Self Employed Health Insurance

If you are self employed and have to purchase your own health insurance, you can deduct that from your taxable income for income taxes. It will not reduce your profit and thus will not reduce your self employment tax.

For example, say your Schedule C profits were $10,000 and you had $4,000 in qualified healthcare premiums. You would pay income tax on $6,000 . You would still pay self employment tax on the whole $10,000.

There are a number of limitations to this. You have to have earned a profit and you cannot claim more than what your profit was. If you were eligible for subsidized health care through your employer or your spouse’s employer, you may not qualify.

This deduction is taken on Schedule 1 that you would include with your tax form. Schedule 1 lists adjustments to income that don’t rely on whether you itemize your deductions.

Some of the calculations can be a bit involved, so it’s better if you have help with your taxes on this deduction.

The Top 16 Small Business Tax Deductions

Each of these expenses are tax deductible. Consider this a checklist of small business tax write-offs.

And remember, some of the deductions in this list may not be available to your small business. Consult with your tax advisor or CPA before claiming a deduction on your tax return.

The cost of advertising and promotion is 100 percent deductible. This can include things like:

- Hiring someone to design a business logo

- The cost of printing business cards or brochures

- Purchasing ad space in print or online media

- Sending cards to clients

- Running a social media marketing campaign

- Sponsoring an event

However, you cannot deduct amounts paid to influence legislation or sponsor political campaigns or events.

What Are The Most Common Self Employment Tax Deductions

Theres a reason why you should hold onto every receipt and invoice possible – if youre self-employed, a lot of expenses are considered tax deductible.

And thats a good thing, considering self employed people tend to have a higher tax burden than other business entities, like LLCs.

Before we dive into the biggest self employment tax deductions you should take, heres a quick rundown of the most common tax deductible expenses for self employed people like me:

- Home office expenses

Ready to take a closer look at self employment tax deductions? Lets do it!

Don’t Miss: When Can You File Your Taxes

Deducting Health Expenses: Self

If youâre self-employed, there are an overwhelming number of options to saving on medical expenses and Health insurance. Generally, there are three options to deducting health expenses and it is important to understand the differences between each. These three options include: Health Insurance Premiums Deductions, Premium Tax Credit , and deducting approved medical expenses. Donât worry! If youâre not sure what these mean, weâll break down what each of these mean for you.

Casualty And Theft Losses

Should you suffer a loss caused by theft, vandalism, natural disaster, car accident, etc. You can deduct the dollar amount of loss over $100. Should you be unfortunate enough to suffer more than one loss in a tax year, you can deduct $100 from the dollar amount of each loss less any funds received from your insurance policy. Once you have that dollar amount subtract the amount of what is 10% of your AGI. If there is a balance you can deduct that value.

Example: $8,500 casualty/theft loss – $1,200 Insurance Reimbursement – 10% AGI = $3,700 deduction

Recommended Reading: Where To File Taxes For Free

Line 9713 Veterinary Fees Medicine And Breeding Fees

Enter the total amount you paid for medicine for your animals, and for veterinary and breeding fees. Examples of such fees include the cost of artificial insemination, stud service and semen, embryo transplants, disease testing, and neutering or spaying. If you used disposable veterinary supplies for your farming business, enter these costs here.

Line 9932 Drawings In The Current Year

A drawing is any withdrawal of cash or other assets, or services of a business by the proprietor or partners. This includes transactions by the proprietor or partners , like withdrawing cash for non-business use and using business assets and services for personal use. Include the cost or value of the personal use of business assets or services in your drawings for the year.

Recommended Reading: How Much Federal Income Tax Should Be Withheld

How Do I Report Self

This would, of course, include LLCs that are taxed as an S Corp. This one gets a little more complicated and there are a few additional steps you have to take to ensure you are properly getting the deduction for premiums paid to the S Corp owner.

Here are the steps:

As I said, there are a few more hoops you have to jump through with this one but essentially the end result is a deduction. You get an expense on the business tax return, but then you include it as income on your W2, and then you get the final deduction for it on your personal tax return.

It is important to note that this treatment is only for the S Corp owners. If you have other employees you would not follow this same treatment.

