How Do I Change The Payroll Rate In Quickbooks

In Intuit Online Payroll

Sales Tax For Online Businesses

Online transactions are trickier when it comes to sales tax collection for small businesses, especially in this past year. There are three main reasons this area is so challenging.

If youre an online business, collecting sales tax can be equally confusing and overwhelming. Here are a few terms and rules you should know about:

How To Add A Sales Commission Tracker In Quickbooks

QuickBooks does not currently offer a commission tracker. As a result, adding sales commission tracking in QuickBooks is a challenge that many businesses face when handling payout for their QuickBooks reps.

Luckily, there are many workarounds you can use to give your QuickBooks reps the sales commission they deserve.

If you need a commission tracking solution to monitor the commission that you pay your sales reps, youve come to the right place. This article will explain the importance of tracking commission and explain your options.

Lets begin!

Also Check: How To Get Tax Form From Doordash

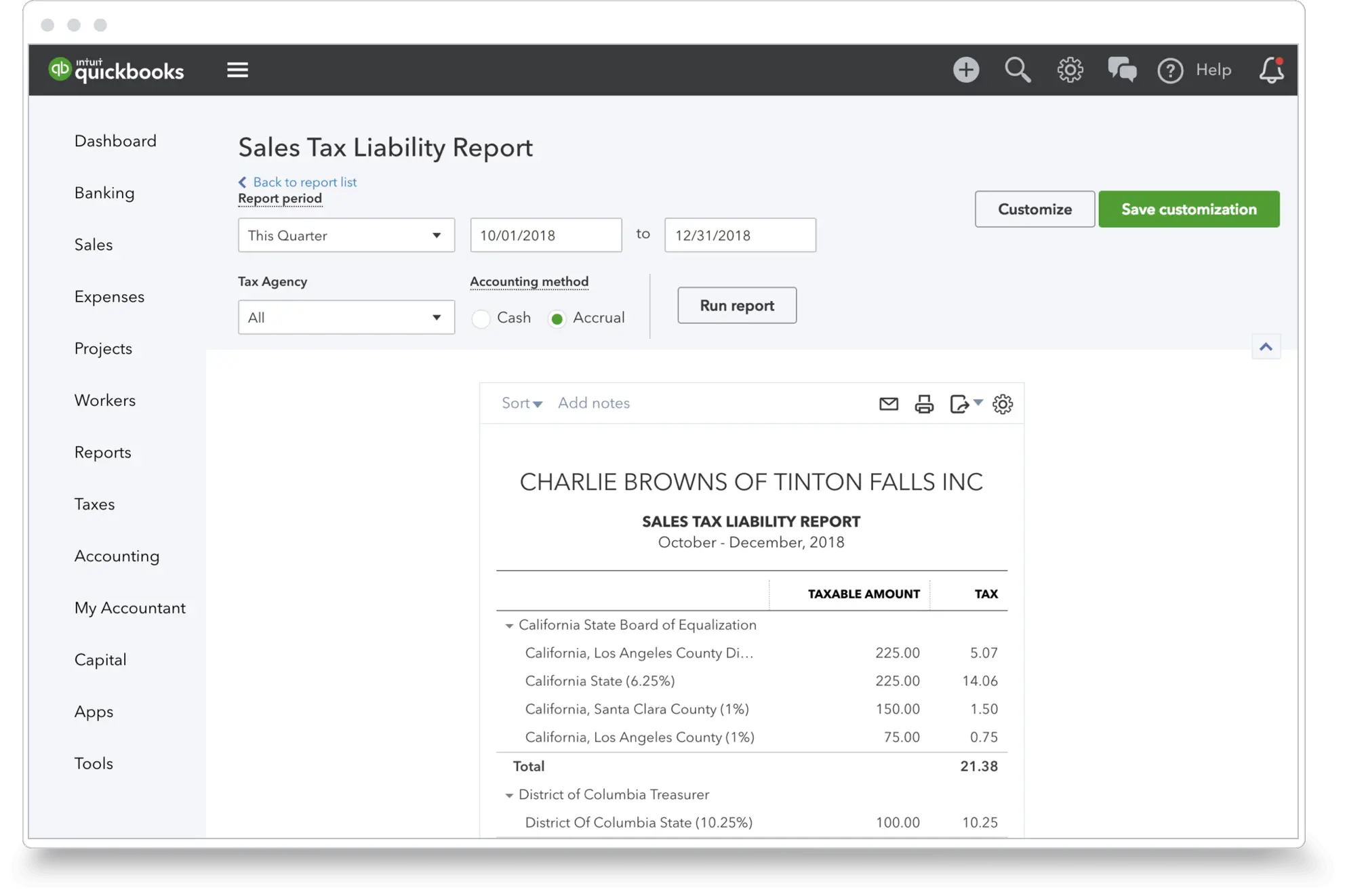

Switch To Automated Sales Tax In Quickbooks Online

Learn how to switch from manual to automated sales tax in a few quick steps.

QuickBooks is simplifying how you track your sales tax returns. With automated sales tax, QuickBooks automatically calculates sales tax based on what you sell, where you sell, and where you ship. If your state changes something, like the sales tax rate, QuickBooks automatically updates your tax rates for you.

Here’s how to switch to the new sales tax system in QuickBooks Online and how to view your existing sales tax info after youve switched.

Note: We’re rolling out automated sales tax for all QuickBooks users. If you don’t see the option to switch, it should be available to you soon. If you want to understand more before switching, learn how QuickBooks calculates sales tax.

Quickbooks Budgets And Forecasts

QuickBooks budgets and forecasting tools help you make smart business decisions by reviewing the prior years fiscal report data and setting up budgets and forecasts for the coming year for efficient tax filing.

