Finding The Magic Number

Start by looking at the numbers: How much revenue is coming in, how much is going out in expenses, and how much cash do you have? Don’t just look at this month’s datago back and see how your business has done over time. Project the amount of revenue and expenses you expect in the months to come. Don’t forget to include:

- Taxes. Consider all that may apply to you: not only your personal and business income taxes but also payroll taxes and unemployment taxes.

- Occasional or annual expenses. Even though they occur less frequently, it’s important to include expenses like insurance premiums and equipment repairs.

- Expansion plans. If you plan to move to a larger location, launch a more complex website, or expand your product line, you may want to accumulate cash in the business for that purpose.

- Expected fluctuations. An ice cream stand is going to do better in the summer than in the winter, and a service business may receive a big lump sum at the start of a major contract and then nothing for months.

Use this information to figure out how much money the business needs in its accounts to stay afloat, with a comfortable cushion, in case your projections don’t prove to be true. This will tell you what’s available to pay the owners.

Paying Yourself As A Sole Proprietor

Payment method: Owners draw

A sole proprietors equity balance is increased by capital contributions and business profits, and is reduced by owners draws and business losses.

Lets go back to Patty and her Riverside Catering business. In this example, Patty is a sole proprietor and she contributed $50,000 when the business was formed at the beginning of the year. Riverside Catering posts this entry to record Pattys capital contribution:

A normal balance for an equity account is a credit balance, so Pattys owner equity account has a beginning balance of $50,000. During the year, Riverside Catering generates $30,000 in profits. Since Patty is the only owner, her owners equity account increases by $30,000 to $80,000. The $30,000 profit is also posted as income on Pattys personal income tax return.

Patty can choose to take an owners draw at any time. She could choose to take some or even all of her $80,000 owners equity balance out of the business, and the draw amount would reduce her equity balance. So, if she chose to draw $40,000, her owners equity would now be $40,000.

Keep in mind that Patty pays taxes on the $30,000 profit, regardless of how much of a draw she takes out of the business.

Income Taxes For Multi

Multi-member LLCs are treated as pass-through entities for federal income tax purposes. Similar to the single-member LLC, this means that the LLC doesnt pay taxes of its own. Instead, each member pays taxes on the businesss income in proportion to their ownership stake in the LLC. Thus, the LLC tax rate is in accordance with each members individual income tax bracket.

If, for instance, two members in an LLC have a 50-50 ownership split, each owner will be responsible for paying taxes on half of the businesss profits. Each owner can also claim half of the tax deductions and tax credits that the LLC is eligible for, and write off half of the losses. This type of taxation works almost exactly like a partnership.

A multi-member LLC has to file certain tax forms with the IRS, including Form 1065, U.S. Return of Partnership Incomean informational return that must be filed annually with the IRS. The LLC must also give each owner a completed Schedule K-1 by March 15 of each year. The Schedule K-1 summarizes each owners share of LLC income, losses, credits, and deductions. Each owner will attach their Schedule K-1 to their personal income tax return thats filed with the IRS.

Pass-through taxation continues at the state and local levels. Most states have their own equivalent of Form 1065 and Schedule K-1. As mentioned above, a few states like California charge additional LLC taxes.

Also Check: How Do I Get A Pin To File My Taxes

How Much Does The Average Small Business Pay In Taxes

Small businesses of all types pay an average tax rate of approximately 19.8 percent, according to the Small Business Administration.

Small businesses with one owner pay a 13.3 percent tax rate on average and ones with more than one owner pay 23.6 percent on average. Small business corporations pay an average of 26.9 percent.

Corporations have a higher tax rate on average because they earn more income. This is easy to understand when you consider that over 18 percent of small S corporations earn at least $100,000 net per year while almost 60 percent of small businesses with one owner earn less than $10,000 net.

Donât Miss: Power To Levy Taxes

Paying For Tax Preparation

Paying for tax preparation can be divided easily between your business tax form and your personal tax return. Ask your tax preparer to divide your bill into two parts: one part for preparation of the business tax form, and one part for preparation of your Form 1040. Then pay the bill for the business tax form with your business account or card. Self-employment taxes are considered a personal expense, so you shouldn’t pay those with your business account.

Also Check: Doordash Taces

Do I Pay Employees In The Same Way

If you have employees, you will need to pay them through a payroll system. You enter their payments, run payroll, and transfer their salary , to their bank accounts. You typically do not need to have a payroll system if youre running a sole proprietorship, partnership, or LLC and youre only paying owners.

