How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Which Tax Package Should You Use

- If you are reporting only income from employment in Canada, from a business or partnership with a permanent establishment in Canada, including a non-resident actor electing to file a return under section 216.1, use the tax package for the province or territory where you earned the income. The tax package includes the return you will need

- If you are also reporting other types of Canadian-source income , you will need Form T2203, Provincial and Territorial Taxes for Multiple Jurisdictions, to calculate your tax payable

- If you are reporting only Canadian-source income from taxable scholarships, fellowships, bursaries, research grants, capital gains from disposing of taxable Canadian property, a business with no permanent establishment in Canada , or if you are filing an elective return under section 217 of the Income Tax Act, use the Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada. It includes the return and schedules you will need. For more information, see Electing under section 217

- If you received rental income from real or immovable property in Canada or timber royalties on a timber resource property or a timber limit in Canada and you are electing to file a return under section 216 of the Income Tax Act, use Guide T4144, Income Tax Guide for Electing Under Section 216. For more information, see Electing under section 216. Form T1159, Income Tax Return for Electing Under Section 216 is the return you will need

You May Like: Door Dash Driver Taxes

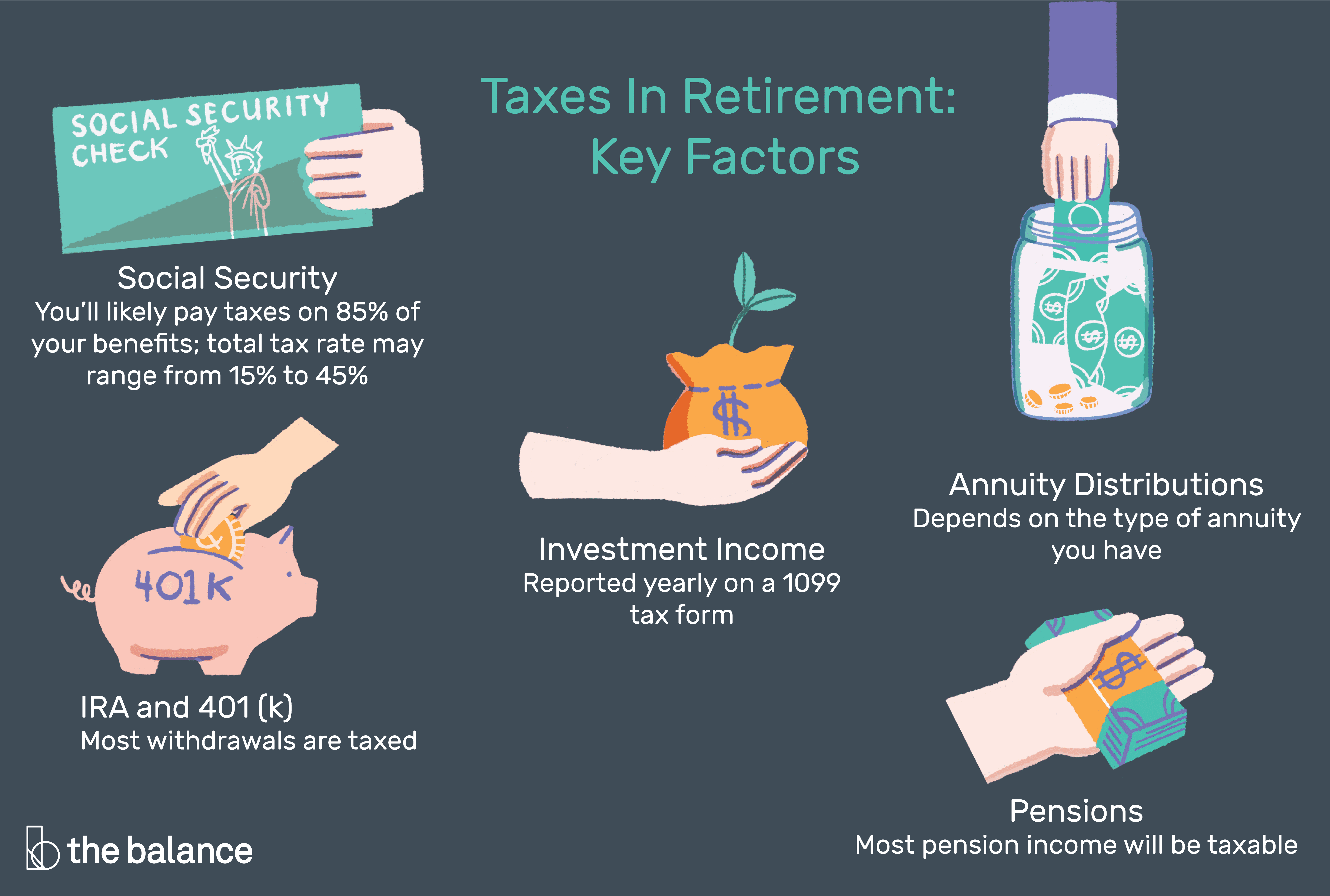

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of what’s due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

How Much Your Social Security Benefits Are Taxed Depends On Your Income

Unlike pensions and traditional IRAs, you dont pay ordinary income tax on all of your Social Security benefits. Instead, the taxable amount depends on your provisional income.

