Volunteer Income Tax Assistance Program

United Ways Free Tax Preparation program helps low- to moderate-income households meet their basic needs and build financial assets. Residents who earn a household income of $66,000 or less can have their federal tax returns prepared, e- filed and direct deposited for FREE by United Ways Volunteer Income Tax Assistance program.

United Way IRS-certified volunteers who are passionate about taxes will prepare your return and determine if you are eligible for the Earned Income Tax Credit , Child Tax Credits, Childcare Credits and/or Education Credits when you file.

We do simple returns. We cannot do returns that have rental income or self-employment income at a loss, with expenses that exceed $35,000, or with employees. Please call to see if you qualify.

Get Your Federal Tax Refund Fast

Not only have we tried to make it as painless as possible to prepare and file your return, filing electronically will also get your tax refund much faster. After all, it’s your money. Why wait any longer than necessary to get it back.

At E-file.com, we work to get your federal tax refund as fast as possible thanks to the electronic filing program with the IRS. Filing electronically with the IRS and selecting to have your refund direct deposited to your bank allows you to get your refund as fast as possible.

What To Bring To Your Local Vita Or Tce Site

-

Proof of identification

-

Social Security cards for you, your spouse and dependents

-

An Individual Taxpayer Identification Number assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

-

Proof of foreign status, if applying for an ITIN

-

Birth dates for you, your spouse and dependents on the tax return

-

Wage and earning statements from all employers

-

Interest and dividend statements from banks

-

Health Insurance Exemption Certificate, if received

-

A copy of last years federal and state returns, if available

-

Proof of bank account routing and account numbers for direct deposit such as a blank check

-

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

-

Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

-

Forms 1095-A, B and C, Health Coverage Statements

-

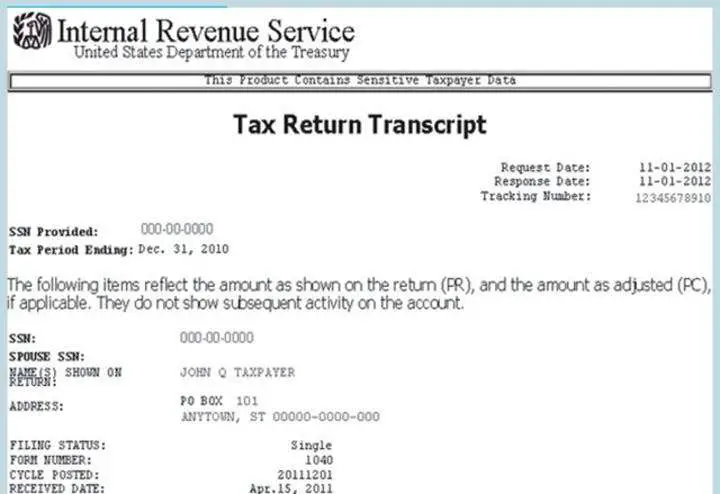

Copies of income transcripts from IRS and state, if applicable

Read Also: How To File Doordash Taxes

Campaign For Working Families

Eligibility: CWF offers free tax preparation services for people in Southeastern Pennsylvania and Southern Jersey who make under $65,000 a year.

They offer online and in-person services by appointment.

-

Online: You can get tax prep help online at cwfphilly.org/virtual.

-

In-person: You can make an in-person appointment and drop off your documents at cwfphilly.org/appointment.

-

: You can also call 215-454-6483 or email .

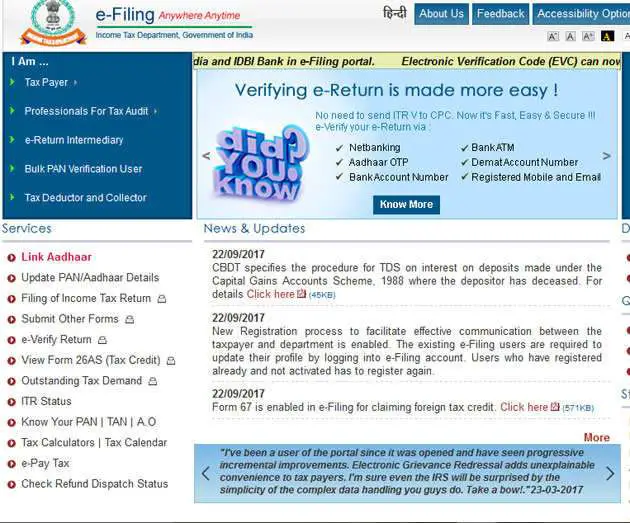

IRS Free File is a free federal service that will help you file your federal, and in some cases, state income taxes online.

Eligibility: You must make less than $73,000 a year.

IRS Free File partners with eligible tax service providers to guide you through filing. While most providers do not charge you for also filing your state taxes with the service, some do providers have to tell you about any fees on their IRS Free File landing page. To get started, visit their website.

