Taxable Brokerage Account: No Worry

In a tax advantaged account like a Roth IRA, the capital gains are allowed to grow tax free. You dont have to set aside some of the winnings for a large tax bill every Spring, instead you can plow all of that money into a new investment. Even tax deferred accounts like a traditional IRA or 401k will let you reinvest that money without taxes for the time being, only charging you when you withdraw money from the account during retirement.

Taxes are definitely a tricky business when it comes to investing. Hopefully you can see why its such a hot button in politics. Its not just the wealthy 1%-ers who pay up in taxes. Unfortunately even the hard working investors who are trying to improve their lot in life like you and me are subject to strict tax laws, and its a real obstacle to financial success.

That being said, dont let this tax nonsense discourage you. Its just another reason why I strongly advocate long term investing, and a slow and steady, patient approach.

The investments we want will be cashed out 10, 15, 20, 25 years down the road after constant dividend increases. Those investments will give us yields on cost of 10%, 15%, 20%, 25% or more. Now thats when serious wealth will happen and at that point, they can tax me all they want. Ill have plenty left over.

Is It Ordinary Income Or A Capital Gain

To determine how an investment vehicle is taxed in a given year, first ask yourself what went on with the investment that year. Did it generate interest income? If so, the income is probably considered ordinary. Did you sell the investment? If so, a capital gain or loss is probably involved.

If you receive dividend income, it may be taxed either at ordinary income tax rates or at the rates that apply to long-term capital gain income. Dividends paid to an individual shareholder from a domestic corporation or qualified foreign corporation are generally taxed at the same rates that apply to long-term capital gains. In 2013, these rates are 0 percent for an individual in the 10 or 15 percent marginal tax rate bracket,15 percent for an individual in the 25 percent, 28 percent, 33 percent, or 35 percent tax rate bracket, and 20 percent for those in the top tax bracket. But special rules and exclusions apply, and some dividends continue to be treated as ordinary income.

The distinction between ordinary income and capital gain income is important because different tax rates may apply and different reporting procedures may be involved. Here are some of the things you need to know.

Brokerage Account Vs Tax

As mentioned above, tax-advantaged accounts – namely, retirement accounts – do come with advantages. Accounts such as 401k, 403b, and 457b are all funded with pre-tax dollars.

That means you dont pay income tax on that money as it it is deposited. It also grows tax-free, with no capital gains tax.

This also has the benefit of reducing your taxable income. Each dollar your earn in high income brackets is taxed at high rates. So, if your retirement contributions knock you down a tax bracket, not only will you pay no tax as the money is going in – youll also have a lower tax rate overall.

Of course, the money is taxed when it is withdrawn, so its not all good news.

Roth accounts such as a Roth IRA or Roth 401k are similar. The only difference is when the money is taxed: as its deposited. Then, you can later withdraw it tax-free.

Thus, having both a traditional account and a Roth can afford you some tax flexibility.

All of these tax advantages show how a retirement account is advantageous to a brokerage account.

However, money in a retirement account cant be withdrawn before age 59 & ½ without a 10% penalty. The only exception is a Roth account, which has no such penalty.

In any case, there is no age-based penalty for withdrawing money from a brokerage account. You will have to pay capital gains tax, however.

Recommended Reading: How To Buy Tax Lien Properties In California

What Is A Roth Ira

First, we need to identify what a Roth IRA is and how its beneficial.

A Roth IRA is an Individual Retirement Arrangement that is funded with post-tax money. That is, youre investing in the account with money that has already been taxed or youre paying tax on the money when you convert it from tax-deferred to Roth.

Growth in your Roth account is not subject to tax. Neither are withdrawals.

Dividends are not taxed. Earnings are tax-free. Quite simply, once your money is in a Roth account, it will never be taxed again. Sure, the tax laws could change, but any proposal that resulted in double taxation of Roth money would be extremely unpopular and unlikely to gain real traction.

