Is It Better To Have More Earned Income Withheld Just To Be Safe

There are some downsides to letting the IRS hold your money for a year or more. For one, processing returns can take a while, and you could have had that money in your bank account sooner.

You wouldnt overpay your mortgage, electric bill, or any other expense by thousands of dollars just so you could get a big refund at the end of the year, right? Yet, we have normalized doing this with our taxable income.

Think about it this way: When you elect to withhold additional tax from your paychecks, you are essentially giving the government an interest-free loan . . . but would they ever allow you to borrow money without charging interest?

On the other hand, many people choose to have extra withholding from each paycheck because it feels safer than the risk of receiving an unexpected tax bill at the end of the tax year. If withholding extra gives you peace of mind, then do what works for your unique financial situation.

Plus, if you are someone who struggles with saving, withholding extra money from your paychecks and getting it all back in one lump sum at the end of the year can be a helpful way to save your cash without the temptation to spend it all immediately.

Whatever you choose, its nice to know you are in control of your money!

Why Do I See A Tax Topic 152 Tax Topic 151 Or Irs Error Message

Although the IRS’ Where’s My Refund tool will generally show one of the three main statuses — Received, Approved or Sent — for your refund, there are a wide variety of messages and notices that some users may see.

One of the most common is Tax Topic 152, a generic message indicating that you’re likely getting a refund, but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

During the 2022 tax season, many Reddit tax filers who filed early received the Tax Topic 152 notice from the Where’s My Refund tool accompanied by a worrisome message: “We apologize, but your return processing has been delayed beyond the normal time frame. You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible.”

The purported delay could be an automated message designed for taxpayers claiming the child tax credit or earned income tax credit. Due to additional fraud protection steps, the earliest filers with those credits can receive their refunds will be March 1. Several Reddit users commented that the message eventually cleared and they received notifications their refunds were sent.

Which Services Should You Use

The two best-known online tax filing services are TurboTax and H& R Block, and theyre the ones that we recommend you use. Both allow you to file your taxes online for free if you meet certain conditions, but have paid options if your situation is a little more complicated, or you want help. The IRS also offers a tax filing service, which you may not know about. Heres the breakdown of how all three services work.

You May Like: How Much Taxes Deducted From Paycheck Mn

Reducing Taxes Owed With Credits

While tax deductions reduce your taxable income, tax credits come directly off what you owe the IRSdollar for dollar. The Internal Revenue Code provides for several tax credits, from the child tax credit for each of your child dependents to the earned income tax credit, which is designed to provide refunds to low-income taxpayers and families with children.

Refundable tax credits can sometimes result if any balance is left over after reducing the tax you owe to zero.

You might have owed the IRS $1,000 had you not claimed a $1,500 tax credit. The credit would erase your tax debt, and the IRS would send you a refund for the $500 balance if the credit were refundable. The IRS would keep that $500 if the credit you claimed was non-refundable, but at least it would entirely erase your tax debt.

Each credit comes with its own qualifying rules, and how you can claim it varies a little as well.

The American Rescue Plan Act of 2021 eliminates the minimum income requirement for the Child Tax Credit. It increases the maximum benefit to $3,600 for children under age six, and to $3,000 for children ages six through 17. The age-17 cap is one year older than the usual age for qualifying. This applies only to the 2021 tax year, the return you’d file in 2022.

Some tax credits, such as the Additional Child Tax Credit, require their own forms that help you calculate how much you’re entitled to and show the IRS how you arrived at that amount.

The Difference Between Claiming 1 And 0 On Your Taxes

Filing taxes every year is an important obligation. If itâs done incorrectly, you could have too much taxes withheld or too little, which determines whether youâll get a refund or not. So, whatâs the difference between claiming 1 and 0 on taxes, and which one is the better option for you?

Before jumping into tax terms, make sure you at least understand the difference between allowances and exemptions:

- Allowances â Allowances are marked on your W-4 when you start new employment, and the amount you mark will depend on your situation like number of jobs you have, marital status, number of children, etc. You can adjust them at any time to make sure you have the correct amount of taxes taken out.

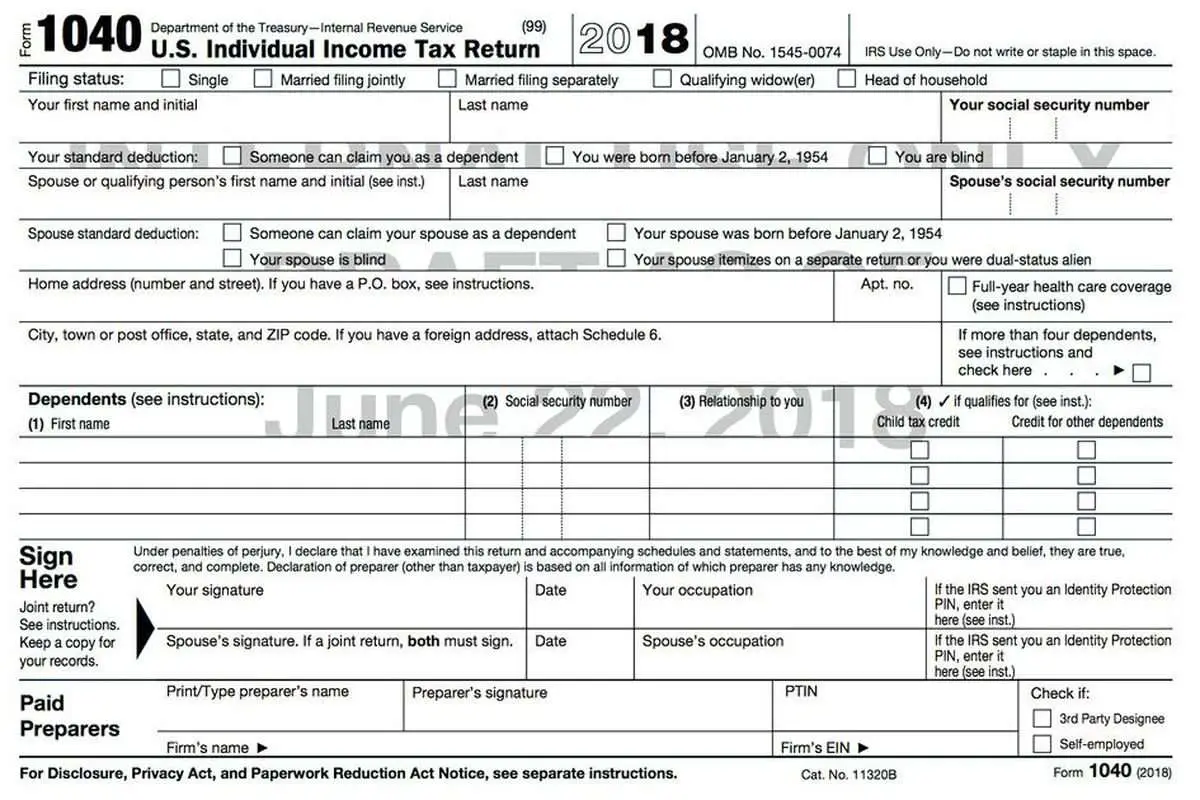

- Exemptions â Exemptions reduce the amount of income being taxed and is claimed on the IRS Form 1040. You can claim yourself, your spouse, and each qualifying dependent. If someone claims you as their dependent, you cannot claim yourself.

Read Also: Tax Write Off For Doordash

Claim The Earned Income Tax Credit

Working families, individuals, people who are self-employed and others who have a moderate to low income may qualify for the Earned Income Tax Credit. The EITC decreases the amount of taxes owed and may qualify you for a tax refund. To qualify, you must:

- Have a valid Social Security number

- Be a U.S. citizen, a year-long resident alien or a non-resident alien married to an American citizen or resident alien filing jointly

- Have income from self-employment, from an employer or from working on a farm

- Not be a claimed dependent or child of another person

- Have a qualifying child and be between the ages of 25 and 65, living in the U.S. for at least half the year

To receive the EITC you must file a tax return, even if you owe no taxes.

Do You Get A Bigger Tax Refund If You Make Less Money

You do not necessarily get a bigger tax refund if you make less money. The amount you get is directly proportionate to how much money you make and how many claims you could have, but didnt make.

If you make more money you are eligible for a larger tax refund . The less claims you make the more likely you are to get a higher proportion of your money back as a tax refund.

Don’t Miss: Efstatus.taxact.com.

Why Did The Irs Send My Tax Refund In The Mail Instead Of Depositing It In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Just in case, sign in to your IRS account to check that the agency has your correct banking information. If you are receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

Get the CNET How To newsletter

How Do I Change My Withholding On The W

The new W-4 form was designed to create the most accurate withholding for all taxpayers. If you want your tax bill to be as close to zero as possible, its important you are claiming the correct number of dependents in Step 3 and including precise numbers for any additional income in Steps 2 and 4.

If you itemize your deductions, dont forget to account for any additional deductions in Step 4 of your W-4 form.

If you are someone who likes receiving a bigger tax refund with your annual return, changing your W-4 to get more money with your refund is easy. You can choose what additional amount, if any, you want withheld from each paycheck on line 4 of the W-4 form.

Also Check: Do Doordash Drivers Have To Pay Taxes

What To Know About The 2022 Tax

Even in 2022, the unprecedented nature of this years tax-filing season all comes down to the COVID pandemic. The federal government tasked the IRS with delivering most of the direct aid approved for 2021 in President Joe Bidens American Rescue Plan, whether that was the child tax credit or stimulus checks.

We urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year, Rettig said. People should make sure they report the correct amount on their tax return to avoid delays.

Those features can cause delays because they leave more room for error either because the IRS didnt tally Americans stimulus totals correctly or because taxpayers made a math error.

Taxpayers are not submitting their tax returns as normal this year, says Garrett Watson, senior policy analyst at the Tax Foundation. Theres going to be wide variations in peoples experiences during this years tax season some are going to see disruptions.

When a tax return doesnt match up with IRS records, its placed in the agencys paper processing backlog, a logjam thats been increasingly harder to work through amid hiring and training challenges.

That means taxpayers are likely to encounter delays if they make a mistake when they file or even if they submit an error-free paper return. Taxpayers who also wait up until the last minute risk accumulating a significant wait time, experts say.

Using The Irs To File Your Taxes

The IRS itself has partnered with private companies to allow you to file your taxes for free if you earn less than $72,000 per year. This program is called IRS Free File. The website looks a little basic, but its well laid out and explains exactly which information youll need to provide.

The service includes pictures of all the forms you need to look for, and will guide you through the entire process, including handling all of the math calculations for you. This is an especially good resource for beginners. The IRS also offers access to free customer service and may not charge state filing fees if you use Free File.

If you make over $72,000 per year, you can use the IRSFree File Fillable forms. You wont get the same guided experience, and cant use it to file your state taxes. If youve been filing your own taxes for years, and havent had a major life event happen, this can be a good option.

Read Also: Taxes Taken Out Of Paycheck Mn

Tax Season Calendar: Key Dates And Deadlines To Remember

- The IRS starts accepting and processing 2021 tax returns.

- Deadline to file your 2021 tax return or request a six-month extension, though youll still need to pay any taxes you owe to avoid penalties or fees.

- Deadline to file your 2021 tax return for taxpayers who live in Maine or Massachusetts.

- : Deadline to file your 2021 tax return if you requested a six-month extension.

- Check with your states tax agency to determine when your state taxes are due.

How Do I Fill Out My W4

Filling out a Form W4 is more than a little intimidating sometimes. But dont lose any sleep! Consult your local Liberty Tax® professional and they will be happy to assist you with your W4 and any other tax issues you may have. If youd like to handle it yourself, follow the step-by-step instructions below.

Step 1:

Provide your name, address and social security number. In addition, provide your marital status you expect to use when you file your 2020 federal tax return. This will determine the tax table/bracket used to figure your amount of withholding.

If youve recently gotten married or changed your name and havent updated that info with the Social Security Administration, you will need to update that in the Name Changes section.

If you are single, or if you are married but only one of you works, and you work at only one job at a time, you may skip Step 2.

Step 2:

If you have more than one job at the same time, or you are married filing jointly and you and your spouse both work, you have some extra things to consider. If you skip this Step 2, you will probably be under-withheld and could owe taxes when you file your return.

Step 3:

Multiply the number of qualifying children by $2,000 and enter the total on the W-4 and multiply the number of other dependents by $500

A $2,000 child tax credit is available for each qualifying child determined by the following seven factors:

Step 4:

Recommended Reading: Is Plasma Money Taxable

Why You Have To File A Tax Return

You’ll be asked to complete Form W-4 for your employer when you begin a new job. The information you enter on this form determines how much in the way of taxes will be withheld from your pay. The decisions you make when you set up your payroll withholding by completing this form can easily result in under or over-paying your taxes. Payroll withholding usually isnt exactly right.

The IRS introduced a revised Form W-4 for the 2021 tax year. Its much easier to complete, guiding you through the process with various questions and eliminating the complicated allowances that once had to be figured out.

The IRS recommends updating your W-4 and withholding requirements whenever you experience a life event that could affect your tax obligation, such as marriage, the birth of a child, or receiving unexpected sources of income.

Youre required to file a tax return every year to come up with a final tally of your tax situation. The process determines whether you owe taxes beyond what youve already paid, or whether youre owed a refund of the taxes that have been withheld. Your tax return is normally due on or near of the year following the tax year. In 2022, the year in which you’ll file your 2021 tax return, the due date is April 18.

How Long Does It Take To Get A Tax Refund In 2022

The IRS anticipates most taxpayers will receive refunds, as in past years. Most should receive them within 21 days of when they file electronically if they choose direct deposit . Last year’s average federal refund was more than $2,800.

The IRS says many different factors can affect the timing of a refund after the IRS receives a return electronically. A manual review may be necessary when a return has errors, is incomplete or is affected by identity theft or fraud.

You May Like: Is Donating Plasma Considered Income

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2021 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $33,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $66,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Get A Bigger Tax Refund: Max Out Your Ira

Setting aside money in a traditional IRA is a great way to build your nest egg and score an additional tax bonus. You can fund your IRA for the previous tax year right up to the and your contributions may be partially or fully deductible. Its an above-the-line deduction, which means you can take the deduction even if youre not itemizing.

You may also be able to claim a tax credit for your contributions. The Retirement Savers Credit applies to contributions to both traditional and Roth IRAs, but you have to meet specific income guidelines to qualify.

When it comes to filing your taxes, every penny counts, especially when youre trying to beef up your tax refund. The more you know about which tax benefits you qualify for, the more money youll be able to put in your pocket.

Don’t Miss: Is Donating Plasma Taxable Income