Example Of How To Calculate The Health Insurance Subsidy

Keep in mind that the exchange will do all of these calculations for you. But if you’re curious about how they come up with your subsidy amount, or if you want to double-check that your subsidy is correct, here’s what you need to know:

Tom is single with an ACA-specific modified adjusted gross income of $24,000 in 2022. FPL for 2021 is $12,880 for a single individual.

Advance Premium Tax Credits

If you enroll in a Vermont Health Connect qualified health plan you may be eligible for financial helpincluding the premium tax credit . You may get PTC if you meet other eligibility rules. You must file federal taxes to get premium tax credits.

If youre eligible for premium tax credits, you can choose to take them:

Many Vermonters take premium tax credits in advance to lower monthly health insurance premiums. When you take the tax credit in advance its called advance premium tax credits, or APTC. The amount of APTC you will get is based on your projected income for the year. Once you choose how much of your APTC you want to use, it comes out of your health insurance premium automatically. For example, if your total insurance premium is $500 per month and you choose to use $400 per month of the APTC amount you are eligible for, your monthly bill is $100 per month .

IMPORTANT: The amount of APTC you can use may change if your income or your tax household size changes. Read on to learn more.

How Does It Work

Participants in the HCTC program may select either of the following credit options:

- Yearly credit: You pay 100% of your premium for the entire year and then the IRS will either issue a refund to you or a credit against your federal taxes owed for 72.5% of your premium.

- Monthly credit: You pay 27.5% of your monthly premium to the IRS. The IRS adds the remaining 72.5% of your monthly premium, and pays your health plan administrator 100% of your monthly payment. This lowers your out-of-pocket payments for your monthly premiums.

NOTE: You may be able to change health care plans to receive the HCTC benefit.

You May Like: When Do We Get Tax Refund

What Happens If My Family Size Or Income Changes During The Year

Life-changing events can impact your tax credit eligibility by either increasing or decreasing the amount that you are allowed to claim. Events that can affect your premium tax credits may include:

- Change in your household income

- Gaining or losing health insurance coverage

Since the marketplace determines your tax credit, it is important to report changes immediately so your health plan eligibility can be updated. And if you’re currently using the advance premium tax credit, then it is particularly important to report any life changes to the marketplace as soon as possible.

If you wait to report such changes, there may be discrepancies between what you paid and what you should pay. In this case, if you used more advance premium tax credits than you are allowed, you may have to pay back money when filing your federal income tax return. On the other hand, if you used less than allowed, you may get an added refund. This is known as “reconciling” your advance premium tax credits.

Health Insurance Tax Credits Deductions & More

Learn how to take advantage of financial help and avoid tax penalties when enrolling for health insurance. You may be leaving money on the table!

When the government wants to encourage you to do something, they often offer you a tax credit. Examples include everything from buying energy-efficient appliances to purchasing health insurance. The bonus is that tax credits actually lower how much you owe and, even better, health insurance tax credits are actually refundable. Consider this, if you owe $2,000 in taxes and have an unused tax credit of $2,500, youâll get a check for $500.

Financial Help, Health Insurance & Your Taxes

Health insurance tax credits are financial help from the federal government that lowers your monthly premium. Thatâs why they are specifically referred to as premium tax credits. Applying for insurance through Covered California is the only way to receive this help.

If you qualify, you can receive financial help as a reduction to your monthly insurance premium. You can also choose to receive this money as one lump sum come tax time. Financial help is based on your household income. That means, if you end up making more or less money than when you applied, then the amount of your financial help could change. To avoid any surprises come tax season, report these changes to Covered California.

Applying for Financial Help

Self-Employed and Small Business Owner Tax Deductions

Avoid Tax Penalties

You May Like: How To Do Your Tax Return Online

How Do I Know If I Qualify For A Tax Credit

When you apply for coverage through a health insurance marketplace, also called an exchange, the system will determine your eligibility for tax credits based on your income and household size.

If your income is below the federal poverty level threshold, you may be eligible to enroll in Medicaid. Most states have now expanded Medicaid eligibility to incomes at or below 138% of the federal poverty level , providing more health insurance choices for those with low incomes.

Those with income between 100% and 400% of the federal poverty level qualify for premium tax credits. And if you earn more than 400% of the federal poverty level, you may still qualify for health insurance discounts.

The so-called “subsidy cliff” at 400% of the federal poverty level was eliminated in 2021 as a part of the American Rescue Plan Act. Those earning more than the 400% threshold gained access to subsidies that limited health insurance costs to 8.5% of their income.

This benefit was extended through the end of 2025 as a part of a wide-reaching federal law called the Inflation Reduction Act.

You can preview your tax credit eligibility by using our Affordable Care Act subsidy calculator. If you qualify, the monthly premium cap shows how much you would spend for the second-cheapest Silver plan on the marketplace.

Questions And Answers On The Premium Tax Credit

Q1. What is the premium tax credit?