Budget reports will show you the budgeted revenues and expenses for the fiscal year. Compare the companys budgeted versus actual revenues and expenses with the Budget vs. Actual Report to find out if youre over or under budget and compare your companys Profit and Loss Budget Performance.

Moreover, the Forecasts Overview Report will help you predict future business revenue and cash flow. Use the Forecast vs. Actual Report to compare the budgeted versus actual revenue and expenses to the projected amounts for a better tax filing experience.

Don’t Miss: How To Appeal Cook County Property Taxes

Products For Avalara Quickbooks Desktop/online

There are a few products that empower sales tax in QB. It includes Avalara AvaTax, Avalara Returns, and Avalara CertCapture. Each product serves a different performance for sales tax and boosts functionality. One of these provides cloud-based sales while others are beneficial for file and managing sales.

- Avalara AvaTax offers cloud-based sales. It uses comprehensive tax calculation. In addition, the updated tax rates go to the invoicing system regularly or to the shopping cart automatically.

- Avalara Returns prefers to use the sales data to create or file the sales. It also uses tax returns & submits payments across different jurisdictions in each filing cycle.

- Avalara CertCapture is an expandable solution. It securely stores, collects, and manages your tax documents such as W-8s, W-9s, and exemption certificates, in the cloud. This also helps you to access all the documents quickly when required.

How Does Avalara Integrate With Quickbooks Desktop

As stated earlier, you can use different products offered by Avalara. For instance, you can use Avalara AvaTax to automate calculation, Avalara Returns to automate filing, and Avalara CertCapture to automate documentation.

By connecting the relevant product with Intuit software , you can automate your tax calculation for the business. Keep in mind, you can also use WePay QuickBooks integration to automate payments.

However, to calculate the sales tax of your business using AvaTax, you will have to perform some steps. Avalara QuickBooks Desktop requires you to create the company profile, connect QuickBooks to AvaTax, adjust the company profile, test the setup, and set up returns.

