Estimated Irs Refund Tax Schedule For 2021 Tax Returns

In prior years, the IRS issued its refund tax schedule to provide a timeline of when you can expect to receive your tax refund. While the IRS no longer publishes a refund tax schedule, we put together an estimate of when you might expect to receive your tax refund based on previous years.

|

Date the IRS received your return |

Estimated direct deposit refund date |

Estimated check refund date |

|

May 13 |

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

What Is The Irs Actually Doing With Your Return

Once your tax return has been accepted, it goes into a queue for processing.

“The best way to think about the IRS is a giant database, and processing your return is simply a series of checks of your data against the data it knows about you already,” Farrington explains. “During this time it looks at all the information you submitted such as your W2 income, child tax credits, and more and looks at its records to see if the data matches. If everything looks good , your return is sent to be approved and then either payment or refund will be processed.”

Also Check: How Much Is New Jersey Sales Tax

Irs Tax Refund Schedule For 2020 Returns

If youre asking yourself, When will I receive my tax refund? keep this in mind: The IRS issues nine out of 10 refunds in less than 21 days, according to its website. However, this timeline only applies if you file your federal tax returns electronically. If you file through regular mail, then expect to wait around six weeks to receive your refund.

Another important thing to note: If your tax return requires additional review, you may have to wait longer to receive your refund.

Why Do Paper Returns Take So Long

Paper returns have to be input manually into the system for processing.

“Submitting a paper return circumvents the limited automation that the IRS has in place for cross-referencing returns with information received from third parties,” says Richard Lavinia, chief executive officer and co-founder of Taxfyle.

“Paper returns require this information to be inputted by hand and then manually reviewed by an IRS agent.”

Recommended Reading: Is The Stimulus Check Taxed

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2021 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

Reason #2 Irs Holding Your Refund

The IRS can hold your refund and request more information from you in several situations. This doesnt mean youre being audited but it can lead to one if you dont respond with all the information by the deadline.

Here are six of the most common situations when the IRS can hold your return:

You mailed in your return, and the IRS flagged a math error:

When taxpayers e-file their returns, the e-file process catches many return errors and rejects the returns at the time of filing. If you mail your return instead of e-filing it, the IRS is more likely to identify an error after the fact.

The IRS calls most of these errors math errors, but they arent limited to arithmetic mistakes. If your Social Security Number or your dependents information doesnt match IRS records, the IRS can change any related deductions or credits . The IRS can also change your return if you forget to include a corresponding schedule or form to support a deduction or credit.

If the IRS changes your return, youll get a letter asking you to correct the error within 60 days. If you dont provide enough explanation and information, the IRS change is final. At that point, you would have to amend your return and follow up with the IRS to get your refund.

The IRS suspects identity theft:

The IRS is challenging tax credit you claimed:

The IRS identified potential ACA health insurance issues:

You need to file an old return:

Also Check: How To Get Income Tax Return Copy

Don’t Miss: What Day Do You Have To File Taxes By

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Some Tax Refunds May Be Delayed In 2022

If you claimed the Earned Income Tax Credit and the Additional Child Tax Credit , your tax refund may be delayed. The IRS will issue tax refunds for returns that claim these credits starting in mid-February.

Your financial institution may also play a role in when you receive your refund. Since some banks dont process financial transactions during the weekends or holidays, you may experience a delay in processing. If you opt to receive your tax refund by paper check, use our tax refund schedule to determine when you can expect to receive your refund.

Finally, you can expect your tax refund to be delayed if you filed an amended tax return. The IRS warns that it is taking more than 20 weeks to process amended tax returns.

You May Like: When Are Federal Tax Payments Due

How Taxpayers Can Check The Status Of Their Federal Tax Refund

IRS Tax Tip 2022-60, April 19, 2022

Once a taxpayer files their tax return, they want to know when they’ll receive their refund. The most convenient way to check on a tax refund is by using the Where’s My Refund? tool on IRS.gov. Taxpayers can start checking their refund status within 24 hours after the IRS acknowledges receipt of the taxpayer’s e-filed return. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Taxpayers can access the Where’s My Refund? tool two ways:

- Visiting IRS.gov

To use the tool, taxpayers will need:

- Their Social Security number or Individual Taxpayer Identification number

- Tax filing status

- The exact amount of the refund claimed on their tax return

The tool shows progress in three phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their bank of credit union to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

File Your Return Electronically And Choose Direct Deposit Of Your Refund

As detailed above, filing your return electronically and choosing to receive your refund via direct deposit instead of a check in the mail will accelerate your refund considerably. With e-filing and direct deposit, your refund could be in your bank account less than two weeks after the IRS accepts your return.

