How To Qualify For A Premium Tax Credit

You may be eligible for a premium tax credit if you meet the following criteria:

- You or a family member have a plan through the Marketplace.

- You or members of your household arent eligible for employer- or government-sponsored health insurance coverage.

- Your household income is between 100% and 400% of the federal poverty line, based on your family size .

- You arent eligible to be claimed as a dependent on another persons tax return.

- If youre married, youll file a joint tax return unless you qualify for an exception.

- You paid all your health insurance premiums.

Health Coverage Tax Credit: Limited Eligibility

The tax law also provides a 2021 tax credit for health insurance premiums for coverage through various state, COBRA, and other sources for limited categories of eligible individuals. Eligibility is restricted to individuals who are certified as displaced workers by the U.S. Department of Labor and who are on leave from training in a federally funded trade adjustment assistance program , and individuals who are age 55 or older and are receiving benefits from the Pension Benefit Guaranty Program. The credit also is available for such individuals family members. To obtain the credit, which amounts to 72.5% of premiums, a taxpayer must file IRS Form 8885.

How Does The Advance Premium Tax Credit Work

When getting a marketplace plan, you estimate your household income for the current year including yourself, your spouse, and your dependents. That income figure will determine the size of the tax credit.

The subsidy will be applied directly to your monthly premiums. You only have to pay the difference. You can request to have the entire tax credit applied to your premiums or you can receive a portion of it in premium reduction and the remainder of the credit when you file your income-tax return for the year.

When you file your tax return, you reconcile your estimated income with your actual income.

- If you end up earning less than expected, you could be eligible for a larger tax credit. In that case, you may get the extra money back as a refund.

- If you earn more than expected and dont qualify for as large a tax credit as you had received, you may need to repay excess advance payments when you file your income tax return.

Repayment of extra credits was suspended temporarily in 2020 because of the job instability from COVID. However, the regular rules are scheduled to resume for tax year 2021.

There are no plans currently in Congress to suspend the premium tax credit repayments again this year, says Mark Steber, chief tax information officer at Jackson Hewitt.

Read Also: Does Donating To Charity Help With Taxes

What Is A Health Insurance Tax Credit

A premium tax credit, also called a premium subsidy, lowers the cost of your health insurance. The discount can be applied to your insurance bill every month, or you can receive the credit as a refund on your federal income taxes.

The credit, implemented under the Affordable Care Act , is designed to help eligible families or individuals with low to moderate incomes pay for health insurance. Premium tax credits are only available if you enroll in a qualifying insurance plan through the federal marketplace or a state marketplace.

A key exclusion is that those who sign up for Catastrophic coverage do not qualify for health insurance tax credits.

Health insurance tax credit amounts are set by the federal government, so they’re the same nationwide.

How To Claim The Advance Premium Tax Credit On Your Taxes

When you file your income tax return, you need to fill out IRS Form 8962 Premium Tax Credit to determine how much you should receive based on your actual income for the year, rather than the estimated income you used when you applied for coverage from the marketplace.

You should receive Form 1095-A Health Insurance Marketplace Statement before you file your taxes, which provides the amount of advance premium tax credit already paid to the insurance company, says Steber.

Use Form 8962 to reconcile the amount you should have received based on your actual household income compared to the subsidy applied to your health insurance premiums during the year based on your estimated income.

If your income ended up being less than originally expected, you can receive the extra money when you file your tax return. It will either increase your refund or decrease the tax you owe. If your income was higher than expected, you may have to pay back some of the money with your taxes.

