A Taxes Are Based On Profit Not Earnings

If you received $20,000 from Doordash this year, you aren’t taxed on all $20,000. Not if you’re keeping records anyway.

You will fill out a Schedule C on your taxes to show your earnings for your self employment business. On that, you will list your earnings and your expenses.

Then you will subtract the expenses from the income. It’s the money that’s left over that is the basis for your taxes. If you had $20,000 in earnings, and $10,000 in expenses, your profit is $10,000. The $10,000 is the taxable income, not the whole $20,000

This is why you MUST track your miles driven, and your expenses.

How Qualified Do You Want Your Professional To Be

The average tax preparer will charge less than a high-quality advisor with loads of experience. But when it comes to the IRS and your money, the stakes can be high, depending on your specific situation.

Now, dont get us wrong. We want you to save money just as much as you do. But when hiring expertslike tax pros, doctors and mechanicswere all for spending more cash to get the job done right. Paying an extra $100300 on the front end may be worth it in the long run if the expert is thorough, accurate and ends up saving you a ton. Remember, were talking about estimates here, so adjust your professional expectations accordingly.

What Tax Credits Are Available To Me

If you owe little to no taxes, you should focus on tax credits that are refundable. That means youll be able to cash them in even if theyre greater than what you owe. Most tax credits are non-refundable, meaning they can reduce your tax bill, but wont pay you anything extra. So, if you owe $300 in taxes, and you score a tax credit worth $500, if its refundable, you can pocket the $200 difference, whereas if its non-refundable, youd just wipe away your $300 bill and call it a day.

One refundable credit you should see if youre eligible for is the Earned Income Tax Credit , meant to benefit workers with low to moderate income. In general, you can claim it as long your total earned income is at least $1 and your AGI is less than specified limits, which depend on your filing status and how many qualifying children you claim on your return. For 2019, those limits range from $15,570 if youre single with no kids to $55,952 if youre filing jointly and have three or more kids. Also, your investment income must be $3,600 or less for the year. And the corresponding maximum amounts you can get with the EITC range from $529 to $6,557. For the 2018 tax year, 25 million eligible taxpayers claimed the EITC, collecting an average $2,488 credit.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Do I Have To Claim The Credits

No, you never have to take advantage of tax breaks, but why wouldnt you? Yes, filing taxes can be an intimidating hassle. But it can be well worth it. And taking advantage of any available tax breaks while minimizing your tax bill is a smart way to give yourself a financial boost.

Acorns does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns.

Stacy Rapacon is a freelance writer, specialized in personal-finance topics including investing, retirement, and smart spending. Her work can also be found on Kiplinger.com, U.S. News and World Report, CNBC, and other publications.

Tax Slips To Watch Out For:

There are a number of tax slips you may have to watch for this year. In fact, even the plain-vanilla T4 from your employer looks a little different this year, says Lisa Gittens, a tax expert at H& R Block Canada. There will be extra boxes at the bottom that will help the Canada Revenue Agency check whether you were working while also collecting COVID-19 benefits like the Canada Emergency Response Benefit or the Canada Recovery Benefit , according to Gittens.

If you did receive any of those income supports, the government will send you various kinds of tax slips with information to fill out your return. For any payments you got through the CRA, expect a T4A, says Gittens. For money sent from Service Canada including Employment Insurance benefits and CERB payments not processed by CRA youll see a T4E.

Don’t Miss: Have My Taxes Been Accepted

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

How To Know If Youre Self

There are a ton of different terms for being self-employed, so I want to start with clearing some things up. If youre a freelancer, if youre a small business owner, or even if you have a side hustle, all of those would fall under the umbrella of self-employed. Self-employed simply means you are earning income by yourself, outside of an employer.

That being said, there are a few exceptions in which you arent self-employed but still need to set aside money for income taxes. For instance, if you earn cash tips from your job, that is considered taxable income. Not only do you need to claim that cash as income when filing your taxes, but you also need to pay tax on it. The same goes for if you do any cash gigs. For instance, if youre a musician and get paid for your performance in cash, that cash is considered taxable income that you need to claim and pay taxes on. If you do not claim any cash you earn as income on your taxes, that is considered tax evasion and is illegal.

Another example would be if you are a hired contract worker for a company. In some instances, the company will pay you regularly as if you are a normal employee, but they wont take any tax or CPP off your paycheque. In this case, you may not be self-employed in the traditional sense, but you would be in the sense that you have to save a percentage of your pay for tax time.

For more info, check out this article on the governments website about tax obligations for self-employed individuals.

Read Also: How Much Is Payroll Tax In Louisiana

Do I Have To Pay Someone To Do My Taxes

Many Americans lean heavily on professionals to do their taxes. Paid tax preparers filed about 59% of the more than 134.2 million individual income tax returns e-filed in 2018, according to the IRS. Keep in mind that number doesnt include paper returns or more-complex returns like ones for estates, trusts or tax-exempt organizations, so the actual percentage of returns done by paid preparers is probably higher.