Roth IRA money is not subject to Required Minimum Distributions , although an inherited Roth IRA will be.

Achieve Greater College Savings Flexibility

If youre saving for education in a 529 plan or a Coverdell account, youre only allowed to use funds for qualified educational expenses. If you want to pay for anything your student needs that isnt considered qualified, a taxable investment account can give your savings a boost and provide increased flexibility.

In fact, complementing a 529 with a taxable brokerage account can be an ideal tax move: Your 529 account covers all qualified educational expenses, letting your taxable investment proceeds pay for expenses like room and board over the summer when school isnt in session, travel to and from home or abroad, and even incidental expenses throughout the school year.

Also Check: How To Appeal Property Taxes Cook County

Avoid Rmds In Retirement

If youre worried about required minimum distributions, or the mandatory minimum withdrawals the government requires of all but Roth IRAs once you reach a certain age, then a taxable account can allow you to keep your money invested for a longer period.

Under the current law with pre-tax dollars, investors must start taking distributions by age 72, says Phelps. Investors are not under any obligation to ever take a distribution from a taxable investment.

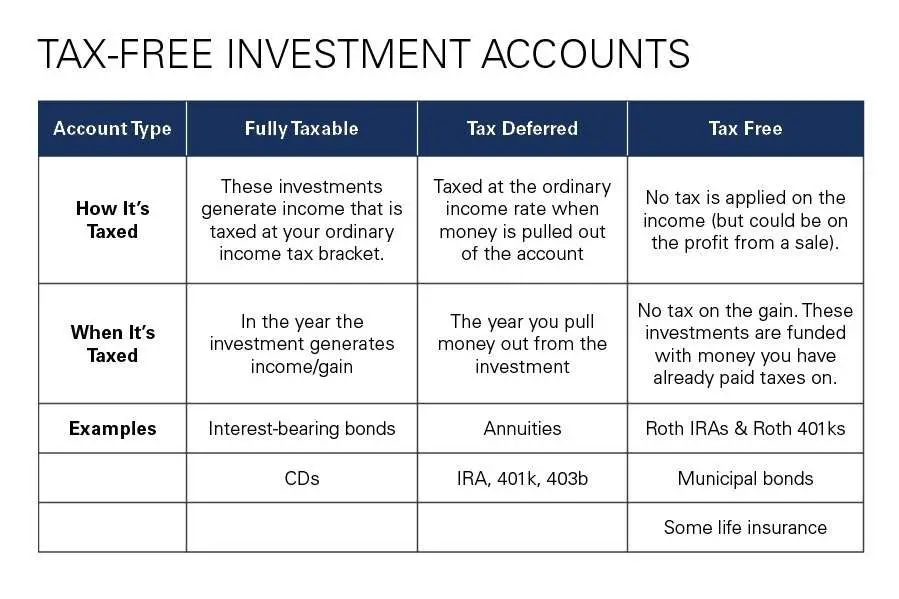

Know The 3 Main Types Of Investing Accounts

Many investors have several different types of accounts that can be aligned with specific investing goals. Some are subject to taxes every year, while others have tax advantages. Here are the 3 main investment account categories:

Remember, contribution limits2 prevent investors from simply saving everything in tax-advantaged accounts.

You May Like: Do You Have To Report Plasma Donations On Taxes

Online Brokerage Accounts And Downward Price Pressure

Launched in early 2015 under a mobile-only platform, online brokerage Robinhood offers commission-free trading and has no minimum account requirements, with the exception of its margin accounts. Although it bypasses commissions, the firm was a pioneer in being able to generate revenue from a practice known as payment for order flow.

The amount paid by the market-making firm is far less than what typical equity trade commissions used to be , so even if this cost ultimately gets passed on to the consumer in embedded fees, this model still benefits the consumer because of its reduced cost and its efficiency. In late 2019, almost all of the discount brokerage firms fully adopted this business model and switched to free commissions on most equity trades.