Filing Personal And Business Taxes Separately: A Small Business Guide

How you file your business taxes with the IRS depends on your businesss structure. Some structures, like corporations, must file their business taxes separately from their personal taxes. Other structures, like sole proprietorships, must report their business income on their personal taxes.

Below well look at how each type of small business must file their taxes.

In this article, well cover:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Recommended Reading: Is Doordash A 1099

How To Enroll In Gpfs

If your business requires one person to sign cheques and youre registered for online banking:

If you hold a CIBC Business Banking Convenience Card and would like to register for online banking, you can:

Big Companies Are Audited At The Highest Rates And Congress Keeps An Eye On Corporate Refunds

The largest corporations have relatively high audit ratesof the 619 companies with assets over $20 billion in 2019, 50 percent were audited by the IRS compared to the overall corporate audit rate of 0.7 percent. Further, the Joint Committee on Taxation must review any C corporation refunds above $5 million.

You May Like: Ein Reverse Lookup Free

As A Single Member Llc Can I Use My Business Bank Account To Pay Estimated Taxes

Good evening, .

I’m here to help make sure you can pay your estimated taxes. Allow me to share some info about paying your federal estimated quarterly taxes.

QuickBooks Self-Employed calculates your federal estimated quarterly tax payments, so you know what to pay each quarter. You can pay these estimates using two options, by mail and online. If you choose to pay by mail, you have to fill out the 1040-ES payment voucher and other forms, a check, and which IRS office you have to mail the payments to. The online method allows you to sign up for an Electronic Federal Tax Payment System account and go over the basic enrollment requirements to pay your estimates.

You can check out this article about paying federal estimated quarterly taxes for more information.

Feel free to hit the reply button if you have any other questions. Enjoy the rest of your day!

What Cra Tax Payments Can I Pay Using Easyweb And The Td App

The following CRA tax payments can be paid using the bill payment feature on EasyWeb and the TD app for Smartphone and Tablet:

To set up on EasyWeb:

After you login:

To set up in the TD app:

After you login:

Also Check: Doordash Tax Percentage

How Do I Pay Myself From My Llc

A Limited Liability Company is a business structure wherein the owners, also known as the members, are not personally liable for the companys debts or liabilities.

Furthermore, the company pays the taxes and is considered a separate legal entity from its owners. For tax purposes, an LLC may be classified as a partnership or corporation or disregarded entity.

IRS does not consider the members of an LLC to be employees. Therefore, the members do not take a salary. Furthermore, there are two types of LLCs single-member LLCs and multi-member LLCs.

What Percentage Should You Pay Yourself From Your Business

There is no standard formula to pay yourself as a business owner. A sole proprietor, partner, or an LLC owner can legally draw as much as he wants for the owners equity. However, the amount withdrawn must be reasonable and should consider all aspects of business finance. These include operating expenses, debts, taxes, business savings

Recommended Reading: Doordash Write Offs

Evaluate The Risk Of Using Personal Assets

While most entrepreneurs believe their business concept will succeed with certainty, nearly half of all new businesses cease to exist within five years. If the business fails, the owner could lose any savings, retirement funds, or other personal assets that they have put into the business.

If you havent done so already, we recommend developing a robust business plan that includes details on how much money you need to fund your business and the sources of those funds. If you have sufficient personal assets to fund your business and also have a reserve for emergency expenses that may arise, using personal assets makes sense.

Should You Pay Personal Expenses From Your Business Account

Enter your email address to instantly generate a PDF of this article.

Do you ever use your business bank account to pay personal expenses? Perhaps youve got some bills due tomorrow and to save time, you pay the mortgage or the electric bill right from the business account. Is that OK? This article will answer that question.

Like many tax questions, the answer is It depends. It depends on what kind of legal entity you own. If you are a sole proprietor, as far as the IRS is concerned, it doesnt really matter whether you pay personal expenses out of the business account. For tax purposes, even though you report your business on a separate form , there really is no legal difference between you and the business.

If you are a corporation, things get a little trickier. If you are a C Corporation, what you are doing is distributing the profits of the corporation on behalf of a shareholder, which will require that you issue a Form 1099-DIV at the end of the year for all such profit distributions.