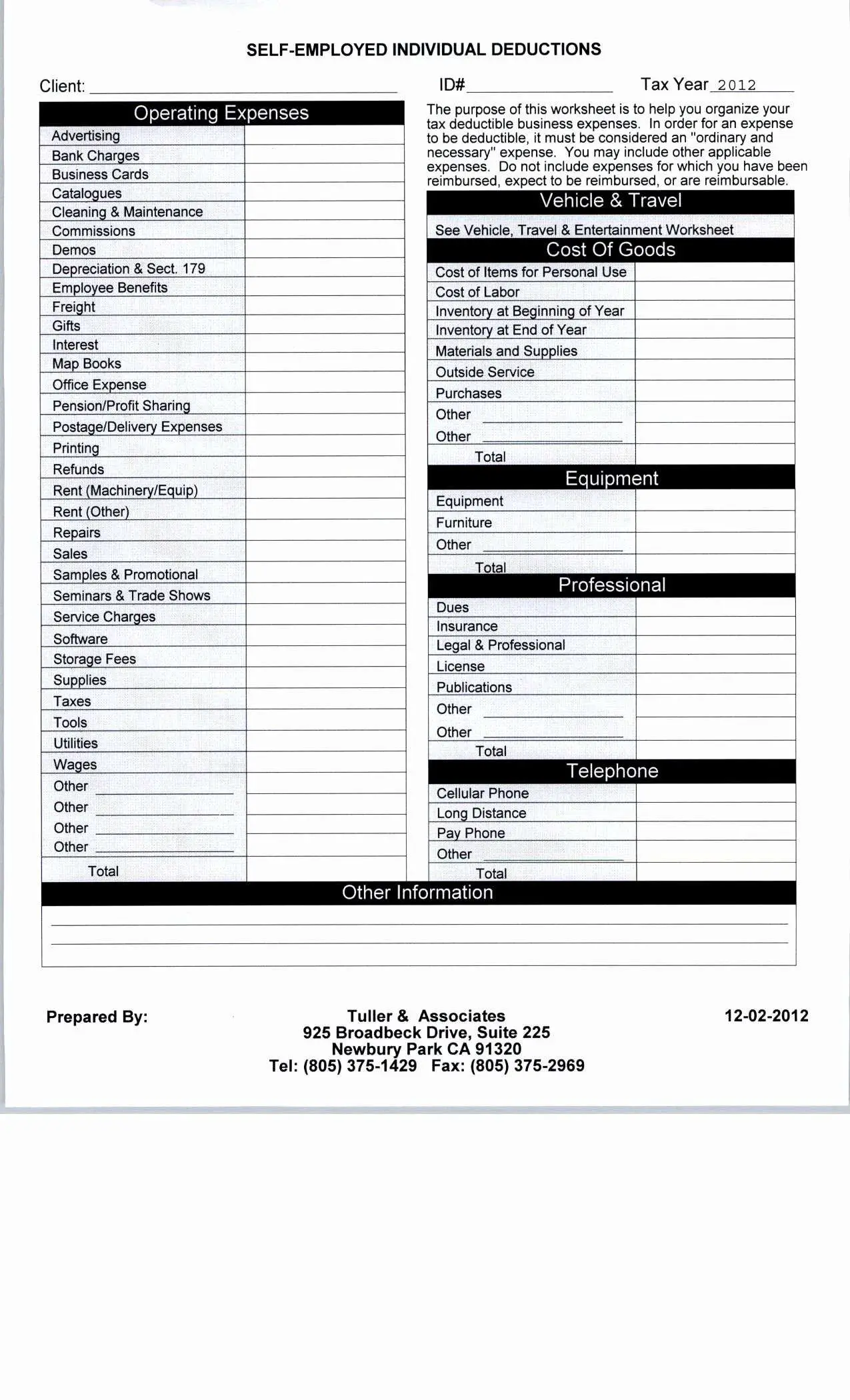

Ordinary And Necessary Business Expenses

If theres a phrase tax attorneys and accountants love to throw around, its ordinary and necessary. To the extent that you can justify a business expense to the IRS, its deductible.

