How Can I Track An Indiana Tax Refund

If youre expecting a refund, there are three ways to track its status. You can check online, call the automated refund line at 1-317-233-4018, or call the live help line at 1-317-232-2240 from 8 a.m. to 4:30 p.m. Monday through Friday. Youll need to have a few things handy: your Social Security number, the amount of your refund and the tax year youre interested in.

What All Do I Need To Send If Im Mailing My Indiana State Return

If you are mailing your Indiana return, the complete filing instructions should print with your state return including the address to mail.

But in general, there are two main pages to the IT-40, Indiana full year resident return. You will sign the second page of the IT-40 and place all other pages of the tax return, behind it. These pages should be numbered, so you know what order to put them in.

You will also need to mail any income documents such as W-2 forms or 1099 forms. Do not attach these forms however. Please view the link below. for a list of instructions on submitting your Indiana tax return.

How Do I Calculate My State Tax Refund

Recommended Reading: Is Doordash Taxable Income

Where Do I Mail My Indiana State Tax Return Payment

for a list of instructions on submitting your Indiana tax return. Indiana Department of Revenue. P.O. Box 7224. Indianapolis, IN 46207-7224.

If you are owed a refund, mail return to this address:

Where to mail 1040-ES Estimated payments?

- Mail your SC1040ES and payment in one envelope. Staple your payment to the SC1040ES. Mail your SC1040ES and payment to: SCDOR, IIT Voucher, PO Box 100123, Columbia, SC 29202

If You Cant Pay It Now Pay It Over Time

If you cant pay your Indiana tax balance in full immediately, you likely can set up a payment plan. The terms of your payment plan depend on who is collecting your Indiana tax debt. Your Indiana tax debt might be being collected by 1 or more of the 3 agencies listed below. The agency who is collecting your Indiana tax debt depends on how long you have owed your Indiana tax debt.

Don’t Miss: Do You Pay Taxes With Doordash

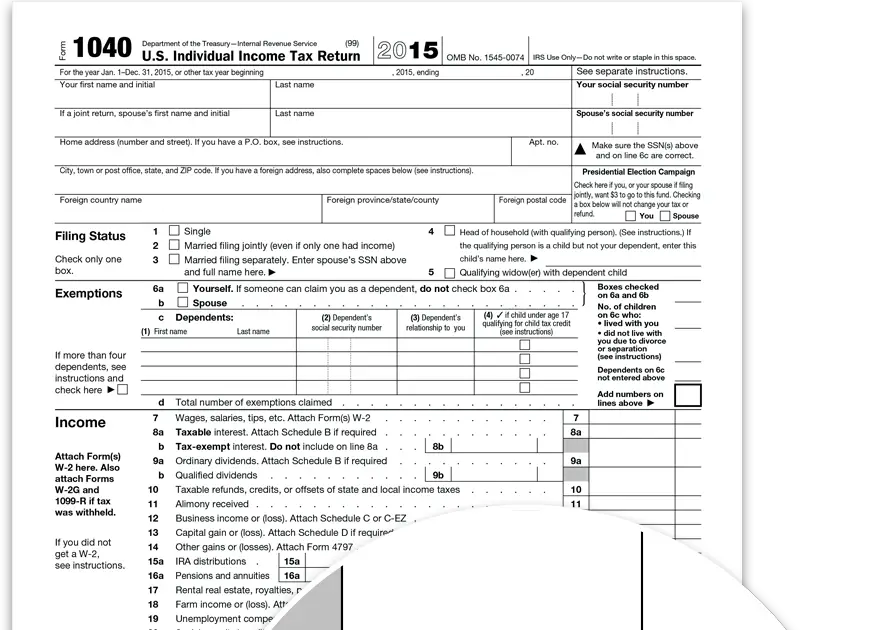

Which Form Should I File

You should file either a 1040NR or a 1040NR-EZ. You may need to file additional forms based on your individual circumstances.

