Filing Your Wisconsin Sales Tax Returns Online

Wisconsin supports electronic filing of sales tax returns, which is often much faster than filing via mail.

Wisconsin allows businesses to make sales tax payments electronically via the internet.

You can process your required sales tax filings and payments online using the official Wisconsin MyTax Account website, which can be found here

Need More Tax Guidance

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get the support you need when it comes to filing taxes.

Need to check the status of your federal refund? Visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

If you were a part of a civil union or had a domestic partner, what filing status should you use on your tax return? Find out from the experts at H& R Block.

State Electronic Filing Details

| You must e-file if preparing 50 or more returns. | |

| Accepts state-only filings | |

|

X-NOL – Carryback of Wisconsin Net Operating Loss Amended |

|

| Accepts returns with these conditions |

Refund |

| The act of e-filing is considered to be signature. | |

| Supports PDF attachments | |

| Tax year supported for e-filing | Current tax year and two prior tax years |

| Special considerations |

See Publication 115 Handbook for Federal/State Electronic Filing for more information. |

Read Also: How Much Do I Pay In Taxes For Doordash

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Your Wisconsin Sales Tax Filing Frequency & Due Dates

Your business’s sales tax return must be filed by the last day of the month following reporting period.For a list of this year’s actual due dates, see our calendar of Wisconsin sales tax filing due dates.

The twentyth of the month directly after the reporting period if the sales and use tax liability is greater than three thousand six hundred dollars per quarter or reporting period.

Recommended Reading: Cook County Board Of Review Deadlines

Deadline To File Wisconsin Filing Taxes:

- Deadline: January 31, 2022 for Wisconsin State Taxes withheld.

- Deadline: January 31, 2022 for Without Tax Withheld.

What are the Wisconsin 1099-MISC state filing requirements? Find your scenario below.

Scenario 1: No Wisconsin state taxes withheld or without withheld, payments do not meet federal threshold.

Recommended filing method: No filing required.

Scenario 2: No Wisconsin state tax withheld, payments meet federal threshold

Recommended filing method: Combined Federal State Filing Program .

Deadline: January 31, 2022

Tax1099 fulfills: Yes

Cost: Included in your federal eFile with Tax1099

With the CFSFP, any federal e-File you submit through Tax1099, our platform will automatically flag your forms based on the state’s participation in the program. In this case, we e-File your forms with CFSF status and the IRS will forward your forms to the state, via the CFSFP. No additional action is required from you.

Scenario 3: Wisconsin requires 1099-Misc filing, if there were Wisconsin state taxes withheld.

Recommended filing method: Direct-to-state eFile.

Deadline: January 31, 2022

Tax1099 fulfills: Yes

Cost: + $0.50 per form

When submitting your federal eFile through Tax1099, select to have us eFile your forms to the state, as well. Well automatically alert you to this filing requirement based on the information you enter into your forms.

Wisconsin requires 1099-NEC filing.

Scenario 1: No Wisconsin state tax withheld, payments meet federal threshold

Wheres My Refund Wisconsin

To check the status of your Wisconsin state refund, go to

You will be prompted to enter:

- Tax return year

- Your Social Security number or ITIN

- Enter refund amount from your return

Then, click Submit.

- in Milwaukee

- Toll free at in other areas of Wisconsin

If filed electronically, most refunds are issued in less than 12 weeks. Filing a paper return could delay your refund.

You May Like: How Much Is Doordash Taxes

Tax Forms For Federal And State Taxes

OVERVIEW

TurboTax software programs include the tax forms you’re likely to need to file your federal and state taxes. And the great thing is they guide you through your tax return so you don’t need to know which tax forms to file. You can also find all federal forms and state tax forms at the links below.

How Can I File A Wisconsin State Tax Return

The easiest, fastest and most accurate way to file your Wisconsin state tax return is to e-file.

The state offers a list of approved vendors that can help you e-file. You may be able to e-file for free if you meet income, age and other requirements. Vendor requirements may vary and if you dont meet those qualifications, the vendor may charge you a fee to file. , which is included in Wisconsins list of approved vendors, never charges you to file your single-state and federal tax returns. However, if your Wisconsin filing status is married filing separately, you wont be able to use Credit Karma Tax to file your Wisconsin state tax return.

