block Charge

How To Calculate Sales Tax Backwards From Total

Whether you’re trying to get back to the pre-tax price of an item as part of a word problem or calculating the sales tax backwards from a receipt in your hand, the math is the same. You’ll need to know the total amount paid and either the amount of tax paid, which will let you calculate the tax rate, or the tax rate, in which case you can calculate the amount of tax paid.

Income From Capital Gains

The nature and number of transactions usually determine the computation of income from capital gains. It can be attained in the following manner:

- Calculate your long-term capital gains from your total sales of assets.

- Calculate your short-term capital gains from the total sales of capital assets.

- Deductions are to be claimed after this.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Example Where Amount Does Include Taxes

- Gross Charge to customer including taxes is Rs. 100.00.

- Service Tax is 10%

- Rate of Education Cess is 2% of the total Service Tax

- Rate of Secondary & Higher Education Cess is 1% of the total Service Tax

- Calculations

- Gross charge = Value + + * 2% + * 1%

- Gross charge = Value* = Value*1.103, now in decimal form

- Since our Gross Charge is 100 Value = 100/1.103 = 90.66

- Using Rs. 90.66 as the gross value of services we can now forward-calculate the individual taxes.

- Service Tax = 90.66 * 10% = 90.66 * 0.10 = 9.07

- Education Cess = ST * 2% = 9.07 * 0.02 = 0.18

- Higher Ed Cess = ST * 1% = 9.07 * 0.01 = 0.09

- Adding these up, the total tax is Rs. 9.34.

- Checking our math, the gross charge, including taxes, is 90.66 + 9.34 = Rs. 100.00

The total tax rate can be calculated as 10% + + . Converting to decimals and calculating the total tax is 0.1 + 0.002 + 0.001 = 0.103 or 10.3%.

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Read Also: Harris County Property Tax Protest Services

History Of The Sales Tax

The very first taxes in human history were direct taxes, which are a type of tax imposed on individual persons. The most general ones were the corvée, compulsory labor provided to the state in Egypt , and the tithe, where crops and grains were given to the state from landowners, which was invented in ancient Mesopotamia. Sales tax, which belongs to another basic form of taxation, the indirect taxes, were also present in ancient time. Tomb paintings in Egypt, dating back around 2000 BC, portray tax collectors and sales taxes on commodities, such as cooking oil, can be traced to that time . In Europe, sales tax appeared firstly during the reign of Julius Caesar around 49 BC-44 BC, when the government of Rome enforced a payment of 1 percent sales tax. Sales tax gradually became widespread over Europe. Spain had a national sales tax from 1342 until the 18th century, with rates varying between 10 and 15 percent. Also, it was introduced in France where it didn’t enjoy much popularity: during the 17th century alone, there were 58 rebellions against it . However, in modern times the sales tax in Europe took a declining path, and from the 1960s the dominating consumer-based tax steadily became the value-added tax.

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Read Also: Can Home Improvement Be Tax Deductible

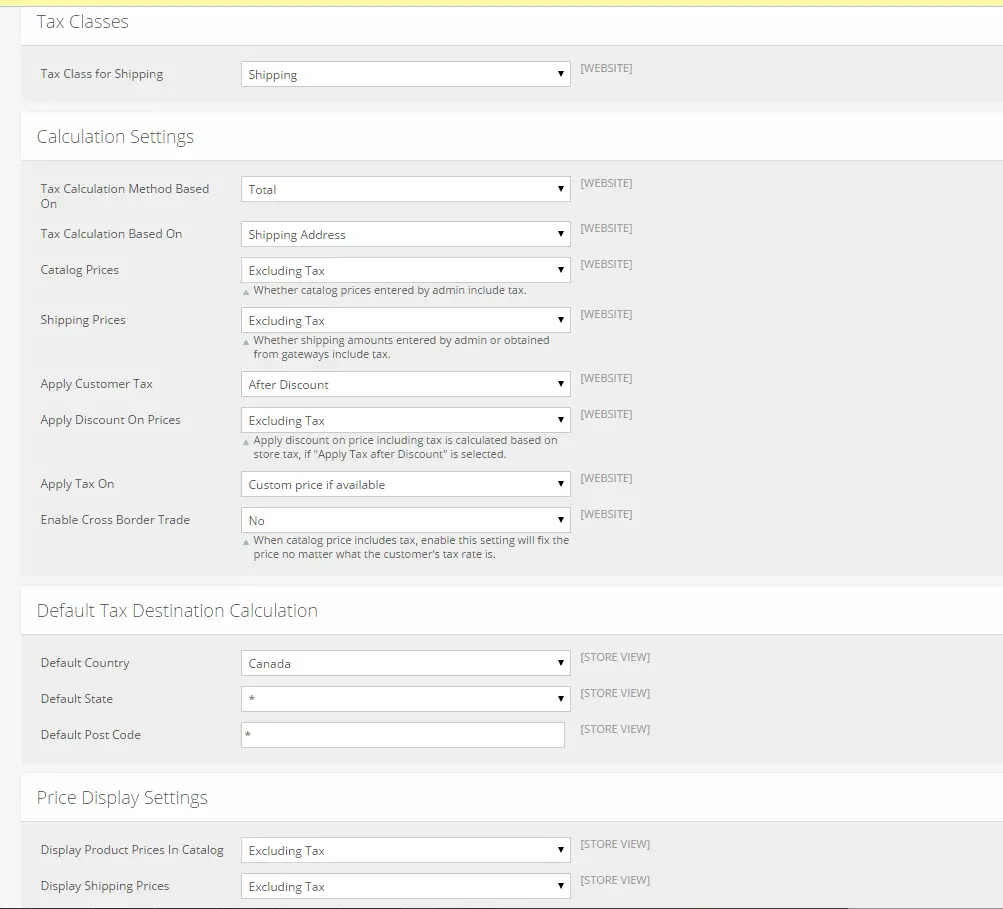

Sap Sd: Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price

Case company suggested retail price/Assessed price includes tax amount and freight value. The suggested material prices are region wise based on customer registered 17% tax and non-registered meaning 20% tax status. Now client requirements are to first calculate the freight and GST from suggested retail price. Freight determines at the time of delivery based on gross weight. So, freight will calculate through shipment cost and not part of this post. After subtracting freight amount system should subtract the GST amount. Then from value exclusive of tax if there is any discount that applies. Then on discounted price applies Tax 17% for register and further 3% on non-registered. After that withholding tax applies on total amount. Furthermore, to avoid hassle with FBR Tax amount must round-off. In the end compare result if sale price is less than cost price send message at the time of creating sales order.

The solution of this scenario is below in three parts.

Part 1- Reverse Tax Calculation

If material price is let say Material-01= 100 PKR, then reverse sales tax works in following way

Step 1: take the total price and divide it by one plus the tax rate

Step 2: multiply the result from step one by the tax rate to get the value of tax

Step 3: subtract the value of tax from step 2 from the total price

Reverse tax calculation based on 17% = 100 *100/117 or 100/1.17 = 85.47 *17%=14.52

Reverse tax calculation based on 20% = 100 *100/120 or 100/1.20 = 83.33*20%=16.66

How To Do The Reverse Tax Calculation

How to calculate sales tax percentage from the total?To calculate the sales tax backward from the total, divide the total amount you received for the items subject to sales tax by 1 + the sales tax rate. For example, if the sales tax rate is 5%, divide the sales taxable receipts by 1.05.

You can calculate the amount of tax paid if you know the total post-tax price for the purchased item and measured tax rate. This method can calculate the tax paid by determining it backward to analyze monetary compensation paid as sales tax.

Adding 100 percent to the tax rate

In this case, you can calculate the total amount of tax paid by adding 100% to the total sales tax rate. This hundred percent is synonymous with the pre-tax amount of the product purchased. This whole amount will get you the total percentage that symbolizes or highlights the items pre-tax amount and the tax when added to the tax rate. For example, if an item has a sales tax of around 5%, you will get 105%.

Conversion to decimal form

To convert an amount to the decimal form, you can divide the tax-paid rate by hundred. For example, if the total amount was 105%, you can divide by a hundred, giving you 1.05.

Division of post-tax price with decimal

Subtraction of pre-tax price from the total or post-tax price

Don’t Miss: How To Get Tax Preparer License

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer. Specifically, after each payroll, you must

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

If you have many employees or don’t have the staff to handle payroll processing, you might want to consider a payroll processing service to handle paychecks, payments to the IRS, and year-end reports on Form W-2.

Example Of Gross To Net Calculation

Lets say your employee is a single-filer living in Phoenix, Arizona with zero claims on their Form W-4.

The employee makes $15 per hour and works 40 hours per week. You pay the employee weekly, and their total gross is $600. The employee does not work overtime.

The employees health insurance premium is $50 per week. Health benefits are exempt from Social Security, Medicare, and income tax withholding.

You will withhold the following to determine the employees net pay:

You May Like: Have My Taxes Been Accepted

More Excel And Finance Resources

Thank you for reading CFIs guide to the Excel sales tax decalculator. If you want to become an Excel power user please check out our Excel ResourcesExcel ResourcesLearn Excel online with 100’s of free Excel tutorials, resources, guides & cheat sheets! CFI’s resources are the best way to learn Excel on your own terms. to learn all the most important functions, formulas, shortcuts, tips, and tricks.

- Debt scheduleDebt ScheduleA debt schedule lays out all of the debt a business has in a schedule based on its maturity and interest rate. In financial modeling, interest expense flows

- List of Excel formulasExcel Formulas Cheat SheetCFI’s Excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in Excel spreadsheets. If you want to become a master of Excel financial analysis and an expert on building financial models then you’ve come to the right place.

- Excel templatesTemplatesFree business templates to use in your personal or professional life. Templates include Excel, Word, and PowerPoint. These can be used for transactions,

- Finance career resourcesCareersSearch CFI’s career resources library. We’ve compiled the most important career resources for any job in corporate finance. From interview prep to resumes and job descriptions, we’ve got you covered to land your dream job. Explore guides, templates, and a wide range of free resources and tools