Property Taxes By State

Overall, homeowners pay the most property taxes in New Jersey, which has some of the highest effective tax rates in the country. The states average effective rate is 2.42% of a home’s value, compared to the national average of 1.07%.

With an average effective rate of 0.28%, the least expensive state for property taxes is Hawaii, surprisingly. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there.

Also of note are Colorado and Oregons property tax laws, which voters put in place to limit large taxable value increases. Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern.

How To Calculate Salary After Tax In Texas In 2022

The following steps allow you to calculate your salary after tax in Texas after deducting Medicare, Social Security Federal Income Tax and Texas State Income tax.

Texas Corporate Income Tax: Everything You Need To Know

Texas corporate income tax is extremely low compared to other states, and there is no personal income tax. The low tax rate can drop to zero if the criteria for a specified revenue amount is not reached.3 min read

Texas corporate income tax is extremely low compared to other states, and there is no personal income tax. The low tax rate can drop to zero if the criteria for a specified revenue amount is not reached.

Also Check: When Do We Start Filing Taxes 2021

How 2021 Sales Taxes Are Calculated In Texas

The state general sales tax rate of Texas is 6.25%. Cities and/or municipalities of Texas are allowed to collect their own rate that can get up to 2% in city sales tax.Every 2021 combined rates mentioned above are the results of Texas state rate , the county rate , the Texas cities rate , and in some case, special rate . The Texas’s tax rate may change depending of the type of purchase. Some of the Texas tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Texas website for more sales taxes information.

Texas Sales Tax Calculator

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Texas has a 6.25% statewide sales tax rate,but also has 815 local tax jurisdictions that collect an average local sales tax of 1.378% on top of the state tax. This means that, depending on your location within Texas, the total tax you pay can be significantly higher than the 6.25% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Texas:

Also Check: Is Plasma Money Taxable

Texas Median Household Income

| 2010 | $48,615 |

Payroll taxes in Texas are relatively simple because there are no state or local income taxes. Texas is a good place to be self-employed or own a business because the tax withholding won’t as much of a headache. And if you live in a state with an income tax but you work in Texas, you’ll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. If you’re considering moving to the Lone Star State, our Texas mortgage guide has information about rates, getting a mortgage in Texas and details about each county.

Be aware, though, that payroll taxes arent the only relevant taxes in a household budget. In part to make up for its lack of a state or local income tax, sales and property taxes in Texas tend to be high. So your big Texas paycheck may take a hit when your property taxes come due.

Texas Property Tax Calculator

| Estimate Property Tax |

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States.

To use the calculator, just enter your property’s current market value . For comparison, the median home value in Texas is $125,800.00. If you need to find your property’s most recent tax assessment, or the actual property tax due on your property, contactyour county or city’s property tax assessor.

Please note:

Recommended Reading: How To Get A Pin To File Taxes

What You Should Know About Tax Title And License In Texas

Tax Title and license are the total amount of money you can pay when you purchase a vehicle. You have to pay these fees whether you are purchasing an old or new vehicle. You have to include these fees in your budget when planning to buy a car.

One of the good sides of working out this calculation is that you can pay it upfront or roll it into your car loan and spread it over a period. Remember that paying your tax title and license upfront is better because it wouldnt accrue interest rates associated with long-term loans.

What Institution Administers Tax Titles And Licenses In Texas

Texas residents have to pay vehicle sales tax and registration fees when buying a new car. You cannot get a title until you pay other taxes. While the sales tax is decided based on the cost of the vehicle, the registration fee will depend on the type and weight of the car.

For passenger vehicles, you may pay up to $50.75 as a registration fee, or $ 30 for motorcycles and between $45 and $54 on trailers, depending on the weight. Keep in mind that the registration fees are paid annually from the first payment.

Texas Department of Motor Vehicles is the institution that administers taxes, titles, and Licenses in Texas. The activities of this institution are governed by a board that formulates its rules and regulations.

The board that oversees the Texas Department of Motor Vehicles consists of nine members, and the Executive Director is the official head of the board. It is the executive director that supervises the control of the day-to-day running of the institution.

The primary responsibilities of the Texas Department of Motor Vehicles include registration of vehicles, issuance of permits, and regulation of vehicles for commercial activities.

Don’t Miss: How Can I Make Payments For My Taxes

Texas Tax Tables And Personal Income Tax Rates And Thresholds In Texas

Each year, the state of Texas publishes new Tax Tables for the new tax year, the Texas Tax Tables are published by the Texas State Government. Each of these tax tables contains rates and thresholds for business tax in Texas, corporation tax in Texas, employer tax in Texas, employee tax in Texas, property tax in Texas, sales tax in Texas and other tax rates and thresholds in Texas as well as providing instruction and guidance for changes to specific Texas state tax law and/or tax legislation.

These tax tables are then, amongst other things, used to calculate Texas state tax and associated payroll deductions. The changes to the Texas tax tables can be long and often contain information that , whilst important for the correct calculation of tax in Texas, is not relevent to the majority of Texas taxpayers who pay most of their direct tax via their salary income. The Texas state tax tables listed below contain relevent tax rates and thresholds that apply to Texas salary calculations and are used in the Texas salary calculators published on iCalculator. The Texas state tax tables are provided here for your reference.

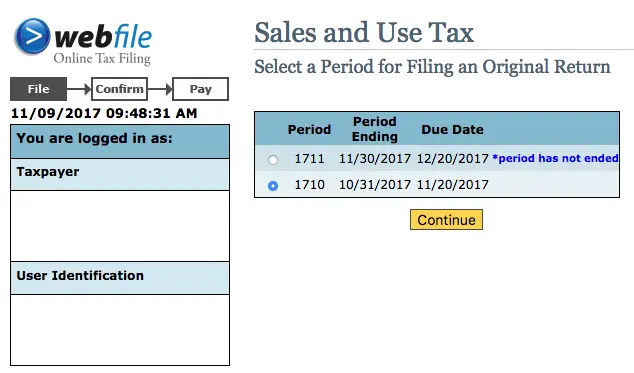

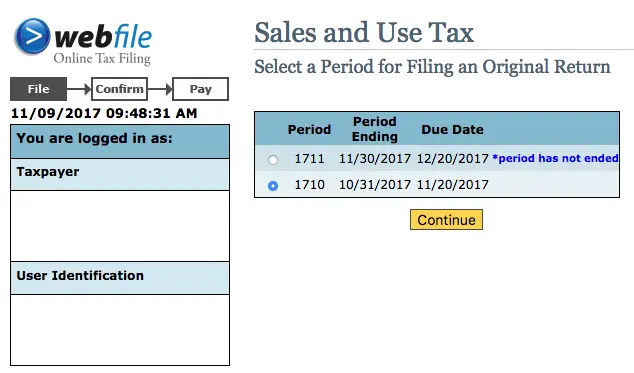

Sales Tax Registration And Collection

Businesses can apply for a sales tax permit via the Texas comptroller’s website. Once a business is registered, it is obligated to file a sales tax report regularly with the state, even if the business has not collected any sales tax during a time period. The state will inform the business about the frequency of required sales tax reports and submissions.

Don’t Miss: How To Get Stimulus Check 2021 Without Filing Taxes

Calculating The Franchise Tax

The Texas Franchise Tax is calculated on a companys margin for all entities with revenues above $1,110,000.

The margin can be calculated in one of the following ways:

- Total Revenue Multiplied by 70 Percent

- Total Revenue Minus Cost of Goods Sold

- Total Revenue Minus Compensation

- Total Revenue Minus $1 Million

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

You May Like: Www.1040paytax.com.

When Do You Have To Pay For Tax Title And License

Whenever you purchase a vehicle, you have to pay tax, title, and license fees whether the vehicle is new or used. You can make this payment at the purchasing point of the vehicle, which is upfront, and in some cases, you can roll it over into the monthly payment plan. Remember that not all vehicle sellers will allow you to roll tax, title, and license fees into the monthly payment plan.

For all upfront payments, you will deal with the vehicles dealership directly, and they will sort out the necessary payments to the government. On the other hand, taxes are remitted to the government coffers, and third-party dealers are not allowed to collect such.

How Do Texas Property Taxes Work

Residential property in Texas is appraised annually by county appraisal districts. The appraisal districts are responsible for determining the current market value of all property within the county, on which tax payments are based. Disagreements about any findings are brought to an appraisal review board made up of local citizens.

Homes are appraised at the beginning of the year, and appraisal review board hearings generally begin in May. Tax bills are sent out beginning on Oct. 1, and are due by Jan. 31 of the following year.

There are a number of exemptions that help lower your property taxes in Texas. The most common is the homestead exemption, which is available to homeowners in their primary residence. It exempts at least $25,000 of a propertys value from taxation.

However, only school districts are required to offer this exemption . So if your home is worth $150,000 and you receive the homestead exemption, the school district tax rate will only apply to $125,000 of you home value.

Persons who are at least 65 or who are disabled can claim an additional exemption of $10,000. Like the homestead exemption, only school districts are required to offer this exemption.

You May Like: Is Past Year Tax Legit

My First Texas Home Loan

State program

Closing cost assistance

What you need to know

The My First Texas Home program offers 30-year, fixed-interest rate mortgages for first-time home buyers and veterans. The program includes down payment and closing cost assistance of up to 5% of the mortgage amount as a no-interest, no-monthly-payment second lien. In order to be eligible for this… Read More

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Do I Have To Pay Texas Unemployment Tax

Unemployment taxes are not deducted from employee wages. Most employers are required to pay Unemployment Insurance tax under certain circumstances. The Texas Workforce Commission uses three employment categories: regular, domestic and agricultural. Employer tax liability differs for each type of employment.

Taxes On Larger Businesses

The state taxes businesses that do not file the E-Z Computation form at a rate of 0.75% on their taxable margins . It defines this as the lowest of the following three figures: 70% of total revenue, 100% of revenue minus cost of goods sold , or 100% of revenue minus total compensation.

Nearly all business types in the state are subject to the franchise tax. The only exceptions are sole proprietorships and certain types of general partnerships.

Small businesses with gross receipts below $1,180,000 pay zero franchise tax for tax year 2020.

For many businesses, the actual tax rates are much lower than the stated rates. For example, the franchise tax for retail and wholesale companies, regardless of the size of the business, is 0.375%. Businesses that earn less than $20 million in annual revenues and file taxes using the state’s E-Z Computation form pay 0.331% in franchise tax.

However, the E-Z Computation form does not allow a business to deduct COGS or compensation, or to take any economic development or temporary credits.

Recommended Reading: How Can I Make Payments For My Taxes

How To Calculate Tax In Texas

Tax Bracket Rates 2021 If youre currently working in Canada or elsewhere, you might be paying taxes that are much lower than those for Americans. In the last 10 years, we have seen a drastic decrease of Canadian tax rates and this is due to the economic situation in Canada after the fall out from the demise of the real estate market for residential properties in Canada. In this economy situation there are more people working and thus there are also greater deductions for income earned by Canadian citizens. While this may seem like a great deal for certain people, many may not be able to take advantage of this and must accept higher tax rates.

There are various types of tax bracket 2021 that are available in Canada among which is one called the Federal income tax. It is the smallest tax bracket 2021 in Canada and it is applied to the taxable earnings of the individual or business. In the case of corporate income taxation, the tax bracket applicable to corporations is the 15 percent tax bracket. The money that an individual pays in tax to the government each year is then sent to the regional Social Development Canada office for processing. After the tax is processed the amount that was debited is immediately sent to the person.