If you are an S Corporation, such payments would also be considered a distribution of profit, even though S Corporations dont usually issue a Form 1099-DIV for such a transaction. In an S Corporation, the shareholder must report his/her share of the profit on his personal return anyway, whether or not the profit is distributed via cash payments or payments of personal expenses.

Also Check: Look Up Employer Ein Number

Take The Long View: A Multiyear Horizon Is Necessary To Accurately Analyze Corporate Taxes

A one-year snapshot of corporate tax situations paints an inaccurate picture of the taxes paid by corporations. Provisions like accelerated depreciation cause short-term gaps in book and taxable income due to timing differences, but over the life of an asset the same nominal deductions are taken for both calculations. Deductions for past losses help smooth out tax liability over time to avoid penalizing companies with volatile earning patterns.

Over a multiyear horizon, timing differences between book and tax income largely disappear, making the two measures more consistent.

Could Negate Part Of The Subchapter S Benefit

Commingled accounts can throw a monkey wrench into the best Subchapter S tax plan.

A Subchapter S is an election you make with the IRS to treat taxes as a pass-through and avoid double taxation of both the corporation and the owner.

Another advantage of a Subchapter S is that it can reduce employment taxes for the owner. Here is how it works. The owner becomes an employee of the company. As long as he takes a reasonable salary, the owner doesnt have to pay employment taxes on corporate distributions over and above the salary.

However, if the owner takes non-salary distributions without keeping good track of how much he is spending, he could run afoul of the IRS. How? By taking distributions that far outstrip his salary. Tax law requires that the owners salary not be unreasonably low compared to profit distributions.

What can happen is that the owner loses track of how much he is taking out of the company for personal purposes. This is easy to do when you mix personal and business expenses and dont have good accounting controls.

As Nolo.com states, If the IRS concludes that an S corporation owner has attempted to evade payroll taxes by disguising employee salary as corporate distributions, it can recharacterize the distributions as salary and require payment of employment taxes and penalties which can include payroll tax penalties of up to 100% plus negligence penalties.

