Filing Your Tax Return

The amount of income tax you pay is correlated with how much money you make in a year. You can reduce the amount of tax you have to pay by claiming certain expenses and tax credits.

Income tax is generally subtracted from your pay by your employer and sent to the CRA. However, you may also have to determine how much you owe and forward the amount to the CRA.

Every year, you should file a tax return to report how much you made, make sure that youve paid all the income tax you were supposed to, and access tax credits and benefits.

After the CRA analyzes your tax return, you will get a notice of assessment that will let you know whether you paid too much or too little income tax, and whether you are eligible to get some money back through credits and benefits.

Tax Return Dos And Donts

Do’s

- Allocate enough time to do your taxes to reduce the chances of making mistakes that could cost you in the long run

- Keep track of your income throughout the year to make tax season less stressful

- Check to see if you could transfer any credits so you can take advantage of it

- Double check everything

Don’ts

- Dont leave your taxes for the last moment

- Dont get professional help if you can file your taxes yourself using software. Tax programs cost $30 – $50, which is significantly less than professional help.

- Miss your filing deadline

Late Filing Penalties And Interest

If your tax return is filed after the deadline, the CRA will charge a 5% late filing penalty on the amount of tax you owe to the CRA and an additional 1% every month that passes after the deadline, for up to 12 months. Plus a 5% interest rate on the balance owing.

For instance, if your tax owing was $1,000 and you file taxes 12 months after the tax filing deadline: Youll pay a late filing penalty of $50, an additional 1% penalty for each month passing after the due date of $120 and interest of $59.98 on the overdue tax amount. So, youll pay $229.98 in interest and penalties.

If you dont owe any taxes to the CRA for the year or you are expecting a tax-refund, late filing wont result in penalties or interest.

You May Like: How Much Is The Federal Tax Credit For Solar Panels

Why You Should File Back Taxes

Filing back tax returns could help you do one or more of the following:

1. Claim a refund

One practical reason to file a back tax return is to see if the IRS owes you a tax refund. While many have federal income taxes withheld from their paychecks, sometimes too much money is withheld. In these cases, filing a tax return could result in a tax refund that puts money in your bank account.

