Transfer Of Policy Is Partially Taxable

If you pay cash or other compensation to have a policy transferred to you , youll likely have to pay federal income tax on the portion of the policy value that exceeds the amount you pay for the transfer . For example, if youve paid $5,000 to take possession of a policy with a $45,000 death benefit, and didnt pay any premiums or other qualifying amounts, youll probably have to pay tax on $40,000.

Whats the difference between term life and whole life insurance?

Term life and whole life vary in many ways. A major difference is that term insurance provides coverage for a set amount of time. If you die during the term, the policy pays a death benefit. Whole life is for your entire lifetime and pays whenever you die.

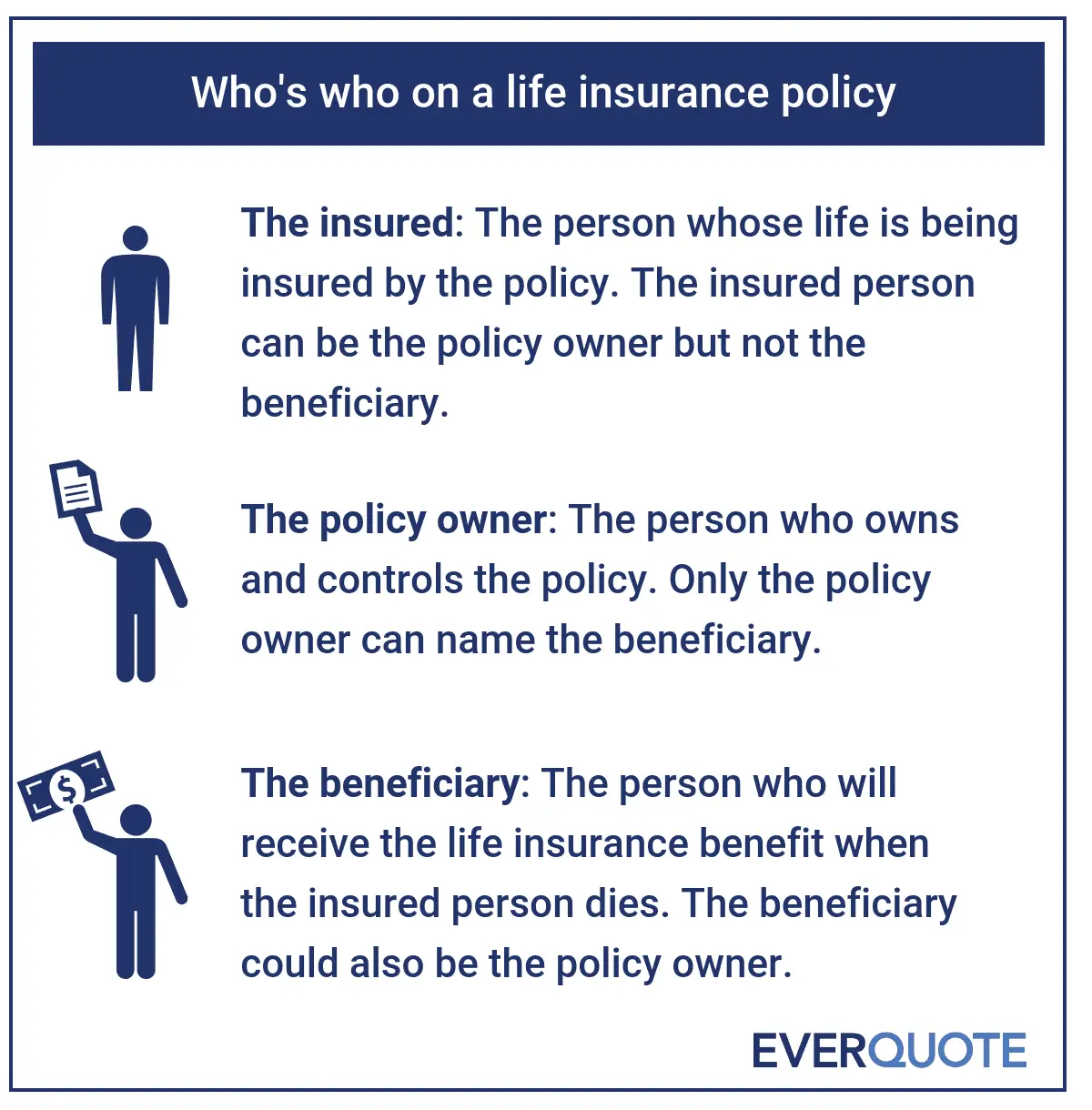

How To Name A Beneficiary

It’s important to name a beneficiary for each policy form when you purchase life insurance. If you dont, your insurer will assume by default the beneficiary is your estate.