A1. The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of your premium tax credit is based on a sliding scale. Those who have a lower income get a larger credit to help cover the cost of their insurance. When you enroll in Marketplace insurance, you can choose to have the Marketplace compute an estimated credit that is paid to your insurance company to lower what you pay for your monthly premiums . Or, you can choose to get all of the benefit of the credit when you file your tax return for the year. If you choose to have advance payments of the premium tax credit made on your behalf, you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return for the year. Either way, you will complete Form 8962, Premium Tax Credit and attach it to your tax return for the year.

Note: For tax year 2020 only, you are not required to attach Form 8962 with your 2020 tax return unless your PTC is more than the APTC paid on your behalf for 2020 and you are claiming net PTC. See link below for information specific to tax year 2020.

See the Coronavirus Tax Relief section on this page for information specific to tax year 2020.

Q2. What is the Health Insurance Marketplace?

Recommended Reading: How Much Taxes Deducted From Paycheck Wa

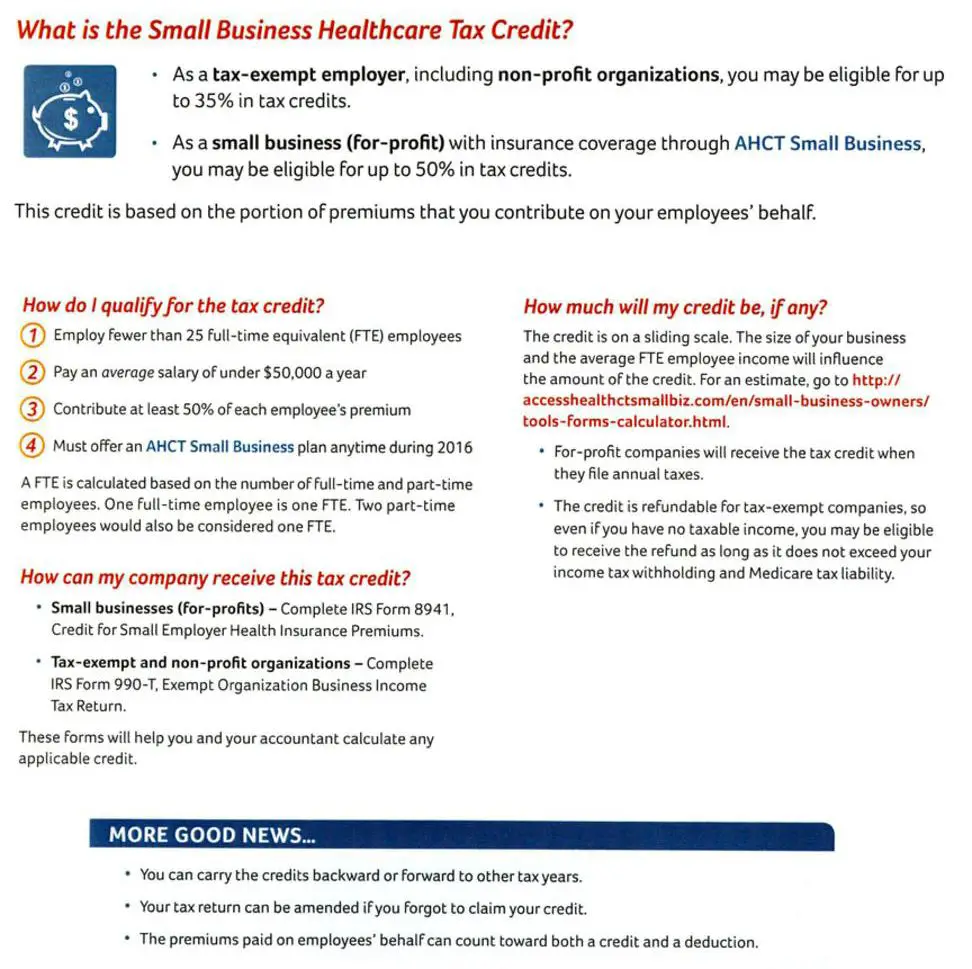

Complete One Application To See Your Options

Access Health CT is the only place where you can qualify for financial help to lower your health insurance costs or, if eligible, enroll into free or low-cost coverage through HUSKY Health . Before you begin an application, you can use the Compare Plans tool to enter some basic information about your household like your tax household size, home address, and household income – to understand your coverage and financial help options.

It is our mission to increase the number of insured residents in Connecticut. We partner with the Department of Social Services to offer a single application process for healthcare coverage to residents. Whether you qualify for a HUSKY Health Program or for a Qualified Health Plan through a private insurance company, you can expect the same free help through Access Health CT – online, by phone, or in-person.

Most people get financial help for coverage through a Qualified Health Plan or low-cost or free coverage through a HUSKY Health Program.

Example For A Family Of Three In Utah Earning $70000/year

Here’s a look at a health insurance premium and tax credit estimate for a family of three living in Utah earning $70,000/year.

In this example, the family would pay about $383/month for a family coverage silver plan, receiving a premium tax credit of $1,064/month . Without financial help, the silver plan would be $1,447/month based on their family size.

If you qualify for a tax credit, using it can be a great idea for lowering your monthly healthcare costs.