Free Tax Return Help For Eligible Taxpayers

Find out if you qualify for the following free tax return preparation services:

-

Volunteer Income Tax Assistance – VITA offers free tax help to people who generally make $57,000 or less, people with disabilities, and taxpayers with limited English. IRS-certified volunteers explain tax credits and prepare a basic tax return with electronic filing.

-

Tax Counseling for the Elderly – TCE focuses on questions about pensions and retirement-related issues. It offers free tax help to all taxpayers, particularly to those who are 60 years old or older.

Due to the COVID-19 pandemic, many VITA and TCE offices are closed. Use the VITA/TCE locator tool to find an open office near you. To learn more about the services of VITA and TCE and what you should bring to your appointment, use the VITA/TCE checklist.

Recommended Reading: Doordash How Much To Save For Taxes

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Make Sure It Has An Auto

Unless youre the kind that simply cant live without hours of manual data entry, look for a provider with an auto-fill option. Most will offer the auto-fill ability, which, once youre signed in, will automatically fill in the parts of your return that the CRA has access to, like your T4 reported income for instance. This greatly simplifies the process, so make sure the software you choose offers it.

Read Also: Taxes Grieved

Irs Free Tax Help Tool

This is a great place to start, no matter what kind of help you need. Check to see whether there is a free local tax prep provider near you by using the IRS Free Tax Help Tool.

Eligibility: If you make less than $58,000 a year, the tool helps you find organizations that offer free tax prep services. All organizations listed should also offer free prep for taxpayers with disability or limited English, but check beforehand.

The program is funded through federal programs that the IRS oversees, such as the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. Its safe and easy, and gives you results based on zip code.

Proof Of Your Identity And Tax Status

If someone else is doing your taxes, you will need to show them your drivers license or state ID. If you are married and filing a joint return, both you and your spouse need to be there while the person is doing your taxes. You and your spouse need to sign the return before it’s filed.

If you are doing your taxes yourself, you need Social Security numbers or Individual Taxpayer Identification Numbers for yourself, your spouse, and your dependents.

You May Like: Do You Pay Taxes On Plasma Donations

Some Private Firms Also Offer Free Services

There are also some private companies that offer tax filing services at no cost, such as TurboTax, owned by Intuit, H& R Block, TaxAct and Credit Karma.

These companies all have free filing options available to some, depending on their annual income, the simplicity of the return, where they live, military status, eligibility for certain credits and more.

Before using online software outside the IRS Free File program, check with the company to see if you’re eligible to file for free and make sure you’re using the correct product, instead of one that will charge you.

Gabriel Mendez- Frances, 20, a student at the University of Alabama in Huntsville, used Credit Karma for the first time to file his taxes last year. He previously did his taxes by hand printing out forms from the IRS website and mailing them in because he had a very simple return, he said.

But last year, he started making money through a side gig as a freelance software developer and wanted help filing his return. He used Credit Karma to help build his credit score, so decided to try their tax tool.

“It’s much more simple online,” Mendez-Frances said, adding that Credit Karma’s tool was a big help in filing his more complicated tax return last year. He didn’t pay anything to file his federal or state return, he said.

There are free options, they do not necessarily have to pay to get their taxes doneTania BrownCFP, financial coach, SaverLife

Free Online Tax Preparation Programs

The IRS also has free online tools to prepare and file your federal tax return. If your income is $73,000 or less, you may be able to use one of the free online tools on the IRS Free File site to prepare your federal and possibly your state tax returns. These tools will guide you through filling out your tax return. If your income is more than $73,000, you can prepare and file your taxes for free using IRS Free Fillable Forms. This site will allow you to prepare and file your taxes online, but you will need to follow IRS instructions and fill out the forms on your own.

Don’t Miss: Does Doordash Issue 1099

What To Do If You Made More Than $72000

If your gross annual income was more than $72,000 in 2020, there is another free program that you can access through the IRS, but it requires you to prepare your taxes yourself.

The Free Fillable Forms program offers online tax forms that people can use to input their information and then either electronically file with the IRS or print out and mail to the agency.

Unlike other programs, Free Fillable Forms doesn’t give you any guidance or step-by-step instruction it only does basic calculations of the numbers you put into the forms. It’s also only available for federal taxes though people in certain states can access local programs to file their state returns.

Still, if you have the time and are comfortable preparing your own taxes, the Free Fillable Forms program is a good option. You won’t be able to do much preparation in advance, however the program opens on Feb. 12.

Free File Is Now Closed

Check back January 2022 to prepare and file your Federal taxes for free.