In general, you can file Form 1040NR-EZ if you meet the following criteria:

- You do not claim any dependents.

- You cannot be claimed as a dependent on another person’s tax return .

- Your taxable income is less than $100,000.

- You do not claim any tax credits.

- You are married, but do not claim an exemption for your spouse.

Some exceptions exist, so make sure to review the 1040NR-EZ instructions for detailed criteria.

How Do I Pay Indiana State Taxes

When you receive a tax bill you have several options:

Read Also: Protest Taxes Harris County

If There Were An Indy 500 For State Income Tax Deductions Indiana Might Have A Good Chance Of Racing Past Other States

Consider yourself lucky if you live in the Hoosier State. Its not only the site of the annual race that draws hundreds of thousands to the Indianapolis Motor Speedway, but its also home to a bounty of tax deductions and refunds that could lower your state income tax bill. On top of that, the state has a flat tax rate of 3.23%.

Here are some things to know about your Indiana state taxes.

Indianapolis, IN 46207-7207

Michigan State Tax Deductions

While filing a Michigan state tax return, you may be able to claim deductions on Michigans Schedule 1 form. Available deductions include

- Renaissance Zone deduction, if you meet income, residency and other requirements

- Charitable contributions made to the Michigan Education Trust charitable tuition program during the tax year

- Price paid during the tax year to buy a Michigan Education Trust 529 prepaid tuition contract

- Qualified contributions made during the tax year to the Michigan Education Savings Program subject to certain limitations and caps

Read Also: How Much Taxes Deducted From Paycheck Mn

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

There Are Three Stages Of Collection Of Back Indiana Taxes

1) First, The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting . Depending on the amount of tax you owe, you might have up to 36 months to pay off your tax debt. If not paid at this point, your Indiana tax debt becomes an Indiana tax lien. If not paid, tax debt at this stage attaches to real estate owned in your county, complicates Indiana professional licensing, and complicates the sale of motor vehicles if not paid. If The Indiana Department of Revenue doesnt collect the tax debt, then the debt moves to your Indiana Countys Sheriff Department.

3) Lastly, United Collection Bureau, Inc attempts to collect Indiana back tax debt by sending you demands via US Mail and calling your telephone. UCB routinely issues bank levies and wage garnishments. If UCB levies your bank account, you will be forced to pay an amount equal to the amount they have frozen in your bank account to be able to unfreeze your account. You have limited payment options with UCB. Sometimes nothing less than immediate full payment will stop collection actions by UCB, while other times you might have to pay a substantial down payments followed by a short period of months repayment.

Also Check: How To Find Employers Ein

Do I Need To File A State Tax Return

If you are a nonresident student, scholar, or dependent and you had any Indiana source income during the previous year, you must file Form IT-40PNR.

Examples of Indiana source income include:

- Employment in Indiana

- Stocks, bonds, notes, bank deposits, and other property where earnings are a part of an Indiana business

- Trusts and estates

If you are a resident alien student, scholar, or dependent and lived in Indiana the entire previous year, you may be required to file Form IT-40 or Form IT-40EZ.

If you were a resident of an Indiana county that had a county income tax, you will also need to file Form CT-40, Form CT-40EZ, or Form CT-40PNR.

The DOR website has instructions to help you determine which form or forms to submit.

The Us Federal And Indiana State Tax Return Filing And Payment Deadline Is May 17 2021

Forms and information are available through the U.S. Federal Internal Revenue Service and the Indiana Department of Revenue . If you worked in a state other than Indiana in 2020, you may need to file income tax returns in that state as well.

Cares Act

The Cares Act was introduced by the U.S. government in April 2020. It provided individual taxpayers an initial stimulus payment of $1200 and then more recently an additional $600 to off-set the financial hardship caused by COVID-19.

To receive this payment a person needed to:

Also Check: Doordash Driver Tax Information

If You Owe And Cant Pay

You should pay your Michigan state taxes by the annual deadline if you want to avoid a late-payment penalty and interest charges on the amount due.