Whats your provisional income? Its simply your adjusted gross income plus your tax-exempt interest and half your Social Security benefits.

You can use Worksheet 1 in IRS Publication 915 to figure out exactly how much youll pay in taxes on your Social Security benefits. In general, though, if your provisional income is below $25,000 , your benefits are tax-free.

If it falls between $25,000 and $34,000 , half of your Social Security benefits are taxable. But if your provisional income is greater than $34,000 , you must pay taxes on up to 85% of your benefits.

Find Out: All You Need To Know About Collecting Social Security While Still Working

You May Like: Is Plasma Donation Income Taxable

Retiree Tax Document Checklist: What Documents Do I Need To File Taxes

Filing taxes is a life-long responsibility not one to fret, but one you can learn to enjoy and make beneficial to your retirement plans. There are numerous reasons that a financial advisor in Bountiful UT should assist.

Similar to pre-retirement, your annual tax burden will be calculated based on your income, though there are different tax rules for each type of income you receive. To minimize the amount you pay in taxes and to avoid any surprises you should familiarize yourself with how each of your income sources will show up on your tax return.

As is the nature of the IRS, tax preparation for retirees is not straightforward. Read on to see what items you can check off your tax document checklist.

Tax On Taxable Income

Certain types of income you earn in Canada must be reported on a Canadian tax return. The most common types of income include:

- income from employment in Canada

- income from a business carried on in Canada

- the taxable part of Canadian scholarships, fellowships, bursaries, and research grants

- taxable capital gains from disposing of taxable Canadian property

You may be entitled to claim certain deductions from income to arrive at the taxable amount. You can also claim a credit for any tax withheld at source or paid on this income.

If there is a tax treaty between Canada and your country or region of residence, the terms of the treaty may reduce or eliminate the tax on certain types of income. To find out if Canada has a tax treaty with your country or region of residence, see Tax Treaties. If it does, contact the CRA to find out if the provisions of the treaty apply.

You May Like: Do You Pay Taxes Working For Doordash

Changing Your Federal Tax Withholding

Your retirement benefit is subject to federal income taxes. If you are a Massachusetts resident, however, your benefit is not subject to state income taxes. At the time of your retirement, we ask you to instruct us whether you want us to withhold any amount for income taxes and, if so, how much.

Please note:

- Unless you direct us otherwise, we must withhold federal income tax starting with your first payment.

- You may change your tax withholding amount at any time before or during your retirement by notifying us in writing. Simply download a , complete it and send it to our . Be sure that you mail your form so that it is received in our office by the 15th of the month in which you want the change to occur.

- If you need help in determining your federal tax withholding, use the IRSs online tax withholding estimator to assist you with your tax withholding preferences.

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Recommended Reading: Cook County Board Of Review Deadlines

Federal Tax And Credits

Complete Step 5 of your return to calculate your federal tax and any credits that apply to you.

Schedule A, Statement of World Income

You have to complete Schedule A to report your world income. World income is income from Canadian sources and sources outside Canada. Your net world income, which is shown on Schedule A, is used to determine your allowable amount of non-refundable tax credits on Schedule B .

Note

Your income from sources outside Canada is reported only on your Schedule A.

Federal non-refundable tax credits

These credits reduce your federal income tax. However, if the total of these credits is more than your federal income tax, you will not get a refund for the difference.

The non-refundable tax credits you can claim depend on the portion of net world income included in net income .

Schedule B, Allowable Amount of Non-Refundable Tax Credits

Complete Schedule B to calculate the allowable amount of non-refundable tax credits you can claim.

If the result from line A of Schedule Bis 90% or more, you can claim all the federal non-refundable tax credits that apply to you. Your allowable amount of non-refundable tax credits is the amount on line 35000 of your return.

If the result from line A of Schedule B is less than 90%, you can claim the following applicable federal non-refundable tax credits if you are reporting Canadian-:

Note

Your tuition, education, and textbook amounts

If you have no Canadian source income, tuition fees paid in 2020 cannotbe claimed.

Certified Financial Planners At Advanced Retirement Strategies

Working with a Certified Financial Planner is an excellent investment of your time and money. With the high standards for CFP® certification, youll know youre getting the expertise and knowledge of a highly-trained and educated professional who will always act in your best interests and with the loftiest ethical standards.

Our team of retirement planners and investment advisors in Bountiful, Utah specializes in helping diligent savers with $250,000 or more of investment and retirement assets prepare for and then transition into retirement.

If youre looking for a CFP® to help you live the retirement you have dreamed of, contact us now.

Also Check: How To Protest Property Taxes Harris County

Find Out Whether Your Pension Ira Or Other Retirement Income Is Taxable

Is retirement income taxable? It depends on where that income comes from and how much of it you will have, as well as where you live.

The major types of retirement income are either taxable, partially taxable, or tax-free. Learn which types of retirement income you will need to pay tax on, including pensions, retirement plans, Roth IRAs, and more.

Calculating Taxes In Retirement

Taxes in retirement can vary widely, based on where the income comes from. The tax rates on the different types of retirement income can also vary widely. Income may be taxed at the ordinary income tax rate, as capital gains, or at a completely separate rate.

No matter what types of income you have, always follow IRS guidelines when paying estimated taxes or preparing your tax returns. The rules for what is and is not taxable may change unexpectedly, depending on new state and federal laws.

If you are unsure whether your retirement income is taxable , consult a tax specialist to ensure that you avoid any IRS penalties or audits.

You May Like: How Do Doordash Taxes Work

You Worked Hard To Build Your Retirement Nest Egg But Do You Know How To Minimize Taxes On Your Savings

Taxes in retirement can be a nightmare for many people with today’s complex rules and regulations. 401 plans, IRAs and other retirement accounts come with many tax traps that even the smartest investors fail to see. Therefore, it shouldn’t be a big shock that retirees aren’t always up to date on every part of the tax code and, as a result, end up paying more in taxes than is necessary. Now that you’ve put together your retirement nest egg, you want to make sure that you’re not overpaying Uncle Sam. To help you evaluate your current tax knowledge, here are 12 questions retirees often get wrong about taxes in retirement. Take a look and see how much you really understand about your own tax situation.

Question: When you retire, is your tax rate going to be higher or lower than it was when you were working?

Answer: It depends. Many people make their retirement plans with the assumption that they’ll fall into a lower tax bracket once they retire. But that’s often not the case, for the following three reasons.

1. Retirees typically no longer have all the tax deductions they once did. Their homes are paid off or close to it, so there’s no mortgage interest deduction. There are also no kids to claim as dependents, or annual tax-deferred 401 contributions to reduce income. So, almost all your income will be taxable during retirement.

Question: Are Social Security benefits taxable?

Completing Your 2020 Income Tax Return

To complete your tax return, use the information in this section along with the instructions provided in the Federal Income Tax and Benefit Guide or the Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada, whichever applies.

The information in this section is presented in the same order as it appears on your return. When you come to a line that applies to you, look it up in this section as well as in your tax guide.

Gather all the documents you need to complete your return. This includes information slips and receipts for any deductions or credits you plan to claim.

If you are completing a provincial or territorial form, you may have to complete Schedule A, Statement of World Income, and Schedule D, Information About Your Residency Status , and attach them to your return.

If you were employed in Canada during 2020, your employer has until February 28, 2021 to issue you a T4 information slip showing your earnings and the amount of tax deducted at source for the year.

Recommended Reading: How Do I Do My Taxes For Doordash

Can I Get A Home Loan When Retired

Most lenders consider pension, Social Security and investment income as your regular income. You may also be able to include your annuity, survivor or spousal benefits and retirement account income as long as you can prove itll continue for at least 3 years. Your assets can contribute to your ability to get a loan.

Penalties And Interest Rates

Q. What are the applicable interest and penalty rates for underpayments of Delaware Income Tax?

A. The interest and penalty rates for underpayment of Delaware Income Tax are as follows:

Don’t Miss: Grieved Taxes

Electing Under Section 216

As a non-resident of Canada, you may have received the following types of income in 2020:

- rental income from real or immovable property in Canada

- timber royalties on a timber resource property or a timber limit in Canada

If so, you can choose to send the CRA a return to report this income for the year. Choosing to send this return is called “Electing under section 216 of the Income Tax Act.” This allows you to pay tax on your net Canadian-source rental or timber royalty income instead of on the gross amount. If the non-resident tax withheld on this income is more than the amount you have to pay under section 216, the CRA will refund the excess to you.

For more information, see Guide T4144, Income Tax Guide for Electing Under Section 216. The T1159 is the return you will need.