In November 2017, Robinhood announced that it had surpassed three million brokerage accounts, exceeding $100 billion in transaction volume. Meanwhile, E*TRADE reported approximately 3.5 million brokerage accounts, with $311 billion in assets under management .

New Medicare Contribution Tax On Unearned Income May Apply

High-income individuals may be subject to a new 3.8 percent Medicare contribution tax on unearned income in 2013 . The tax is equal to 3.8 percent of the lesser of:

- Your net investment income , or

- The amount of your modified adjusted gross income that exceeds $200,000

So, effectively, you’re subject to the additional 3.8 percent tax only if your adjusted gross income exceeds the dollar thresholds listed above. It’s worth noting that interest on tax-exempt bonds is not considered net investment income for purposes of the additional tax. Qualified retirement plan and IRA distributions are also not considered investment income.

Read Also: Pastyeartax Reviews

How A Brokerage Account Can Provide Tax Planning Opportunities In Retirement

There is a common misconception that retirees will invariably be in a lower tax bracket than they were during working years. Although this can certainly be the case, some retirees with a significant portion of assets in tax-deferred accounts ) find themselves in a much higher tax bracket once Required Minimum Distributions begin at age 72.

Withdrawals from a tax-deferred retirement plan are taxed as ordinary income, which can be problematic when you have fewer options to reduce your taxable income, as many retirees later find out. A brokerage account isnt the only option for investors, however. At any income, individuals can make one Roth IRAconversion each year. A Roth IRA can also help retirees with tax planning alternatives, potentially avoiding the retirement tax cliff altogether.

What Are The Main Differences Between A Brokerage Account And An Ira

While there are many similarities between brokerage accounts and IRAs, there are some important distinctions to be made. Here are some of the main differences between the two.

- IRAs provide tax benefits. An IRA will provide tax advantages either on the front- or back-end, depending on the type of IRA. A brokerage account, on the other hand, is a taxable account and does not offer any retirement tax advantages.

- Brokerage accounts have no limits. For 2021 and 2022, IRA contributions are capped at $6,000 . However, investors can contribute as much as they want to a brokerage account.

- IRAs can have required withdrawals. Once an investor turns 72, they will be required to take minimum annual withdrawals from their traditional IRA. Roth IRAs have required distributions, too, but only after the primary account owner dies and passes the account on to a beneficiary. Brokerage accounts, on the other hand, have no such requirements.â

- Brokerage accounts can offer more liquidity. Early withdrawal penalties are possible with both traditional and Roth IRAs, depending on the circumstances. With a brokerage account, though, investors can buy, sell, or otherwise liquidate any assets at any time, without penalty.

Recommended Reading: Taxes For Doordash

No Tax On Withdrawals From A Taxable Account

When youre working and earning a good income, your spending money should come from your paychecks. You should have no need to sell your taxable holdings to fund your lifestyle.

If you do face a situation where selling from taxable is your best option , thats quite alright, but understand that your taxable account will not mimic a Roth account if you do this while still earning a good living.

The time that tax-free withdrawals become possible is in retirement, particularly in early retirement.

As long as your taxable income is below $80,000 or $40,000 , you will pay no tax on long-term capital gains and qualified dividends.

How might this work in real life?

Lets say youre retired with a paid-off mortgage and want to live on $120,000 a year.

A married couple could sell $120,000 worth of taxable assets purchased long ago that have appreciated 600% and not owe any tax, as long as the assets have been held for over a year. Their capital gains when selling would be $120,000 $20,000 = $100,000 long-term capital gains.

A simple tax calculation would be $100,000 long-term capital gains $24,800 standard deduction in 2019 = taxable income of $75,200. That puts them in the 0% capital gains bracket with no taxes owed on the year. They could have another $4,800 in income from other sources and still owe zero capital gains taxes.

Additional outside income could foul this up, of course, but the bottom line is that your total taxable income should be under that magic number.

