Supplemental Property Taxes With An Impound Account

If you are impounding your tax payment into your monthly payment supplemental tax bills can be particularly disruptive. Your lender will receive a copy of the original tax bill but will not receive a copy of your supplemental bill.

If the homeowner does not forward the supplemental property tax bill onto the lender, the lender will not be aware of the additional taxes owed and may inaccurately lower or adjust your impound account. This may result in the lender not adequately collecting enough taxes and then raising your impound account drastically in the future.

The best way to handle all supplemental tax bills is to immediately contact your lender to make them aware of the additional taxes owed so they do not incorrectly adjust your future payments.

You dont have to become a property tax expert to buy a house. The most important part of the process is knowing you can trust the professionals involved in the process from your real estate agent to your mortgage company to your tax specialist. They will deal with the nitty gritty, and make sure your best interest is represented.

Even so, its important to understand the fundamental aspects of your personal finances so you can feel confident about every step of the process, and know youre setting yourself up for a bright financial future in a gorgeous home!

If you have questions about the process of buying a home, or the particular property tax details of your transaction, feel free to drop us a line. Were here to help.

Los Angeles County Homestead Exemption

For properties considered the primary residence of the taxpayer, a homestead exemption may exist. The Los Angeles County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes.

Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Los Angeles County property taxes or other types of other debt.

In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. To get a copy of the Los Angeles County Homestead Exemption Application, call the Los Angeles County Assessor’s Office and ask for details on the homestead exemption program. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space.

What Are California Tax Assessments

Property taxes typically are based on assessed value rather than current fair market value. In most states, tax assessments are conducted every one to five years and are not changed when a property is sold or transferred as a gift.

However, in California, laws have been passed that artificially limit the tax assessed value over time, explained Wolberg.

In 1978, California voters approved Prop. 13, a constitutional amendment known as ‘The People’s Initiative to Limit Property Taxation’ that was meant to protect older residents who were unable to keep up with large property tax increases,” said Wolberg. Several propositions since then have tinkered with property taxes.”

Homeowners who plan to transfer their residence to their children now or as part of their inheritance should seek professional advice, so they understand the impact of the new property tax rules, said Bruce M. Macdonald, an attorney with Carico Macdonald Kil & Benz LLP in El Segundo, Ca.

The change in property tax rules could be significant for some families, because it’s not that unusual in California to have a house that was assessed at $150,000 when the parents bought it to be worth $5 million 40 years later,” said Macdonald.

When the kids could inherit their parents’ house at the assessed value of $150,000, the property taxes would be approximately $1,500. Now, if the house is assessed at $5 million, that would incur a significantly higher tax bill,” he explained.

Also Check: Do Beneficiaries Pay Taxes On Life Insurance Policies

How To Avoid Late Payments On Your Property Taxes

In order to avoid late penalties , its important to factor in your property taxes throughout the course of the year so the bill doesnt come as a sudden and significant surprise.

One strategy is to divide up your estimated taxes for the year by 12, and budget the monthly amount into your savings. That way the money will be set aside and ready to go when you need to pay your bill.

Impound accounts are another way to ensure your property taxes get paid on time.

How Are My Property Taxes In California Calculated

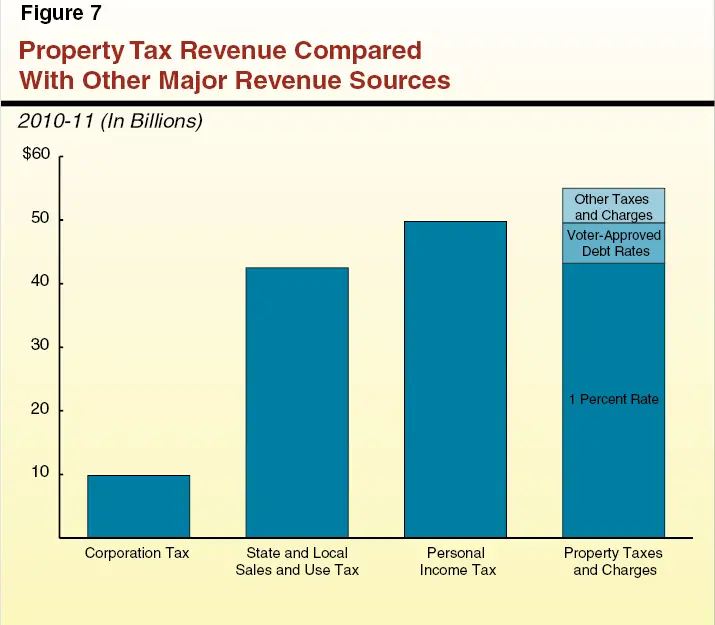

As mentioned before, the absolute minimum for California property tax is the 1-percent tax rate. By 1-percent, the law refers to the value of 1-percent of the property. For example, a house at 123 Lazy Lane is valued at $400,000. By taking the value of the property and multiplying it by 0.01, the amount would come out to $4,000.