2. Stop late filing and payment penalties and interest

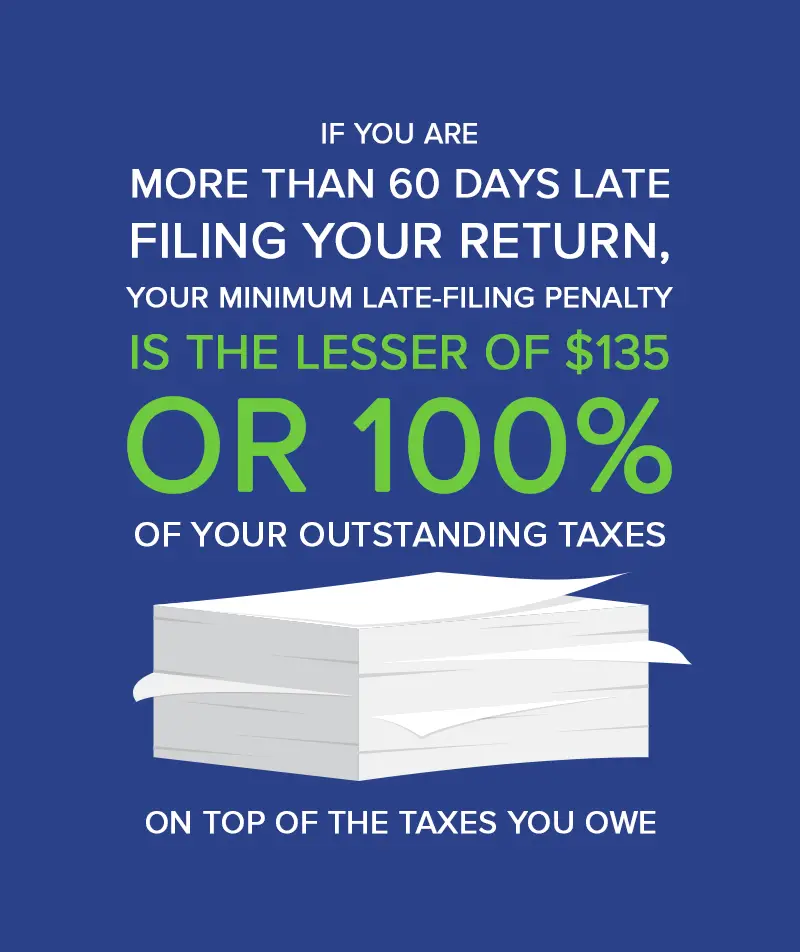

Filing a tax return on time is important to avoid or minimize penalties, even if you can’t pay the balance you owe. If you don’t file your return, you may have to pay an additional 5% of the unpaid tax you were required to report for each month your tax return is late, up to five months. Minimum penalty limits can also apply.

The IRS assesses another penalty for a failure to pay your taxes owed. If you do file on time, but you can’t pay what you owe in full by the due date, you’ll be charged an additional 0.5% of the amount of the tax not paid on time for each month or part of a month you are late. These fees will accrue until your balance is paid in full or the penalty reaches 25% of your tax, whichever comes first.

The IRS also charges interest on overdue taxes. Unlike penalties, interest does not stop accruing like the failure to file and failure to pay penalties.

3. Have tax returns for loan applications

4. Pay Social Security taxes to qualify for benefits

Details Of Advances Inward And Outward Supplies Made During The Financial Year On Which Tax Is Payable

14.1.1. Click the 4. Details of advances, inward and outward supplies made during the financial year on which tax is payable tile to enter/ view the summary of outward/ inward supplies made during the financial year.

Note: Details will be auto filled based on details uploaded by you in Form GSTR-1 and Form GSTR-3B during the said relevant financial year.

14.1.2. The 4. Details of advances, inward and outward supplies made during the financial year on which tax is payable page is displayed.

14.1.3. Enter/edit the Taxable Value, Integrated Tax, Central Tax, State/UT Tax and Cess details.

Note: You can click the Help link to know more details.

14.1.4. Click the SAVE button.

Note: If the details provided are +/- 20% from the auto-populated values, then cells would be highlighted in red for your reference and attention.

14.1.5. Click the YES button.

14.1.6. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button

14.1.7. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.1.8. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled up in Table Number 4N.

Recommended Reading: How To Pay My Federal Taxes

How To File Form 706

Within nine months of the decedents passing, you must file a paper Form 706 to report the estate or GSTT.

If you cant submit Form 706, you can use Form 4768, Application for Extension of Time to File a Return and/or Pay U.S. Estate Taxes, to request an automatic six-month extension.

Within nine months of the decedents death, both the estate tax and the GSTT are due.

Checks must be made payable to United States Treasury and write Form 706 on the check along with the decedents name and Social Security number. Alternatively, you can use the Electronic Federal Tax Payments System to pay online .

You must also attach a death certificate to the return.

What If You Do Not File A Return You Pay Late Or Are Charged With Tax Evasion

Normally, if you do not file a tax return and are required to, or if you make false statements in completing your tax return, or if you leave out important information so that you under report your income, the Income Tax Act imposes penalties. In circumstances of willful fraud or tax evasion you may be criminally prosecuted.

Don’t Miss: Where Do I Find My Agi On My Tax Return

Tax Deadlines In Canada

You should file your individual tax return by April 30. Keep in mind that, if youre paying your taxes by mail, your letter should be postmarked before April 30 to avoid penalties.

If you or your spouse are self-employed, you can file your income tax and benefit return by June 15.

If youre a small business owner, you should file your income tax return by June 15, but you should pay off your balance owing for the previous tax year by April 30.

Corporations should file their income tax returns in up to six months after the end of the tax year, so this date will vary according to the corporations fiscal period.

Dont Lose Your Refund By Not Filing

Many people may lose out on their tax refund simply because they did not file a federal income tax return. By law, they only have a three-year window from the original due date, normally the April deadline, to claim their refunds.