If you cant pay what you owe, you still must file your Michigan state tax return by the due date and then you can arrange to pay the amount you owe later. But you must wait until you receive a Bill for Taxes Due notice from the Michigan Department of Treasury to request an installment agreement. Before getting the notice, however, you can pay any amount using the states e-Payments system.

How Do I File My Indiana Tax Return

You have the option to file and pay your tax return online. If you prefer to pay by mail, you can mail a copy of your official tax documents and your completed tax forms to Indianapolis.

If you do not owe money to the state of Indiana, send your tax documents and forms to the following address. :

Indiana Department of Revenue

Also Check: Doordash Tax Rate

Why Did I Not Receive A State Tax Refund

How Do I Mail A Tax Return Payment

If you choose to mail your tax payment:

Read Also: How To Take Taxes Out Of Doordash

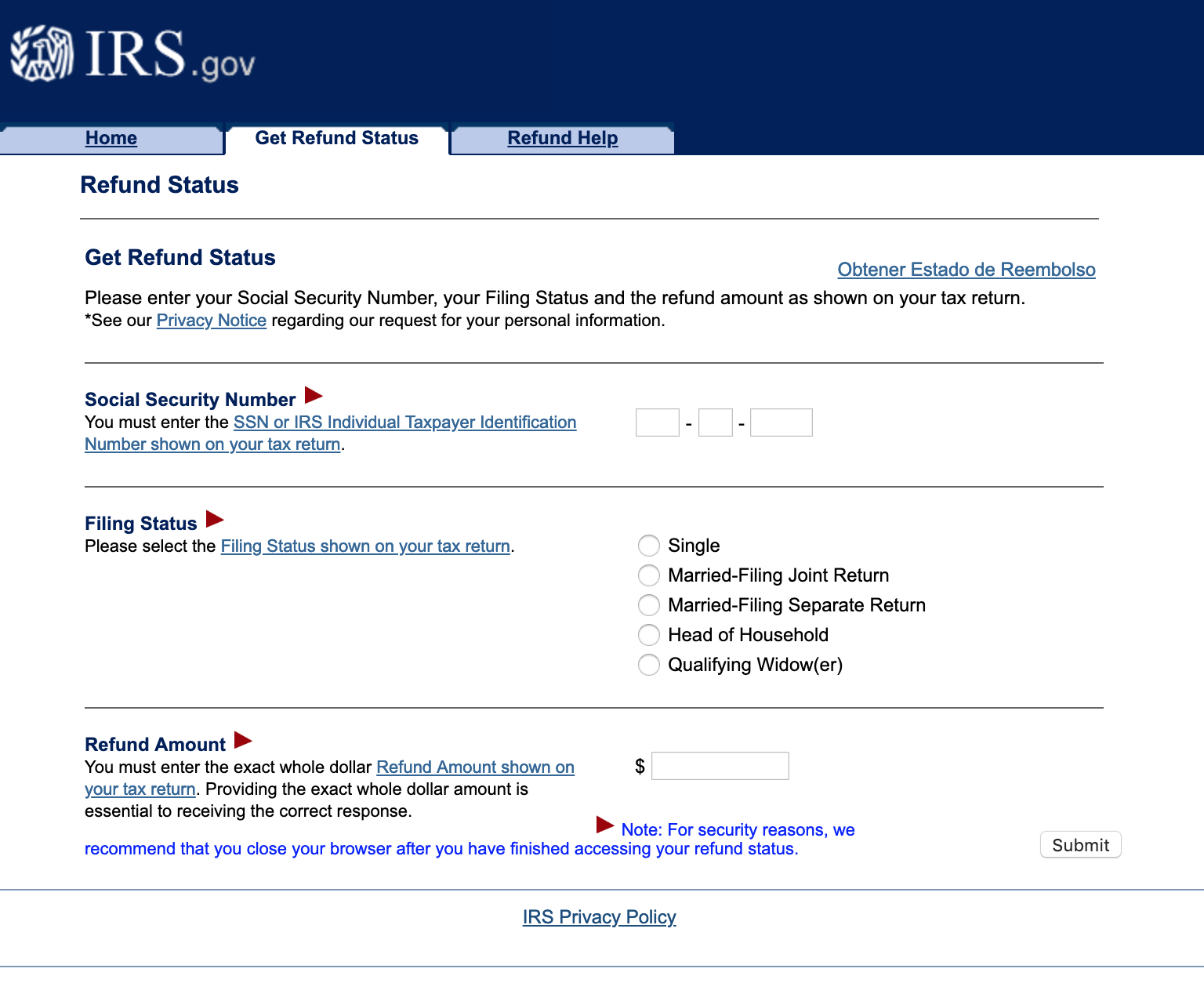

Get A Free Copy Of Your Tax Return Information Online

There are many reasons you may need a copy of your tax return information, such as applying for a student loan, a home mortgage or a credit card. If you dont have a copy, you can get a free transcript from the IRS online or by mail.

Transcripts are available for the most current tax year after the IRS has processed the return. You can also get them for the past three tax years.