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via Irs.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Don’t Miss: Doordash Dasher Taxes

Free Tax Prep For Students

Students who have basic tax filings can usually do their taxes using free online tax prep services, such as IRS Free File. However, many universities participate in the federal VITA program and help students with free tax assistance. Check with your school first to see whether it will offer free tax help. If not, check out these resources:

Online:

Whether you go to a free site or the IRS offices, make sure to bring:

- Any tax forms from your employer

- ID, that is current government-issued photo identification

- Social Security cards for members of your household, including spouse and dependents

- Any IRS letters or notices you got about the Child Tax Credit or stimulus payments. Note: The Child Tax Credit was raised in 2021 to $3,600 per child, up from $2,000, but only for that one year.

- For the Advance Child Tax Credit, make sure to bring a copy of IRS notice 6419.

- For the Stimulus Payment, make sure to bring a copy of IRS Letter 6475.

Who Is Eligible For Irs Free File

IRS Free File is a partnership between the IRS and a nonprofit organization called the Free File Alliance. IRS Free File provides access to free tax preparation software from 10 tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify for IRS Free File . IRS Free File providers include big names such as Intuit , TaxAct, and TaxSlayer.

You May Like: Appeal Cook County Taxes

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Temple Universitys Volunteer Income Tax Assistance

Temples VITA program is a free tax preparation service. Due to COVID, Temple is operating virtually this year, said Steven Balsam, professor at Temples Fox School of Business.

Operating virtually does not take the client out of the process, as we use Zoom or call the client as we walk though their returns, Balsam said.

Eligibility: You must make less than $57,414 a year, not own your own business, not own rental property, and be a U.S. citizen or permanent resident.

The online program offers three options to send Temple your tax documents. For more information, contact Temples VITA program at 215-326-9519 or .

-

Online: To file with Temples VITA program online getyourrefund.org.

-

In-person: To drop off your tax documents in-person, visit 1509 Cecil B. Moore Ave, Room 214 . Open Monday from 10 a.m. to 5 p.m., Tuesday from noon to 5 p.m. or Thursday from 10 a.m. to 5 p.m.

-

: Send documents to Temple University VITA program, Fox School of Business, Department of Accounting, Alter Hall Room 403A, 1801 Liacouras Walk, Philadelphia, Pa. 19122. Temple will contact you when it receives your information. If you havent heard from the program within a week, call 215-326-9519 or email .

Don’t Miss: What Home Improvement Expenses Are Tax Deductible

Can I File My Taxes Online For Free

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

A Note About Audit Protection Plans

Filing for free usually means not having something called audit protection, which usually comes with the pricier tax-prep packages.

Audit protection works like insurance against the possibility of a CRA audit, according to Toronto tax lawyer David Rotfleisch.

Most taxpayers will never need it. However, if the CRA does come knocking on your door, audit protection will take care of responding to CRA inquiries and audit requests at a much lower cost than hiring an accountant or tax lawyer.

The unknown is the level of expertise of the people providing the representation services, Rotfleisch said. In a complex audit situation, he added, if the representatives do not have the proper expertise, the taxpayers situation may very well be prejudiced.

WATCH:Carbon tax fuels higher gas prices and plenty of political spin

Recommended Reading: Do Doordash Take Out Taxes

Watch Out For The Upsell

The CRA divides its certified software categories into free products and products with pay what you want model, and paid products and products with free offerings. The second category is largely made up of companies that have a bare bones filing platform that is free, but once on their site, they may do everything they can to upsell you on paid products, and perhaps push you into thinking you need them when you might not. Youve been warned!

Paid products, like audit protection plans, an insurance that assures that should the CRA audit you, their company will serve as an intermediary, are more controversial. Full tax audits are exceedingly rare And as Toronto tax attorney David Rotfleisch told Global News, should you be audited, you might be better off hiring a bone fide accountant or tax attorney to help you rather than relying on someone with unspecified qualifications. Rotfleisch said:

The unknown is the level of expertise of the people providing the representation services,

He went on to point out if the representatives do not have the proper expertise, the taxpayers situation may very well be prejudiced.

How To Get Your Taxes Done For Free This Year

- Impact Areas:Moving Families Out of Poverty

Every year, tax refunds make up an essential part of the finances of thousands of families. Even so, many households miss out on thousands of dollars each year because theyre unaware of refund credits theyre eligible for. For example, 1 in 5 families miss out on the Earned Income Tax Credit which equates to an additional $2,100 on their refund. In Massachusetts alone, thats over $200 million left on the table, which could be put to work in our communities by families who use their returns to buy home heating oil, pay for childcare, utilities, or housing.

For people with children, the need to file is multiplied for 2021 primarily because of enhancements to the child tax credit, says Jim Graham, Quincy Community Action Programs financial coach.

Thats why, at United Way, were committed to helping people make the most of their return every year. We do this by supporting free tax preparation services in local communities across our region and offering a free online service myfreetaxes.com, with volunteers available by phone.This year, United Ways community partners are projected to help prepare taxes for more than 2,660 people, leveraging nearly $4 million in returns. Cumulatively, volunteers will spend around 4,286 donated hours working with clients.

Read Also: Plasma Donation Earnings