Some people may choose not to file a tax return because they didn’t earn enough money to be required to file. Generally, they won’t receive a penalty if they are owed a refund. But, they may miss out on receiving a refund.

Recommended Reading: How To Find Property Tax

How Far Back Can You Go To File Taxes In Canada

According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately. You may think that since you dont have the money to pay your taxes, its best to not file, but this isnt the right move.

The CRA does not forget about you over time. Every day that goes can cost you more money in late-filing penalties, interest, and other potential fees when you delay filing your taxes.

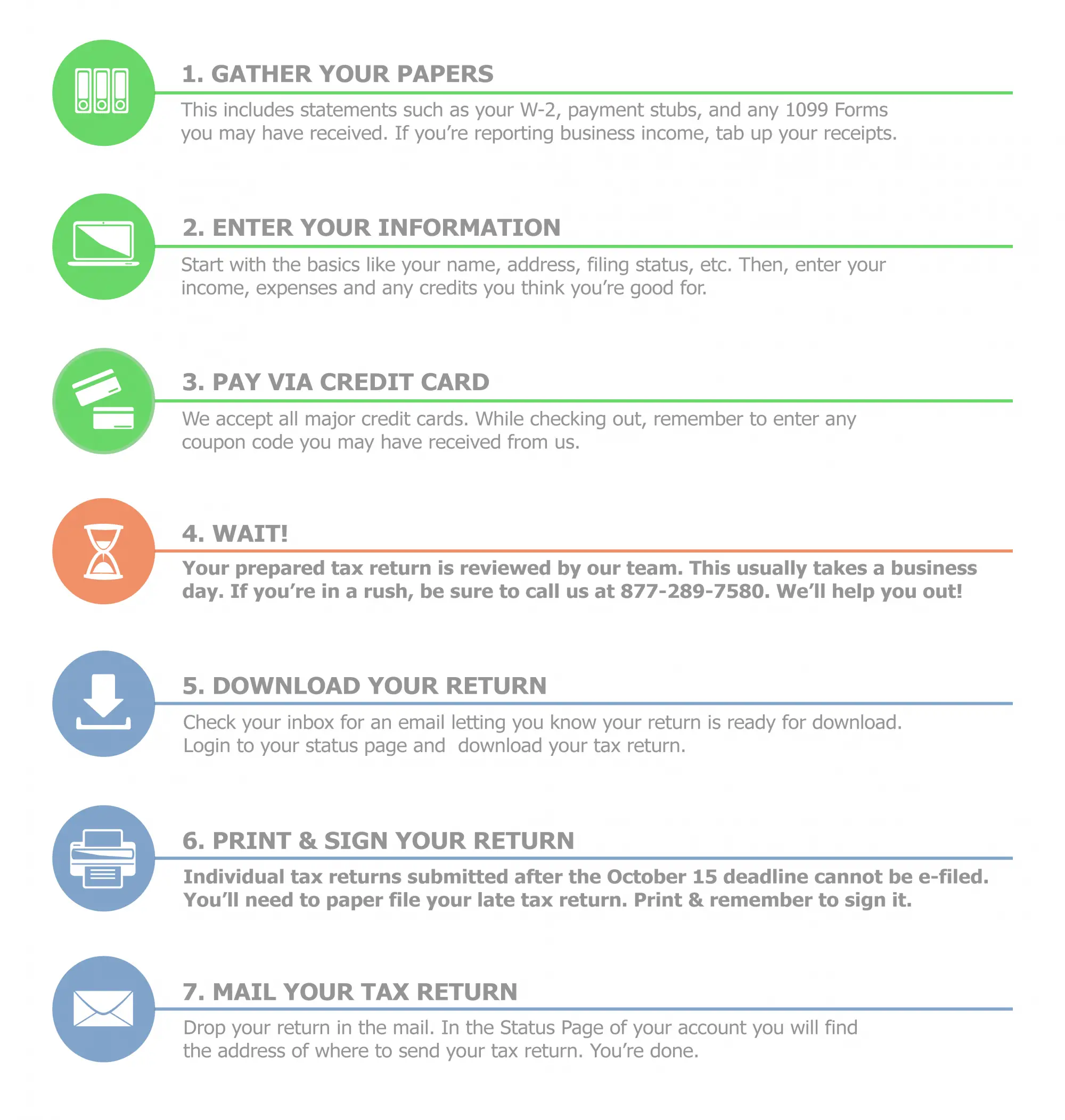

You’re Disorganized And Your Papers Are Not In Order

If organizing isn’t your forte, look for a tax preparer or accountant that offers “shoebox services.” These tax preparers are ready to do the sorting and cataloging for you. Your other option is to rip off the band-aid, sit down with your papers, and sift through them. Once you start organizing your receipts, bank statements, and any other slips that might apply to your tax return, you might find that this task won’t be as arduous as you had feared.

Don’t Miss: How To File Taxes For Investments

Does The Irs Ever Negotiate The Amount Owed

Under certain circumstances, the IRS is authorized to resolve a tax liability by accepting less than full payment. An “offer in compromise” is an agreement between a taxpayer and the IRS that settles the taxpayer’s tax debt. There are three circumstances under which the IRS is authorized to compromise:

Form 656: Offer in Compromise Package should be completed to file an Offer in Compromise with the IRS. Included with the Form 656 package are Form 433-A, Collection Information Statement for Wage Earners & Self-Employed Individuals and Form 433-B, Collection Information Statement for Businesses.

- You may need to complete the appropriate Form 433 and should be prepared to provide other documentation and explanations as they are requested.

- Various options are available for accepted Offers in Compromise requests, such as a reduced total payment and scheduled monthly payments.

- Defaulting on an accepted offer in compromise can result in the IRS filing suit against you and reinstatement of the original tax debt, plus interest and penalties.

Tax Deadline In Canada