If you do your federal tax return separately, you can e-file your Wisconsin state tax return on the WI e-file site on its own.

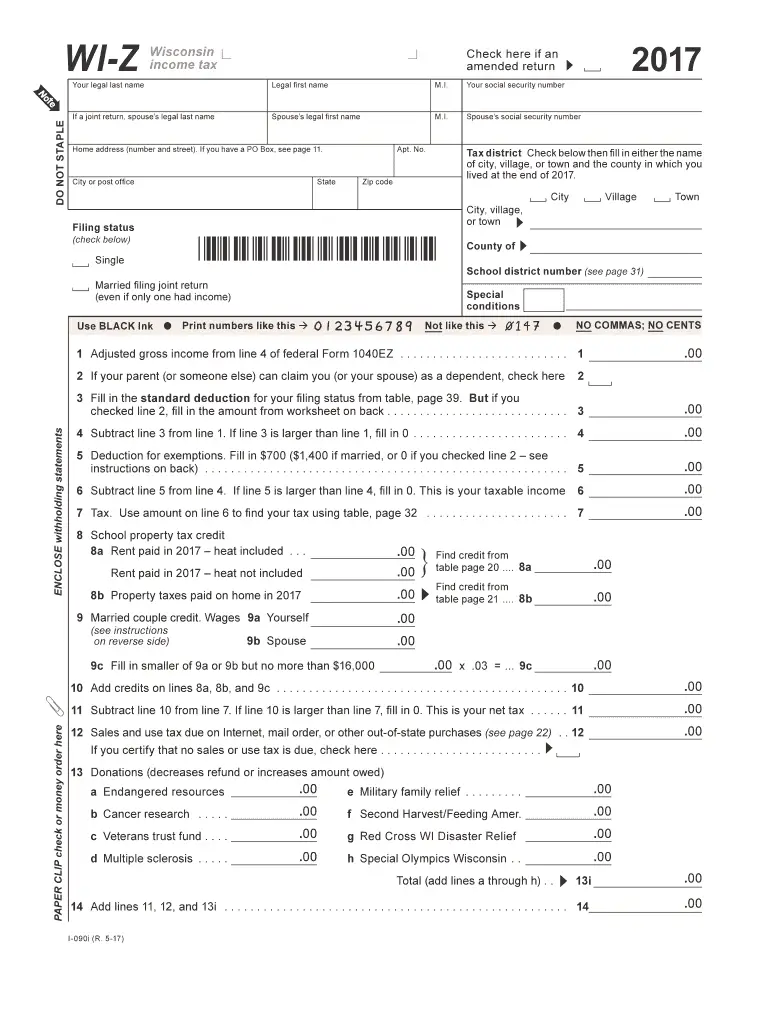

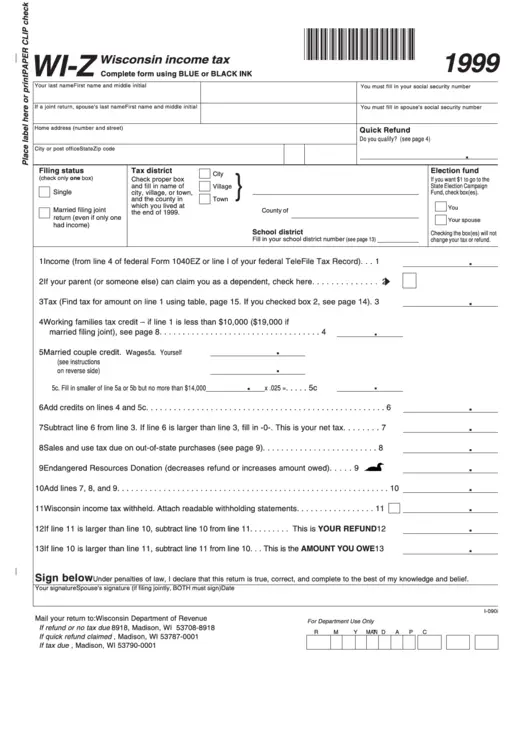

If you prefer to mail in your Wisconsin state tax return, you can also do so by downloading the necessary forms here. One thing to note is that in recent years, Wisconsin had four separate income tax forms, depending on your situation. But this year due to the new federal tax changes, theyll be migrating to a new system. Going forward, residents only need to worry about one main form the aptly titled Form 1. Nonresidents and people who only lived in Wisconsin for part of the year will instead file Form 1NPR.

The Wisconsin Department of Revenue has five different mailing addresses to send your paper tax return to, depending on which form you file and whether you owe money or not. Here are the mailing addresses.

Recommended Reading: Do Doordash Drivers Pay Taxes

Residency Status Information For Wisconsin Returns

Residents: A full year resident is an individual who was domiciled in Wisconsin for the entire year. Full year residents file Form 1.

Part-year Resident: A part year resident is an individual who was domiciled in Wisconsin for only part of the year. Part year residents file Wisconsin Form 1NPR.

Nonresidents: A nonresident is an individual who was not domiciled in Wisconsin for any part of the year. Nonresidents file Form 1NPR.

Reciprocal Agreements – Wisconsin has a reciprocity agreement with the following states: Illinois, Indiana, Kentucky and Michigan.

Wisconsin State Tax Payments

Wisconsin has many income tax payment options. Find the option that works best for you below.

Pay with Direct Debit

If you e-file your Wisconsin tax return with us, you can set this up when filing your return. Otherwise, visit the Wisconsin Department of Revenue’s website to pay your tax by direct debit.

Pay with a Credit Card

Visit the Official Payments Corporation website to pay your Wisconsin tax by credit card. Additional fees may apply.

Due by April 18, 2022

Pay by Mail

If you mail your Wisconsin tax return, include a check or money order with your return.

Due by April 18, 2022

If you e-file your Wisconsin tax return, include a check or money order with Form EPV .

Due by April 18, 2022

If your payment is late, Wisconsin charges 1% interest per month on any overdue amounts.

You May Like: Doordash State Id Number For Unemployment California

How To File For A State Income Tax Extension

Please note, E-file.com provides software to prepare federal tax extensions. However, we do not provide software for state/local tax extensions. With every purchase of our extension software we include free software to prepare and file a tax return once the taxpayer is ready to file.

Most states, which require taxpayers to file an income tax return, use the federal deadline of April 15th If your state requires that you file a return and you believe you will not be able to complete your return by the deadline, you may be able to file a request for an extension.

In order to request an extension of your federal taxes, a Form 4868 must be completed before the tax deadline. E-file.com offers you the ability to file the Form 4868 electronically at .

If you live in a state that has an income tax its important to visit the States Departments of Revenue or Tax Commission office website and become familiar with your states requirements.

If you find that you must file an extension, you will follow similar steps to your federal tax extension. For example, as with a federal request, you will need to estimate your state tax liability and should pay what you owe by the original tax due date. In most cases, the date will be the same as your federal taxes, but in some cases the dates are not exactly the same.

| State Tax Collection Dept. |

I Was Unable To Efile My Wisconsin State Tax Return It Shows Started On The Turbo Tax Site But Im Unable To Do Anything With It Can I Still File My State

Your only option now is to print, ink sign and mail in the state return. If the return was ready to mail then you can download the PDF now. If the return is not ready then …

To prepare and file a 2019 return:

Online preparation and e-filing for 2017, 2018 and 2019 is permanently closed.

To file a return for a prior tax year

If you need to prepare a return for 2017, 2018, or 2019 you can purchase and download desktop software to do it, then print, sign, and mail the return

You may also want to explore purchasing the software from various retailers such as Amazon, Costco, Best Buy, Walmart, Sams, etc.

Remember to prepare your state return as wellif you live in a state that has a state income tax.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2s or any 1099s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. It cannot be used on a mobile device.

They are available from 5 a.m. to 5 p.m. Pacific time Monday-Friday

You May Like: Ein Number Lookup Irs

Wisconsin Individual Income Tax Returns Are Due By April 15 In Most Years If You Cannot File By This Date You Can Get A Wisconsin Tax Extension

Wisconsin personal extensions are automatic, which means there is no application to submit. A Wisconsin extension will give you 6 more months to file, moving the filing deadline to October 15. However, an extension of time to file is NOT an extension of time to pay. Your Wisconsin income tax must be paid by the original due date , or interest and penalties will apply.

If you have a valid Federal tax extension , you will automatically be granted a corresponding Wisconsin tax extension. Make sure to attach a copy of your approved Federal extension to your Wisconsin tax return when its filed.

If you dont have a Federal extension, you must provide either a written statement indicating that you wish to utilize the Federal extension provision OR a copy of Federal Form 4868 . Make sure to attach your written statement or Form 4868 copy to your Wisconsin tax return when its filed.

If you owe Wisconsin income tax, you can make an extension payment using Wisconsin Form 1-ES . Wisconsin extension payments can also be made online through My Tax Account: tap.revenue.wi.gov/services

For more information, please visit the Wisconsin Department of Revenue website: www.revenue.wi.gov

The Wisconsin Income Tax

Wisconsin collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, Wisconsin’s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Wisconsin’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Wisconsin’s %. You can learn more about how the Wisconsin income tax compares to other states’ income taxes by visiting our map of income taxes by state.

Some states, including Wisconsin, increase, but don’t double, all or some bracket widths for joint filers .

There are -644 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

You May Like: Is Plasma Donation Taxable Income

General Tax Return Information

Due Date – Individual Returns – April 15, or same as IRS

Extensions – An automatic 6-month extension is granted if a federal extension is filed. The automatic extension only applies to filing a return no extensions are granted for payment of taxes due. All tax payments are due by the original due date of the return.

Drivers License/Government Issued Photo Identification: Wisconsin allows Driver’s License or Government Issued ID information to be included in the tax return in order to electronically file. Returns without Driver’s License or Government Issued ID information may encounter delays in processing of refunds.

How Do I Efile A Wisconsin S Corp Tax Return That Is Completed In Turbotax I Receive The Message That I Need An Update But Turbotax Is Updated

This is the 2nd year in a row I’ve had this problem. It took months last year to finally reach someone who could fix the problem for me. Good news is, you can efile the federal return so at least you know that has been filed. As for the Wisconsin return – I guess we have to wait for them to release a manual update that we can download from this website. Unbelievable the amount of time I’ve wasted on this software the past two tax seasons.

Also Check: Does Doordash Take Taxes Out

How To Collect Sales Tax In Wisconsin

If the seller has an in-state location in the state of Wisconsin, they are legally required to collect sales tax at the tax rate in which the buyer of their product is located, as Wisconsin is a destination based sales tax stateIf the seller’s location is out of state, then the state of Wisconsin also requires the seller to charge sales tax based on the buyer’s location.

What Can Cause A Delay In My Wisconsin Refund

A number of things could cause a delay in your Wisconsin refund, including the following:

- If your homestead credit claim was selected for review

- If your earned income credit claim was selected for review

- If you were selected for identity verification

- If we found errors in matching wage information

- Fraud and error safeguards could delay some returns

Read Also: Wheres My Refund Ga State

Your Wisconsin Sales Tax Filing Requirements

To file sales tax in Wisconsin, you must begin by reporting gross sales for the reporting period, and calculate the total amount of sales tax due from this period. The state of Washington gives all of its tax payers two options to both file, and pay sales tax. One way this can be accomplished is by filing online, at the Wisconsin Department of Revenue. It is also possible for sales tax payment to be remitted through this online system. The other way to file and pay is by using Autofile, another online service which handles both payment and filing. Tax payers should be aware of a late filing penalty and returns which were filed after the designated due date will be required to pay a twenty dollar late fee, and a penalty of 5% for each month or part of the month that the return is late. If the filing was late due to the death of the taxpayer required to file, the penalty will be waived.The state of Washington requires that every seller who owns a sales tax permit to file a sales tax return on the required day, even if it is a “zeroes-out” tax return, and there is nothing to report.