Read Also: How To Check Your Tax Status

What Are The Income Limits For The Health Insurance Subsidy

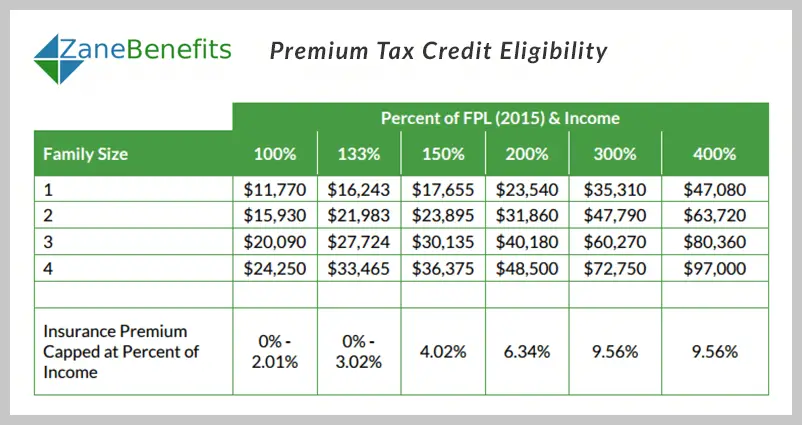

Each year, the Department of Health and Human Services determines the income guidelines. Below are the minimum and maximum eligible income limits based on household size. It is important to note that you would use the prior year’s federal poverty level to determine eligibility and apply for the current year’s health care tax credits. When you file for the 2021 tax year, you would compare your household income against the 2020 FPL figures shown below.

| Household/family size |

|---|

What Is The Premium Tax Credit

The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace.

You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace. This counts as the advance premium tax credit. You can also claim the premium tax credit after the fact on your tax return with your actual income.

The amount of credit you receive depends on your estimated income and your household information, which you’ll report on any application you file with the Marketplace.

If your estimated income falls between 100% and 400% of the federal poverty level for a household of your size, you can claim the premium tax credit. You may use some or all of this credit in advance to lower your monthly premium costs, leaving money in your pocket.

If you use more of your premium tax credit than your final taxable income allows, you’ll need to repay the difference when filing your Form 1040 at tax time. But if you use less of the premium tax credit during the year than you qualified for, you’ll receive the difference as a refundable credit on your return.

It is important to note that for tax year 2020, the American Rescue Plan Act of 2021 suspended the requirement to repay any excess of the advance payments of the Premium Tax Credit when filing your Form 1040.

Also Check: How To Know If My Taxes Were Filed

Premium Tax Credits In 2021

The maximum health insurance premium youd pay for a Marketplace insurance plan is typically the premium of the second lowest cost Silver plan available to you on the Marketplace, minus a specific percentage of your household income based on your federal poverty level. Your premium tax credit is then the difference between your maximum premium contribution and the plans gross premium. The SLCSP is sometimes also called the benchmark plan.

Your SLCSP premium is usually noted on Form 1095-A, a tax form the Marketplace will send you by February if someone in your household had a Marketplace plan the previous year.

Heres how much of the SLCSP premium youre responsible for, based on the tax-filing year and your income compared to the poverty line. Remember that the premium tax credit works on a sliding scale, so the percentage of SLCSP premiums you pay directly correlates to your income level.

| Income as a Percentage of the Federal Poverty Line | Percentage of SLCSP Premium You Pay on Income Earned in 2021 and 2022 |

|---|---|

| < 150% | |

| 8.5% |

How Married People Filing Separately Can Qualify For The Premium Tax Credit

Posted by Lee Reams Sr. on August 24, 2016

Generally, a married taxpayer filing separately who does not qualify as a victim of domestic abuse or spousal abandonment cannot take the premium tax credit and thus must repay all advance premium tax credit received ). However, when an individual has obtained insurance through the marketplace, received APTC, and subsequently files as MFS, the amount of APTC that must be paid back may be limited based on the taxpayers household income relative to the federal poverty level ). The maximum payback for a MFS with an income expressed as a percentage of the federal poverty level is:

Percent of the Federal Poverty Maximum PaybackLess than 200% $ 600

Read Also: How Much Tax Should I Have Paid

A Premium Tax Credit Example

Suppose you live in one of the 48 contiguous United States and want to calculate your premium tax credit for a Marketplace health insurance plan that youre purchasing in 2021.

Federal poverty guidelines show that your family of threes poverty line is $21,960. You estimate your household income for 2021 to be $54,900, which puts you at 250% of the poverty line . That means youre responsible for paying between 4% and 6% of the SLCSP.

Now suppose the benchmark plan available to you costs $10,000 for the year. If your maximum premium contribution is 4%, youd only pay $400 per year and your premium tax credit would be $9,600 .

Your premium tax credit remains the same regardless of which type of you choose and how much that health plan costs. But if you purchase one thats more expensive than the SLCSP, the tax credit won’t cover as much of your premium.

Only Silver plans are eligible for cost-sharing reductions, which reduce out-of-pocket expenses. Cost-sharing reductions are available to those with household incomes of 100% to 250% of the federal poverty line.

Who Is Eligible For An Aca Subsidy

Subsidy eligibility is normally based on income , but subsidies might continue to be available in 2022 for people who receive unemployment compensation .

For income-based subsidy eligibility, a household must have an income of at least 100% of the federal poverty level . And although there is normally an income cap of 400% of the poverty level , that does not apply in 2021 or 2022. Instead, subsidy eligibility is based on the cost of the benchmark plan relative to the persons income. If its more than 8.5% of the persons income , a subsidy is generally available.

The Build Back Better Act would temporarily eliminate the lower income threshold for subsidy eligibility, which would close the coverage gap that still exists in 11 states that have refused to expand Medicaid. Low-income residents in those states would become eligible for premium subsidies in the marketplace, instead of having no access to financial assistance with their health coverage.

But in addition to income, there are other factors that determine eligibility for premium subsidies. Lets take a look at what they are:

Access to affordable employer-sponsored coverage

Access to Medicaid or CHIP

In addition, premium subsidies arent available to people who qualify for Medicaid or CHIP, since Medicaid and CHIP generally provide even more financial assistance than premium subsidies.

Age: Nothing but a number

The Medicaid coverage gap

Immigration status

Read Also: When Are Taxes Due In Arizona

Advance Premium Tax Credit Example

Lets look at an example. A 40-year-old Philadelphia couple who have two young children and earn $70,000 for the year can receive a subsidy worth about $1,156 per month, leaving them to pay $274 per month for a Silver-level plan. They could pay $0 for a Bronze-level plan.

You can quickly estimate your tax credit and the cost of coverage in your area using the Kaiser Family Foundations Health Insurance Marketplace Calculator. You can get specific costs you would pay for the policies in your area at your state marketplace, and most have calculators to help you run a quick estimate, too. You can find links to each states marketplace at Healthcare.gov.

Who Qualifies For Premium Tax Credits

To qualify for a premium tax credit, you must meet the following requirements:

- Have a household income between 100% and 400% of the federal poverty level .

- File a tax return with a filing status thats not married filing separately.

- Arent eligible to be claimed as a dependent on someone elses tax return.

In addition, you or a family member must:

- Have had health insurance through the Marketplace for at least one month.

- Not be able to get affordable coverage through your employer.

- Not qualify for health insurance through a government program such as Medicaid, Medicare, or TRICARE.

Also Check: Does Washington Have Income Tax

Can I Claim A Tax Credit For Premiums Paid For My Employer Group Health Plan

No. The credit is not allowed against premiums paid for employer group health plan coverage in 2021. For future years, if your employer plan does not meet legal requirements for affordability and minimum essential coverage , you could waive employer coverage, choose a plan on the health exchange for your area, and receive the premium tax creditprovided that you meet income and other eligibility requirements. However, most employers structure their group health insurance plans to pass both the affordability and MEC tests.

Definition And Examples Of Premium Tax Credits

The premium tax credit was created to provide affordable health insurance to eligible families and individuals with low to moderate incomes. Its available only for health insurance purchased through the Health Insurance Marketplace . One of the primary qualifications is that your income must fall between 100% and 400% of the poverty line for your household size.

The premium tax credit works on a sliding scale, so the lower your income, the bigger the credit. Its also a refundable tax credit, so you could get a refund when you file your federal income tax if your credit is larger than your tax liability.

- Acronym: PTC

Recommended Reading: When Will My Taxes Be Processed

Other Health Care Tax Credits

The premium tax credit isnt the only credit available to help you save money on your health insurance. The health coverage tax credit is another federal tax credit that helps reduce the cost of insurance for people aged 55 through 64 who receive benefits from the Pension Benefit Guaranty Corp or people eligible for Trade Adjustment Assistance allowances due to a qualifying job loss.

If you own a small business, you may also qualify for the small business tax credit. To claim this credit, you must enroll in a Small Business Health Options Program plan. There are additional eligibility requirements based on the size of your business and the number of employees you have.

Sample Calculations For 2022 Under The American Rescue Plans Adjustments To The Acas Subsidy Amounts

This spreadsheet shows several scenarios different ages, income levels, and locations with after-subsidy benchmark and lowest-cost plan prices under the American Rescue Plan in 2021. And you can see the corresponding amounts without the ARP, to see how much more affordable the ARP made coverage as of 2021.

Lets work through a specific example, so that you can see exactly how it works :

Rick is 27 and lives in Birmingham, Alabama . According to HealthCare.gov, the benchmark plan for Rick has a full-price premium of $433 per month in 2022.

If Rick earns $25,760 he would be expected to kick in 2% of his income, or $515 in 2022, towards the cost of the benchmark plan , with a subsidy covering the rest of the premium. That amounts to about $42 per month in premiums that Rick would have to pay himself if he buys the benchmark plan.

Its important to understand that without the American Rescue Plan, Rick would have been expected to pay 6.52% of his income for the benchmark plan in 2021, and a similar percentage in 2022. This would have amounted to $1,664 in 2021 that Rick would have had to pay for the benchmark plan, and something similar to that in 2022. So the American Rescue Plan is increasing Ricks subsidy amount by about $1,149 in 2022, or about $96/month .

If Rick and Alice were younger, the Silver plan would be less expensive and their subsidies would be smaller. If they were older, the Silver plan would be more expensive, and their subsidies would be higher.

Also Check: Which Is The Best Tax Software To Use

How Do You Coordinate Premium Tax Credits With Stipends

Theres another option for employers looking to offer a health coverage benefit to employees who have premium tax credits, and thats through stipends.

Healthcare stipends are taxable allowances provided to employees to cover health-related costs, including insurance premiums and out-of-pocket expenses. Some stipends are offered up-front like a bonus, while others are paid through reimbursements, much like an HRA.

Because stipends are taxable non-wage income, they can be offered to employees who receive premium tax credits. This allows employees to participate in their employers benefits package while still taking advantage of their tax credits.

Just keep in mind that employees will be responsible for paying income taxes on their stipend.

How Does The Premium Tax Credit Affect My Taxes

The size of your premium tax credit is based on a sliding scale. Those who have a lower income get a larger credit to help cover the cost of their insurance. The credit is refundable because, if the amount of the credit is more than the amount of your tax liability, you will receive the difference as a refund.

You May Like: Can I Still File My 2016 Taxes Electronically

Understanding The Premium Tax Credit

The premium tax credit is generally paid in advance to the insurer issuing the qualified plan as an advance payment PTC, or APTC. The APTC is credited monthly against premiums for qualified plans i.e., plans offered through the Health Insurance Marketplacethat is, state and federal health exchange plans. In some cases, eligible individuals can elect to pay their premiums out of pocket and claim the PTC in their tax return for the year, instead of benefiting from an APTC.

The amount of the monthly premium tax credit for 2021 is the lesser of the monthly premium for a qualified plan in which the taxpayer, the taxpayers spouse, and dependents are enrolled, or the excess, if any, of the premium for the second-lowest-cost silver plan for the same individuals that is available on the exchange in the taxpayers area, over an amount equal to 1/12th of a specified percentage of the taxpayers household income for the year, in accordance with the brackets of the applicable federal poverty level in the following table:

| Percentages Applicable to PTC Calculation for Household Incomes at FPL Ranges | ||

|---|---|---|

| Household income percentage of federal poverty line | Initial percentage | |

| At least 400% and higher | 8.5 | 8.5 |

If your circumstances change after enrollment, you must inform the exchange promptly.