While some people with complex financial situations may benefit from getting professional help filing their taxes, many people can file their own taxes and skip the professional-preparation fee.

Online tax preparation services, like , offer a do-it-together approach to tax filing that can help you avoid the filing preparation fees and still get it right. Here are some points to keep in mind if youre debating whether to use online tax preparation software or shoulder the cost of tax preparation by a professional.

Tax Brackets And The Marriage Penalty

When people get married, their combined income would put them over the tax brackets they were in when unmarried. Because of this, the IRS uses a separate set of tax brackets for married couples filing joint returns that allows higher levels of combined income to be taxed at lower rates.

This tax benefit works really well for couples at different levels of income. If you earn $250,000 per year and your spouse earns $50,000 per year, if you file a joint return then your marginal tax rate for $300,000 of combined income is only 24%. It would’ve been 35% if you’d filed as an individual. See the rates tax brackets for each filing status above.

But if couples earn the same level of income, in some cases they may pay a so-called . The marriage penalty isn’t a real penalty it’s a quirk of the progressive taxation system that occurs when each spouse is individually in the same marginal tax bracket and combining their income pushes them into the next highest bracket.

The Tax Cuts and Jobs Act mostly mitigated the marriage penalty. That’s because the maximum levels of income for married couples filing jointly in each tax bracket are now double the levels for individuals.

You May Like: How To File Taxes Without Income To Get Stimulus Check

If You Cannot Pay In Full

If you are not able to pay the full amount:

- file on time to avoid paying a late-filing penalty

- make a partial payment to reduce the amount of interest you need to pay on unpaid amounts

You can set up a payment arrangement to give yourself more time and flexibility to repay what you owe. For details: Arrange to pay your personal debt over time

If you are unable to pay, you can discuss your options with the CRA.

Cases When Youll Have To File

Even if you didnt have much income, you may still have to file taxes if any of the following circumstances apply:

- You had Federal taxes withheld from your pension and/or wages for 2019 and wish to get a refund back

- Are you entitled to the Earned Income Tax Credit for 2019

- You received unemployment income

- You were self-employed with earnings of more than $400

- You sold your home

- You owe any special tax on a qualified retirement plan You may owe tax if you:

- Received an early distribution from a qualified plan

- Made excess contributions to your IRA or HSA

- Were born before July 1, 1949, and you did not take the required minimum distribution from your qualified retirement plan

- Received a distribution in the excess of $160,000 from a qualified retirement plan

If any of the above circumstances apply to you then you should file a federal tax return regardless of your earnings.

Most of us with a small business or side hustle will need to file since self-employment income of more than $400 is one of the minimum requirements.

You May Like: Appeal Property Tax Cook County

Pay At The End Of The Month

It can be a headache to remember to transfer some of every single payment you receive, depending on the frequency with which your payments come in. An alternate method could be to calculate how much money you earned last month, then set aside 25% to 30% of that before you begin paying the next month’s bills.

This tactic assumes that youâre already saving some of your income and that your account isn’t empty, or that it won’t become empty when you transfer the tax money. Set aside money for taxes before you begin paying your bills if you tend to spend everything that comes into your account.

Personal Income Tax Brackets And Rates

| Taxable Income – 2021 Brackets | |

| Over $222,420 | 20.5% |

Tax rates are applied on a cumulative basis. For example, if your taxable income is more than $42,184, the first $42,184 of taxable income is taxed at 5.06%, the next $42,185 of taxable income is taxed at 7.70%, the next $12,497 of taxable income is taxed at 10.5%, the next $20,757 of taxable income is taxed at 12.29%, the next $41,860 of taxable income is taxed at 14.70%, the next $62,937 is taxed at 16.80%, and any income above $222,420 is taxed at 20.5%.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Advantages Of Online Tax Preparation

- Affordable: Many online tax preparation services offer to file your basic federal tax return for free. However, they may charge a fee if you have a business or investments, if you want to file a state return or need to complete and file certain other tax forms along with your 1040 tax return. With ®, filing both federal and state taxes is always free, regardless of your financial situation.

- Faster: Eight in 10 taxpayers get their tax refunds faster by opting to e-file and have their refunds directly deposited into their bank accounts, according to the IRS. In fact, the IRS says e-filing with direct deposit is easy to do and is the fastest way to get your refund if youre owed one. Also, the actual filing process can go more quickly if the service you choose helps you consider your options and lets you know if anything is missing.

- User-friendly: Online tax preparation services typically walk you through the entire process, asking questions to help you avoid mistakes.

Obligations Of The Tfsa Issuer

The issuer of a TFSA must exercise the care, diligence and skill of a reasonable prudent person to minimize the possibility that a trust governed by the arrangement holds a non-qualified investment.

If the issuer fails to comply with this obligation, the issuer is liable to a penalty under the Income Tax Act .

The issuer is also required to notify the holder of the TFSA in prescribed Form and manner before March of a calendar year, if at any time in the preceding year the TFSA trust acquired or disposed of a non-qualified investment, or if an investment became or ceased to be a non-qualified investment.

