File Up To 20 Returns

You may file up to 20 returns per computer or online account using NETFILE-certified tax software in Canada for each tax year. Tax software companies must respect this limit to be certified for NETFILE.

The Canada Revenue Agency does not look at the privacy policies of software developers. It is your responsibility to research these policies before buying or using a software product or web application.

Use of the software, and any omission or error in the information provided, is the responsibility of the user and the software developer. The CRA cannot be held responsible if programming errors affect the calculation of income tax and benefits payable.

The CRA respects the Official Languages Act and the relevant Treasury Board policies, and it is committed to making sure all information and services on this site are available in English and French. However, users should be aware that some information from external sources that do not have to follow the Official Languages Act is offered only as a convenience and is available only in the language in which it was provided to the CRA.

It Makes Filing Taxes Easier

Handling your taxes can be time-consuming and confusing, especially if you are new to cryptocurrencies.

Cryptocurrency tax software can take care of much of the work for you, including importing data, tracking cost basis, and creating tax reports. This can save you time and stress during the tax-filing process.

How Do You File Taxes

There are really only three options when it comes to filing taxes:

- Manual filing: Manual tax filing is cut and dry. It is done by completing the IRS’s Form 1040, known as the Individual Tax Return form. Once it is completed, it is mailed to the IRS. However, paper tax returns are the slowest to process. The IRS had a backlog of nearly 3 million amended tax returns and a processing time of 20 weeks in the fourth quarter of 2021.

- Using a tax preparation service or tax professional: There are numerous tax preparation services and tax professionals to aid you in your quest during tax season. Some individuals opt for professional services to help them wade through the sea of forms and tax jargon — tax credits and deductions.

- Using tax software programs: Tax software programs are a popular option as well. Many online programs are offered to help walk people through the process of filing their taxes electronically. Of course, many of these software programs come with a cost but it may be well worth the small investment to receive your tax refund faster. Plus, most tax software programs come with fail-safe checks that ensure accuracy and maximize your deductions.

Also Check: How Do Taxes Work On Doordash

Best Tax Software For 2022

For many, tax season brings a flurry of activity. There are documents to be gathered and a decision to be made regarding which tax preparation software does the best job of scoring a refund. We’ve combed through many services to find five of the best tax software options that do an excellent job of walking taxpayers through filing their taxes and extracting every credit available.

The best place to file taxes online for you will likely depend on your comfort level, how complex your returns are, and what sort of customer support and tax help you need. Our select best tax software picks are all standouts for price and support and are a good place to start your search.

When Are Taxes Due For The 2021 Tax Season

The IRS announced in March that its extending the tax deadline from April 15 to May 17, 2021. If you reside in Louisiana, Oklahoma and Texas, you may have more time. The IRS announced residents of these states now have until June 15, 2021 to file their tax returns due to recent storms.

If you need more time to file, make certain to file an extension to extend the tax due date to October 15, 2021although be aware that any taxes that you owe the IRS will still be due on May 17.

Recommended Reading: Do You Pay Taxes Working For Doordash

How Much Does Tax Software Cost

Most major tax software programs allow users to file very simple tax returns for free. From there, they offer tiered plans that can handle more complex types of filings and often include additional levels of support .

The paid plans we reviewed ranged from as low as $44.95 plus $34.95 per state filed to as high as $200 plus $55 per state filed. Every provider we reviewed allowed users to start and work on their returns for as long as they want for free and only charged them when it was time to file a return.

Accointing: 1st Best Crypto Tax Software

Accointing can automatically import all your transactions from more than 300 wallets and exchanges through APIs or Xpubs or manually input them via a provided Excel template, which helps the software calculate taxes. This is an all-in-one platform that offers its customers a lot of services like a crypto tax calculator, trading tax optimizer, crypto tracker, and hub. Moreover, along with a crypto tracker, it also has a cryptocurrency tax calculator that delivers specific outputs for Germany, Switzerland, Austria, the UK, the US, or any other country.