Keep a business expenses list with receipts during the year. Youll be grateful for your organization come tax time.

The most common expenses that fall under this category are rent, business insurance, advertising, employee payroll, office supplies, and the cost of goods sold. Check out our guide to business expenses for a more exhaustive list.

There are restrictions on business tax write-offs for meals, vehicles, and depreciation. We explore the business expenses with limitations below.

Don’t Miss: How Much To Do Taxes

Business Use Of Home Or Dwelling

Accountant and consultant Jéneen R. Perkins, principal of Éclat Enterprises LLC, in Milwaukee, Wisconsin, said most self-employed taxpayers’ businesses start as home-based businesses. Those people need to know portions of business costs are deductible, she said, adding, It is very important that you keep track of expenses relating to your housing costs.”

If your gross income from your business exceeds your total expenses, then you can deduct all of your expenses related to the business use of your home, Perkins said. If your gross income is less than your total expenses, your deduction will be limited to the difference between your gross income and the sum of all business expenses you would pay if the business was not in your home. Those expenses could include telephone lines, the Internet, and other costs to do business.

You must also have a home office that is truly used for work. Hillis said the Internal Revenue Service may require you to document this.

Line 9819 Motor Vehicle Expenses

You can deduct expenses you incur to run a motor vehicle you use to earn farming income. Fill in “Chart A Motor vehicle expenses” of Form T2042. The chart will help you calculate the amount of motor vehicle expenses you can deduct. If you are a partner in a business partnership and you incur motor vehicle expenses for the business through the use of your personal vehicle, you can claim those business related expenses on Line 9943 Other amounts deductible from your share of net partnership income of Form T2042.

Don’t Miss: Do You Have To Claim Social Security On Taxes

Keeping Motor Vehicle Records

You can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. To get the full benefit of your claim for each vehicle, keep a record of the total kilometres you drive and the kilometres you drive to earn income. For each trip, list the date, destination, purpose, and number of kilometres you drive. Record the odometer reading of each vehicle at the start and end of the fiscal period.

If you change motor vehicles during the fiscal period, record the dates of the changes and the odometer readings when you buy, sell, or trade the vehicles.

Use Of Personal Vehicle

You can deduct the business use of your personal car in one of two ways. The most straightforward is applying the IRS mileage rate $0.575 in 2020 to every mile driven for business purposes.

Say you own a construction business, and you use your personal car to visit clients homes. When you make a 14-mile round trip to a clients home, you can deduct $8.05 on your taxes .

Either set up a spreadsheet or use software to track your business mileage. It might benefit you to take pictures of your cars odometer before and after each business trip.

Your second option is deducting a portion of the total amount you spent operating your car during the year. To deduct actual costs, you need to determine what percentage of miles driven were for business and multiply it by the total cost of insurance, registration, gas, oil, and the like.

Read Also: Where Do I Pay My Federal Taxes

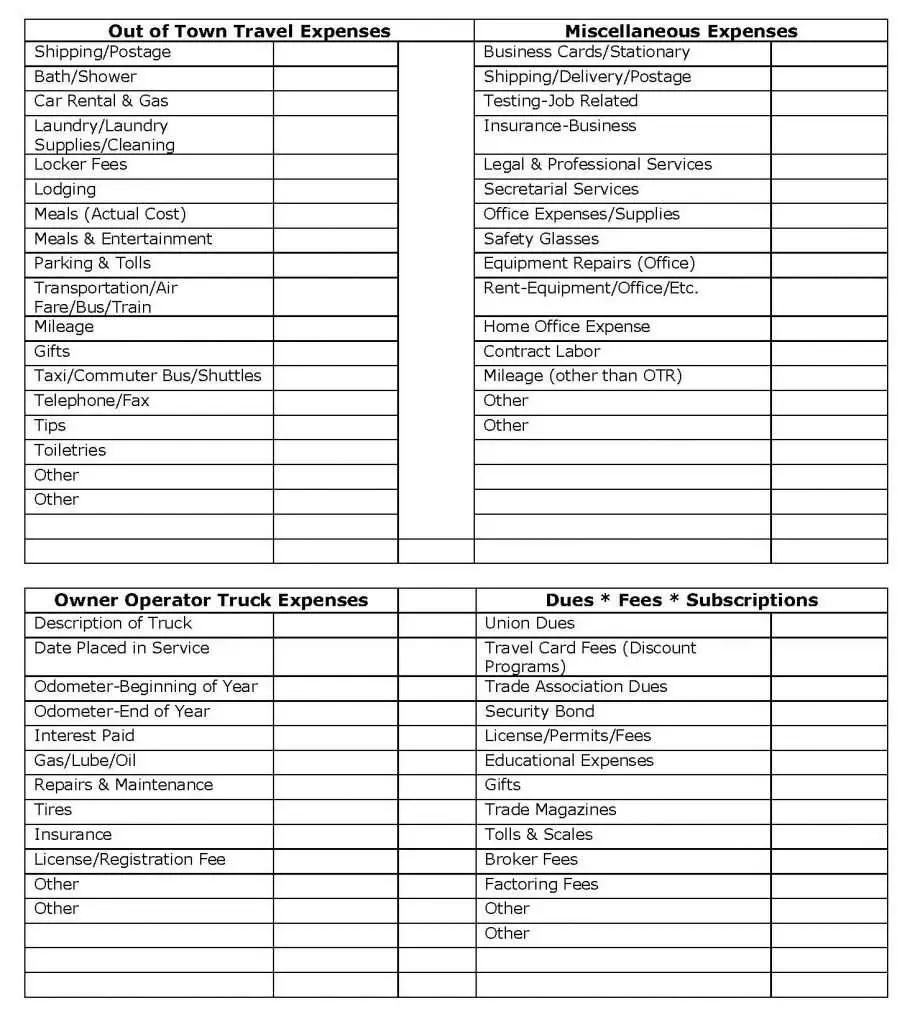

Complete List Of Self

Self-employed professionals face unique challenges when tax season comes around. But because they dont have taxes withheld from their paychecks like traditional workers, they can use deductions to cover their expenses and lower their tax burden. But when it comes to self-employed deductions, the process certainly isnt one-size-fits-all.

Deductible expenses are those that are seen as ordinary and necessary for conducting business. These expenses can range from advertising to utilities and everything in between. Remember, however, that you can only deduct the business use of the expense youre deducting.

This list is relevant for many self-employed professionals. This may include ridesharing drivers, such as Uber or Lyft drivers, who claim large mileage deductions, or writers who might take the home office deduction as part of a quiet refuge from the corporate scene. These deductions can also apply to designers, housekeepers, photographers, construction workers, consultants or any other professionals who work for themselves.

Some tax deductions may not apply to your profession, but you might be surprised by the number that do. When youre ready to file, youll list the majority of your deductions in Part II of your Schedule C . If you have less than $5,000 in claims, you may be able to use Schedule C-EZ. Whichever you choose, both are due April 15, along with your annual tax return.

Line 9797 Crop Insurance Revenue Protection Program And Stabilization Premiums

Enter the amount of deductible premiums to the Crop Insurance Program. Do not include any premiums for private, business-related, or motor vehicle insurance. For information on other types of insurance, see Line 9760 Repairs, licences and insurance, Line 9804 Insurance and Line 9819 Motor vehicle expenses.

Recommended Reading: How To Pay Back Taxes Online

What Expenses Can You Deduct If You Are A Self

The general rule for an expense being deductible is that it reasonable in the circumstances and was incurred for the purpose of earning income.

Examples of deductible expenses for self-employed artists include:

- Insurance premiums on musical instruments and equipment

- The cost of repairs to instruments and equipment, including the cost of new reeds, strings, pads and accessories

- Legal and accounting fees

- Union dues and professional membership dues

- Agents commission

- Remuneration paid to a substitute or assistant

- The cost of makeup and hair styling required for public appearances

- Publicity expenses including the cost of promotional materials and advertising in talent magazines

- Transportation expenses related to an engagement in the following situations

- The engagement is out of town,

- A large instrument or equipment must be carried to the engagement,

- Dress clothes must be worn from a residence to the place of the engagement, or

- One engagement follows another so closely that a car or taxi is the only means by which the engagement can be fulfilled.