You May Like: Is Doordash Taxable Income

Example Of The Sales Tax Calculation

As an example, assume that all of the items in a vending machine are subject to a sales tax of 7%. In the most recent month the vending machine receipts were $481.50. Hence, $481.50 includes the amounts received for the sales of products and the sales tax on these products. The use of algebra allows us to calculate how much of the $481.50 is the true sales amount and how much is the sales tax on those products:

Let S = the true sales of products , and let 0.07S = the sales tax on the true sales. Since the true sales + the sales tax = $481.50, we can state this as S + 0.07S = 1.07S = $481.50. We solve for S by dividing $481.50 by 1.07. The result is that the true product sales amounted to $450. The 7% of sales tax on the true sales is $31.50 . Now let’s make sure this adds up: $450 of sales of product + $31.50 of sales tax = $481.50, which was the total amount of the vending machine receipts.

How To Resolve Quickbooks Online Automated Sales Tax Issues

QuickBooks Online has made its Automated Sales Tax feature an automatic setting for new QBO users. It automatically calculates tax rates based on the location on an invoice. Because we dont initiate the integration until an invoice is sent to QBO, it may cause tax rate discrepancies in your QBO account.

Important: Not everyone has this feature activated on their account. The easiest way to tell if you have this feature activated is to check if you are able to create your tax rates in QBO. If you are not able to create tax rates, this feature is activated in your account.

Read Also: Www Aztaxes Net

Intuit: Sales: Tax: Calculator: Website

Intuit’s new calculator takes the guess work out of figuring out sales tax, with Intuit automatically doing the math for small businesses on thousands of state, city, and county sales tax rates in the U.S. The sales tax reporting will be changing for many small businesses engaged in online sales as a results of all the changes taking place in sales tax recently.

Workaround #: Record The B& o Portion Of Sales Tax As A Sales Tax Adjustment

The upside: this method wont complicate working in the bank feed or reconciling the bank account

The downside: this method is more complex to enter, and WA B& O payments wont show up properly on accrual-basis financial statements.

The tutorial at the end of this article will show you how to use this second workaround, and it will also illustrate the limitations of this workaround.

Recommended Reading: How To Keep Track Of Taxes For Doordash

Add Tax Categories To Your Products And Services

Rules for how to tax a product can change depending on where you sell. Check our blog on how the sales tax of a lemon can change depending on the final product and where it’s sold.

When you’re ready, you can assign sales tax categories to anything you sell. This lets QuickBooks know how much sales tax you need to charge based on what exactly you’re selling.

How To Calculate Sales Tax And Avoid Audits

One of the toughest things for a small business owner to learn is how to calculate sales tax correctly. Miscalculating sales tax is a common error that can trigger an audit. With the explosion of e-commerce, calculating sales tax has become even more critical. Its especially challenging for online retailers, as they often dont understand whats taxable, which sales tax rate they should use, and which government agency receives the sales tax that they collect.

Using this guide, well walk you through the intricacies of sales tax. Well start by defining sales tax, including how to collect it and how to pay it. Then well dive into how to avoid sales tax audits.

Also Check: License To Do Taxes

Connecting Quickbooks Online To Avalara Avatax

To properly connect QuickBooks Online AvaTax, you just need to provide the appropriate details so your transactions can be sent for the tax calculation. For this, you will have to sign in to the account, open the connector settings, select the appropriate company, and apply the correct integration setting.

- Log in to the AvaTax account. Here, you will see the QuickBooks Connector Settings screen.

- Go to the Avalara Company option and choose the company that you need to link with AvaTax.

- Once done, you can go to the Integration Settings. Then you can check the settings.

- After that, click the Save button.

- Here, click on the Return option.

- Now, you can return to QuickBooks Online.

Thereafter, you can send your transaction for the tax calculation. If you want to customize the way that QBO interacts with AvaTax, you can check the connector settings for QBO.

Why Does Quickbooks Sometimes Calculate Sales Tax For My Tax

Keep in mind that tax-exempt rules are not the same everywhere. In some places, not all types of products and services can be tax exempt. And sometimes, tax-exempt just means your customer only gets a certain percentage of tax discount.

If this seems a little complicated, don’t worry. You just need to map your items to their proper tax categories, and make sure your customer’s address is correct on each transaction. Then, QuickBooks follows the correct tax-exempt rules based on what you sell and your customer’s address.