Also read, Accointing Review- A Complete Crypto Tax solution

Recommended Reading: How To Protest Property Tax Harris County

How Do I Sign Up For An Online Tax Software

Signing up for an online tax software only takes a few minutes.

Required documents

You dont need any information to sign up for a tax software other than your name, email address and phone number. But you should have these documents on hand when you start the filing process.

- W2s

- 1099s for earned interest, self-employed income, dividends, retirement distributions and more

- Receipts for child care, educational expenses, medical bills, charitable donations, property taxes and mortgage interest, state and local taxes and any other expenses youre claiming as a deduction

- Proof of retirement contributions

The Software Is Specifically Designed For Cryptocurrency Users Ensuring It Will Meet All Of Your Needs

With tax reporting for crypto being a relatively new issue, most tax software providers have created products specifically for this niche. These tools can be tailored to meet your needs and may help you get additional deductions or save on your taxes if you qualify for them.

Without using these tools, some of these deductions wouldnt be obvious, and you might end up losing out and paying more taxes.

Read Also: Tax Preparation License

Software Features And Add

To streamline the tax filing process even further, some tax return software makes additional features and add-ons available for a fee. These include features like auto-importing your info from the CRA, storing your returns for later use and so on.

With paid add-ons, you can have an actual tax professional look over your returns, enable audit protection, and even plan your last will and testament. These are more or less upsells and the option to choose them only pop up at the tail end of the tax filing process

Now that you know what to look out for when choosing the right tax return software for your tax needs, we have rounded up 7 of the best tax return software that is available to Canadians for filing their taxes.

How Do I File My Taxes For Free

When it comes to free tax filing options, all products are not created equally.

During our analysis, we reviewed the free advertised versions of each of the six platforms and awarded H& R Block as our best free pick. But while these tax online products do provide limited free filing options, many of the same providers partnered with the IRS Free File Program to offer a different free product for those who may qualify.

The IRS Free File Program allows you to file your tax return for free if you have an adjusted gross income of less than $72,000. Your AGI is your total income minus certain deductions. Before using this service, you should browse each product offering to see which free product works best for you.

While this program has been in existence since 2001, you may not have heard of it. The IRS estimates that 70% of all taxpayers qualify for the program, only a small percentage of taxpayers have used it.

Since online tax software providers donate these services, they advertise them very little. The free versions from tax software online providers that youll typically see advertised on the top of the page if you Google file taxes for free are different. The main difference? The product youll find through IRS Free File may allow you to file more forms for free than the advertised version.

Recommended Reading: Doordash Quarterly Taxes

Tokentax: 3rd Best Crypto Tax Software

If you are searching for a platform that can do your taxes with the help of professionals but still with a considerably lower price than all the other competitors, we highly recommend TokenTax. Their custom-build platform handles all aspects of digital asset taxes, from automatic tax form generation to capital gains calculation. Moreover, TokenTax helps in seamlessly tracking your capital losses, capital gains, and tax liability for every virtual currency transaction.

Is Your Home Work Space Tax Deductible

For example, self-employed workers who were suddenly working entirely from home may have made the den or the unused bedroom exclusively a place of business. And that means it may be deductible. However, be sure to read ZDNet’s home office deductions checklist. None of the software packages do a really good job of spelling out just what is, and what is not, allowable as workspace deductions, so your best bet is to understand the situation before starting the process.