For most Canadians, the deadline to file federal tax returns is April 30th. By this date each year, you must file your returns for the previous year . If this date falls on a Saturday, a Sunday, or a public holiday recognized by the CRA, individual returns will be considered on time if they are filed the next business day. If you have a balance owing, the CRA will charge compound daily interest on any unpaid amounts starting on May 1st. This means that if you owe a tax debt, its a good idea to pay it as soon as you possibly can. Otherwise interest charges will start to quickly add up.

Individuals who are self-employed have until June 15th to file their returns. However, if you have a balance owing, it still must be paid by April 30th to avoid interest payments.

Final tax returns must be filed for deceased persons as well. The deadline to file these returns is the normal filing deadline of April 30th or six months after the date of death, whichever is later. For example, if a person dies on October 1st, six months from that date would be April 1st. Since April 30th is later, the return would be due on April 30th. However, if the person died on November 15th, six months from that date would be May 15th, which is later than April 30th and thus the return would be due on May 15th. If a person died on January 30th, 2020, their 2019 tax return would be due on July 30th, 2020 but a 2020 tax return would also be due on the regular 2020 due date .

Recommended Reading: What Is The Tax Deadline This Year

What Happens If I Dont File My Taxes Canada

All Canadians have to file their tax returns every year. And unless the Canada Revenue Agency announces an extension like it did in 2020, individual taxpayers must pay their taxes by April 30, 2022 for the 2021 income year.

Filing your taxes late and not filing your taxes at all can have severe consequences. Read on to find out what could happen if you dont file your taxes, how to file your personal income tax and benefit return, and more.

Deadline To Pay Tax Owing: Balance

A taxpayer must pay the tax owing for that year by the taxpayers balance-due date for that year. After that date, interest will begin to accrue on any tax owing but not yet paid.

- Individuals: For an individual who died on or after October 1st in a particular year and on or before April 30th of the following year, the balance-due date is six months after the date of death. In any other case, the balance-due date for a particular tax year is April 30th of the immediately following year. Further, an individual must make instalment payments for income-tax owing if the individuals income-tax owing for the year is greater than $3,000 , and that amount isnt subject to withholding at source.

- Corporation: Generally, a corporations balance-due date is two months after the end of its taxation year. A corporation that qualifies for the small business deduction will generally receive an extra monthi.e., its balance-due date is three months after the end of its taxation year. In addition, a non-Canadian-controlled private corporation must generally make monthly instalment payments for the years estimated income-tax owing.

- Trusts and Estates: A trusts balance-due date is 90 days from the end of its taxation year.

You May Like: Are Refinance Fees Tax Deductible

Taxpayers Have Until April 18 2022 To File Their 2018 Return And Get Their Refund

If a taxpayer doesn’t file their return, they usually have three years to file and claim their tax refund. If they don’t file within three years, the money becomes the property of the U.S. Treasury.

To claim a refund for 2018, taxpayers must mail returns to the IRS center listed on the Form 1040 instructionsPDF. While they must mail in a 2018 return, taxpayers can still e-file for 2019, 2020 and 2021.

Taxpayers can download tax forms and instructions from the IRS.gov Forms, Instructions and Publications page of IRS.gov or by calling 800-829-3676.

The IRS may hold refund checks if the taxpayer has not filed for 2019 and 2020. The IRS may also apply the refund to overdue state or federal tax bills or other state or federal debts, like child support and student loans.

A Login And Navigate To Form Gstr

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

3.1 Click the Services > Returns > Annual Return command.

3.2. Alternatively, you can also click the Annual Return linkon the Dashboard.

4. The File Annual Returns page is displayed. Select the Financial Year for which you want to file the annual return from the drop-down list.

5. Click the SEARCH button.

6. The File Returns page is displayed.

7. Please read the important message in the boxes carefully.

8. This page displays the due date of filing annual return, by giving relevant information in separate tiles by the taxpayer. In the GSTR-9 tile, click the PREPARE ONLINE button.

9. A question is displayed. You need to answer this question whether you want to file nil annual return for that particular financial year or not, to proceed further to the next screen.

Note:

Nil annual return can be filed by you for a particular financial year, if you have:

-

NOT made any outward supply AND

-

NOT received any goods/services AND

-

NO other liability to report AND

-

NOT claimed any credit AND

-

NOT claimed any refund AND

-

NOT received any order creating demand

-

There is no late fee to be paid etc.

9.1. In case of Yes :

9.1.1 Select Yes for option 1 to file nil return.

9.1.2. Click the NEXT button, click oncompute liabilities and proceed to file.

9.2. In case of No:

10. Select No for option 1 to file GSTR-9 return.

11. Click the NEXT button.

You May Like: What Tax Forms Do I Need

Tax Credits & Benefits

Its important to know that you may be eligible for tax credits and benefits. There are two different types of tax credits you may be eligible for:

- Refundable tax credits this type of tax credit can reduce the amount you owe, but may also be available even if you dont owe any tax. A good example of this is the Ontario Energy and Property Tax Credit.

- Non-refundable tax credits may reduce the amount you owe. You may be eligible for this type of tax credits for donations and gifts.

You can check out the CRA forms, guides, tax packages and more in the General Income tax & benefits guide.

Heres What Could Happen If You Dont File Your Taxes

Some Canadians may be tempted to avoid filing their tax returns on time because they cant afford to pay what they owe. They hope that the CRA might ignore their late or missing filing and get away with it.

However, the CRA has multiple systems in place to find out if you have unpaid taxes. One of those systems enables the CRA to receive a copy of the T4 slips issued by your employer, making it easy for the agency to determine whether you paid your taxes or not.

And once the CRA finds out that you havent paid your taxes, you have to pay whatever you owe in full plus a late filing penalty of 5% of what you owe and an interest of 1% for every month you are late, compounded daily starting May 1st for up to 12 months. If you know you owe taxes, doing nothing will only make things worse. Fortunately, there are several options available if you owe taxes and cant pay.

In other words, failing to pay your taxes can attract a penalty of up to 17% of what you owe plus interest, making it more difficult to repay your tax debt. And thats not all. Not filing your tax returns is also a criminal offence.

You May Like: How To File S Corp Taxes