Also Check: Www.1040paytax

Learn What Happens When You Switch To Automated Sales Tax

When you switch to automated sales tax, youll be asked to match your existing tax rates to the official tax agency listed in QuickBooks. If you have less than 20 tax rates, you must match all your rates.If you have more than 20 rates, its strongly recommended but not required to match all your rates. Any rates you dont map will be unavailable to use on future sales forms. While you can still access historic data for your rates from the sales tax liability report and chart of account registers, you wont see transactions that use the unmatched rates in your Sales tax tab.

The Best Way To Track And Calculate Sales Commissions In Quickbooks

Heres a common problem many businesses using QuickBooks face: not being able to track QuickBooks sales commissions on specific items, excluding any associated tax or shipping fees on an invoice.

This challenge arises because QuickBooks does not have a commission calculation feature. So, in order to calculate a commission payout, you need to create a class within QuickBooks.

You must then create a subclass for every sales rep, manually calculate commissions for every item based on each person, and finally create a commission report.

Sounds tedious, right?

Well, this is the reality of how to add commission in QuickBooks.

In many cases, businesses manually calculate commissions with pen and paper or track numbers on spreadsheets to complete the payout for QuickBooks reps. But the larger your business, the more complicated this process will become.

Luckily, theres an easier way.

Don’t Miss: Mcl 206.707

Quickbooks Online Calculates Sales Tax Rates Based On:

- Where you sell. Every state is different. If your business is located in Florida and you sell to a customer in Minnesota, youll be charging any sales tax levied by the state of Minnesota and possibly the city and county and other taxing authorities if you have a connection, a nexus in that state .

- What you sell.

- To whom you sell. Some customers do not have to pay sales tax. Youll need to edit their customer records to reflect this in QBO. Open a customer record and click the Edit link in the upper right. Click the Tax info tab and make sure theres no checkmark in the box that says This customer is taxable. The Default tax code will be grayed out, and you can enter Exemption details in that field.

Customer records for exempt organizations should contain details for that exemption. Youll need to see their exemption certificate or at least know its official number.

Track Sales Tax Automatically When You Make A Sale

Read Also: How Much Tax Do You Pay On Doordash

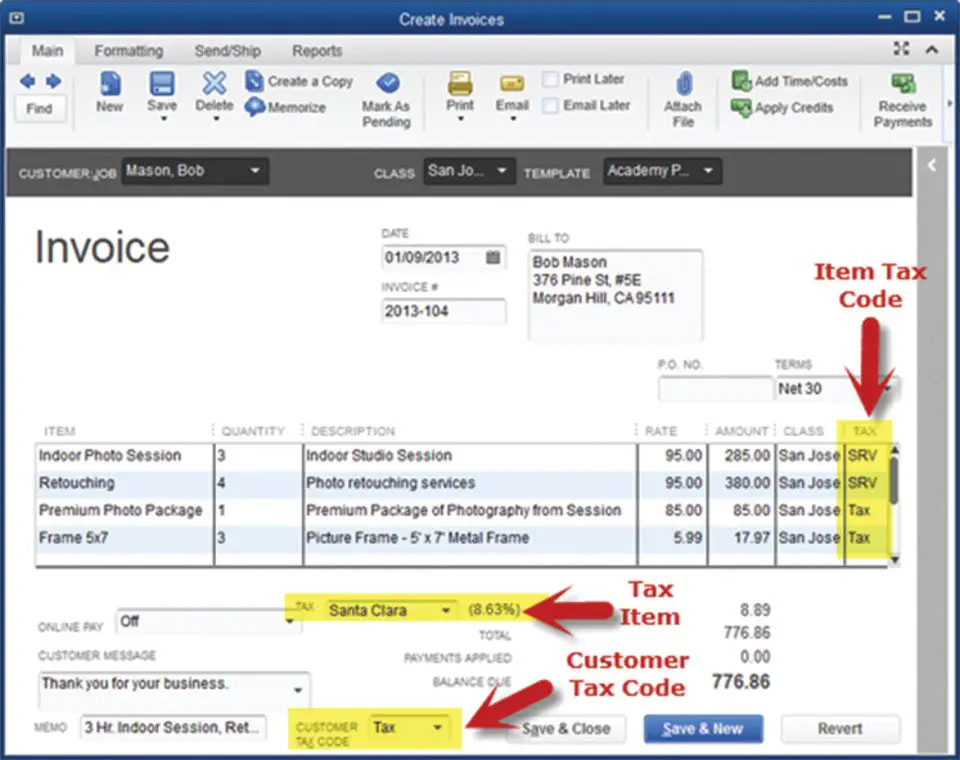

You Can Combine Individual Tax Rates

If you are required to pay city, county, and state sales tax rates for a particular customer, for example, you can create a Combined tax rate that contains all of the individual components. The customer will only see the total on an invoice or sales receipt, but QuickBooks Online will track each one accordingly for payment and reporting purposes

You can combine sales tax rates in QuickBooks Online .

Workaround #: Record Sales Tax And B& o As Two Separate Payments In Quickbooks

The upside: this is easy to record, and easy to make accrual vs. cash basis accounting work correctly in QuickBooks .

The downside: it makes working in the bank feed and reconciling the bank account more complicated, because the single payment that posts to the banks ledger wont match the two separate payments you recorded in QuickBooks.

Also Check: Grieved Taxes

Can You Track Use Tax In Quickbooks

Businesses are now becoming more aware of the requirements to remit use tax on goods brought into their state when sales tax is not charged. However, QuickBooks users have found it challenging to find an effective method of tracking the amount of use tax to report and pay. The good news is QuickBooks can track use tax and you can make the payments using the pay sales tax feature!

Below are the simple steps you would take to track use tax in QuickBooks. Lets say your Michigan based business purchased office supplies on Amazon. The supplies were purchased from an out-of-state vendor for $500 and no sales tax was charged. The sales tax rate in Michigan is 6%.

1. When you record the purchase for $500 in QuickBooks, you will post $530 to your office supplies expense account and -$30 to your Sales Tax Payable account. In the Customer:Job column, you will need to enter the sales tax agency vendor name.

a. Some may vary where the use tax is posted. For example, some may create a separate use tax expense. Using the above example, $500 would be posted to your office supplies expense account, $30 would be posted to your use tax expense account, and -$30 would be posted to your sales tax payable account.

b. Some may also wish to assign a different vendor name for the use tax, like Out of State or OOS.

c. When you create a Sales tax liability report, the use tax due will not appear in the Tax Collected column but will be included in the Sales Tax Payable column.

Expense Tax Settings In Quickbooks

Finally, there is a killer feature of the app: taxes on fees of payment processors. Some jurisdictions require businesses to pay these fees for the transactions processed by payment providers. Learn more about how to apply taxes on fees in QuickBooks.

Congratulations, you have set up the app to apply taxes to any synced Sales transaction!

If you have any other questions, please use the contacts specified in the footer of the page or, alternatively, initiate our in-app support chat. We will be more than happy to help.

Recommended Reading: Pastyeartax Com Review

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Let me share some information about the new sales tax feature in QuickBooks Online , giudidetorres.

May I know what problems you encountered with the new sales tax system? QBO tracks your states tax laws to accurately calculate sales tax and returns using the Automated Sales Tax feature. Also, it will automatically calculate the total tax rate for each sale based on the following:

- Your customers tax-exempt status

- Where you sell and where you ship

- Your service or products tax category

For more details about sales tax calculation, check out this article: Learn how QuickBooks Online calculates sales tax.

If you’re referring to the Location of Sale box turns blank and reverts sales tax rate upon saving invoice using the automated sales tax settings, then we have an ongoing issue about this one. Our engineers are still working on the permanent fix.

In the meantime, just manually override the tax rate on the invoice.

Once done, please reach out to our Customer Support Team. They’ll pull up your account in a secure environment and add you to the list of affected users.

Just request a callback from our support agent. This way, you won’t have to wait on the line. Here’s how: