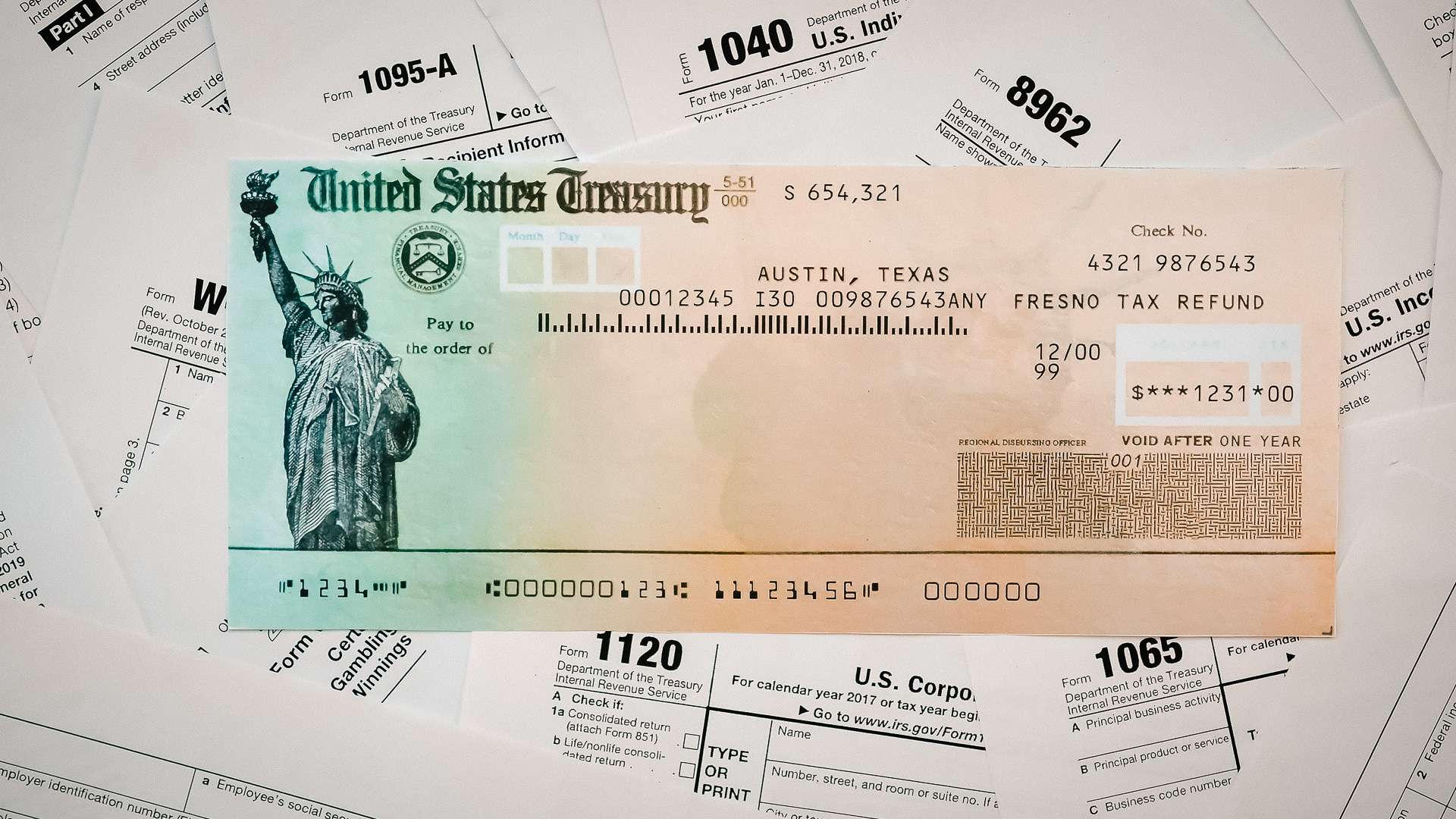

Why Do I See Irs Treas 310 In My Bank Statement

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

How To Check When You Will Receive Your Tax Return

IRS2Go is the official mobile app of the IRS, which you can use to check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips and more. The app is available in Spanish and English, and you can download it from Google Play, the Apple App Store or Amazon.

You can also use the “Where’s My Refund” tool on the IRS website. To check your refund status, you will need your social security number or ITIN, your filing status and the exact refund amount you are expecting.

The IRS updates the tool’s refund status on a daily basis, usually overnight, so check back in routinely for the most up-to-date information.

If it’s been more than 21 days since you e-filed your federal tax return, you should you call the agency directly.

If you haven’t filed your taxes for the 2021 tax year yet, consider going with a tax prep software that offers expert tax assistance. Speaking with a tax-prep expert may help ensure that your return is accurate, which can help facilitate a timely return.

Here are Select’s top picks for best tax filing software:

- Best overall tax software: TurboTax

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

Read Also: Is It Too Late To File Your Taxes

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

When Are Taxes Due

For most years, the deadline to submit your tax return and pay your tax bill is April 15. But for your 2020 taxes, it was pushed back about a month to May 17, 2021 due to the Coronavirus pandemic. Theres currently no such plan in place for the 2021 tax year, for which youll file in early 2022.

If you still cant meet the tax filing deadline for the upcoming year, you can file for an extension. But the sooner you file, the sooner you can receive your tax refund.

Recommended Reading: What Can Be Written Off On Taxes

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Is filed on paper

- Needs further review in general

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q& A below.

- Includes a Form 8379, Injured Spouse AllocationPDF, which could take up to 14 weeks to process

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return. If were still processing your return or correcting an error, neither Wheres My Refund? or our phone representatives will be able to provide you with your specific refund date. Please check Wheres My Refund? for updated information on your refund.

You May Like: Can You Claim Rent On Your Taxes

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2020, the IRS recommends that you check your withholding amounts again. Do so in early 2021, before filing your federal tax return, to ensure the right amount is being withheld.

You May Like: Do Nonprofits Pay Payroll Taxes

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Recommended Reading: Do We Pay Taxes On Stimulus Checks

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

My Bank Account Number Has Changed I Want To Change The Bank Account Number Which I Mentioned In My Income Tax Return

You can only change your Bank Account Number if you had a refund failure i.e your IT Return is processed and a refund was generated for you but you did not receive it. If you wish to change the Bank Account Number for Refund failure case, then login in the Income Tax e-Filing website and go to My Account â Refund re-issue request. Select the mode through which you wish to receive the refund- ECS or Cheque. Enter the new Bank Account Number and provide address details. Submit the request.

Once the request is submitted, your new Address is updated with the Income Tax Department.

Recommended Reading: What If I File Taxes Late

Recommended Reading: How To Calculate Paycheck After Taxes

Can You Transfer Your Refund

Yes, you can ask the CRA to transfer your refund to your instalment account by:

- Selecting this option when filing electronically

- Attaching a note to your paper return

The CRA will transfer your full refund to your instalment account and consider this payment to be received on the date the CRA assesses your return.

Why Haven’t I Gotten My Refund Yet

There are numerous reasons why your tax return may not have been completely processed yet, resulting in a delayed refund. Here are the most common.

- Your return had errors or was incomplete

- You owe the IRS money

- Your bank account info was incorrect

- You filed a paper return

- You didn’t properly enter your stimulus payments

- The IRS suspects identity theft

- You filed an amended return

- Your return needs further review

In testimony to the House Ways and Means Committee, IRS Commissioner Charles P. Retting said that, in 2021, the agency received “far more than 10 million returns” in which taxpayers failed to properly reconcile their stimulus payments with their recovery rebate credit, which required a manual review and resolution.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If there’s a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

If you’ve requested a paper check for your tax refund, that’ll take longer, too — about six to eight weeks, according to the IRS.

You May Like: How To Use Pay Stub For Taxes

What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more about identity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.

How Do I Check My Refund Status For My Amended Return

The Wheres My Refund tool does not provide refund information for an amended federal income tax return on Form 1040X. However, you can track the status of an amended return for the current tax year and up to three past tax years using the IRS Wheres My Amended Return? tool.

To use this tool, youll need to enter your Social Security number, birth date, and zip code. An amended return may take up to four weeks to appear in the portal after youve mailed it. Normally, amending a return takes up to 16 weeks, but due to COVID-related processing delays, its been taking the IRS more than 20 weeks. If your amended return has been received, changed, or finalized, use the Wheres My Amended Return feature to find out.

Your amended return will go through three steps while being processed, just like it did with the Wheres My Return? tool:

- Return received

- Return adjusted

- Return completed

You May Like: What Are The Taxes On Investment Income

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

Make The Most Of Your Refund

If you’re getting a tax refund this year, it might be tempting to splurge on a pricey purchase or vacationbut you might want to put the money toward your financial goals instead. This could be building an emergency fund, paying down debt or funneling it into savings for larger future purchases.

Using your tax refund to reduce your debt and catch up on late payments can even help improve your credit score and improve your financial health. If you want to track how these efforts boost your credit over time, you can sign up for free credit monitoring with Experian.

Read Also: What If I File My Taxes 1 Day Late

How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity. Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider. Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

How To Check The Status Of Your Refund

What you will need

- Social Security number of taxpayer

- Exact amount of the refund

Two ways to check the status of a refund

- Online via INTIME

- Inquiries can be made on refund amount from 2017 to the current tax season.

Note: If a direct deposit of your Indiana individual income tax refund was requested, once DOR initiates the deposit, our system will reflect the date the request was processed. Normally, it takes seven business days for your financial institution to receive and process the funds.

For more information on refunds, use INTIMEs secure messaging to contact DOR Customer Service.

Information regarding the $125 Automatic Taxpayer Refund issued in 2022 will not be displayed or available via INTIME. The ATR will be sent separately from your 2021 Individual Income Tax refund . More information is available on information page.

Also Check: How To Claim Inheritance Money On Taxes

How Do I Check My Refund Status

The IRS requires that you have some information from your tax return to check your refund status. Youll need the following information from it:

- Your Social Security number, which you include at the top of your tax return.

- Your filing status, which can be found near the top of the first page of your tax form.

- Your tax refund amount, as stated at the bottom of your tax return.

Was Your Refund Supposed To Go Directly To Your Bank Account

There are a few things that could have happened:

- The bank account information you put on your tax return was incorrect.

- The IRS isnt responsible if you made an error on your tax return. Youll need to contact your bank or credit union to find out what to do.

- If you already contacted your bank or credit union and didnt get any results, file Form 3911, Taxpayer Statement Regarding Refund with the IRS. The IRS will contact the institution and try to help, but the IRS cant require the bank or credit union return the funds.

Recommended Reading: Do Seniors Have To File Taxes

Log In Or Create An Account

Once youve logged in to your Online Services account:

Filing Information sample form: Field 5: State/ProvinceField 6: Zip/Postal CodeField 7: Filing Method Option 1: Gross Weight Method Option 2: Unloaded Weight MethodField 8: Number of Vehicle Records to Report

Header cel: Electronic notification optionsBills and Related Notices-Get emails about your bills.Other notifications-Get emails about refunds, filings, payments, account adjustments, etc.Header cell: Receive email

Where’s My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You

If you filed your tax return on time and still haven’t gotten your refund, at least it’s earning interest.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Peter Butler

How To and Money writer

I’m a writer/editor for CNET How-To and Money, living in South Berkeley, CA with two kids and two cats. I enjoy a variety of games and sports — particularly poker, ping-pong, disc golf, basketball, baseball, puzzles and independent video games.

If you filed your tax returnelectronically and were due a refund, you probably already received it. The IRS reported that it’s processed 97% of the more than 145 million returns it received this year and issued a few more than 96 million refunds.

As a result, delays in completing paper returns have been running from six months up to one year.

Read more: 8 Reasons Your Tax Refund Might Be Delayed

You May Like: Where Can I Get Wisconsin State Tax Forms