So, a property valued at $400,000 will have a minimum property tax of $4,000.

In California, it is common for utilities to be taxed annually on the property tax. Different parts of California charge varying amounts for their water district/utilities. In larger metropolitan areas, the need for utilities increases and is usually more expensive.

In the case of county-specific taxes, every tax is voted on, usually by popular vote. In some cases, this vote may have been enacted by representatives . The county-specific taxes exist to fund special projects for the city such as infrastructure like repaving roads, funding public services, etc.

One of the most popular county-specific taxes is that of the Mello-Roos tax. For almost four years, it wasnt a permitted tax. Though the Mello-Roos tax charges a nominal tax to maintain public services and facilities, it was once the center of controversy. Its more commonly accepted today as it is a necessary tax for the functioning of a county. It is now heavily regulated by the state of California which seeks to protect its residents from a gross amount of property tax.

Recommended Reading: How To Calculate Tax Liability

California Property Tax Rates

Property taxes in California are applied to assessed values. Each county collects a general property tax equal to 1% of assessed value. This is the single largest tax, but there are other smaller taxes that vary by city and district.

Voter-approved taxes for specific projects or purposes are common, as are Mello-Roos taxes. Mello-Roos taxes are voted on by property owners and are used to support special districts through financing for services, public works or other improvements.

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their home’s purchase price by 1.25%. This incorporates the base rate of 1% and additional local taxes, which are usually about 0.25%.

The table below shows effective property tax rates, as well as median annual property tax payments and median home values, for each county in California. Assessed value is often lower than market value, so effective tax rates in California are typically lower than 1%, even though nominal tax rates are always at least 1%.

| County |

|---|

Want to learn more about your mortgage payments? Check out our mortgage payment calculator.

How You Pay Property Tax In California

If youve already made a monthly mortgage payment, its likely that youve paid some of your annual property taxes. Your real estate agent or mortgage lender should be able to tell you more about your property taxes. The initial mortgage payment you make when you first move into your new home is paid from your escrow account. When you receive a bill for your monthly mortgage payment, there should be four separate components that make up the full payment. These components include:

- The principal of your loan

- The interest rate thats attached to your loan amount

- Homeowners insurance payments

- California real property taxes

To make sure that your property taxes are part of your monthly mortgage payment, all you need to do is look at the last mortgage statement you received. You should notice property taxes as a line item somewhere on the statement. If you pay property taxes as part of your mortgage, you shouldnt give much thought to these taxes.

However, there is a deadline for when annual property taxes must be paid. This deadline applies to any homeowner who doesnt make property taxes payments as part of their mortgage payments. Your property taxes are due in full by November 1 every year. In the event that your taxes are paid on a monthly basis, you should notice a $0 balance on November 1.

You May Like: Are Charitable Contributions Made From An Ira Tax Deductible

How Proposition 13 Works

Proposition 13 provides three very important functions in property tax assessments in California. Under Prop 13, all real property has established base year values, a restricted rate of increase on assessments of no greater than 2% each year, and a limit on property taxes to 1% of the assessed value .

What Are Property Taxes Used For

When property taxes are collected in California, they can be used for a wide range of different public services. The primary services that taxes are used for include:

- Various government services

- First responders and other forms of law enforcement

- Municipal land and infrastructure construction

- Municipal improvements

- Residential services, the primary of which is garbage pickup

You May Like: Do You File For Use Tax

How Are Property Taxes Handled At Closing In California

Real estate taxes are typically prepaid for a complete year of ownership. Then who pays property taxes at closing when it happens mid-year? Real estate ownership flips from the seller to the buyer at closing. And so does the obligation for remitting real estate levies. Thus, the purchaser will be reimbursing the previous owner for the after-closing piece of the levy.

Typically, this is not a prorated tax refund paid straight to former owners, however. Rather, tax repayments will be part of all other obligations of the new owner at closing.

How Often Do Octal Taxes Assessed In California

A California tax assessment is a type of tax that is collected from California businesses. A property tax is usually calculated based on an assessed value and is not calculated based on fair market value. Tax assessments generally are done every few years on a property, and cannot be changed when it is given away.

Read Also: Do You Need To Report Unemployment On Your Taxes

How Does California Real Estate Tax Work

California gives property taxation authority to thousands of community-based public units. Typically, the taxes are received under a single assessment from the county. Collections are then distributed to related taxing units as predetermined. In general, there are three stages to real property taxation: creating tax levies, appraising property worth, and then collecting the tax.

Counties and cities plus thousands of special purpose districts possess taxing authority given by California law. These entities are legal governmental units administered by officials either appointed or elected. These entities conduct business within outlined geographic area, e.g. an agricultural preserve or hospital district.