Tax payable on an advantage

If the holder or a person not dealing at arms length with the holder was provided with an advantage in relation to their TFSA during the year, a 100% tax is payable which is:

- in the case of a benefit, the FMV of the benefit

- in the case of a loan or a debt, the amount of the loan or debt

Note

For more information, see Income Tax Folio S3-F10-C3, Advantages – RRSPs, RESPs, RRIFs RDSPs and TFSAs.

You May Like: Amended Tax Return Online Free

Where Can I Find My Tfsa Contribution Room Information

Your TFSA contribution room information can be found by using one of the following services:

- Represent a Client if you have an authorized representative.

- Tax Information Phone Service at 1-800-267-6999.

In addition, if you want to receive a TFSA Room Statement, call us. You can also ask for a TFSA Transaction Summary that shows the information that we received from your TFSA issuer about your contributions and withdrawals.

If the information that we have about your TFSA transactions is not complete or if you have made contributions to your TFSA this year, use Form RC343, Worksheet TFSA contribution room, to calculate your TFSA contribution room for the current year. If we have deemed your unused TFSA contribution room to be a specific amount, do not use this form call us for more information.

You must keep records about your TFSA transactions to make sure that your contributions do not go over your TFSA contribution room. We will keep track of an individual’s contribution room and determine the available TFSA contribution room for each eligible individual based on information provided annually by the TFSA issuers.

Federal Benefits Tied To Personal Income Tax Returns

Your familys reported income determines which other benefits you may be eligible for, both at the federal as well as at the provincial level. When the federal Liberal government was elected, they made changes that affect families with children. According to their website, a family of 4 with a household income of $90,000, 1 child under 6 years old and another child between 6 and 17, could receive a tax-free benefit of $490/month. Thats cash to your bank account.

A family of 4 with a household income of $45,000 with 2 children under 6 years old would receive a tax-free benefit of $904 a month. Thats a lot of cash for your bank account. They illustrate a number of other examples as well however, no one is eligible to receive any of these benefits if you dont file your income tax return by the deadline. You can try the Child and Family Benefits Calculator to see what benefit you may be entitled to.

Eligibility for the GST/HST Credit is Automatically Determined When You File

There are other federal benefits you may miss out on if you dont file your tax return or if you file it late. The GST/HST credit helps modest income people and families offset some of the tax they pay throughout the year. By filing your tax return, CRA automatically determines how much of a rebate youre eligible for.

Check to see what other benefits you may be eligible for on the CRA website under individuals and families.

Read Also: Taxes For Doordash

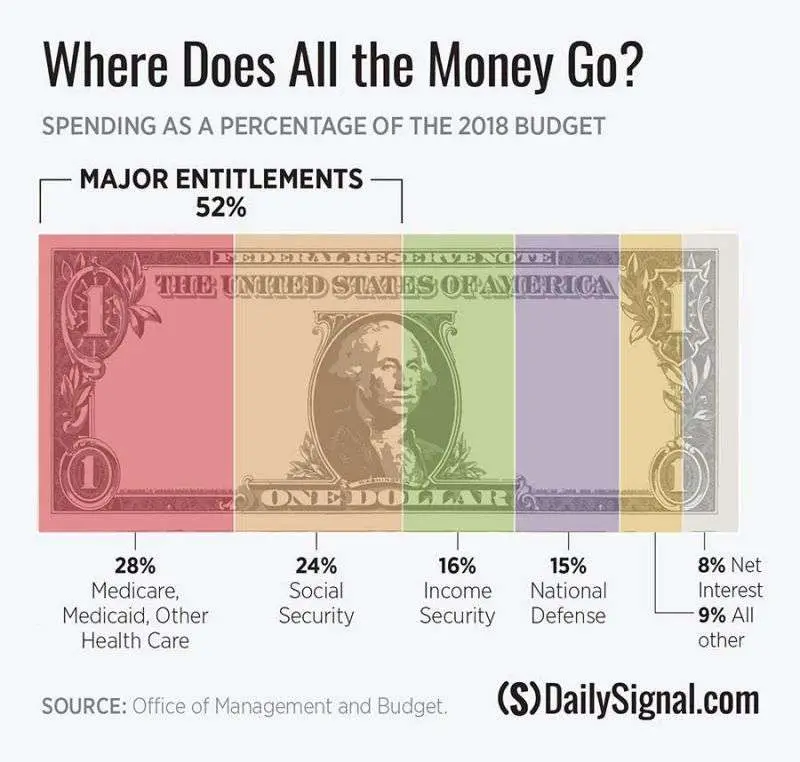

What Americans Get For Their Taxes

Americans enjoy a strong national defense. As of April 2017, the U.S. spent $611 billion on defense, which, as the Peterson Foundation points out, is “more than China, Saudi Arabia, Russia, United Kingdom, India, France and Japan combined.” Additionally, “the United States has historically devoted a larger share of its economy to defense than many of its key allies.“