Also Check: How Much Are Taxes For Doordash

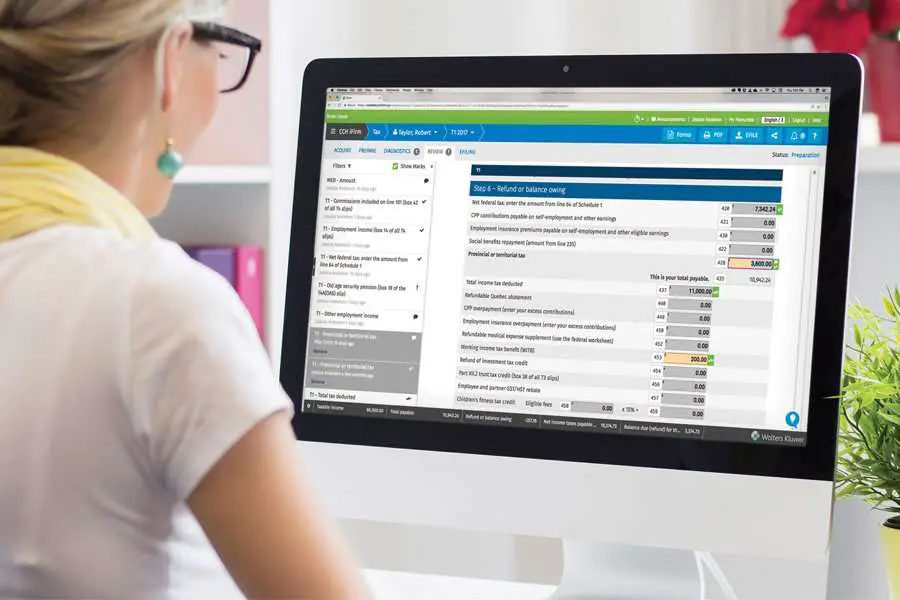

The Best Tax Software For Tax Preparers

Every year, accountants and certified financial planners face the complicated task of keeping up with the changes to state and federal tax laws. Whether the update is minor or major, its the tax professionals responsibility to adapt to it and file their clients returns accordingly. Regardless of how organized a tax specialist may be, the pressure to grasp all the alterations and prepare the returns efficiently and accurately can be overwhelming. Thats where the beauty of the best tax software for tax preparers comes in. Developed to automate the tax preparation process by offering easy access to all tax law changes, updated forms, and in-depth preparation assistance, these software solutions can also include practice management capabilities, client portals, and e-signature support. Keep reading to learn all about the top-rated professional tax software solutions available for this tax season.

- QuickBooks integration

- Seven different packages

Launched by Intuit, ProSeries has been among the best online tax service companies for years. Best-suited for small and medium-sized accounting firms that handle both individual and business tax returns for their clients, this tax solution lets you choose between seven competitively priced and highly customizable packages.

- Comprehensive filing capabilities

- Discounts available

- Optional cloud storage

- Online data backup

- Integrated bank products

- Depreciation module

Taxact Professional: Best Value For Preparing Unlimited Returns

TaxAct Professional is one of the best professional tax software options for small accounting firms. Its a robust solution that comes at an affordable price. You can choose between an on-site application or having it hosted on the providers servers for cloud access.

There are several add-ons that allow you to customize the software based on your needs, including payment acceptance and practice management features. You can also access digital marketing capabilities and facilitate client returns. TaxAct Professional offers a money-back guarantee to all clients, allowing you to return it for a full refund within 30 days if you arent completely satisfied.

Recommended Reading: How To Get 1099 From Doordash

If You Care Most About A Big Tax Refund

If getting a big tax refund is most important to you and you have time to spare, you may want to fill out a tax return with a few different online preparers. Each of the companies on our best tax software list allows you to begin a tax return for free and pay only when you’re ready to submit the return . Before payment is required, you should be able to see your tax refund amount and cancel any filing application that doesn’t give you the biggest refund.

Proseries Professional: Best Overall Professional Tax Preparation Software

ProSeries Professional is a good fit for accountants looking for desktop software with a forms-based interface that can import account balances from QuickBooks Desktop. ProSeries offers four pricing tiers with a great option for small firms that prepare less than 200 returns per year or firms that focus almost exclusively on individual returns. ProSeries pricing starts at $566 per year plus $90 per return, including charges for both federal and state returns.

You May Like: How Do You Report Plasma Donations On Taxes

Best Support From Tax Pros

Tax filing time can be a challenge, especially for filers facing new tax situations. Trying to figure out what you can legally deduct is important, but tax filers can end up overpaying to have pros file their taxes for them.

Were recommending companies that offer ask a tax pro options for their online filers . These companies allow filers to set appointments to get their personalized tax questions answered.

Tax Software Makes It Easy

Tax software can help you track your expenses throughout the year, so reporting is easy when tax season rolls around. You might be surprised to learn just how many deductions and write-offs youre eligible for. You could even deduct a portion of your mortgage, utility bills or even vehicle payments .

If youre self-employed, Benzinga is here to support your financial goalswhether youre looking to grow your business or just make it through this tax season. We offer a wealth of resources to help you. Check out our guide to saving for retirement when self-employed to get started.

You May Like: Doordash Tax Form

Best Tax Software For Small Business Owners

Small business owners have a lot to think about when it comes to their tax returns. Beyond just entering income and expenses, there are considerations around business structure, asset depreciation, individual retirement plans, and more.

While many small business owners would likely benefit from an accountant, those that want to DIY it need to have software that is up for the challenge.

Best For Partnerships And Corporations: Taxact

TaxAct

TaxAct includes an option to complete tax filings for partnership and corporations completely online and is the only place you can prepare taxes for a partnership or S corporation with either a PC or Mac online, which is why it’s our choice as best for partnerships and corporations.

-

Completely online federal and state taxes for partnerships, C corporations, and S corporations

-

Unlimited free support from tax specialists and technical support by phone and email

-

Choose between online and downloadable versions

-

Discounts available for bundling personal and business taxes

-

Limited options for audit support

-

State forms may not be available to file electronically

TaxAct is a large provider of online and downloadable tax software that has completed over 80 million tax returns since 2000.

Business owners who file online will pay $124.95 plus $49.95 per state. That includes sole proprietors who file with a Schedule C, partnerships that require Form 1065, corporations that file with Form 1120 or Form 1120s. However, tax-exempt organizations that file Form 990 must by the downloadable version though..

The download version , which includes 5 federal e-files is $109.95. States cost $50 each. You can bundle personal and business for a total of $200.

You May Like: 1040paytax.com Official Site

Winner: H& r Block Premium

Why: H& R Block Premium allows users to upload tax forms from their brokerages. H& R Block will then use those forms to figure out the filers taxable income. It also imports up to 500 stock trade transactions per brokerage . Then H& R Block takes on the burden of calculating your capital gains taxes. H& R Block Premium isnt cheap, but the time savings is well worth the price.

Best For Complex Returns Needing Professional Input

Unlike most online tax offerings, Online Tax Pro from, either as a web form or a mobile app, gives you a real, live human being to assist you via telephone or a secure chat channel, for an unlimited number of sessions, rather than leaving you in a do-it-yourself process.

Online Tax Pro began during the pandemic, on the premise that you still want an office visit, but you can’t get there. The company apparently found that true, so they’ve continued the mixture of online filing with human assistance.

Jackson Hewitt emphasizes the time savings, the certainty, and the flexibility of the human element.

Online Tax Pro this year has ditched tiered pricing in favor of an all-you-can-eat $99 fee. The company pledges to handle a return of any complexity with that fee.

The company offers a “lifetime accuracy guarantee,” with reimbursement for penalties and interest in the case of a preparation error and a “maximum refund guarantee,” refunding the fees plus $100 if another preparer can show you deserve a higher refund.

In addition to the web version, you can use the mobile app for iOS or Android to step through the process.

Pros

- Simple pricing

- Extensive network of physical offices should you want to have a real, live meeting with a preparer

- Partnership with Walmart allows for drop-off of your returns.

Cons

Also Check: How To Do Taxes On Doordash