How Are Dividends Paid In Roth Ira

If youre looking to save money on taxes, you might want to consider opening a Roth Individual Retirement Account .

Roth IRAs are tax-free retirement accounts that allow people to save their post-tax income for the future.

Put money that has already been taxed into your Roth IRA . You can withdraw money from your Roth IRA tax-free in order to save for your retirement .

- Those over the age of 50 can contribute up to $6,000 per year, or $5,500 per year if theyre under the age of 50.

- If your AGI is less than or equal to $184,000, you can make your full contribution as a married couple filing jointly.

- If your taxable income is less than or equal to $117,000, you can make the full amount of your single tax payment.

In most circumstances, a 10% penalty tax will be imposed if the following distribution conditions are not met. Here is a complete list of qualified exemptions from the tax penalty .

- Once youve contributed to the Roth IRA for five years, you must begin making withdrawals.

A Roth IRA has the advantage of tax-free growth for your investments.

As a result, you pay taxes before the value of your investments grows, rather than afterward.

Qualified dividends are taxed at the long-term capital gains rate of 20% in nonretirement accounts. It is taxed at 39.6 percent for dividends that are not considered to be eligible dividends .

A Roth IRAs dividend income is tax-free. For Roth IRA contributions, this does not count.

How Are Capital Gains Calculated

Capital gains and losses are calculated by subtracting the amount you paid for an asset from the amount you sold it for.

If the selling price was lower than what you had paid for the asset originally, then it is a capital loss.

You can then use this amount to calculate your capital gains tax.

You may also use an online capital gains tax calculator to estimate what your taxes might be. Most calculators you find online will only give you an estimate of your tax liability. It is recommended to consult with a professional tax advisor or tax software to arrive at your actual tax liability.

Dealing With Capital Loss

You can use any capital losses to offset or reduce capital gains. And if you have more capital losses than you need to reduce your capital gain to zero, or if you only have capital losses, you are allowed to carry forward that capital loss into future years, OR, you can carry it back up to three previous years to amend a capital gain you declared.

Also Check: Is Selling Plasma Taxable

Adjusted Cost Base For Real Estate

For real estate properties, the adjusted cost base includes the purchase price of the property, closing costs, and capital expenditures on the property.

Closing costsare the fees that a buyer pays to acquire the real estate property and include one-time fees such as theland transfer taxes, lawyer and legal fees, home inspection fee, and property survey fee. It is important to differentiate between capital expenditures and current expenses on your property.

Current expenses cannot be included in the adjusted cost base while capital expenditures should be included in the ACB, irrespective of when the capital expenditures were made during the entire duration of your ownership of the home.

Some examples of capital additions and improvements to your home include installing a new HVAC system, waterproofing your basement, installing a hot tub, etc. Meanwhile, current expenses are monthly costs incurred by the homeowner or a tenant, such as electricity bills, hydro bills, restorations, and short term repairs such as painting the wall or replacing broken light bulbs.

TheCanada Revenue Agency guidelines on current expenses and capitalexpenses indicate that capital expenditures are improvements that provide a long term benefit, significantly increase the value of the home, and contribute to extending the useful life of your property.

How Do You Pay Taxes On Robinhood Stocks

Offering free trades with no minimum account balance, Robinhood has become a popular investment site for those who wish to dabble in stocks and cryptocurrency. Unfortunately, the IRS does not adhere to the same free fee structure as the platform. You may be able to execute trades for free on Robinhood, but the IRS will still expect you to pay taxes on selling stocks.

Read Also: Does Doordash Tax Tips

How Investment Income Is Taxed

You need to include investment income in your tax return. This includes what you earn in:

- interest

- capital gains from property, shares and cryptocurrencies

You pay tax on investment income at your .

Use our income tax calculator to find out your marginal tax rate.

You’re allowed tax deductions for the cost of buying, managing and selling an investment. But there are rules around what you can and can’t claim as a tax deduction. See the Australian Taxation Office ‘s investment income deductions.

Investing and tax can be complex. See choosing an accountant for where to go for help.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: What Can I Write Off On My Taxes For Instacart

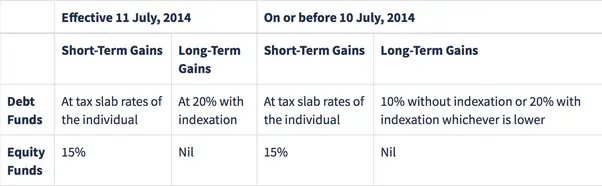

How To Calculate Short

Tax rates differ for short-term capital gains and long-term capital gains. There is a 15% tax on short-term capital gains that fall under Section 111A of the Income Tax Act. This includes equity shares, equity-oriented mutual-funds, and units of business trust, sold on or after October 1, 2004 on a recognised stock exchange, and falling under the securities transaction tax .

Nisha Hegde bought equity shares worth Rs. 1 lakh in January 2013 and sold it in November 2013 after 10 months at Rs. 1.8 lakh. Let us calculate her short-term capital gains tax.

Capital gain: Full sales value = 1,80,000 = Rs. 79,100

Short-term capital gains tax: Short-term capital gain multiplied by Tax rate divided by 100 = 79,100 * 15 / 100 = Rs. 11,865

Debt-oriented mutual funds and preference shares, however, do not fall under the purview of Section 111A. In this case, the income from the sale of the funds or shares will be added to the regular income of the owner and taxed according to normal individual I-T rules.

How To Avoid Capital Gains Taxes

Unfortunately, both short- and long-term capital gains taxes are simply the entry price of playing the stock market game. If you hope to benefit from the historic substantial growth of the U.S. stock market, youll be hard pressed to avoid them entirely. That said, you may be able to minimize them a few ways: with retirement accounts, tax-loss harvesting and tax-exempt investments, like municipal bonds.

Also Check: How Much To Set Aside For Taxes Doordash

Capital Gains Tax Rates For 2021

The capital gains tax on most net gains is no more than 15 percent for most people. If your taxable income is less than $80,000, some or all of your net gain may even be taxed at zero percent.

As of 2021, the long-term capital gains tax is typically either zero, 15 or 20 percent, depending upon your tax bracket. This percentage will generally be less than your income tax rate.

2021 Long-Term Capital Gains Tax Rates Based on Taxable Incomes

| CAPITAL GAINS TAX RATE |

Source: Kiplinger

There are some exceptions to this 0-15-20 percent rule which allow certain capital gains to be taxed at higher rates.

Higher Capital Gains Tax Rate Exceptions

- Taxable portions of the sale of certain small business stocks are taxed at a 28 percent maximum rate.

- Net capital gains from selling collectibles such as coins or art are taxed at a 28 percent maximum rate.

- Certain portions of capital gains from specific real estate sales are taxed at a 25 percent maximum rate.

Source: Internal Revenue Service

How Do Taxes Work On Stocks

Generally speaking, if you held your shares for one year or less, then profits from the sale will be taxed as short-term capital gains. If you held your shares for longer than one year before selling them, the profits will be taxed at the lower long-term capital gains rate.

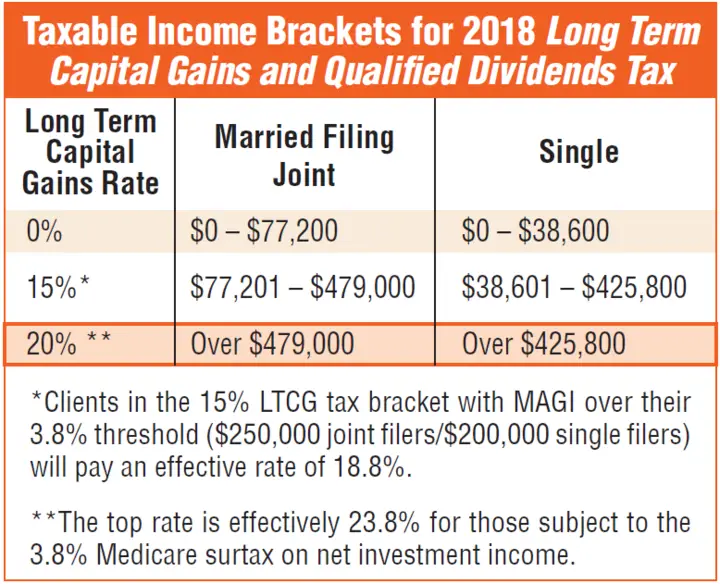

Both short-term and long-term capital gains tax rates are determined by your overall taxable income. Your short-term capital gains are taxed at the same rate as your marginal tax rate . You can get an idea of what your tax bracket might be from the IRS for 2020 or 2021.

For the 2020 tax year , long-term capital gains rates are either 0%, 15%, or 20%. Unlike in past years, the break points for these levels don’t correspond exactly to the breaks between tax brackets:

|

Long-Term Capital Gains Tax Rate |

Single Filers |

|---|

|

Over $473,750 |

Over $250,800 |

Data source: Internal Revenue Service Revenue Procedure document 2020-45. Figures represent taxable income, not just taxable capital gains.

To calculate your tax liability for selling stock, first determine your profit. If you held the stock for less than a year, multiply by your marginal tax rate. If you held it for more than a year, multiply by the capital gain rate percentage in the table above.

Don’t Miss: H& r Block Early Access W2

How To Calculate Your Profits From Selling Stocks

When you sell stock, you’re responsible for paying taxes only on the profits — not on the entire sale.

In order to determine your profits, you need to subtract your cost basis , which consists of the amount you paid to buy the stock in the first place, plus any commissions or fees you paid to buy and sell the shares.

How Can You Avoid Paying Taxes On Stocks

Read Also: Pastyeartax

What Is A Capital Gains Tax

Capital gains taxes are a type of tax on the profits earned from the sale of assets such as stocks, real estate, businesses and other types of investments in non tax-advantaged accounts. When you acquire assets and sell them for a profit, the U.S. government looks at the gains as taxable income.

In simple terms, the capital gains tax is calculated by taking the total sale price of an asset and deducting the original cost. It is important to note that taxes are only due when you sell the asset, not during the period where you hold it.

There are various rules around how the Internal Revenue Service taxes capital gains.

For most investors, the main tax considerations are:

- how long youve owned the asset

- the cost of owning that asset, including any fees you paid

- your income tax bracket

- your marital status

Once you sell an asset, capital gains become realized gains. During the time you own an asset, they are called unrealized gains.

Are Capital Gains And Dividends Taxed In A Roth Ira

As long as you keep the money in your Roth IRA until you retire, you wont have to pay income taxes on any of your earnings, including capital gains and dividends from Roth stock investments. Your stock gains and dividends from your Roth IRA can be withdrawn tax-free and penalty-free after you reach the age of 59.5 years, provided that your account has been open for at least five years. Even if youre beyond the age of 59.5 and have a Roth account, any gains or dividends you receive will be subject to taxes if you withdraw them from the account before it has been open for five years.

Also Check: Deductions For Doordash

Capital Gains Tax On Sale Of Property

Real estate property includes residential properties, vacant land, rental property, farm property, and commercial land and buildings. If you have sold real estate property, you will have to report any capital gains or losses on Schedule 3, the capital gains and losses form. If you sold both the property along with the land it sits on, you must determine how the sale price is distributed between the land and the building and report them separately on theTax Form Schedule 3. For example, you just sold a property for proceeds of disposition less outlays and expenses of $500,000. The Municipal Property Assessment Corporation appraised the land at $125,000, meaning that the land is worth 25% of the property value. Your adjusted cost base was $400,000, so your total capital gains is $100,000, and your taxable capital gains is 50% of that, or $50,000. The taxable capital gain for the land would be $12,500 and the taxable capital gain for the building would be $37,500.

What Taxes Do I Pay On Stock Gains

When you earn money in the stock market, you have to pay income tax on it, just like any other income. But paying taxes on stock gains is a little tricky. The amount you owe depends on the type of investment income youve earned, when you earned it, how long youve owned the asset, and how much you earnedas well as your total income for the year.

Read Also: How Much Should I Set Aside For Taxes Doordash

Monitor Your Holding Periods

When selling stocks or other assets in your taxable investment accounts, remember to consider potential tax liabilities.

With tax rates on long-term gains likely being more favorable than short-term gains, monitoring how long youve held a position in an asset could be beneficial to lowering your tax bill.

Holding securities for a minimum of a year ensures any profits are treated as long-term gains. On the contrary, the IRS will tax short-term gains as ordinary income. Depending on your tax bracket, any significant profits from short-term gains could bump you to a higher tax rate.

These timing strategies are important considerations, particularly when making large transactions. For the do-it-yourself investor, its never been easier to monitor holding periods. Most brokerage firms have online management tools that provide real-time updates.

Sales Can Generate Profit Or Loss

When you sell shares, you usually gain a sales profit, i.e. a capital gain, or incur a sales loss, i.e. a capital loss. When calculating the amount of profit or loss, deduct the following from the selling price of the shares:

The purchase price you paid for the shares and the transfer tax

The expenses incurred in making a profit, such as brokerage and handling fees.

If you have received the shares as a gift or an inheritance, you can deduct the taxable value used in the taxation of gifts or inheritance from the selling price. Read more on calculating profit and loss in the detailed tax instructions Arvopaperien luovutusten verotus, section 4 Luovutusvoiton ja -tappion laskeminen .

Recommended Reading: Irs Taxes Due

What Will I Owe In Taxes On My Stock Gains

Here’s where it gets tricky. The amount you owe in taxes on your stocks will depend on what tax bracket you’re in. Short-term capital gains are taxed as ordinary income, just like your paycheck.

We don’t need to go through every bracket here , but for most investors, the rate is tolerably low. For example, a married couple filing jointly with taxable income of $80,251 to $171,050 will be in the 22% bracket. So, if that’s you, and you earned $1,000 in the stock market, you’ll be paying $220 in capital gains taxes.

If you sold stock that you owned for at least a year, you’ll benefit from the lower long-term capital gains tax rate. In 2020, a married couple filing jointly with taxable income of up to $80,000 pays nothing in long-term capital gains. Those with incomes from $80,000 to $496,600 pay 15%. And those with higher incomes pay 20%.

There’s also a 3.8% surtax on net investment income, which applies to single taxpayers with modified adjusted gross incomes over $200,000 and joint filers with MAGI over $250,000. Net investment income includes, among other things, taxable interest, dividends, gains, passive rents, annuities and royalties.

And remind yourself to set aside money for the tax man when you enjoy gains on your stocks in the years to come.