California statutory rules and regulations have to be observed in the citys conduct of taxation. All real estate not eligible for exemption must be taxed equally and uniformly on one present market worth basis. Owners rights to timely alerts to rate raises are also required.

Within those confines, the city establishes tax rates. However reserved for the county are evaluating property, mailing bills, receiving the tax, engaging in compliance efforts, and working out disputes.

Real estate assessments are undertaken by the county. Once more, the state sets rules related to appraisal practices. This helps to guarantee real property appraisals are mostly completed consistently. Evaluation techniques and precision matters are promising areas for potential appeals.

Are There Any States With No Property Taxes

All 50 states and the District of Columbia levy property taxes. However, some people may qualify for a property tax exemption. Some states offer homestead exemptions, while other types of exemptions exist for older homeowners, people with disabilities, military veterans, and homeowners who make certain renovations or install renewable energy systems .

Don’t Miss: Where To File Quarterly Taxes

Who Determines My Propertys Value

Your local assessor estimates your homes value according to:

- Your homes curb appeal

- Homes in the neighborhood

- Size and number of bedrooms

- Your homes interior

Once the assessor establishes the market value of your property, he or she will perform the property tax assessment and, consequently, calculate your property tax bill.

New 2021 Rules For Transferring Property Taxes In California

Avoiding Fair Market Values with Proposition 19 Trust Loan Exclusion from Property Reassessment

If youre inheriting a home from a parent and wish to avoid property tax reassessment you still have all the tools to do so, as long as all new requirements are met. If youre a beneficiary, a brand new homeowners, you can transfer parents property taxes when inheriting property and thus inheriting property taxes with the ability to keep parents low property tax base, as long as you live in your inherited home.

Michael Wyatt, an Expert on CA Tax Savings for Homeowners Shares His Viewpoint on Keeping a Low Property Tax Base

As Michael Wyatt Consulting, tells us:

When it comes to keeping a low property tax base, with Prop 58 and a trust loan, I always bring my clients to Commercial Loan Corp. Their loans to trusts give my clients several invaluable benefits. Their terms can be a lot more flexible than an institutional lender like Wells Fargo or Bank of America. Theyre self funded, and thats why they can extend easier terms to clients

When your parents die, and your trust agreement says equal shares That means equal shares! People basically just get the overall concept of getting money from a trust loan even if it doesnt sell. It makes more sense all around to get a trust loan and everyone gets more money.

Read Also: What’s The Minimum Income To File Taxes

Understanding Property Tax Limits

Under Proposition 13, property taxes are limited to one percent of the assessed value. Additional property taxes may be approved for schools or local projects, which can vary amongst communities and bring the tax rate higher than one percent. These additional property taxes change annually and are determined by voters in each tax rate area.

How Much You Pay

To turn a property value into a property tax, there has to be a tax rate, e.g., $1 of tax per $100 of value. Until 1978, tax rates were set by each jurisdiction, be it a city, county or school district. With the passage of Proposition 13, the tax rate was set at maximum of 1% and values were established as of 1975 with a limited inflation factor, unless there was a change in ownership or new construction, at which time the value could be adjusted to current market levels.

Recommended Reading: Does Bankruptcy Clear Tax Debt

Where Do Your Property Tax Dollars Go

Now, this is a question that many property owners ask. What happens to all the property taxes that you pay? Well, your property tax is what keeps the state and local governments functioning. They comprise a bulk of the revenue that goes into funding public safety, infrastructure, public schools, as well as the county government.

Particularly for public schools, it is easy to find that the best public schools are located in municipalities that have highly-priced homes and as a result, significant property taxes.

County projects are funded by some states, while others leave the counties to carry out the levying and tax use without interfering. This implies that the county has only property taxes as its source of funding.

Hereâs a summary of public services that your tax dollars go towards funding:

- General government services

- First responders and other law enforcement

- Municipal employeesâ pay

- Municipal infrastructure and land construction or improvements

- Recreational services

Tax Collectors & Assessors

The people who did this valuation were originally the tax collectors, who set the values and collected the taxes, sometimes right on the spot under threat of bodily harm or death. In more modern societies, the functions are usually split between the appraisal function, also know as the assessment function, hence Assessor, and the calculation and collection functions. Threats of bodily harm and direct seizure have been replaced by tax liens, tax-deeded auctions and other more humane, but no less effective, measures.

Don’t Miss: How To E File Tax Returns For Free

Transfer Of Assessment To A Replacement Property By Senior Citizens

On November 4, 1986, the voters of California passed Proposition 60 to provide qualified homeowners the transfer of the base-year value of their principal residence to a replacement dwelling located in the same county, under certain circumstances.

Qualification Requirements:

Eligibility Requirements:

If you sold the original property to your parent, child, or grandchild and that person filed a claim for the parent-child or grandparent-grandchild change in ownership exclusion, then you may not transfer your base year value under section 69.5.

Definition of Equal or Lesser Value:

Filing Requirements: