How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

What Is A Tax Refund

Tax refunds usually call for a celebration. But in reality, they often mean that you made a mistake by paying more income tax than was necessary. Federal or state governments will refund the excess money that you paid out to them. You can avoid overpaying by filling out employee tax forms correctly and estimating or updating deductions with greater accuracy.

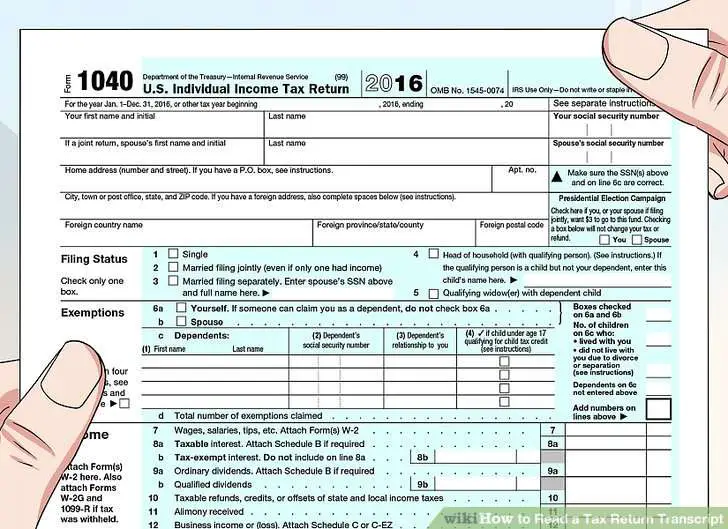

About Free File Fillable Forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

- Choose the income tax form you need

- Enter your tax information online

- Electronically sign and file your return

- Print your return for recordkeeping

If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Limitations with Free File Fillable Forms include:

- It wont give you guidance about which forms to use or help with your tax situation

- It only performs basic calculations and doesnt provide extensive error checking

- It will only file your federal return for the current tax year

- No state tax return option is available

- You cant make changes once your return is accepted

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose 2021 income is greater than $73,000. Taxpayers whose income is $73,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Recommended Reading: Protest Property Taxes In Harris County

Don’t Miss: Harris County Property Tax Protest Services

I Lost My Documents / I Never Received My Documents What Do I Do

We know it’s easy to lose documents in the move back home or to not even receive them in the first place. That’s why we have a document retrieval service to organise replacements for you. If you’re missing documents, just contact us at and we’ll sort it out for you. Please note that there is a cost for this service.

How Tax Refunds Work For The Self

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> In contrast, self-employed individuals are responsible for their own cash flow throughout the year. Ideally, they should estimate their average tax rate at the beginning of the year, and transfer that percentage from each paid invoice to a separate bank account.

At the end of the fiscal year, the self-employed add up all their income, subtract expenses, deductions, determine their average tax rate and then subtract credits. Because no taxes have yet been collected, they must send the full amount to the CRA.

The self-employed require the time to do bookkeeping, plus the willpower not to spend the accumulated cash.

Those who pay taxes annually like this rarely receive a refund. The vigilance this approach requires usually results in the taxpayer paying the correct or nearly correct amount in taxes.

Its also possible for this group to pay taxes throughout the year, in quarterly installments. Theres several different ways to calculate how much these installments are, but its unlikely it will add up to the exact amount owed. If you overpay, you will get a refund. This group generally has until April 30th to pay any taxes owed and until June 30th to actually file a return.

You May Like: Doordash 1099-nec Schedule C

How To Do Your Taxes In Canada

Whether youre a first-time filer, or someone whos been going to a tax preparer for years, you might be wondering if you can do your own taxes. You can, and its easier than you think.

What Happens If I Submit My Tax Return Too Late

If you miss the deadline for filing your tax return, the Tax Office may set a so-called delay fine . Whether you are going to be charged such fine is at the discretion of Tax Office staffs. However, if you submit your tax return 14 months after the end of the tax year you are reporting, you must pay the delay fine, which can increase rapidly. According to §152 Tax Code, the fine amounts to 0.25% of the monthly tax deducted due to advance payment and the applicable deductibles- but the minimum fine is ⬠25 per month.

Furthermore, the Tax Office can charge you an administration fine which is usually between ⬠100 to ⬠500 euro. Such a fine notice is sent per mail.

Read Also: Who Has The Power To Levy And Collect Taxes

What Is The Deadline For The Tax Return In Germany

The German tax year runs from January to December. If you are obligated to submit a tax return, you can submit it any time between January 1 and July 31 the following year . If you need, you can also apply to your local tax office for an extension, which is usually granted automatically. If you use the services of a tax advisor, the tax office automatically extends the deadline to the end of the following February.

If you are submitting a tax return voluntarily, you can apply for refunds for up to the four previous years .

Between two and six months after submitting your return, you will receive a tax assessment from the tax office. This document informs you whether you can expect a refund , or if you owe tax. If you owe tax you will be given around four weeks to pay.

The Tax Refund Process

You can request a tax refund from the government by filing an annual tax return. This document reports how much money you earned, expenses, and other important tax information. And it will help you to calculate how many taxes you owe, schedule tax payments, and request a refund when you have overpaid.

Once the government gets your tax return and processes your information, it officially approves you for a refund before sending off your money. Tax refund processing varies depending on the way that you file your taxes.

Refunds for tax returns filed electronically are generally sent out less than 21 days after the IRS receives your information, though they can take up to 12 weeks to show up. Refunds for tax returns filed on paper often arrive between six and eight weeks.

You could be wondering, why does my tax refund take so long to show up?

Delays can happen as a result of mistakes, budget cuts and overwhelmed tax preparers. The timelines that the IRS provides are only estimates, so its probably not a good idea to count on using a refund to make an important payment or purchase.

In some cases, you might be tempted to take out a refund anticipation loan. Sure, youll get your money earlier. But as a consequence, you may have to pay a hefty fee and interest.

Recommended Reading: Doordash Write Offs

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or well pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

Why Should I Submit A Tax Return In Germany

Nine out of ten taxpayers in Germany receive a refund when they submit their annual tax return . Anyone who has earnings in Germany can claim back part of the income tax which they have paid throughout the year. With the help of a good software tool like SteuerGo.de, this process should only take an hour or so to complete. In the following years, this is even easier and quicker due to the automatic transfer of many entries.

Recommended Reading: 1040paytax Irs

Why You Should Consider Filing A Tax Return Even If Youre Not Required To File

Filing a tax return is probably not something most people enjoy doing. So why would anyone want to file a tax return if they dont have to? Well, actually, there are some important reasons you might get a tax refund and you may be eligible for an additional stimulus payment. If youre eligible for future payments or credits, it helps if IRS has your 2020 tax return and direct deposit information on file.

While people with income under a certain amount arent required to file a tax return because they wont owe any tax, if you qualify for certain tax credits or already paid some federal income tax, the IRS might owe you a refund that you can only get by filing a return. Some tax credits are refundable meaning that even if you dont owe income tax, the IRS will issue you a refund if youre eligible. Many people miss out on a tax refund simply because they dont file an IRS tax return.

There is usually no penalty for failure to file if you are due a refund, but why miss out on money thats rightfully yours? If, however, you wait too long to file your return and claim a refund, you risk losing it altogether. Thats because an original return claiming a refund must generally be filed within three years of its due date. If you havent filed a tax return for tax year 2017 and had any money withheld from your paychecks or are eligible for tax credits, you need to file by May 17, 2021. If you dont, the money is forfeited, by law, and becomes property of the U.S. Treasury.

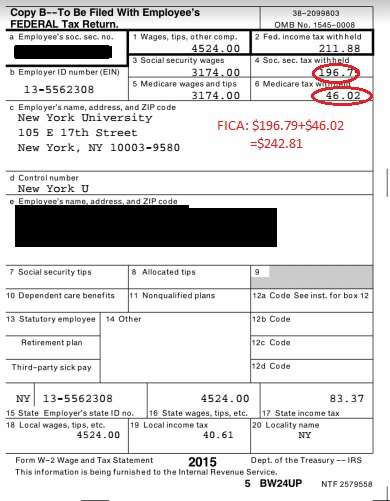

How Tax Refunds Work For Employees

Employers collect tax on behalf of the government at the sourcefrom the paycheque before it even gets to your bank account. Employed individuals file a tax return detailing their income, deductions, credits before April 30 of the following year to figure out the actual tax they owed. If they paid more than they owe, then the government refunds the money. If they underpaid then they must pay up by April 30th.

Don’t Miss: Protesting Harris County Property Tax

Tax Declarations For Freelancers

Things get a lot more complicated around tax season when you work for yourself.

Freelancers need to fill in the following forms in ELSTER:

- Main income tax declaration form

- Freelance income

- Revenue statement if your yearly income exceeds 17.500 per year

- Health and pension insurance

Self-employed tradespersons need to fill out:

- Main income tax declaration form

- Self-employed income

- Revenue statement

- Health and pension insurance

Freelancers and the self-employed who charge VAT also need to submit a separate annual VAT declaration however, small business entrepreneurs are exempt from this.

Tax Return Software And Online Applications

If you find the ELSTER tool too complicated, there are a range of desktop and online tools available to help you complete your tax return in Germany correctly. They also provide tips and support for maximising your refund.

As the first and most comprehensive online tax return software in English, SteuerGo.de is ideal for employees and freelancers, especially if itâs your first time.

- You are guided step-by-step through a clearly structured interface.

- When you register for your free account, any entries you make are automatically saved.

- It is all in English â every step of the process. A wealth of explanatory texts help you to understand what is needed and key German terms are given in brackets to help you navigate your way through German tax documents.

- You can contact us via email, chat or call our hotline if you have any questions.

- It only costs 29,95 Euro and you only need to pay if you decide to actually submit a tax return using the software.

Our software also tells you in real time how much you can expect to get back as a refund, so you know if itâs worth the one-time fee.

Recommended Reading: How To Find Employers Ein

Buy And Sell Stocks Commission

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Trade is offered by Canadian ShareOwner Investments Inc. , a registered investment dealer in each province and territory of Canada, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to activities undertaken by ShareOwner.

Wealthsimple Invest and Work are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Invest and Work accounts are held with ShareOwner.

You Need To Account For Support Your Received

Living in Germany has been a blessing during Corona times. The country has had a healthy budget in order to support freelancers, companies & employees with support packages. Many of us have received support with public money in one way or another.

The money you have received from the German authorities need to be accounted for in the tax return made for 2020 and 2021. This could come under different forms. Some examples:

- Kurzarbeit Geld: if your employer reduced your hours, the German state has compensated for your lost income in the form of Kurzarbeit Geld.

- Corona grants/aid/support money for freelancers: This has taken different names like Corona Zuschuss, Überbrückungshilfe, Neustarthilfe or Härtefallhilfe. In some cases, the application had to be done by your Steuerberater, so they would know where/how to include it for you. For this you use the new Corona Hilfen form. Those aids are also to be accounted in your general profit statement .

- Compensation due to legal restrictions: you could not work because of restrictions measure

- Krankengeld: if you were infected by the Corona virus and werent able to work because of it. You probably have received support money in this case too.

Basically anytime you received public money, it should appear in your tax declaration for that time window.

You May Like: How Do Taxes Work For Doordash

Who Has To Submit A Tax Declaration

Generally speaking, if youre a full-time employee within a company, submitting a yearly tax declaration isnt usually mandatory. Its only necessary in specific circumstances, like if you freelanced in addition to your full-time job, or received wage replacement benefits while you were employed.

That said, its often worth your while to submit a tax declaration even if you are in full-time employment, because doing so might result in a tax refund.

As stated above, tax declarations are mandatory for the self-employed, those who receive any kind of welfare benefits, those who received more than 410 in wage replacement benefits, those who had more than one employer in the past financial year, or earned more than 410 per month in addition to their regular employment . In certain cases those who are married or have a common-law partner are also required to submit a tax declaration.

What To Look For In A Tax Preparer

Youll want someone in your corner if you get an audit notice, so find out if the professional youre considering hiring can represent you before the IRS. Not all can. Some can go with you to an audit, while others can actually go in your place and spare you the ordeal.

Enrolled preparersare registered with the IRS and can sign tax returns and help with tax audits. Unenrolled preparerscant do either of these things. An accountant who is not a CPA is considered to be an unenrolled preparer.

Enrolled agents have earned this designation through a rigorous test of tax law and are specifically employed to help with tax issues. CPAsare accountants who have passed a licensing exam in the state in which they practice. CPAs can deal with accounting and payroll issues in addition to tax issues.

Youre ultimately responsible for your tax return no matter who does your taxes, and you alone are answerable to the IRS if the return is fraudulent or inaccurate. Its something to keep in mind.

Read Also: Doordash Taxes For Drivers