Business Income Vs Employment Income

Business incomeBusiness income includes money earned from a:

-

Profession

-

Trade

-

Manufacturer, or

-

An undertaking of any kind, an adventure or concern in the nature of trade, or any other activity you carry on with the intention to earn a profit, provided there is evidence to support that intention.

Employment incomeEmployment income includes money earned from:

-

Wages, or

-

Salary received from an employer.

Read Also: How Does Doordash Do Taxes

Expenses With Specific Rules

Some of the expenses that you have as a self-employed Canadian have rules for how much you can claim on deductions. These include:

- Food, beverages, entertainment You can claim up to 50% deductions on the meal expenses you pay for the fiscal year. Like food and drink, dont claim more than 50% on entertainment costs for the year.

- Home office The expenses you claim on your home office are specific, and you must know what you can add. For example, home renovations or improvement projects dont count towards your tax deductions.

- Home officeequipment Your home office likely contains equipment that you use daily. Depending on the degree of use, you can claim from 1% up to the total cost of the material.

What Else Do I Need To Know About Deductions For Health Insurance Premiums

Just a few additional notes to consider:

- If you are part of one of those medical sharing plans, those are not technically considered health insurance ,so would not be deductible through the business.

- Health insurance costs are 100% deductible for small business owners , you just need to ensure you are taking the deduction properly as discussed here.

- Depending on your employee count you may be required to offer health insurance.

- If you have employees outside of the owners you may qualify for a small business health care tax credit. The credit covers up to half of your contributions towards employee premiums. To qualify you would need to meet these requirements:

- Less than 25 full-time equivalent employees

- Your team’s average salaries are less than $50,000

- You help your team with their premium payments

- You purchase through the marketplace

The Time Is NOW To Start Paying Less In Taxes. Join Our Tax Minimization Program !What you’ll get:

- Library of Tax Strategies and Implementation Guides to Start Using Today

- Unlimited Ask A Pro Questions

- Private Facebook Group

You May Like: How To Claim Inheritance Money On Taxes

Line 9795 Building Repairs And Maintenance

Deduct repairs to fences and all buildings you used for farming, except your farmhouse. Do not include the value of your own labour. If the expenditure improved a fence or building beyond its original condition, the costs are capital expenditures. Add the expenditure to the cost of the asset on your CCA charts on Form T2042. CCA charts are explained in Chapter 4.

If you used your farmhouse for business reasons, see Line 9945 Business-use-of-home expenses.

Hsas Allow Insureds To Pay For Medical Expenses With Pre

Although being self-employed means that theres no employer footing the bill for health insurance, it also gives entrepreneurs a lot of flexibility in terms of what type of health insurance they purchase. One popular option is an HSA-qualified high deductible health plan .

Although some people have expressed concerns that market reforms under the ACA would be incompatible with HSAs, that has not proved to be the case, and HSA-qualified plans are still a popular choice in the individual market.

Coverage under an HDHP makes the insured eligible to open an HSA and make pre-tax contributions that can be used later to pay for medical expenses. In 2021, the contribution limit is $3,600 for people who have individual coverage under an HDHP, and $7,200 for those who have family coverage under an HDHP.

As is the case with the self-employed health insurance deduction, HSA contributions are deducted above the line on the 1040, which means the deduction is available to filers regardless of whether they itemize deductions. And there are no income limits in terms of who can contribute to an HSA anyone who has an HSA-qualified HDHP can contribute to an HSA with pre-tax money. You have until the tax filing deadline to make some or all of your HSA contributions.

Read Also: What Is Tax Liabilities On W2

Examine Your Peers And Competition

Intuit’s and Gallup’s Gig Economy and Self-Employment Report shows that the median income of workers who are primarily self-employed is $34,751, compared to a median income of $40,800 for those who work for an employer. The total compensation is effectively less because self-employed individuals must pay for their own benefits. However, your self-employment situation depends a lot on your particular profession.