- Order online Use the Get Transcript Online tool available on IRS.gov. You can use this tool to confirm your identity and immediately view and print copies of your transcript in a single session. The tool is available for five types of tax records: tax account transcript, tax return transcript, record of account, wage and income and verification of non-filing.

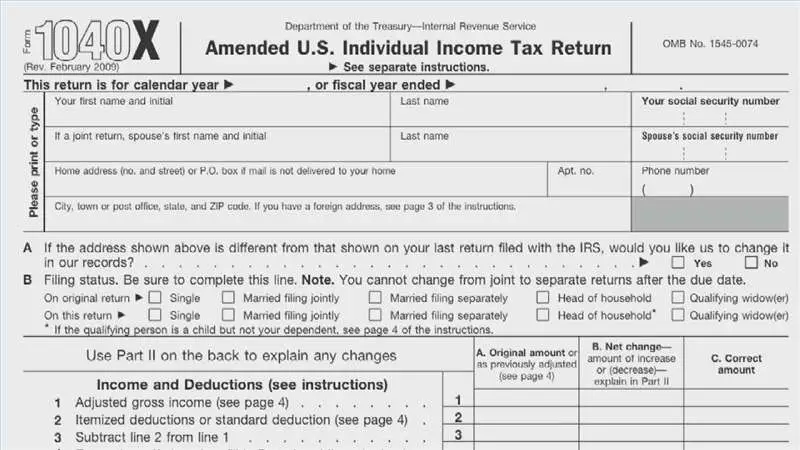

- Order by mail Use the Get Transcript by Mail online option on IRS.gov or complete and mail Form 4506T-EZ to get your tax return transcript. Use Form 4506-T to request your tax account transcript by mail.

Before you order your transcript, figure out which you need: a tax return transcript or a tax account transcript:

When you access Get Transcript Online, the IRS suggests the type of transcript you need based on the reason you provide. For Get Transcript by Mail, you must decide which available transcript type best meets your needs.

Michigan State Tax Credits

You may be eligible for state-level tax credits. In 2017, available credits included

- Homestead property tax credit: This can help cover part of your property taxes if youre a qualified Michigan homeowner or renter and meet certain requirements. The amount of credit is typically based on total household resources. For 2019, the limit for household resources is $60,000 and the maximum credit amount is $1,500.

- Earned income tax credit: If you qualify for and receive the federal earned income tax credit for lower-income earners, you are also eligible for the Michigan earned income credit. The state-level credit is worth 6% of the federal credit you received.

- This can include income tax paid to a nonreciprocal state, local government , the District of Columbia or a Canadian province.

Also Check: Does Doordash Take Taxes Out For You

Heres Where You Want To Send Your Forms If You Are Not Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Florida, Louisiana, Mississippi, Texas: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0014

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0014

What If I Cant Fully Pay My Back Indiana Taxes Or Even Afford The Payment Plans Offered By The Indiana Department Of Revenue My Indiana Countys Sheriff Department Or United Collection Bureau Inc

You still have options.

1. Get Outside Help Consult with a tax attorney, experienced in dealing with back Indiana taxes. If you are in an emergency situation where you are unable to fully pay your tax debt, you are likely juggling IRS tax debt, Indiana tax debt, and other expenses. Its best to determine a strategy that takes into account your entire financial picture. Hiring a tax attorney to create and implement this strategy can save you enormous amounts of heartache, time, and money.

2. Go To The Source The Indiana Department of Revenues Taxpayer Advocate Office helps the people who owe Indiana taxes, but arent able to pay taxes in full or according to the payment options given by The Indiana Department of Revenue, the Indiana County Sheriff, or United Collection Bureau, Inc. This office is understaffed, its paperwork requirements are steep, but its assistance to Indiana taxpayers is invaluable. While its help might not be immediate , if you provide it the paperwork it requests, the Taxpayer Advocate Office will be able to assist you.

Recommended Reading: Doordash File Taxes

Where Can I Find Indiana Tax Forms

There are a number of ways to find the forms you need to file your taxes in the state of Indiana. Perhaps the quickest and easiest method is to download the appropriate forms from the Indiana Department of Revenues website. You can find Indiana tax forms here.

Some post office locations have state tax forms available. Your local library may have tax forms as well. If not, the library will have computers and a printer allowing you to print your own forms, likely for a small fee. Your local Indiana Department of Revenue office also has the state tax forms. Find the nearest location here.

Indiana Income Tax Rate

The state charges taxpayers a flat income tax rate of 3.23%, regardless of income level. The flat state rate means calculating your tax liability should be a breeze. But dont forget to take advantage of the surfeit of tax credits and deductions, which can help you lower your bill further.

Don’t Miss: Doordash Pay Calculator

What Is A State Tax Lien

Tax Offset Information For Non

1. How Child Support Cases are Submitted for Tax Refund Offset

In order for the non-custodial parent to be submitted for the state tax refund offset program, the amount of child support delinquency must be at least $150.00.

In order for the non-custodial parent to be submitted for the federal tax refund offset program, the amount of child support delinquency must be at least $150.00 in a Temporary Assistance for Needy Families case and at least $500.00 in a Non-Temporary Assistance for Needy Families case.

Both state and federal tax refund offsets are AUTOMATIC through Indianas statewide child support computer database.

2. How to Dispute a Tax Refund Offset Submission

Federal Tax Refund: In order to dispute a federal tax refund offset submission, you must write to your local child support office that certified you for federal tax refund offset submission. You must mail the following information to your local child support office: a) your written request for review, b) a copy of your federal tax refund offset notice and c) evidence showing that the amount submitted for federal tax refund offset was incorrect. An Enforcement Agent will conduct a review of your federal tax refund submission dispute within thirty days of your written request. Thereafter, you will be noticed of the results of your review by mail.

3. How to File an Injured Spouse Claim & Allocation

Read Also: Do I Have To Pay Taxes For Doordash

How Can I File An Indiana State Tax Return

When it comes to filing your Indiana state tax return, you can do it online or send it in by mail.

Filing your state tax return electronically may be the fastest and easiest option. You can e-file your return by using

- The Department of Revenues INfreefile portal, which allows lower income taxpayers to file state and federal taxes online for free

- Online filing companies from the Department of Revenues list of approved software providers, including , which never charges a fee to prepare or file your federal and state returns be aware some other providers may charge a fee

- A paid tax professional

To file your taxes by mail, youll need to and complete the tax forms click on current year tax forms. Mail your forms and any additional documents to either of these addresses:

If youre expecting a refund:

Indiana Department of Revenue

Indianapolis, IN 46207-7224