Don’t Miss: Do I Have To Pay Taxes For Doordash

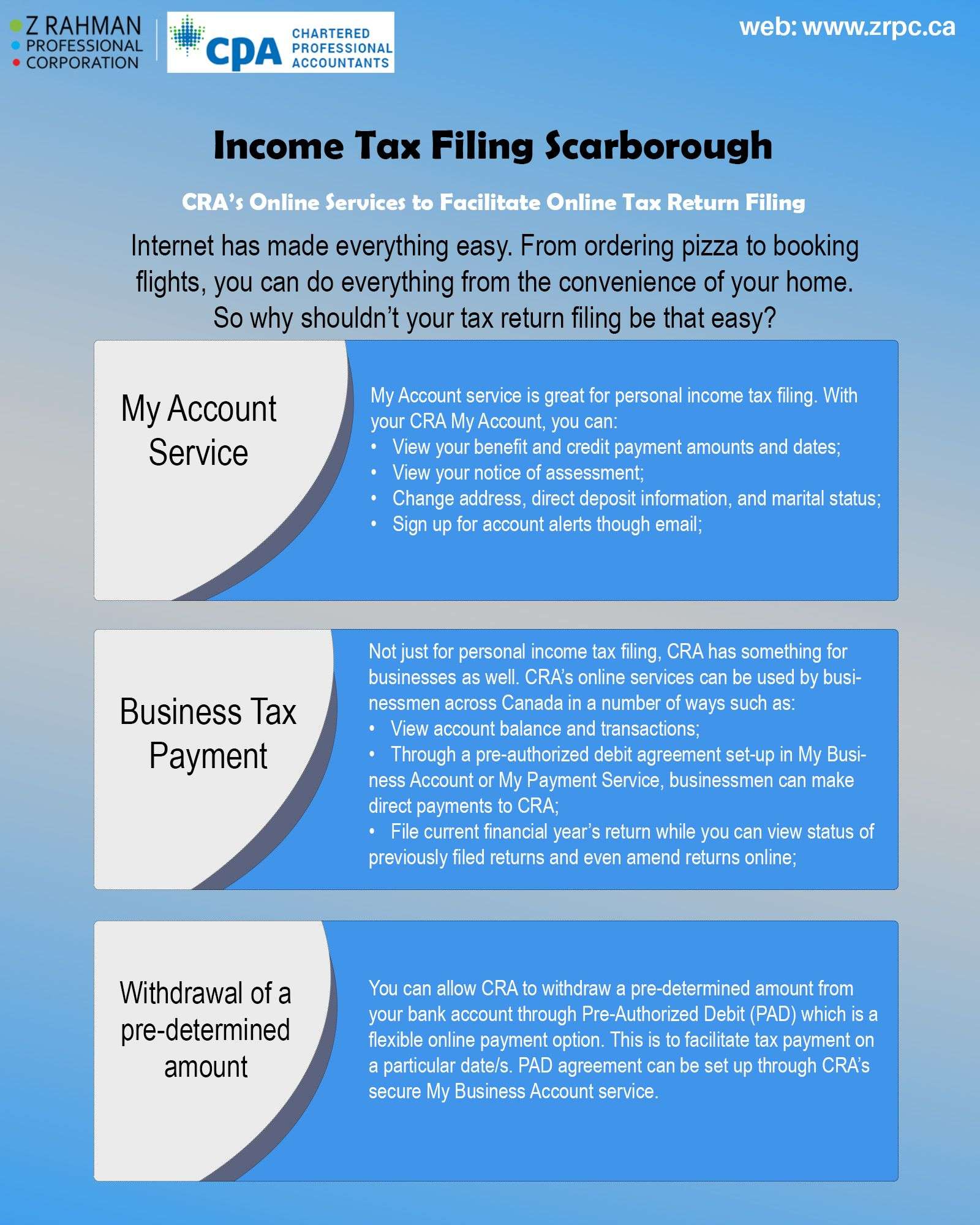

How To Pay Using The Cra Website And Pre

When you use My Business Account to set up a pre-authorized debit , you agree to authorize the CRA to withdraw a pre-determined amount from your bank account to pay tax on a specific date or dates. To set up a PAD agreement:

Businesses can also set up pre-authorized debit with their mobile device using CRA BizApp.

Estimate Your Tax Liability

Once you’ve determined you’re required to pay quarterly taxes and when you need to pay them, it’s time to calculate how much you’ll owe.

The potentially huge number of inputs used in your final tax return can take hours to put together using tax prep software, depending on the complexity of your finances. Fortunately, the quarterly tax process is much simpler.

It’s better to estimate a little high than estimate low, as any excess taxes paid will come back in your refund. But if you underpay, you may end up facing underpayment penalties.

Here are the 2021 tax brackets according to the IRS:

For tax year 2021, the top rate is 37% for individual single taxpayers with incomes greater than $523,600 . The other rates are:

- 35% for incomes over $209,425

- 32% for incomes over $164,925

- 24% for incomes over $86,375

- 22% for incomes over $40,525

- 12% for incomes over $9,950

- The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less

And here are the 2022 tax brackets according to the IRS:

For tax year 2022, the top rate is 37% for individual single taxpayers with incomes greater than $539,900 . The other rates are:

- 35% for incomes over $215,950

- 32% for incomes over $170,050

- 24% for incomes over $88,075

- 22% for incomes over $41,775

- 12% for incomes over $10,275

- The lowest rate is 10% for incomes of single individuals with incomes of $10,275 or less

Multiply your quarterly results by your tax bracket to get a number you may use for your payment.

Recommended Reading: Is Plasma Donation Income Taxable

Tax Strategist Or Tax Evader

Cmonadmit it. You know someone whos done it. Maybe they:

- Took some petty cash and used it to pay for a couple of cases of beer, some food at the store, and lunch with friends.

- Charged that expensive dinner with the missus on the corporate card.

- Bought a bunch of clothes and other household stuff, and charged it to the business.

- Wrote off an entire resort vacation with the family because they made a single, one-hour sales call to a customer while in town.

- Had the contractor who upgraded a home kitchen send an invoice to the company.

Yeah, you know someone whos done this stuff. Or at least some of it. Right?

The truth is, many small business owners have, at one time or another, blurred the lines between business and personal expenses to try to save money on taxes. No ones perfect. No one talks about it, or likes to admit it.

But its too tempting.

Charging a personal expense through the business means taking a deduction for it against income. And if our state and federal tax rates are somewhere between 20 to 30% combined, then effectively that could be like getting a 20 to 30% discount on those things purchased. Its a perk of being a business owner, right?

What harm is there?

And really, whos going to know? Chances are someone probably wont even get audited. And besides, even if a small business owner fudges the numbers a bit on their tax deductions, its such a small amount, relatively the IRS has much bigger fish to fry, right?