You may want to consider naming an alternate or contingent beneficiary. This is the person or persons who will receive the proceeds of the death benefit if your named beneficiary dies either before you or at the same time as you.

It’s a good idea to review your beneficiary designations from time to time and update them if necessary.

How Many Beneficiaries Can Be Named On A Life Insurance Policy

You can decide how many people you want to leave a life insurance payout to. It may just be one person or you could pick lots of different people.

You can also decide how much each person will receive either as a set amount of money or a percentage of the final payout. All of these details are decided upon when you take out a life insurance policy, and you should be able to change these details if you need to at a later date.

Recommended Reading: Is Plasma Donation Income Taxable

When Is A Life Insurance Payout Not Taxable

Generally, life insurance benefits paid out to individual beneficiaries arent subject to federal income tax. Thats because you dont have to include life insurance payouts in your gross income or report them to the IRS.

Lets consider an example: Youre the beneficiary on someone elses policy, such as a parent or spouse, and receive a payout from the policy when the covered person passes away. Because youre the named beneficiary, you wont have to pay federal income tax on that payout.

If youre the person covered by the policy, have a terminal illness and are receiving accelerated death benefits , those generally arent taxable either.

How Do I Change My Life Insurance Beneficiaries

If youre the policy owner, you can change your nominated beneficiary/beneficiaries at any point before a claim. Simply contact your insurer for the correct documentation, fill out the required form, and return it as soon as possible.

To avoid delays, be sure to answer each question on the form as carefully and as accurately as you can. Many insurers suggest you seek professional estate planning advice before nominating any beneficiaries.

You May Like: Is Freefilefillableforms Com Legit

Are Life Insurance Payments Tax Deductible

If you have an individual policy, life insurance premiums are not tax deductible. Theyâre treated the same as any other expense.

Group term life insurance policies, typically provided by an employer or association, are different. The employer can deduct life insurance premium payments for up to $50,000 of coverage per employee, so long as the employer is not the beneficiary. As an employee or association member, the cost of group or supplemental life insurance can actually be added to your taxable income.

If you have less than $50,000 of group and supplemental term life insurance, you wonât be taxed on the value of it. However, any coverage over $50,000 will be assigned a fair market value by the IRS, which is determined by your age. The amount you pay in premiums is deducted from the fair market value, and the difference is considered to be taxable income. It may seem odd to pay taxes on coverage that youâve already paid for, but this rule is meant to account for cases in which you receive a discounted rate by purchasing group life insurance. With group coverage, risk is pooled across a large number of people so, if youâre quite unhealthy or older, you may receive a much lower rate than you would get with an individual policy.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Cash Surrender Is Partially Taxable

When you surrender a policy for cash, you may have to pay tax on any proceeds that exceed the cost of the policy. This usually includes the total amount in premiums that you paid for the policy, minus any rebates, dividends, unrepaid loans or refunded premiums that arent otherwise included in the income you report to the IRS.

You May Like: Is Giving Plasma Taxable Income

Set Money Aside For Your Children’s Education

Create a college fund for your kids by putting some money into a 529 college savings plan. The funds can be withdrawn tax-free to pay for qualified school expenses. If possible, when paying for education, use any available tax credits first. After this, consider using 529 funds on remaining expenses, while watching out for penalties. You need to withdraw 529 funds during the year they will be used for school expenses.

Paying Capital Gains Tax On Key Person Insurance:

If a business takes out a key person policy for a capital purpose , then the benefit of that policy will not be subject to income tax, but the business may still have to pay capital gains tax.

This is because the ATO views the payment of the life insurance policy as the disposal of a CGT asset.

But, before you worry about whether payment of your key person insurance benefits might be considered a capital gain, take a moment to familiarise yourself with the two major exemptions the government has put in place.

Under section 118-300 of the Income Tax Assessment Act 1997, the law states that CGT is not payable on a life insurance benefit when:

- The life insurance benefits are distributed to the original beneficial owner of the policy or

- The person receiving the benefits of the policy gave no consideration in exchange for the life insurance cover.

In this context, an original beneficial owner is the person who first possesses or controls the policy.

And, consideration is a legal term that, when talking about CGT exemptions for life insurance policies, basically means doing or giving something in exchange for something else. This could be paying money, giving gifts, offering rights or making another sort of exchange.