Recommended Reading: Where To Find My Agi On Tax Return

What Does It Mean When My Tax Return Is Accepted

When you receive confirmation that the IRS accepted your return, it means that they have reviewed your return, and it has passed their initial inspection. They verify your personal information and other basic items, like if your dependents have already been claimed by someone else. Then, they have a few days to approve your refund. They will take a more in-depth look at your return and your history. After the IRS approves your return, they will fund your refund based on the schedule mentioned above.

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns that we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

The CRA may take longer to process your return if it is selected for a more detailed review. See Review of your tax return by the CRA for more information.

If you use direct deposit, you could get your refund faster.

Recommended Reading: When Is California Accepting Tax Returns 2021

How To Track The Progress Of Your Refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Also Check: What Tax Return Does An Llc File

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 2 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

Choosing Electronic Or Paper Filing Of Your Tax Return

This is one of the main factors affecting the timing of your refund. The other main factor is choosing direct deposit for your refund or receiving your refund via a paper check.

E-filing will considerably speed up the refund process. Before e-filing was available, tax returns had to be mailed to the IRS where the information was scanned or manually entered into the system. Then the IRS issued paper checks that had to be mailed to taxpayers. This manual process could take up to two months, keeping many people anxiously waiting by their mailboxes for weeks.

According to the IRS, refunds can be issued to taxpayers by direct deposit as soon as eight days after tax returns are filed. Meanwhile, nine out of 10 taxpayers choosing direct deposit receive their refunds within 21 days of the date they file electronically. Keep in mind that it may take an extra few days for your bank to make funds available to you after the refund is issued electronically.

Recommended Reading: How To Dispute Your Property Taxes

Preparing For The Irs Refund Schedule

Properly filing your taxes and keeping relevant information on hand can help you track your IRS refund status. Filing your tax returns electronically can help expedite the process, as can opting for direct deposit rather than a paper check in the mail. With multiple options to contact the IRS, its easy to find out when youll get your tax refund this year. Once you receive your money, the only thing left to do is to .

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Recommended Reading: How Long Does It Take To Get Your Taxes

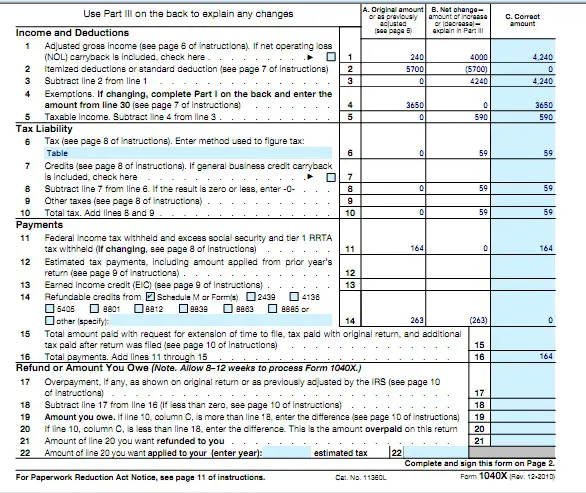

How To Use The Tax Refund Chart:

- Use the left-hand column to look up the date your tax return was accepted by the IRS

- Use the middle or right column to look up when you should receive your refund .

If you filed your taxes with e-File, you should receive a confirmation that your federal tax return was accepted by the IRS. This date will go in the left column. If you didnt file your taxes electronically, then this chart may not be useful for you for two reasons: you wont have a confirmation date regarding when your tax return was accepted, and paper tax returns are manually entered by IRS employees, so the process takes longer.

You will also note that this chart covers dates beyond the traditional filing date. If you file after April 18, 2022, then you should file a tax extension request. Its simple to do and can potentially save you a lot of money in penalties.

Note: Military members deployed during the tax year may be eligible for additional tax deadline extensions.

Individual Income Tax Refunds

Check the status of your refund online using Where’s My Refund?

- Most error free, electronically filed returns are processed within 5 business days of receiving the return and most refunds are issued within 21 days from the date a taxpayer files their return.

- If a return contains incorrect or questionable information, it may take up to 12 weeks from the date of receipt by DOR to process a return and issue a refund.

- All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check.

- Read our important tax updates for the latest news and how to protect yourself from tax fraud.

The surviving spouse, administrator, or executor may file a return on behalf of a taxpayer who died during the taxable year. When filing, use the same filing status and due date that was used on the Federal Income tax return.

To have a refund check in the name of the deceased taxpayer reissued, mail the following to the address on the form:

- Copy of the death certificate

- Original refund check issued in the deceaseds name

- Any other information specified on the form

Contact Us if you need additional assistance.

Lost, Stolen or Stale-dated Checks

If your refund check was lost, stolen or becomes stale-dated, Contact Us for assistance.

Name Change

To have a refund check reissued in your changed name, submit a copy of two of the following accepted documents:

- Social Security Card

- Name change decree from Superior Court

Also Check: Do You Have To Pay Back Unemployment On Taxes