Whats A Brokerage Account And Who Can Open One

A brokerage account is also known as an investment account, a securities account or simply a taxable account. It can be opened by anyone over the age of 18 if they have a social security number or tax ID number and a US address. Non-citizens and non-permanent residents are eligible to open the account as well. The account can be opened at an online brokerage like Vanguard, or at a robot-advisor like Betterment.

It takes a very short time to open one of these accounts online. Simply go to the firms home page and fill out a new account application form. When starting out, look for firms where the accounts minimum is close to zero, with great customer support, and access to a broad range of investing options. There are three high-level investing methods.

- Online brokerage account you are on your own in picking out the investments.

- Robo-advisor you answer a series of questions on your goals, risk profile etc. This allows the algorithm to design a portfolio that fits your described needs.

- A managed account As the name implies, even though its a brokerage account, its being managed by a financial advisor.

A brokerage account is great for somebody looking to start learning about investing on their own.

There are many ways of funding the account, the easiest is a direct transfer from your bank to the newly created account. Linking your bank account means you can move money in both directions.

You May Like: How Do I Amend My State Tax Return

When Should I Consider Opening A Brokerage Account

Great question! Keep in mind that working with a financial advisor who can give you guidance on the pros and cons of opening a brokerage account in your situation is always a good idea.

Now, here are four scenarios where a brokerage account might play a big role in helping you reach your financial goals:

Hold Investments For At Least One Year

The IRS treats investments differently based on how long you hold the investment. The important cutoff date to remember is one year.

Any investments you sell within one year of buying are treated as short-term investments. You pay your regular income tax rate on any short-term capital gains you make from them.

If you hold an investment for at least one year before you sell it, you only have to pay the long-term capital gains rate.

In 2021, the long-term capital gains rates for single filers and those who are married filing separately:

| Income |

| $501,601+ | 20% |

Compared to the top income tax rate of 37%, the 20% long-term capital gains tax rate is a great deal that can make holding investments for the long-term well worth doing.

Youll also pay the long-term capital gains tax rate on any qualified dividends you receive. These are dividends paid by U.S. or qualifying foreign companies on shares that youve held for a sufficient period of time before the ex-dividend date.

In other words, dividends are also taxed at a lower rate if you hold the dividend-paying investment for the long term, providing even more incentive to buy and hold.

Also Check: How Can I Make Payments For My Taxes

Definition And Example Of A Brokerage Account

A brokerage account is a type of taxable investment account that can be opened with a brokerage firm. The account holder can order trades, such as buying or selling stocks, and those orders are executed by the brokerage firm.

- Alternate name: Taxable account

Brokerage accounts are the more basic alternative to retirement investment accounts, like 401 plans and Roth IRAs. Unlike retirement accounts, which have special rules and tax advantages, brokerage accounts have very few restrictions, and any gains or losses are reflected on your taxes for that year.

You Maxed Out Your 401 And Ira Contributions

First things first: We recommend you invest 15% of your gross income into tax-advantaged options like your 401 and Roth IRA. But if youve maxed out your tax-advantaged options and still havent invested 15% of your gross income, you can use a brokerage account to help you hit that mark.

In 2022, you can put up to $20,500 in a 401 and $6,000 into your IRA. If youre age 50 or older, you can put in catch-up contributions that allow you to invest $27,000 in a 401 and $7,000 into an IRA this year.1,2 Make sure you focus on investing as much as you can in those accounts before turning to a brokerage account. You dont want to miss out on those tax benefits!

Just like with your 401 and IRA, we recommend spreading your investments in a brokerage account across four different types of mutual funds: growth and income, growth, aggressive growth, and international.

Recommended Reading: How Can I Make Payments For My Taxes

Fill Out An Application

Once you find a brokerage firm you want to open an account with, opening a brokerage account is a pretty simple process that just takes a few minutes to complete. You might need to sign some forms and provide some personal information, like your Social Security number, employment status, net worth and more.