You May Like: Michigan Gov Collectionseservice

Whats The Benefit Of Cash Value

The cash value piece of your whole life insurance will increase each year1 on a schedule guaranteed by the insurance company,2 allowing it to grow throughout your life. Its also likely to grow from annual dividend payments , if you buy the policy from a mutual whole life insurance company.3 As long as you pay the premium your coverage cant be cancelled for any reason. This could be a big plus when youre older. Even if you live a very long life, your beneficiaries will receive a guaranteed sum of money after youre gone.

Apart from the certainty that your loved ones will receive an income-tax-free sum of money , there are other benefits you get from a whole life insurance policy, including tax considerations.4

Capital Gains Tax On Appreciated Property

If you inherit property that appreciates in value, the amount of the gain is also taxable. To calculate exactly how much the property has gained in value, you’ll need to determine what’s called the “basis” in the property. Typically, for tax purposes, the basis would simply be how much you originally paid for the property. However, when you inherit property, you get the benefit of what’s called a “stepped-up basis,” which means that instead of being taxed on the entire gain from the moment of the deceased person’s purchase, you’re taxed only on the gain from the deceased person’s date of death.

Example: In 2020, Miko inherited her mother’s house, whose fair market value on the date of her mother’s death was $500,000. Miko’s mother had purchased the house in 1990 for $200,000. In 2021, Miko sells the house for $550,000. Because her basis is “stepped up” to $500,000, Miko owes capital gains tax only on a gain of $50,000.

You May Like: Doordash Tax Tips

You Receive A Delayed Payout

Some beneficiaries leave life insurance proceeds on deposit with the insurance company. They draw periodic payments from the balance. This type of arrangement also earns interest and that interest is taxable. For example, you might elect to receive $3,000 a month. The portion of that $3,000 that represents interest earned must be reported on your tax return.

You can calculate the taxable portion by dividing the total amount on deposit with the insurance company by the number of installment payments youre to receive. The result is how much of your installment payment is tax-free. Any amount above that figure is considered taxable.

The insurance company should issue you a tax Form 1099-INT at years end, reporting exactly how much of your payments represent interest. The IRS will receive a copy, too.

Do Beneficiaries Pay Tax On Life Insurance

The great thing about life insurance is that unlike some inheritances, it is not subject to income or capital gains tax.

However, although the payout from a life assurance policy is generally free of deductions for personal income tax, if it is equal to or more than £325,000, your beneficiary may have to pay inheritance tax.

Anything under this amount is non-taxable and can be passed on to loved ones at no additional expense.

Don’t Miss: How Do I Get My Pin For My Taxes

When The Payout Comes In Installments Instead Of A Lump Sum

There are two ways the benefit can be paid as a single lump sum or in installments. Some people prefer to receive money over time to avoid spending the full amount. But they should be aware that the interest is taxable.

Jonathan Holloway, co-founder of NoExam.com, a digital life insurance brokerage explains, If the payout is paid in installments, the interest that accrues on the payouts is taxable. The death benefit is not taxable, only the interest on installments.

Tax On Life Insurance Proceeds

Whether a beneficiary has to pay tax on the proceeds of a life insurance policy depends on whether the proceeds are paid in a lump sum or in installments with interest. If they are paid in a lump sum, they are not taxed. If they are paid in installments over several years, the part of each installment that constitutes interest is taxable income each year.

Read Also: Is Plasma Money Taxable

What To Know About Taxes On Life Insurance

Life insurance is an important part of financial planning. It becomes increasingly important as people get older and begin to think about ensuring the care of their family after they die. However, there are important tax implications to consider when deciding to use life insurance and when naming your beneficiaries. From taxes on payouts to estate tax issues, there is a lot of information to manage. It might make sense to find a financial advisor who can help you navigate the various life insurance products available. SmartAsset can help you find the right one who is right for you with our free financial advisor matching service.

When Are Life Insurance Proceeds Tax

Generally, your beneficiaries can dodge taxes in these situations.

Death benefit paid out to beneficiaries

Most people buy life insurance so they can leave money to their beneficiaries when they die. Fortunately, the death benefit isnt considered taxable income, so the full payout will go to your beneficiaries. Theres one exception, and thats when your estate is valued at more than $11.58 million the IRS threshold for 2020. In this case, the proceeds of the policy will be counted as part of your estate and may be subject to federal estate taxes.

Cash value gains

If you choose a whole or universal life insurance policy, it builds cash value over time. The cash value gains are not subject to any taxation unless the policy is surrendered or transferred to another owner a scenario referred to as a life insurance settlement.

Surrender payouts

If you decide to discontinue your life insurance policy before it matures, youre eligible to gain access to your accrued cash value minus any surrender fees. This is called a life insurance surrender, and as long as your settlement amount is less than the total you paid in premiums, your surrender payout is tax-free.

Early payout for chronic or terminal illness

Annual life insurance dividends

Return of premium policy refunds

A return of premium policy reimburses you for your paid premiums if you outlive the policy. Since its a refund and not a payment or profit the money you receive isnt subject to tax.

You May Like: Tsc-ind Ct

How Do I Name A Beneficiary

If you wish to, you can name your beneficiaries when you purchase your policy. You should discuss your plans with your beneficiary. You should decide if the beneficiary is revocable, or irrevocable.

- Revocable beneficiary: you can change the beneficiary at any time without telling them.

- Irrevocable beneficiary: you must have written permission from the irrevocable beneficiary before you can make any changes.

What Happens To A Life Insurance Policy With No Beneficiary

If no beneficiaries are listed on a life insurance policy and the life insured passes away, the payout goes directly to the policy owner. However, if the policy owner is the deceased, the benefits would go to their estate and would be divided as per their will.

A nominated beneficiary cant amend the life insurance policy unless theyre also the policy owner. The only involvement they have is making a life insurance claim and receiving their share of the benefit payout once the claim is processed through the insurer.

If youre a policyholder, you may wish to include this information in your will.

You May Like: What Can I Write Off As A Doordash Driver

Estate Taxes And Life Insurance Payouts

People with a large life insurance death benefit used to be worried about the estate tax, Mullaney says. Thats because the limit on assets including life insurance coverage that could be passed onto heirs tax-free was much lower than it is now.

For example, in 2004, an estate tax return had to be filed for estates exceeding $1.5 million, according to the IRS. For 2020, a federal estate tax exemption covers estates up to $11.58 million. If you have a term life policy and its included in your estate, you dont have to worry about the estate tax most likely, Mullaney says.

If you have a large estate, though, Allec suggests working with a tax planning professional to discuss tax minimization strategies.

To keep your insurance payout out of your estate, it may be advisable to transfer your policys ownership to someone else, perhaps the life insurance beneficiary, Allec says. Another strategy is to transfer the ownership of your life insurance policy to an irrevocable life insurance trust, where the proceeds of a life insurance policy may be insulated from estate taxes, subject to certain requirements. Again, work with a tax planning professional to see what may suit your specific situation.

Which Exceptions Exist For Not Paying Taxes On Life Insurance

As alluded to above, some exceptions certainly exist for when your life insurance payout may come into the cross hairs of Uncle Sam. You will encounter one exception when dealing with the transfer of a life insurance contract for cash or other valuable consideration from one party to another. In other words, when you buy or sell the policy and it transfers ownership from one party to another.

When this occurs and you buy the policy from another party, you have the ability to exclude the price you paid as well as any additional premiums you pay toward the policy following the purchase. This exclusion is formalized in the IRStransfer-for-value rule.

To illustrate this exception, imagine you purchased a $250,000 policy for $60,000 and paid $50,000 in premiums before the insured passes away , you can exclude $110,000 of the proceeds from your income .

And not to be outdone, exceptions exist to this exception! In general terms, you would report the taxable amount of the insurance policy based on the type of tax document you receive such as Form 1099-INT or Form 1099-R, both informational documents provided by the insurance provider or related carrier. To learn more about the finer details of this exception to the exception, see IRS Publication 525.

Recommended Reading: How Much Do You Pay In Taxes Doordash

Are Life Insurance Payouts Taxable

According to the IRS, any money received from a life insurance policy is not required to be declared as gross income and does not need to be reported on your tax return. The money is typically distributed tax-free to the beneficiaries.

While life insurance payouts are not treated as taxable income, there are some scenarios where you will need to pay taxes on related funds.

Interest income

Any income earned in the form of interest is taxable and must be reported on your tax return.

Basically, “if the policyholder elected to hold payout for a period of time instead of paying it out immediately, you may have to pay taxes on the interest generated during that period of time,” said Josh Zimmelman, owner of Westwood Tax & Consulting.

So if you received a delayed payout last year, any interest accrued before you recieved it is taxable. This may occur if the payout is held in an account, gaining interest, for a period of time before it’s distributed to you.

Typically, death benefits are paid out in one lump sum to the beneficiary. However, a beneficiary may choose to receive incremental payouts over time â for example, if they would have difficulty managing a lump sum or they wish to receive stable, regular income. In that case, the payout will accrue interest over the years, which is taxable.

Estate tax

âIf the death benefit is paid to an estate then the person who later inherits that estate might have to pay estate taxes,â said Zimmelman.

Image: MARHARYTA MARKO