Don’t Miss: How To Contact Irs About Tax Return

Tips For Planning Your Taxes

- There are plenty of tax credits, and a financial advisor can help you find them to minimize your tax burden each year. Finding a financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you lost money on an investment, a financial advisor who specializes in tax planning can harvest your losses to offset your tax liability.

- Tax software can also make filing easier. Our best tax software roundup will help you pick the right one for your needs.

- If you want to get ahead of the tax filing deadline, SmartAssets free income tax calculator can help you figure out how much you will likely pay in income taxes.

How Do I Access The Premium Tax Credits

You may wonder, does the premium tax credit work with any type of insurance? No to receive your premium tax credit, you must purchase health insurance through the federal marketplace, healthcare.gov4, or your state’s marketplace.

You can purchase a qualified health plan during your state’s open enrollment period. Otherwise, you can only get health coverage during a special enrollment period .

Most states have a website where you can view and compare policies, enroll in a plan, and receive the premium tax credit. A licensed health insurance broker is a great resource for help selecting a health plan.

It’s important to note that while federal and state marketplaces will display catastrophic plans as an option for those under 30, they aren’t eligible for premium tax credits.

If you elect to receive premium tax credits on your tax return, you will receive your subsidies as a refund when you file IRS Form 8962. This is because they are considered refundable tax credits, meaning, unlike other subsidies, you’ll receive the full amount even if you owe fewer taxes than your credit amount.

Recommended Reading: When Are Federal Income Taxes Due This Year

What Are The Income Limits For The Premium Tax Credit

For the 2023 tax year, you’re eligible for premium tax credits if you make between 100% and 400% of the federal poverty limit, which is between $13,590 and $54,360 for a single person, and those with higher incomes may also qualify.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Who Is Eligible For A Health Care Credit

Before 2021, the PTC was available to people with household incomes from 100% to 400% of the poverty level who bought health coverage through an exchange. If youre enrolling for 2023, those income levels range from $13,950 to $55,800 for singles and $27,750 to $111,000 for a family of four . For 2021 through 2025, people with incomes over 400% of the poverty line who enroll in coverage through an exchange also get PTCs to the extent their cost exceeds 8.5% of income.

Individuals who are eligible for Medicare, Medicaid, Tricare or other federal, state or local government insurance do not qualify for the PTC. Nor do individuals who are offered affordable health insurance through their employer. Employer coverage is treated as affordable if the employees share of annual premiums for self-only coverage doesnt exceed 9.12% of household income . For years, this same self-only test also applied in determining affordability for the employee’s spouse and children, but President Biden’s administration changed that rule. It recently issued final regulations that determines affordability for family members based on the employee’s share of the cost of family coverage under the employer’s plan. This change will be in place for open open enrollment for 2023.

Don’t Miss: When Do You Stop Filing Taxes

Can I Save Money By Buying A Cheaper Plan Or Must I Buy The Benchmark Plan

Just because the benchmark plan is used to calculate your subsidy doesnt mean you have to buy the benchmark plan. You may buy any bronze, silver, gold, or platinum plan listed on your health insurance exchange. You may not use your subsidy to buy a catastrophic plan, though, and premium subsidies are never available if you shop outside the exchange .

If you choose a plan that costs more than the benchmark plan, youll pay the difference between the cost of the benchmark plan and the cost of your more expensive planin addition to your expected contribution.

If you choose a plan thats cheaper than the benchmark plan, youll pay less since the subsidy money will cover a larger portion of the monthly premium.

If you choose a plan so cheap that it costs less than your subsidy, you wont have to pay anything for health insurance. However, you wont get the excess subsidy back. Note that for the last few years, people in many areas have had access to bronze or even gold plans with no premiumsafter the application of their premium tax creditsdue to the way the cost of cost-sharing reductions has been added to silver plan premiums starting in 2018. And as a result of the American Rescue Plan, far more people are eligible for premium-free plans at the bronze, gold, and even silver levels.

Guide To Premium Tax Credits For Health Insurance

With the recent passage of the Inflation Reduction Act in the summer of 2022, there’s been a lot of talk about the extension of federal advance premium tax credits and lowering health insurance costs. But, what is a tax credit for health insurance, and what do these subsidies have to do with how much you pay for health insurance?

In this article, we’ll cover what premium tax credits are, who qualifies for them, and how to calculate exactly how much you can expect to pay for health insurance premiums.

Don’t Miss: What Receipts Can I Claim On My Taxes

Live Your Best Life Colorado Weve Got You Covered

Apply for savings

- your familys estimated annual income.

You can use the financial help in two different ways:

If you take the financial help in advance, the amount of the tax credit you use should be based on your estimated gross income for the year youre getting coverage, not last years income.

How To Apply For A Disability Tax Credit

Once you or your loved one is diagnosed with ADHD by a doctor or medical practitioner, you can apply for this tax credit. The medical practitioner will need to complete part of the application form and you might be required to supply supporting evidence in order to make your case clear to those reviewing your application. It is essential that the medical practitioner understands all the difficulties that their patient encounters on a daily basis so that they can include them in the application. Those reviewing the application may contact the doctor who signed off on the relevant paperwork in order to obtain further details and to confirm the condition as well as the severity.

You May Like: Does Washington Have Income Tax